Why uranium bulls shouldn't get too excited about the Kazatomprom production cut

A new research report from Morgan Stanley proposes that the recently announced cut in production guidance by the world’s biggest uranium producer Kazatomprom, may not have the long term positive impact on the uranium price that many bulls are counting on.

If the price action in the futures market is anything to go by (yes uranium pricing is a complicated beast, and futures pricing is just one piece of the puzzle), major investors and fund managers appear to agree – for now.

%20COMEX%20chart%2027%20August%202024.png)

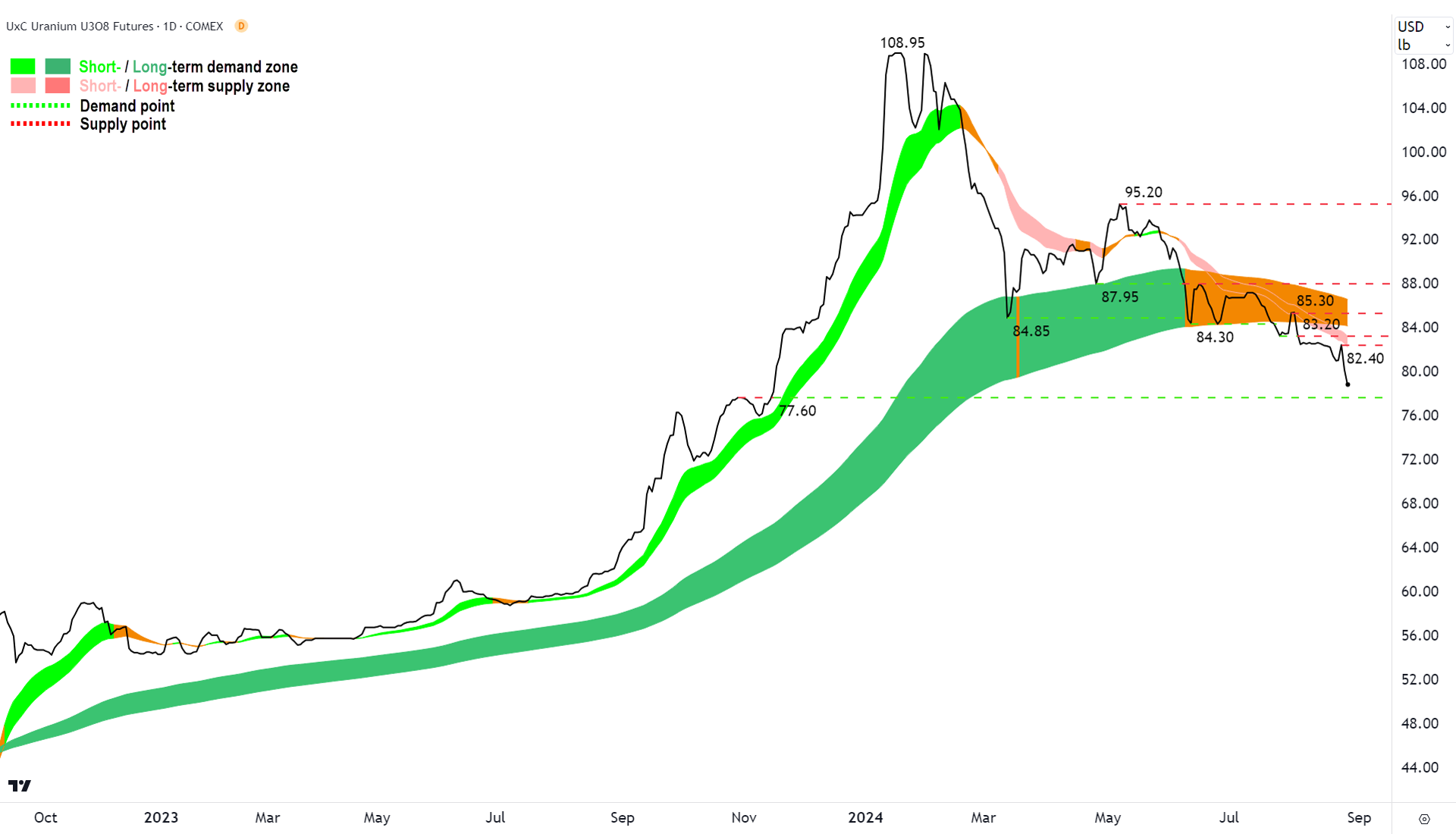

See above my technical analysis chart of the uranium front month futures price (back adjusted) including my short and long term trend ribbons. I peg the uranium price trends as short term down and long term down.

If you follow my regular uranium futures chart analysis in our Evening Wraps, you would know that I started warning investors in early May that not all was right with uranium’s short term trend, and then in July, I called the end of its long term trend.

Note the bounce that occurred following the Kazatomprom news on Friday – it only triggered a minor blip to US$82.40/lb. The two subsequent trading sessions have produced a sharp resumption of the prevailing downtrends. The market has digested the news, and it has voted in terms of demand and supply.

Complementing the technicals nicely, is Morgan Stanley’s latest research report on the Kazatomprom announcement titled “Uranium: Kazatomprom Cuts 2025 Guidance”. Let’s investigate the broker’s main arguments for why this news may not have a major positive impact on the uranium price.

Morgan Stanley notes that Kazatomprom’s new guidance is “in line” with their 2025 forecast of 25.2 ktU, but was still ahead of Visible Alpha’s consensus of 23ktU – and it still represents a 12% increase on 2024 production.

Uranium bulls will argue that the uranium market is currently in a deficit, that is, current demand outstrips current supply. This is likely to remain the case in 2025, concedes Morgan Stanley, but the broker notes “this [deficit] is a lot smaller than deficits seen in previous years”.

The reason why it's possible for the uranium price to presently be falling in an environment of a supply deficit is major producers like Kazatomprom retain massive inventories. Morgan Stanley implies this will continue to be the balancing factor in the uranium market in the near term, noting that Kazatomprom “remains committed to its 2025 contractual obligations and will use its ‘comfortable level of inventories’ to meet these”.

The other key part of the puzzle when it comes to uranium pricing is the contracting market. This is where nuclear power producers purchase material directly from producers.

According to the U.S. Energy Information Administration’s (EIA) most recent report in June regarding global uranium sales, 85% of the international uranium trade is transacted via long term contracts – with the remaining 15% transacted via spot/futures contracts*.

Morgan Stanley describes current contracting activity in the uranium market as “very weak”, noting activity is down 71% in the first half of this year. Ironically, the run up in the uranium price is likely to blame for this, but the broker notes the market is also cautious over the recent US ban on Russian uranium.

Morgan Stanley does note that “there is room for utility contracting activity to pick up from a very low 1H, with uncertainty on future supplies and the US ban on Russian uranium now in place”, but also that “this will likely still take time to come through”.

Morgan Stanley’s uranium outlook

All of the above leads Morgan Stanley to retain the “cautious view” on uranium they’ve held since March. The broker notes that the current spot price of US$81/lb is now approaching its forecast of US$79/lb by the fourth quarter of 2024.

One positive for uranium bulls is that Morgan Stanley suggests that given the spot price is so close to their target, this “implies limited further downside”. Still, the broker notes it prefers to “stay on the sidelines for now”.

A final word from the charts

A quick look back up to my technical chart, and I peg major demand-side support at US$77.60/lb. In my Evening Wrap analysis from yesterday, 27 August, I noted:

77.60 is shaping up as the key level, as in, it could be make or break there. It would not surprise me at all to see a bounce from 77.60, or at the very least, a prolonged period of consolidation bumping along it (for potentially many weeks or even months). The third scenario – is the one where uranium slices straight through 77.60. I suggest this scenario is the one likely to keep U-bulls up at night.

It appears then, there’s plenty at stake both from a fundamental and technical viewpoint with respect to the uranium price in the near term.

This article first appeared on Market Index on Wednesday 28 August 2024.

5 topics

5 stocks mentioned