Why Worry?

I returned from holidays thinking this market is way too confident, way too bullish, and way too exuberant on numerous accounts. Turns out, market strategists at Bank of America (short cut BofA) are in full agreement.

BofA's latest global fund manager survey suggests institutions the world around have fully embraced the 2021 re-opening & economic recovery trade, using defensives, quality and growth stocks as the funding source to stock up on miners, energy companies and banks.

Emerging Markets have become the new Go To destination. Elsewhere it's small cap stocks. And now average cash holdings (at 3.9% as at mid-January) are at their lowest level since March 2013.

On BofA's own experience, when cash levels are this low the odds for an imminent correction shorten significantly. Hence, no surprise, the January update from the BofA global find managers survey comes with the warning: market correction could be imminent.

Other indicators from the same survey show overall sentiment is firmly "bullish" while expectations for global EPS growth, a pick-up in inflation and a rise in bond yields are at or near all-time highs in the history of the survey. For the first time since October 2019 being long technology stocks is no longer the most crowded trade with the survey revealing the most crowded trade is now being long Bitcoin.

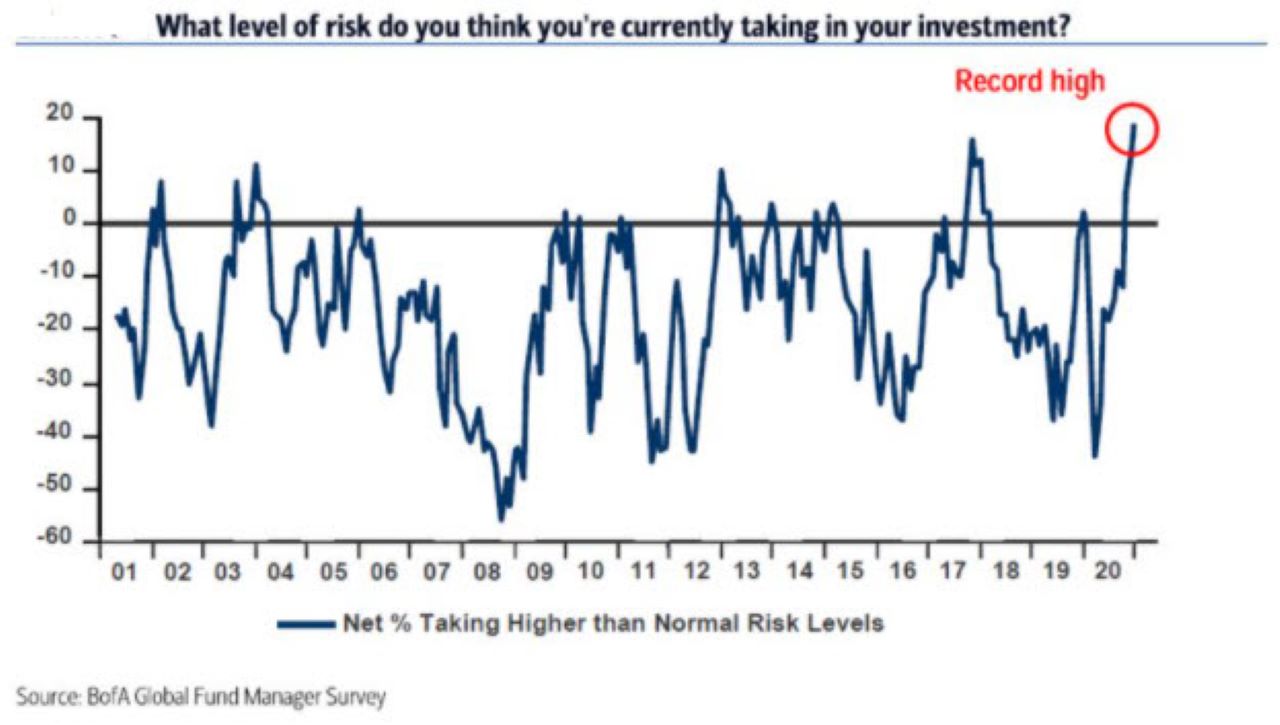

The graphic below shows respondents' answer as to how much risk they are taking with their strategies. I think the visual speaks for itself.

Of course, share markets are not going to roll over and correct simply because of one survey. And, on my observation, BofA first started hinting at elevated levels of share market optimism and increased odds for a correction about three months ago. In hindsight, that was too early.

But here's a Tweet I picked up earlier:

"A remarkable number of people I admire greatly are talking, very quietly, about how they are taking down risk. No great fuss. No great fanfare. Very matter-of-fact but...

These are the people who generally do this stuff before the crowd. Just thought I’d pass that on."

The BofA survey was conducted from January 8 to 14.

****

For good measure, the BofA survey results are being reflected in just about every portfolio and model portfolio update that has passed my desk over the past month, while earnings forecasts, in particular for energy and mining companies and for banks, are firmly on the rise, as also shown by the January sector reports the FNArena team has reported on.

Rising forecasts tend to coincide with increasing optimism and higher share prices. Many of this month's sector updates come with predictions of further upside, so it's anyone's guess how exactly this uptrend can/shall continue. Can elevated market comfort be sustained as long as earnings forecasts and economic data point to ongoing improvement?

I guess we will find out. The February reporting season is almost upon us. In the all-dominating US corporate results season has just begun.

****

Those familiar with my writings know I have created a habit of reassessing the strategy and portfolio holdings at every serious downturn for risk assets. The last time was in March last year. Arguably, the start of a new calendar year is equally a great opportunity to take another look at what has worked out and what hasn't thus far, and what might not be the best position to have for the year ahead.

This year a general reassessment, and general clean-out of the portfolio, looks double-appropriate given the sharp switch in share market momentum that has characterised the closing part of 2020, with firm continuation in January.

The FNArena/Vested Equities All-Weather Model Portfolio decided to move part of its holdings into cash earlier in the month. This move was partially inspired by broad share market enthusiasm in combination with rising bond yields, but equally by the fact that Quality, Growth and Reliable Yield -the core constituents of the strategy- are now all on the wrong side of market momentum.

The portfolio will remain true to its core strategy, but a general re-orientation nevertheless seems but appropriate. Below are a number of considerations that can be used as a general framework for portfolio re-adjustments ahead of the February reporting season.

****

The Australian economy once again stands out within international context as the country has dealt remarkably well with the pandemic and thus the economic recovery is not dependent on a successful vaccine rollout. Keeping the borders closed will suffice, thank you very much. Not so great for Qantas, Sydney Airport, Flight Centre and the like, but super-duper for just about everybody else.

Short-term mortgages below 2% and the inability to travel overseas have once again injected renewed oomph into the local property market and retailers can hardly believe their sales figures these days. No surprise, housing related stocks and discretionary retailers are among the most wanted on the ASX. Combine both in one company and you have a double-winner!

Equally important, there is a growing sense among analysts both these trends can potentially stick around for a while. This means anything that might look bloated on current forecasts, like a high PE ratio, probably isn't, as long as that operational momentum continues. Rule number one when assessing investment opportunities: don't treat PE ratios, share price targets and/or forecasts as a static input. If current trends persist, earnings estimates will simply receive more upgrades.

The same principle applies for energy producers, mining companies and banks. Positive sentiment is feeding into higher prices for energy and base materials, while banks are enjoying a widening spread between short term and longer dated government bonds; essentially delivering free money to bank shareholders through widening profit margins.

January has equally proven strong operational trends are continuing for Buy Now, Pay Later companies, as well as for operators of alternative financial platforms, including Hub24 ((HUB)), Netwealth ((NWL)) and Praemium ((PPS)).

Global optimism, a lower-risk economic recovery profile and downward pressure on the USD have quickly catapulted AUD to a much higher level against the greenback, and this has created a headwind for foreign earners, of which the local healthcare sector is the prime example. Cochlear ((COH)), ResMed ((RMD)), CSL ((CSL)) and the like have not necessarily done anything wrong, but rising bond yields in combination with a much stronger AUD have proved too much combined pressure for their share prices in recent months.

The same pressure has fallen upon local technology companies that failed to show unquestionably strong operational momentum a la BNPL and financial platforms. The likes of Megaport ((MP1)), Appen ((APX)) and Altium ((ALU)) combined macro pressure with disappointing market updates, hence why their share prices received the double-whammy slap-down punishment. At some point, these share prices will come back in favour, though it may as yet be too early for that (disappointments tend to take a while to be digested).

For investors with a longer-term horizon, it should not be forgotten that strong mega-trends such as cloud computing, artificial intelligence and data-analysis, telehealth, online gaming, vaccines and protective gear, electric vehicles, etc are not withering because of current market fixation on emerging markets, small caps, miners and banks.

Ansell ((ANN)) shares, for example, couldn't find a single buyer post-October, or so it seemed, with its share price tanking from $42-plus to $34-minus but all it took was a reaffirmative trading update to inject new momentum in that share price. TechnologyOne ((TNE)) didn't even need to provide another market update; one positive update by Bell Potter elicited a similar response.

Both stocks are held in the All-Weather Model Portfolio. Such examples should be encouraging for investors looking outside of the current popular parts of the share market, though it is equally good to remind ourselves that investors are a fickle lot. Don't be surprised if opportunities such as Ansell and TechnologyOne require more patience in 2021, at least as long as there is so much perceived potential still in Westpac ((WBC)), BHP Group, Senex Energy ((SXY)) and the like.

****

One special mention needs to be made about yield stocks. With rising bond yields one of the consensus forecasts on Wall Street (and beyond) for calendar year 2021, your typical bond proxies are facing more resistance than usual, which in many cases has already shown up in weaker prices and noticeable share market underperformance.

Most income-seeking investors would have a long-term horizon and not be too fussed about what happens short term with the share price as long as those dividend payments keep arriving. In most cases there is no change to cash flow projections for REITs and infrastructure companies as a direct result from rising bond yields.

However, those investors focusing on total return including dividends might want to reconsider allocating more exposure towards industrial companies this year. It remains true that headwinds are best tackled with operational growth, and this includes higher bond yields. Industrial companies in general usually have more options to achieve (higher) growth, assuming they are not solely dependent on borders re-opening quickly or struggling with an existential threat from tech-disruption.

Therefore the likes of Aurizon Holdings ((AZJ)), Super Retail ((SUL)), Pendal Group ((PDL)), Amcor ((AMC)), Accent Group ((AX1)) and Perpetual ((PPT)) are likely to outperform your typical bond proxy this year, and potentially by quite a margin. The banks are firmly making their come-back on income-seeking investors' radar, with analysts busy upgrading their forecasts.

Non-bond proxies offering relatively high dividend yield include Orora ((ORA)), Magellan Financial ((MFG)), Sonic Healthcare ((SHL)), Suncorp ((SUN)), and Iress (IRE)). Of course, as with REITs that own office towers and shopping malls, investors must remain cognisant some of the attractive looking stocks today can easily turn into a value trap in case of adverse outcome. Educated risk assessment remains an investor's best friend, more so this year I would argue.

Within this context, it is worth highlighting Telstra ((TLS)) shares are staging a noteworthy come-back from the sub-$2.80 price reached in October last year. For loyal shareholders, the past five years have been an extremely frustrating experience, probably best illustrated by the fact Telstra shares sprinted to $6.50 in January 2015, and subsequently lost almost half their value over the following 5.5 years.

The company is now segregating into separate divisions and looking to sell equity in hard assets including telecom towers and infrastructure which should prove a straightforward and obvious way to unlock more shareholder value. Selling assets should also guarantee there will be no further cuts to the 16c in annual dividends in the years ahead, which is yet another positive.

I suspect Telstra might well prove one of the surprise-outperformers in 2021. Certainly, it can be argued the prospect of asset equity sales has turned the stock into a lower-risk dividend opportunity while many of its peers are facing obvious headwinds.

****

"We worry that investors are not acting in a way that underscores any sense of caution" market strategists at Citi stated in their most recent market update. Similar to the BofA survey mentioned earlier, Citi's proprietary Panic/Euphoria model has investor sentiment firmly into Euphoria territory.

Citi's Euphoria reading has never been as high as the current reading with the data series stretching as far back as 1987. It does raise a few questions. Is it time for a breather/pause/pull back is but one of them.

FNArena offers truly independent and impartial, ahead-of-the-curve share market commentary and analysis, on top of The Australian Broker Call Report and proprietary tools for self-researching and self-managing investors. The service can be trialed at (VIEW LINK)

4 topics

5 stocks mentioned