Why this could be as good as it gets for big tech

My washing machine had finally packed it in. With a DIY spirit and the desire to save money, I began searching online for parts. I turned to Google for answers.

There were none.

Google's once helpful pages have vanished, now replaced by sponsored handyman repair links.

Similarly, Amazon’s shops are now filled with sponsored trinkets with little relevance to my search.

How many of you have found yourself in a similar situation?

Relying on the usual helpfulness of big tech is now a past dream.

There is a good reason why…

And it could be a sign that the golden era for tech may be coming to an end.

Let me explain…

Online services are squeezing us for the last dime

Big tech players like Google, Amazon, and Facebook are now in the final stages of a process called ‘enshittification’.

The man who coined the term, Cory Doctorow, summed up the process simply as this:

‘First they are good to their users; then they abuse their users to make things better for their business customers; finally, they abuse those business customers to claw back all the value for themselves.’

It wasn’t always this way.

The steady evolution from user-friendly platforms into self-serving machines has been a slow drip.

But they are now using their dominant position to monetise users as much as possible. This comes at the expense of their utility, which will erode long-term value.

Why are they doing this?

Well, they have utterly destroyed the competition.

Lawmakers have allowed the tech industry to eat up anything resembling a competitor. Think of big names like WhatsApp or Instagram that were bought out before they challenged Facebook.

There are many more. Between 2010 and 2019, Microsoft, Apple, Google, Facebook, and Amazon made 616 acquisitions. Those are just the ones we know about.

But times are changing. Antitrust lawsuits are being filed across the board, and Nvidia’s up next.

The good times are coming to an end.

Market Peak for tech valuations?

After a disappointing earnings season, big tech stocks look fragile. Despite many hitting earnings targets, the market isn’t satisfied.

Just look at Nvidia. Its revenue doubled over the past year to hit US$30 billion for the quarter. Net income was US$16.6 billion, up 168% y/y.

What did the market think about that? Its price is down 17% since then.

Both expectations and valuations have hit feverish levels for many of these big tech names. Expectations of a ‘hail mary’ pass from AI to save the sector have yet to emerge.

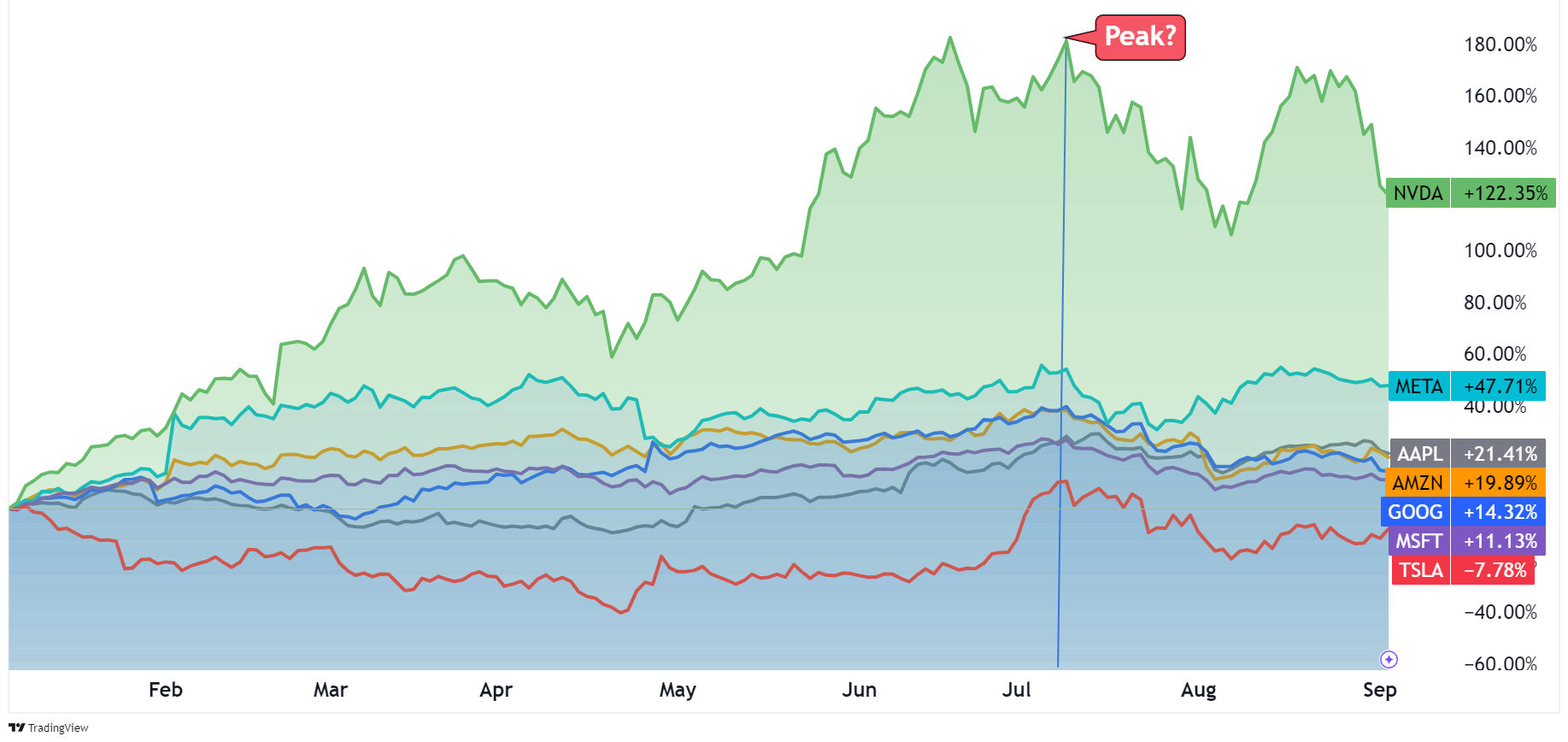

Here is what the ‘Magnificent 7’ looks like in the past year:

Traders have now returned to their desks after their summer vacation with apparent gloom.

