Why this strategist is a China bull for the first time in two years (and what it means for you)

For more than two years, the world's largest emerging market has been essentially closed off to the world. A myriad of uncertainties around its property market's stability, its future control over offshore territories, and Beijing's uncompromising approach to eliminating COVID-19 have made China a difficult place to invest.

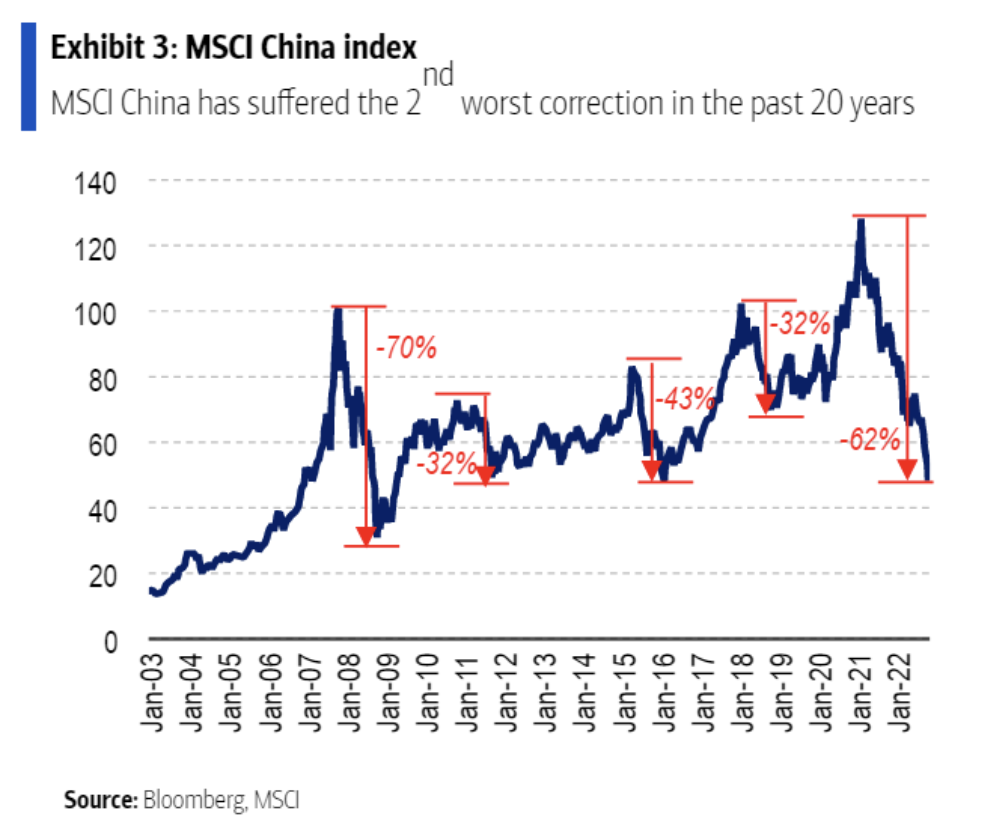

China's share market's performance shows how difficult it has been to win in the region in recent times, with the Shanghai-based CSI 300 stock market index still down 22% year-to-date. In addition, the MSCI China Index has had its second-worst correction in two decades.

But one strategist thinks the de-rating could end soon, admitting he is finally buying Chinese equities for the first time in more than two years. This man is Ajay Singh Kapur, the Asia Pacific equity strategist at Bank of America.

In this wire, we'll introduce you to his thesis and explain what the change in policy could mean for your China-exposed investments.

Why the change in tone?

For two years, Kapur has had a long-term bearish case for Chinese assets. The case was predicated on five themes:

- COVID-zero

- Property sector policy

- Private sector scrutiny (think big tech regulation, rules around overseas listings)

- The state of Chinese credit demand

- Geopolitical tensions in Hong Kong and Taiwan

But as of last week's changes at the government level, the last domino (COVID-zero) fell. Couple the changes at these levels with the extensive de-rating in Chinese equities and you've got a reason to become bullish - even if it's cautious.

What has changed?

Australia's first official meeting in six years with Chinese President Xi Jinping is a big deal, but there are many other structural changes happening right now in the tiger economy. A week ago, President Xi chaired a meeting of Beijing's Politburo to discuss how the zero-COVID policy could be wound down. The meeting resulted in a reduction to close contact and inbound travel quarantine rules.

But perhaps the most significant change of all was the scrapping of the "flight ban". Previously, an airline had to suspend a route for up to two weeks if Chinese authorities found too many cases of COVID-19 onboard.

Whether you want to call it a policy change, a pivot, or an "aha moment", the moves are a first step towards relaxing Beijing's zero-tolerance policy to COVID-19 since it first broke out in December 2019.

All the above points plus the broad perception that the Chinese central bank will loosen monetary policy are reasons why fund managers are moving more money into Chinese equities and assets. The historic underperformance of the Yuan against the US Dollar will also help China's exports and exporting companies.

As the world turns: Chinese markets edition

Sectors to watch

So now that Kapur and his team are more constructive, where can you start nibbling away? In his view, several sectors are set to benefit from the easing in policy including:

- Energy stocks (e.g. Sinopec and Petrochina)

- Materials stocks (Ganfeng and Tianqi Lithium are among two of the biggest)

- Industrials stocks (shipping giant ZTO and conglomerate CITIC are examples)

- Consumer discretionary stocks (e.g. Alibaba and retailer JD.com)

Needless to say, all this is dependent on China actually going ahead with its reopening. As rival research house Goldman Sachs points out, an eventual reopening could drive a 20% increase in Chinese stocks - or a 15% fall if those hopes don't materialise.

How to gain exposure to Asian equities from Australia

Locally, there are two leading ETFs giving Australian retail investors exposure to Asian equities. The Vanguard FTSE Asia Ex-Japan Shares Index ETF (ASX: VAE) and Betashares Asia Technology Tigers ETF (ASX: ASIA) are both down 17% and 29% year-to-date respectively but have benefitted from the Chinese equity market's bullish run of late. To be clear, Livewire is in no way recommending these products, we are simply making readers aware of them.

There is also any number of stocks that have heavy exposures to the Chinese economy - many of which are brilliantly detailed here in these two pieces by Livewire's Sara Allen.

.png)

Datt Capital's Emanuel Datt also published a wire on this very website back in August which highlighted some of the above. Although it's a sector-specific story, a Chinese reopening would be good for a slew of commodities including iron ore, copper, and rare earths.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed-income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics

2 stocks mentioned

2 contributors mentioned