Why UBS says gold and lithium is better than iron ore

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,903 (+1.5%)

- NASDAQ - 11,621 (+2.28%)

- CBOE VIX - 26.08

- FTSE 100 - 7,189 (+1.14%)

- STOXX 600 - 415.37 (+1.97%)

- USD INDEX - 107.05

- US 10YR - 3% even

- GOLD - US$1740/oz

- WTI CRUDE - US$102.14/bbl

THE CALENDAR

Today's most important data point will be US jobs (payrolls). The easy part is knowing what the unemployment rate will be (sub-4% which indicates a very tight labour market). The hard part is knowing how a tight labour market will influence what people are being paid.

You will see this in the "average hourly earnings" metric. All the same, the consensus estimate for the month-on-month change is 275,000. While it doesn't seem like a lot, you have to remember that the US has been adding jobs consistently all through the post-pandemic era.

That makes finding those extra jobs an achievement.

THE CHARTS

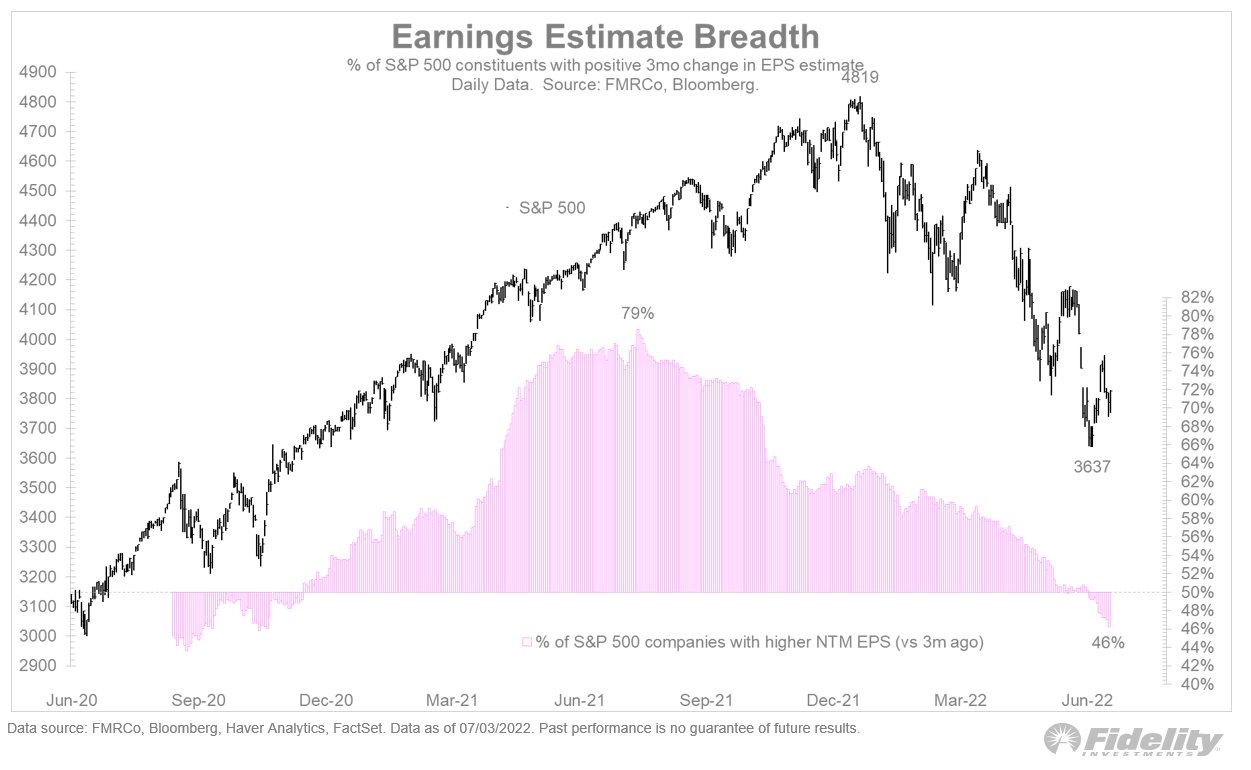

Jurrien Timmer is Fidelity International's head of macro. This chart from him really speaks to what analysts and fundies are probably so concerned about - earnings downgrades.

More companies in the S&P 500 are seeing their estimates go down than up. Rarely does the pendulum stop at the mid-point, so chances seem good that more downgrades are coming.

The big issue now, in Jurrien's view, is whether earnings growth will turn negative. This is how we will know if we're in a recession bear market or a non-recession bear market. Either way, whatever happens in the US will probably have some bearing on the August earnings season in Australia. If only for the changing sentiment.

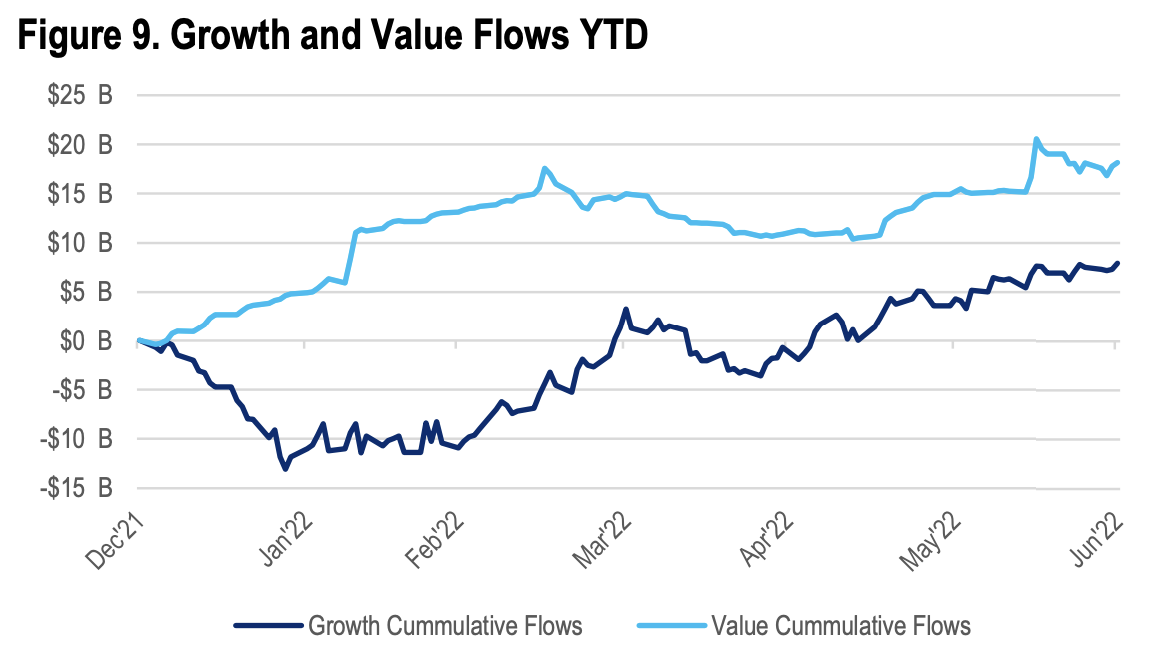

Speaking of sentiment, a great way to get a view of what retail traders are thinking is ETF flows. This chart, from Citi's US team, suggests that the risk of a recession is not only underpriced but that the aftermath of a said recession could also be underpriced.

How do they know that? Check out the cumulative flows (and the pace of those flows) into growth-oriented ETFs.

Speaking of which, the brilliant Ally Selby has hosted our latest ETFs edition of Buy Hold Sell - you can watch that episode here:

.jpg)

STOCKS TO WATCH

Away from ETFs and our stocks to watch today is the ASX materials sector. Namely the iron ore miners, the gold plays, and the lithium miners.

UBS wrote a note yesterday which was widely circulated. Analyst Lachlan Shaw thinks it's too early to buy the dip in the materials space. Why? I'll let him explain.

We are not convinced they present enough value yet to encourage sector-wide buying. For instance, all prices sit above or in line with UBS' mid-cycle/long-term [targets], as well as marginal cost, and not below or within cost curves. [It's] All [the more] reason to be cautious and selective on buying.

Strong earnings near term should support returns this August - but as we flagged in the charts to watch, it's all about how costs may change those balance sheet profiles.

For now... here's their list:

- Neutral on the big three iron ore miners

- Buy ratings on most ASX gold stocks (NST, EVN, GOR, DEG, SSR)

- Even higher conviction buys on ASX lithium stocks (IGO, MIN, AKE)

THE STAT

Australian coal exports were worth more in May than iron ore exports (Source: Deutsche Bank, ABS)

Coal, iron ore, and gas exports are also up 250%+ since the peak of the mining boom 10 years ago! That's approximately $300 billion extra in the nation's coffers.

Talk about a surplus of the bad (or good, if you're non-ESG-oriented) stuff.

THE TWEET

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

11 stocks mentioned

2 contributors mentioned