The good vibes of summer are over.

Major US indices rallied relentlessly in recent months on the back of economic weakness. The market saw any weakness as a sign the Fed would cut rates sooner rather than later.

But this ‘good news is bad news’ period has finished.

The market absorbed the weaker Purchasing Managers Index (PMI) data from China and the US with the appropriate concern this week.

At this point, the Fed’s September cuts are almost guaranteed. Any further expectations of more cuts simply weren’t enough for the tech stocks to rally.

Bad news is now bad news.

Why should you care, and what should you do about it?

Don’t be passive

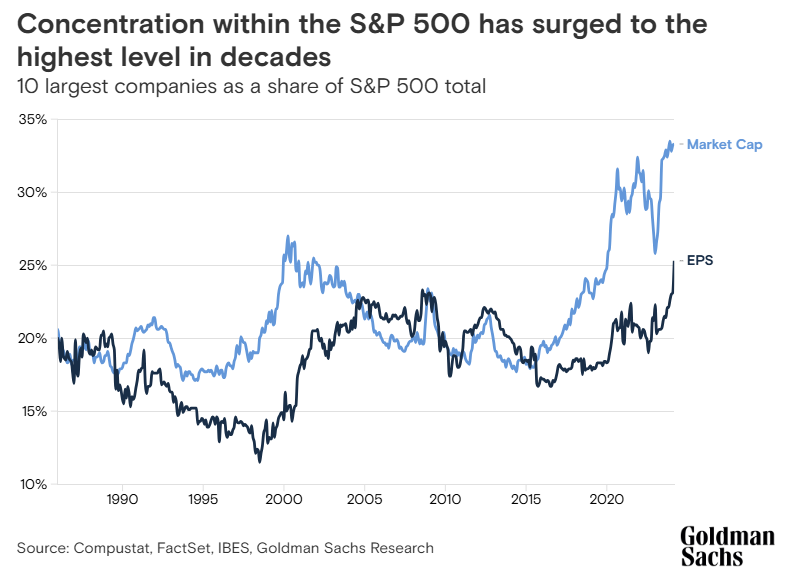

The great concern here is that many of these major tech players are now the primary drivers of the stock market.

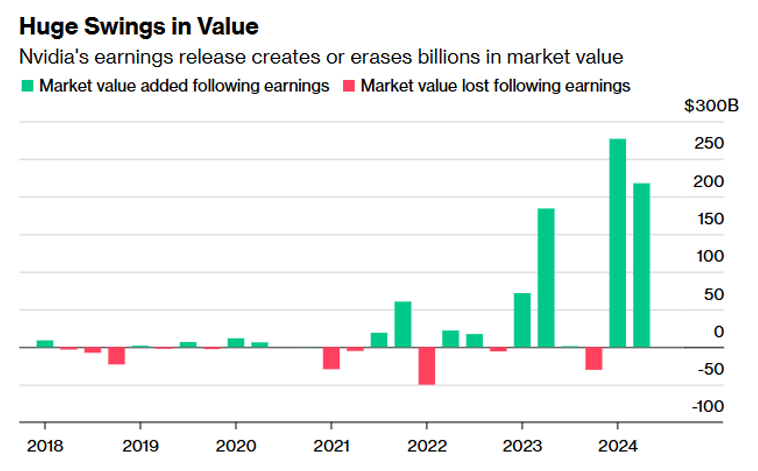

Just look at how much market value swings on the days of Nvidia’s earnings alone.

This chart is missing its most recent drop, but you get the picture. Where it goes, the market follows.

But if we assume that the party could be coming to an end, then it is time for investors to take an active approach.

That means picking up smaller undervalued stocks rather than following the trend or relying on indexed funds.

Looking back at the early 2000s, we can see that small companies significantly outperformed these larger caps.

It’s also a far more diversified approach, reducing your risk.

Gone are the days of easily diversifying using passive indexes. They are all slaves to the moves of big tech.

Today, around 31% of the S&P 500’s market cap sits within these major tech players. They are also responsible for the bulk of the gains.

Any passive funds or broad ETFs can’t help but be swayed by this.

To be clear, I'm not ringing the bell for the end of the world here. I’m just highlighting that the Mag Seven party might be over.

If you’ve been riding that trend, it’s time to take some profits and consider a more active approach to your investing.

Market cycles are natural, and new periods can often bring opportunities.

The key is to recognise when these cycles change, and position yourself accordingly.

If you want to learn more about what the next phase of competition looks like or more analysis like this. Sign up at Fat Tail Investment Research to see more market-leading topics on gold, commodities, and macro trends.

1 topic

1 stock mentioned

%20cropped.png)

%20cropped.png)