Why yield investors should take a look at Centuria

If you’re looking for a robust income stock, Centuria Capital Group (ASX:CNI) is worth considering. Centuria owns a suite of assets focused on property and investment bonds, and pays an annual yield of around 4.3 per cent. Making this business even more appealing, is a share price that keeps heading in the right direction.

One powerful thematic that is likely to continue to play out over the medium term is growing demand for income generating assets and the shrinking availability of income generation per unit of assets.

The search for higher income yields

With the Baby Boomers moving increasingly into retirement, their investment focus shifts from accumulation to income generation. This is driving a slow acceleration in the growth of demand for lower risk income producing assets.

At the same time, the return generated from risk free income generating assets has been falling for decades. Nominal returns, even on longer dated government backed fixed income assets, are now close to zero and well below rates of consumer price inflation. This means that the income generated from these assets is not even high enough to preserve the purchasing power of the underlying principle over time.

This will see investors increasingly move up the risk curve in search of higher income yields. Invariably this will lead to the value of these assets being bid up and yield compression over time.

Which asset classes will benefit?

Key asset classes to benefit from this are likely to be corporate bonds and hybrids, property and lower risk equities.

There are a number of ways to gain exposure to this investment thematic, including buying income producing assets now ahead of an expected increase in demand and benefiting from the uplift in valuations as investors become willing to accept lower returns over time.

Another way to benefit is by owning managers of these assets. The benefit of owning the manager rather than the asset itself is the manager benefits in two ways. First there is the uplift in the value of the portfolio they manage, resulting in increased fee generation. Secondly, the increase in investor demand allows the manager to augment this by growing its assets under management through additional funds flow.

Is Centuria Capital a company to watch?

The key to a manager being able to leverage both of these attributes is having capability in both distribution and investment procurement. Property manager Centuria Capital has materially broadened and deepened both its distribution and asset procurement capabilities over the last few years. The company has grown from being predominantly a manager of fixed term single asset office property funds for high net worth individuals, to now having a much more flexible portfolio of funds, investor types and property segments.

In the last few years Centuria has materially grown its two listed trusts (Centuria Office Trust, and Centuria Industrial Trust), launched and grown an open ended unlisted property (Centuria Diversified Property Trust) and acquired a pool of assets and capability in the healthcare space with the Heathley acquisition. More recently, the company secured a $500 million institutional mandate in the healthcare space and acquired Augusta Capital, adding New Zealand to its platform.

Centuria’s distribution platform now sees it able to tap investor funds across high net worth, retail unlisted (through financial planners and platforms), as well as institutional mandates. This grows its access to investor flows at a time when demand for income is increasing materially.

At the same time, the company has also diversified its property capabilities beyond core non-CBD office and into healthcare, industrial and now New Zealand. This increases its flexibility in being able to identify and acquire assets to support the accelerating growth in investor funds flow.

At the start of the COVID-19 pandemic sell off, Centuria’s share price fell with the rest of the market due to concerns around the impact on demand for office space, which in turn could result in a material reduction in assets under management as well as impairing Centuria’s ability to acquire new properties to meet accelerating investor demand as fixed interest returns fell to negligible levels.

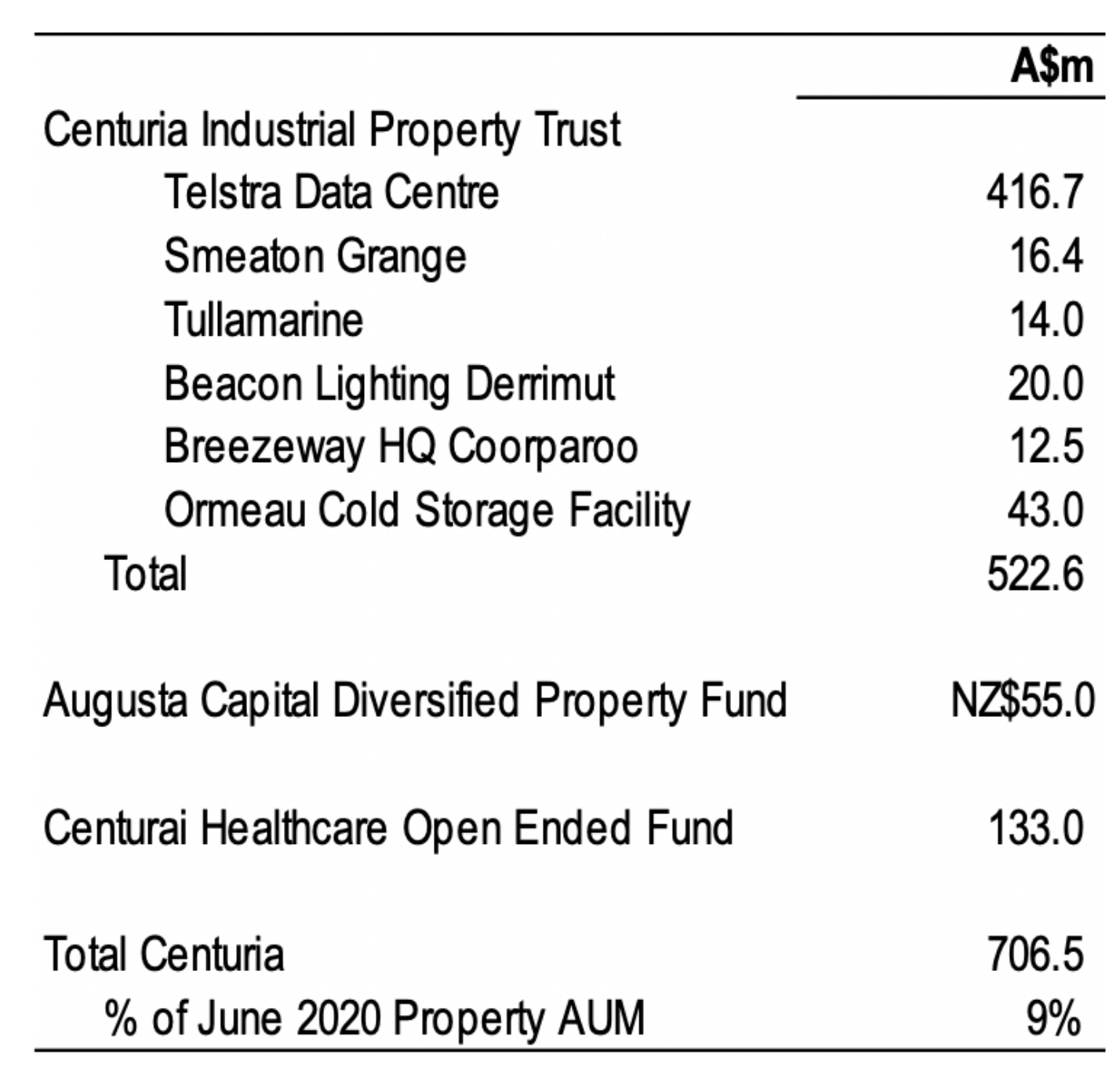

This potential risk was quickly met with a string of property acquisition announcements from Centuria since June, as the company pivoted away from office toward industrial, healthcare and the New Zealand market. Since June 2020, Centuria’s investment trusts have announced around A$706 million of acquisitions, equivalent to 9 per cent of the company’s property assets under management as at 30 June 2020 including Augusta.

Source: Company, MIM estimates

This demonstrated the value of the company’s recent diversification of its property category capabilities.

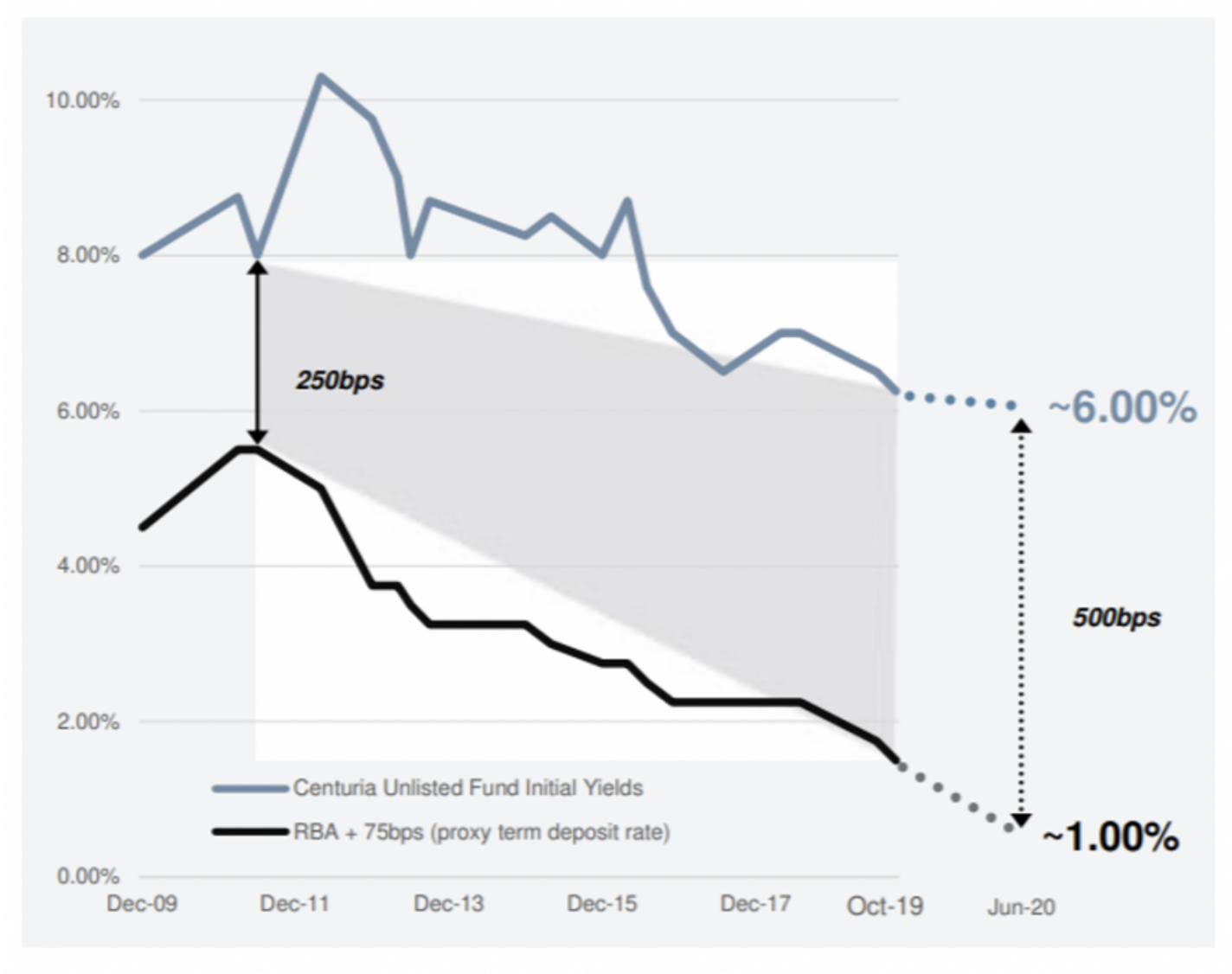

The company’s ability to acquire assets across a broader range of property categories means that it is more likely to benefit from an acceleration in demand for its products as investors are forced further down the risk curve in search of income generation. The company views term deposit rates as a base indicator of returns available to investors looking to income generating products. The gap between term deposit rates and the estimated first year return on Centuria’s new product launches has continued to widen despite continued downward pressure on property capitalisation rates.

Figure 1: Spread between Centuria product initial yield and term deposit rate

Source: Company

Given the pressure on bank net interest margins from the fall in the RBA’s Official Overnight Rate to 0.25 per cent, term deposit rates are likely to continue to fall, even if the RBA does not cut the Official Overnight Rate further.

Investors only tend to compare rates of return when they have an existing investment to be rolled over after maturing. This creates a lag in the price signal flowing through to investment demand and substitution between asset classes. Therefore, investor demand is likely to continue to grow in the near term as they become increasingly aware of how significantly term deposit rates have fallen.

With both investor appetite for Centuria’s products, and its ability to pivot its property purchasing away from office and into industrial, healthcare and New Zealand, the next question is what the share price implies from a cost of growth perspective.

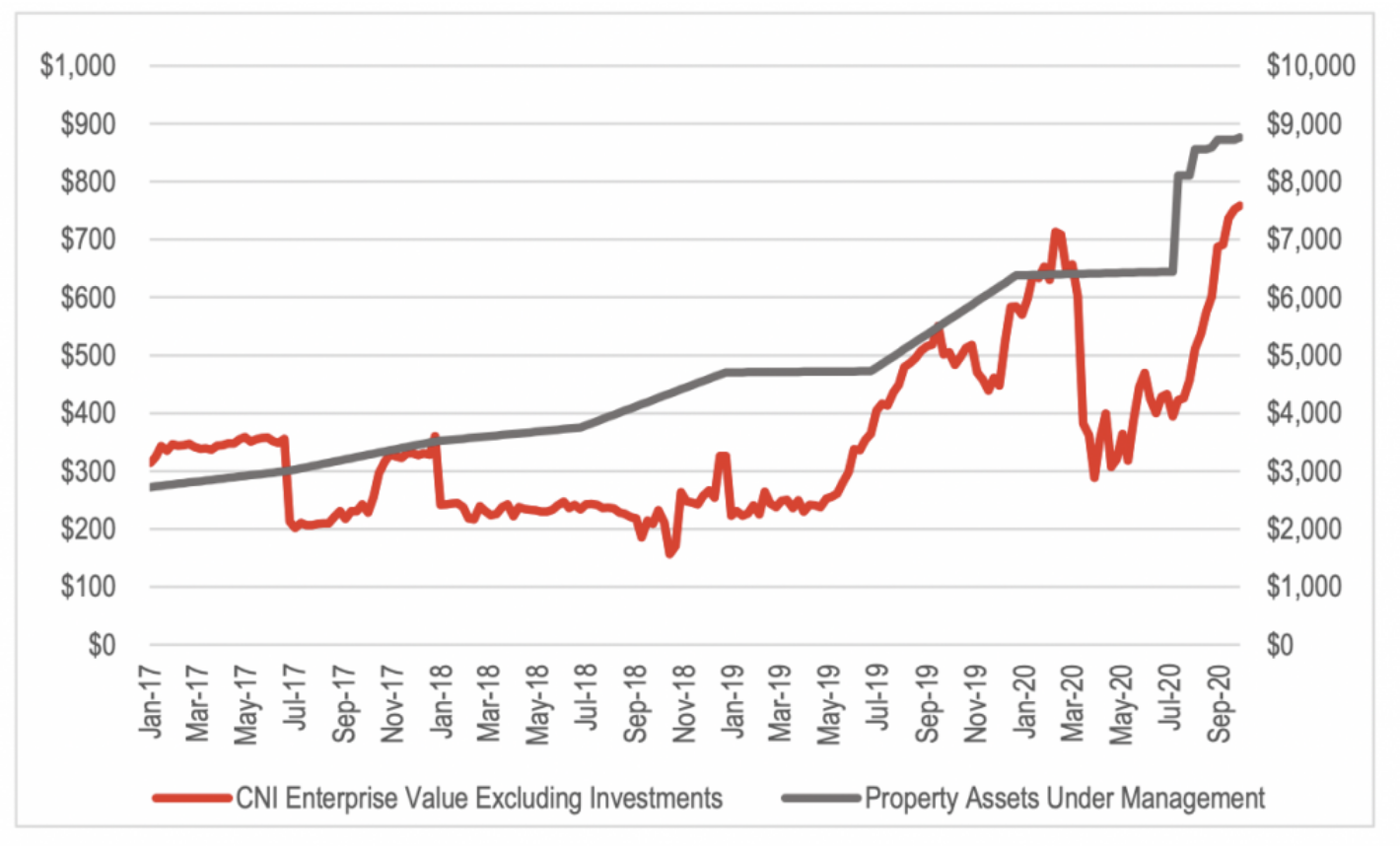

One way to look at what is priced into the stock is to deduct the market value of Centuria’s holdings in its three listed trusts, as well as the most recent book value of its holdings in the unlisted trusts, from its current enterprise value. This isolates what the value market is effectively placing on the property management, investment bonds and corporate costs segments. This can then be compared to its assets under management over time as a proxy for its sustainable level of revenue.

Figure 2: Centuria enterprise value excluding investments vs assets under management

Source: Company, MIM estimates

The chart below tracks the enterprise value of Centuria excluding the market value of its investments as a percentage of property assets under management.

Figure 3: Centuria enterprise value excluding investments as a percentage of assets under management

Source: Company, MIM estimates

The charts above show the correlation between Centuria’s assets under management and the implied value of the businesses excluding its investment holdings. However, there have been periods where the lines have diverged.

While Centuria’s share price has recovered in recent months, this rally has really only returned it to the same enterprise value to AUM ratio it was trading on this time last year. However, the outlook for investor demand from income is likely to be materially higher today, and Centuria’s platform is more diverse and robust.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned