Why this year’s rally is not a bear market rally (and what it means for equities)

Investors in global equities experienced a bear market in 2022. A rapid move higher in global policy rates, elevated inflation, a war in Ukraine and a recession in China led to a massive bearish consensus that anticipated a recession in early 2023.

But last year’s equity bear market was NOT the recession bear market. And this year’s equity market rally is NOT a bear market rally. In this wire, I share why an extension of the cycle after the Fed’s pause from February will support risk assets.

2022 was NOT the recession bear market.

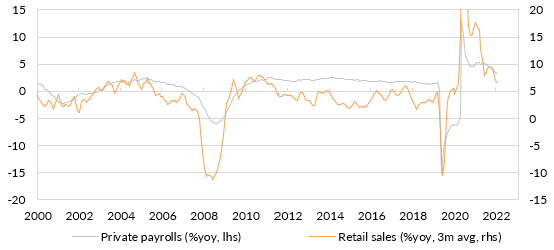

The US S&P500 fell 19.4% over 2022. That hides a peak-to-trough drawdown of around 27%. Markets certainly moved to price a high probability of recession. But there was no recession! Underlying economic growth remained solid. It was supported by a strong labour market and household spending that had tailwinds from pandemic-boosted savings.

Chart 1: A strong labour market and resilient households supported growth in 2022

The bear market instead reflected a rapid increase in policy rates from the US Federal Reserve and a consequent increase in longer-dated US Treasury yields. This much higher discount rate was a painful reality for equity valuations, particularly "growthier" tech stocks.

This year’s rally is NOT a bear market rally

The bear market in 2022 reflexively led a significant market consensus view that there had to be a recession in early 2023. I shared in a wire in October 2022 that a US recession was both unnecessary and unavoidable. Economic growth was clearly slowing. And that had already made it clear that there was no outbreak in inflation expectations, no wage-price spiral, and that inflation would cool much faster than economists and the Fed expected.

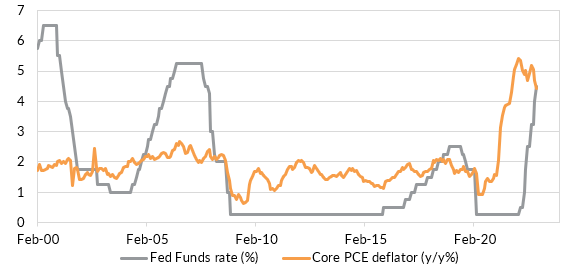

My wire in November argued that by end-January, core PCE inflation would almost certainly be below the Fed Funds rate. Annual core PCE inflation was 4.4% in the latest reading – leaving it below the Fed Funds rate. Further, as inflation was cooling rapidly, I had argued in October that the Fed would move to a pause in the rate hike cycle much sooner than the market or the Fed anticipated.

Chart 2: US core PCE inflation is below the Fed Funds rate

Right now, the Fed has clearly communicated a shift to a 0.25% rate hike at its meeting this week. I think it is likely that could be the last rate hike allowed by the data. And that will be a positive for the economy, extending this cycle through a slowing growth, disinflationary period over 2023.

Position for the upside, prepare for the downside

The bearish consensus in 2022 was looking for the next leg down as the US entered recession. But 2022 was not a recession bear market. And the rally now leaves investors with FOMO. And that will drag sidelined cash back into the market as the Fed moves to a pause in Q1.

I expect equities will continue to rally in this environment. Growth is slowing but earnings can surprise to the upside. We have remained exposed to US equities and expect further upside through 2023.

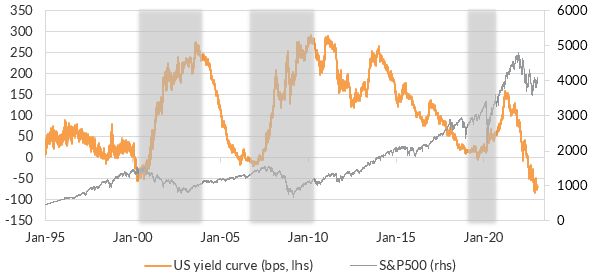

But a recession is on the horizon. The US yield curve (the differenced between the 10-year and 2-year Treasury yield) is deeply inverted. That has always preceded a US recession. However, equities can continue to rally through an inverted yield curve.

Instead, we are laser-focused on normalisation of the yield curve. A bull-steepener, which occurs when the 2-year Treasury yield collapses as markets price aggressive rate cuts, has historically been the sign of recession.

Chart 3: The yield curve is inverted. It is the normalisation that is painful for equities

In a November wire, I wrote that longer-dated government bond yields were attractive at levels north of 4.00%. Since that time, 10-year US Treasury yields have collapsed by almost 0.70%. This continues to be an important position for our portfolios, as it provides income, diversification, and considerable downside protection for when a recession does hit.

But we have now started to add shorter duration exposure in preparation for the normalisation of the yield curve. We don’t think normalisation – or a US recession – will happen any time soon. But with 2-year US Treasury yields still above 4.00%, and the Fed approaching it’s pause, we see limited scope for the curve to get more inverted, and more scope for lower yields across the curve.

2023 should be a good year for diversified portfolios.

After a year where all traditional assets suffered in 2022, the outlook for 2023 is much better. Recession remains a key downside risk. But a pause from the Fed should delay that outcome for some time. And while equities and bonds rally, I expect bears will be dragged back into the market, adding momentum. Last year was NOT the recession bear market. And this year is NOT the bear market rally. This is NOT the time to be on the sidelines.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics