Why you should add government bonds to your portfolio now

It has been something of a painful round trip for government bonds over the past month. 2-year US Treasury yields were around 4.6% a month ago, but climbed above 5.00% briefly before rallying back down to around 4.75%. That is a volatile move for diversified portfolios. Fortunately, equities have been delivering solid returns and most portfolios will have ended Q2 in reasonable state on a 12-month basis. But the Fed’s most recent minutes reveal more than a hint of arrogance, and that should worry investors. The Fed will almost certainly hike in July, and that will be a signal to begin preparing for difficult times ahead.

The Fed expects a recession.

The FOMC minutes showed that Fed staff expect a “mild” recession. This is caused by tightening bank credit conditions with already tight financial conditions. They expect:

- negative GDP growth in Q4 2023 and Q1 2024,

- below-trend GDP growth for 2024 and 2025,

- rising unemployment to peak in 2024, remaining near peak levels through 2025.

This is similar to a growing market consensus that the US can get by with a mild recession, or with a soft landing that evades recession entirely.

No such thing as a mild recession.

Recessions are non-linear. They tend to expose cracks in the economy that were unanticipated. Right now, there are plenty of areas I could anticipate cracks. Commercial property, auto loans, mortgage loans, leveraged loans, high-yielding corporate credit and junk bonds… There are no doubt other areas that will become evident in time.

Inflation tends to fall in a recession.

Inflation is sticky, until it isn’t. And it isn’t sticky in a recession. 2007-09 shows a neat example of this.

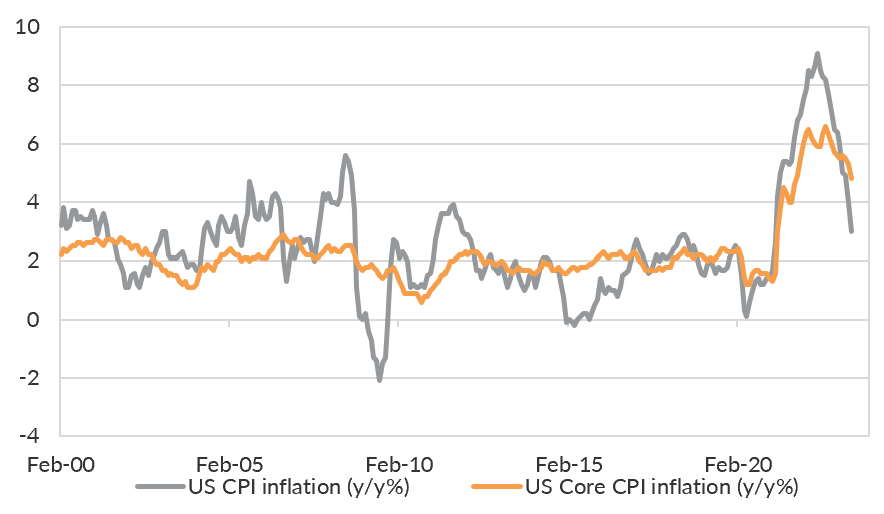

Chart 1: Inflation tends to collapse during recessions.

I expect that will be especially the case later this year given headline inflation is already collapsing. Evidence of disinflation abounds. There is a strong chance that headline inflation is materially below the Fed’s target by end-2023, with the disinflation compounded by the beginning of a recession.

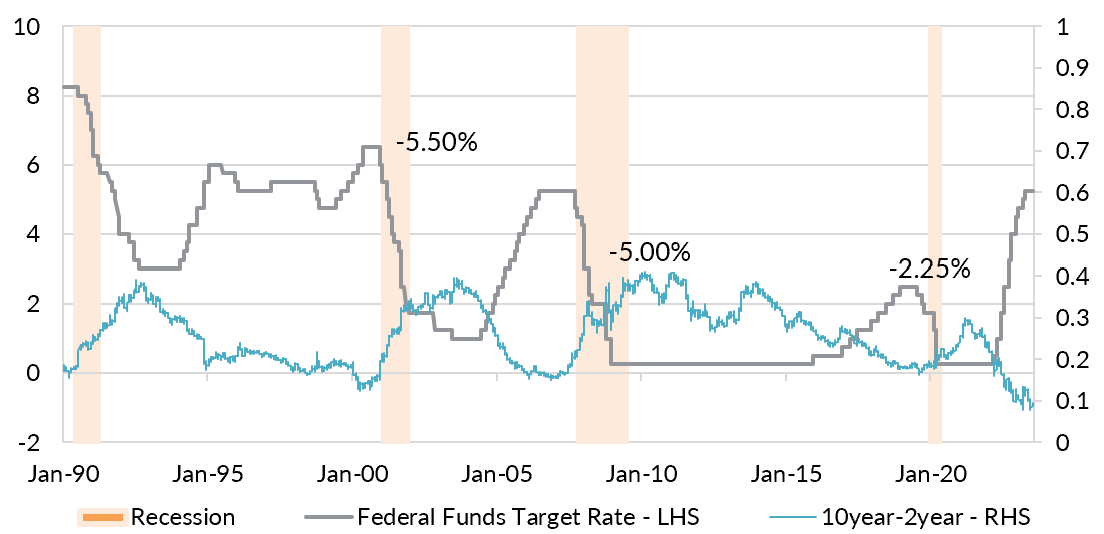

The Fed cuts during recession.

Because inflation tends to fall hard during a recession, the Fed tends to cut hard. In two of the last three recessions, the US Fed has cut rates at least 5.00%. The exception was the pandemic where rates were already low. But the Fed still cut by as much as they could. The idea of a mild recession where the Fed tinkers with rates but doesn’t cut hard doesn’t add up.

Chart 2: When the Fed cuts, it cuts hard.

Policy rate cuts means significant declines in yield.

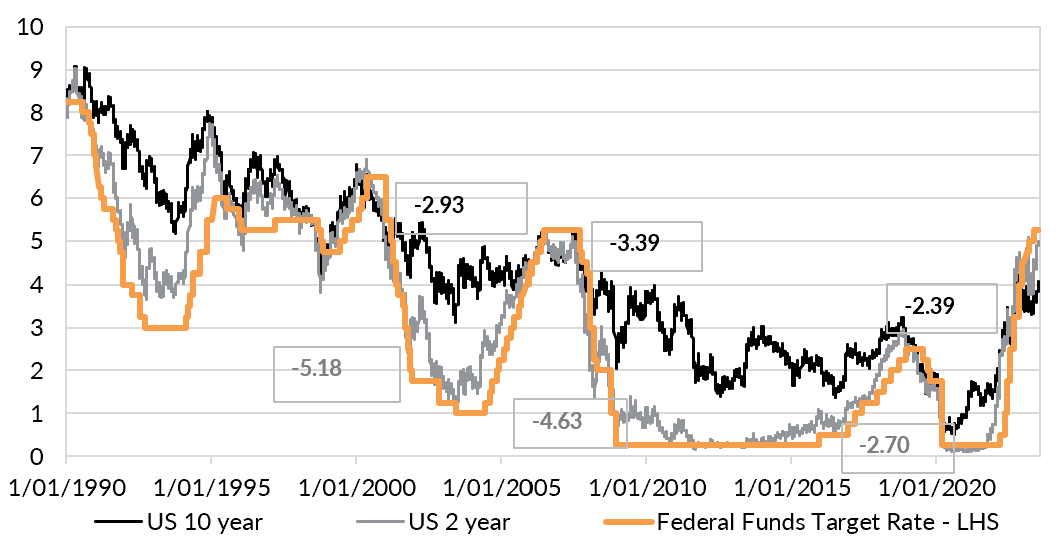

Chart 3 shows the moves lower in the 2-year and 10-year US Treasury yields through rate cutting cycles from the Fed. These are material shifts lower – even during the pandemic recession where policy rates were cut by less than in the previous recessions.

Chart 3: US Treasury yields follow Fed Funds rates lower during recessions.

With yields having backed up over the past week or two, there is now significant scope for US Treasury yields to move lower if and when the Fed needs to begin cutting rates for the recession it has as part of its own internal base case.

The outlook favours government bonds.

I expect the US to enter recession next year. I expect that will force the Fed to reverse a significant amount of monetary policy tightening – potentially as much as 4.00%-5.00%. But there are scenarios where the Fed needs to keep tightening. That could plausibly result in 10-year and 2-year US Treasury yields following policy rates higher. A potential upside could be as much as 1.00%-1.50% from current levels. That would take the US 2-year to around 6.00%, and the US 10-year to around 5.00%.

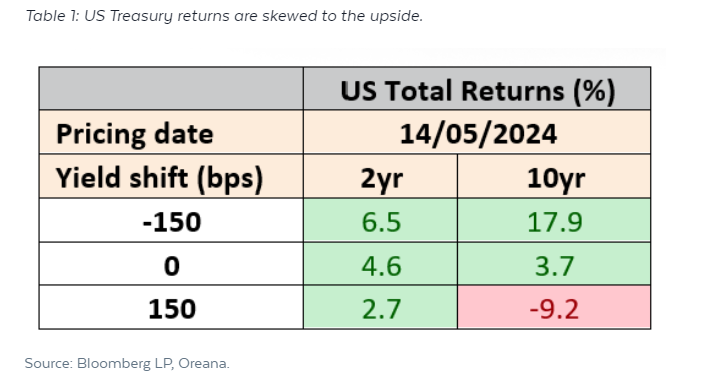

Table 1 below shows the potential total returns on a US 2-year and 10-year US Treasury bond between now and mid-May next year, assuming a 1.50% increase in yield versus a 1.50% decrease in yield. Because yields are high already, the risk is skewed towards the upside.

Table 1: US Treasury returns are skewed to the upside.

.png)

If you believe, as I do, that a recession is likely, then the returns on offer are even more attractive.

Prepare now and lock in positive outcomes.

Equity markets tend to drift higher after the Fed’s final rate hike. That means there is no burning rush to reduce equity risk right now. But there is an opportunity to lock in higher US Treasury yields before they begin to move lower. If you believe, as I do – as the Fed does, as the market does – that a recession is likely, then there will be few better times than now to lock in potentially attractive returns and important downside protection against a recession.

5 topics