Why you should ignore this year’s reporting season

In this wire, I’m going to argue that you should more or less ignore the earnings reports that are currently hitting the ASX.

As you know, reports are coming in for the 12 months to 30 June. Over that timeframe, economic growth was strong. In nominal terms, it was very strong, probably around or even over 10%.

According to the RBA, total credit growth was 9.1% in the year to 30 June, while broad money growth was 10%.

In other words, companies should be making hay.

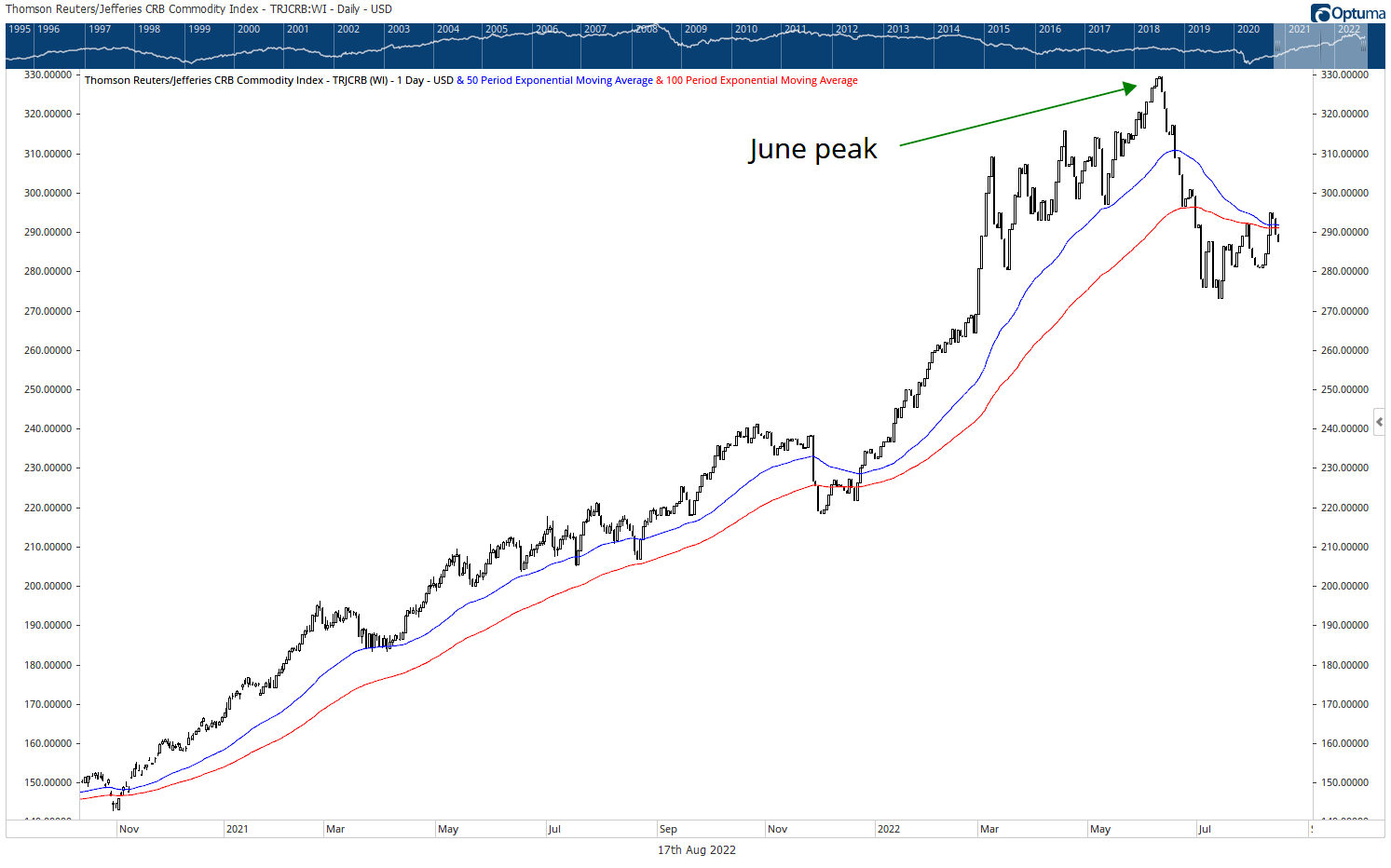

And while commodity price strength feeds into robust nominal economic growth, just to emphasize the point, commodities price peaked in June, as the chart of the broad CRB commodity index below shows…

So there was a lot of earnings momentum going into the end of the financial year. But 30 June was a long time ago. Well, only about seven weeks to be exact, but in the world of forward looking markets, that’s a distant memory.

Remember, the COVID induced inflationary surge forced central banks to tighten aggressively this year. The RBA only started raising rates in May. And then it was only by 25 basis points. They hiked by 50 basis points in June, July, and August. Due to the lagged nature of banks passing on higher interest rate costs, tighter monetary policy will only start affecting household budgets around now, with more to come.

Then there are the second order effects to consider. Once spending slows, employers start to respond to this weaker demand by laying off workers. That takes time.

This is why you’re not seeing labour market weakness yet.

But employment is a lagging indicator. And the full effect of monetary policy tightening takes 6-9 months to show up in economic output.

It’s all about the outlook

That’s why I wouldn’t put too much stock in FY22 earnings giving you a read on the future.

It’s all about the outlook and, from what I’ve seen so far, many companies aren’t prepared to say much on that front. Earnings guidance is difficult to give when you don’t know what the future brings.

JB Hi Fi’s vague outlook statement from Monday’s results release sums it up…

‘As we enter an increasingly uncertain retail environment and household budgets come under further pressure, customers will gravitate to trusted value-driven retailers.

They know what’s coming…

Stock markets usually respond to uncertainty by falling. They did that for the first half of the year, by anticipating the slowdown that would come from tighter monetary policy.

But in recent months, markets have become more certain that central banks will engineer a soft landing. That is, they will tame inflation while keeping economies (and company earnings) afloat.

Maybe they can do it. But I think it’s a low probability outcome.

The thing is, by rallying so strongly since the June low, the market is telling the Fed it hasn’t tightened enough!

But that’s just my opinion. And in this game, opinions are more or less worthless. Which is why I always consult the charts. Charts are simply a visual representation of the millions of decisions that investors make on a daily basis.

The message in the charts

But sometimes looking at a broader index doesn’t give you the full story. Drilling down into specific sectors, and looking at the performance relative to the broad index, can be insightful.

That’s what I did for members of my Fat Tail Investment Advisory this week.

I compared two economically sensitive sectors to the broader S&P500 to see how the relative performance looked. The idea being that these sectors should lead the ‘recovery’, being economically sensitive and all.

I wrote…

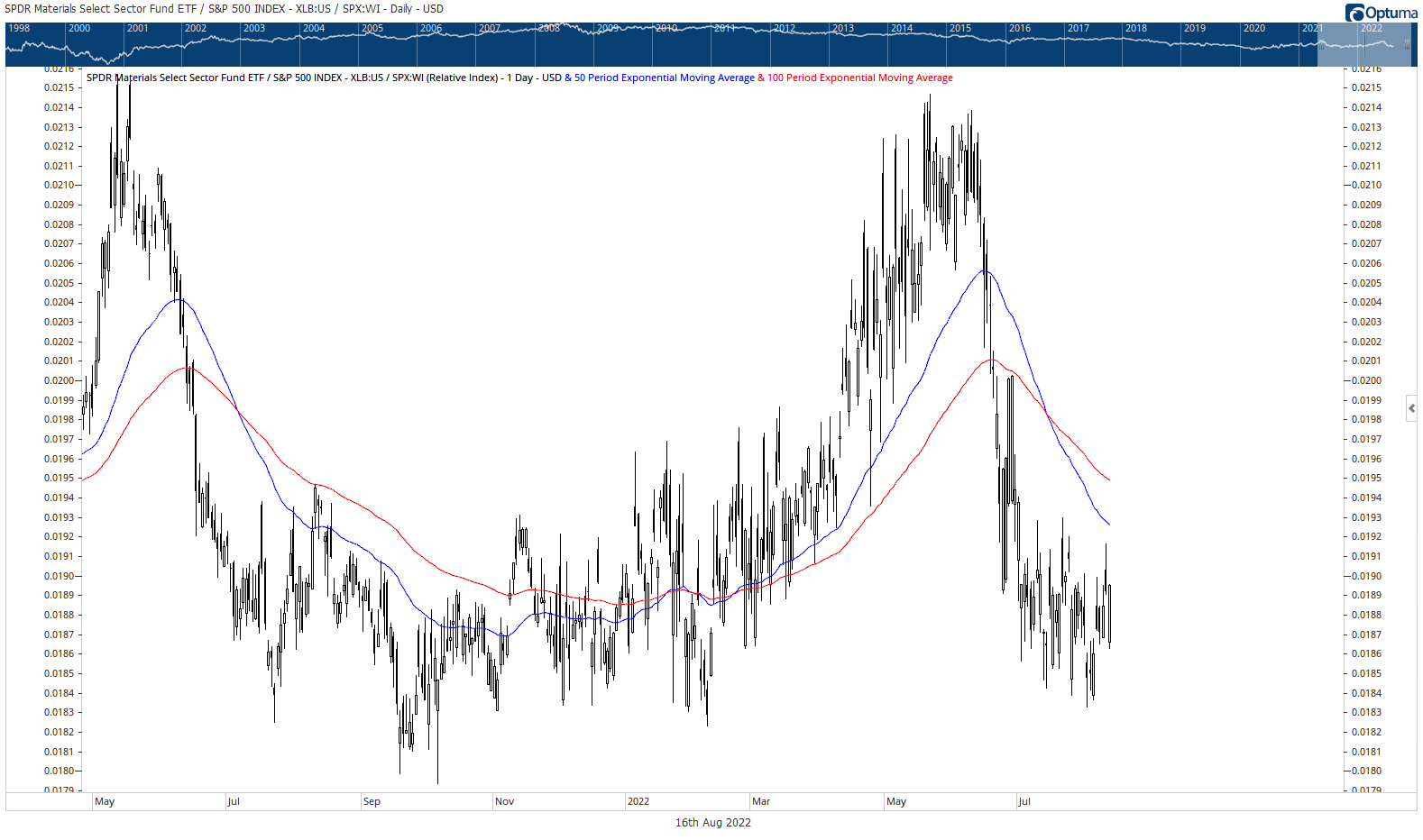

‘…the following chart shows the SPDR Materials Select Sector ETF relative to the S&P 500. This economically sensitive sector has underperformed the broader market considerably since May/June:

‘As everyone knows, copper is one of the best barometers of economic activity. Yet the next chart shows the Global X Copper Miners ETF underperforming the broader market too:

‘Again, if we were at a genuine economic turning point, these two economically sensitive sectors should be outperforming.

‘That’s why I’m inclined to think what we’re experiencing is a bear market rally driven by a change in sentiment more than anything else.’

If we’re still in the early stages of the tightening cycle, and with the full effects of this year’s rate rises still to be felt, of course economically sensitive cyclicals should not be outperforming.

So those charts make sense.

Let’s look at some others…

Financials are another cyclical sector that should be outperforming in a ‘worst is over’ environment. But as you can see below, this sector is going sideways relative to the S&P500 (the green arrow starts from the June market low).

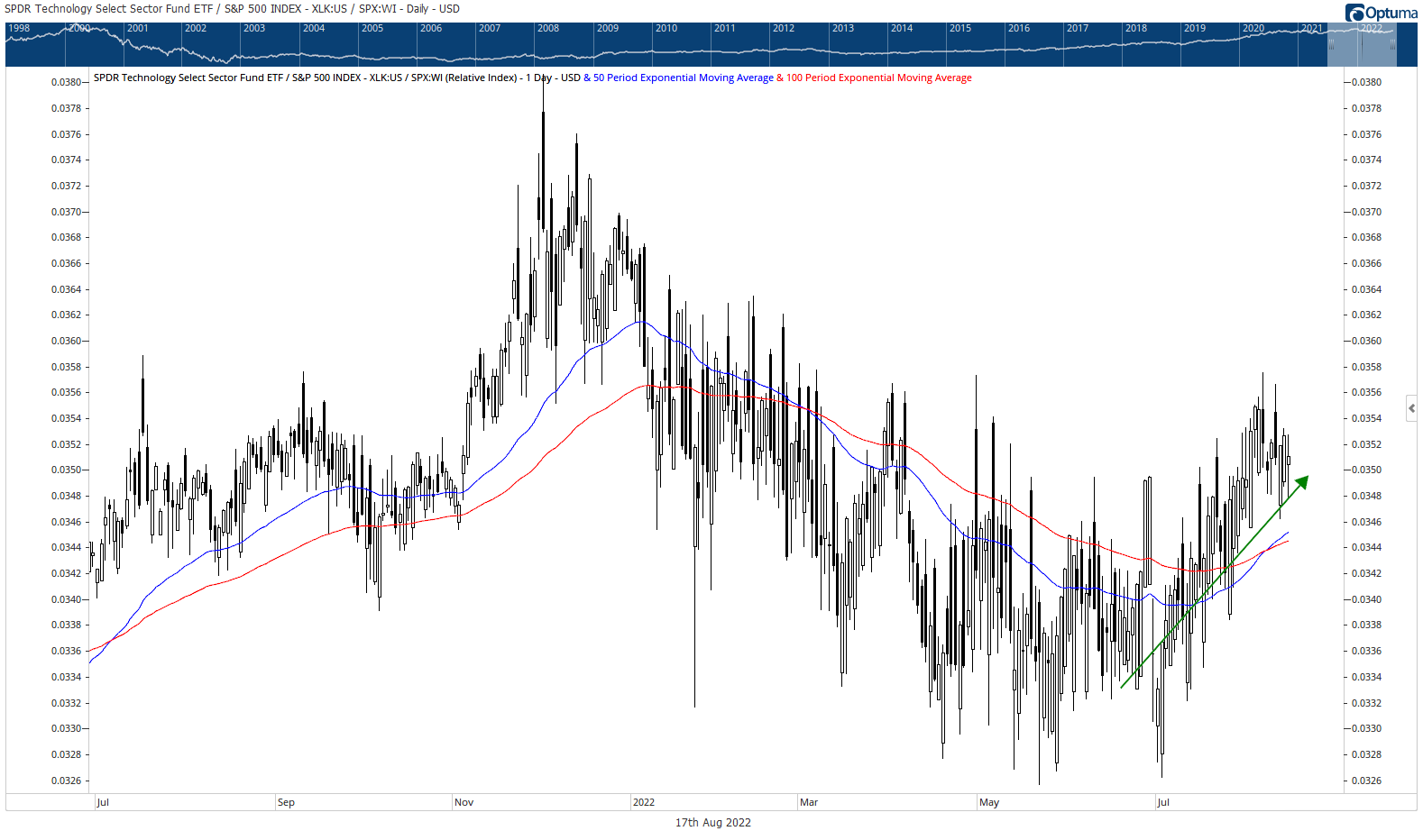

So what is outperforming the broader index in this (bear) market rally?

The SPDR Technology Select Sector Fund ETF…

This tells you investors are going back to what worked previously.

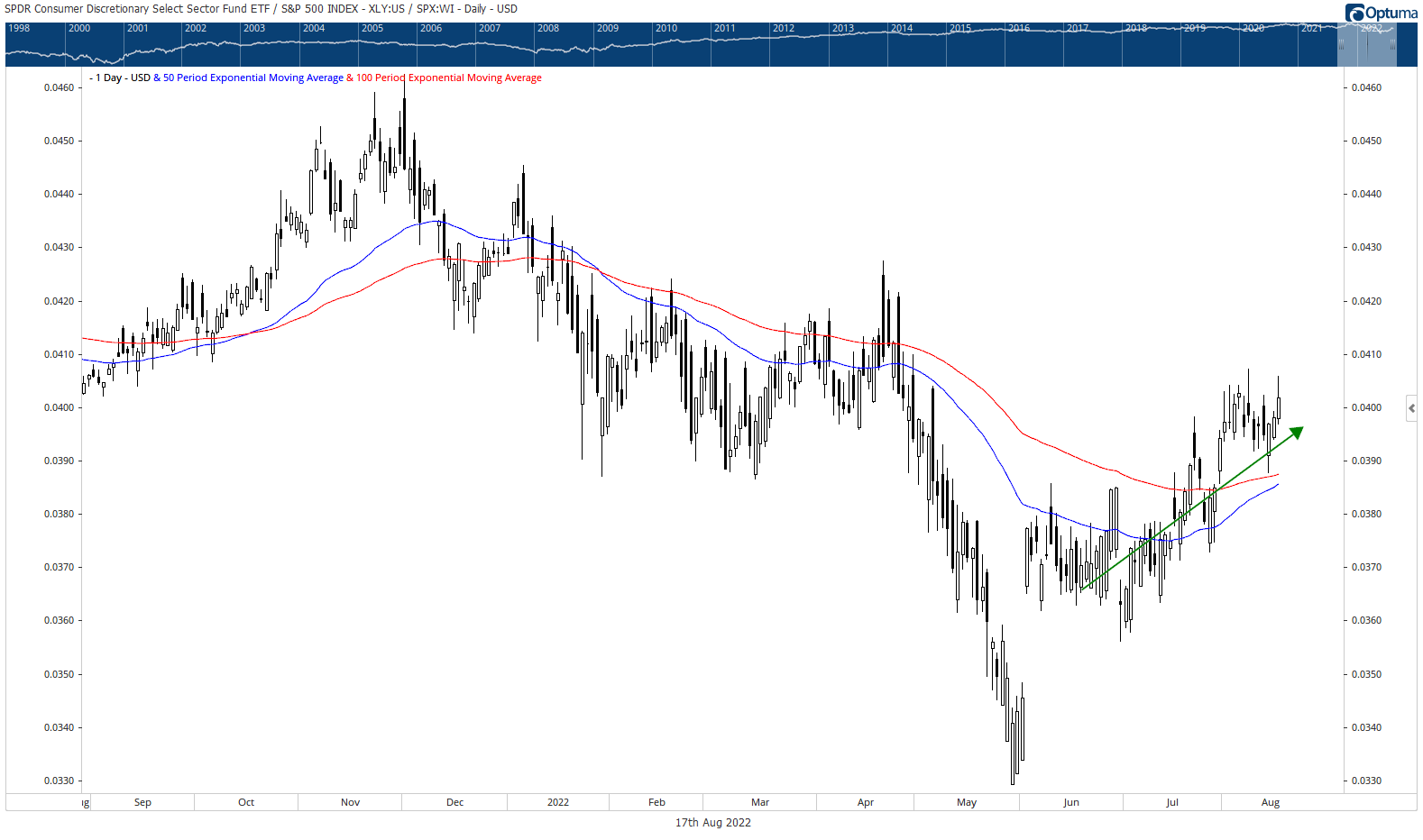

Here’s the SPDR Consumer Discretionary Select Sector ETF…

This outperformance is interesting. On the one hand this is a highly cyclical sector and the outperformance is a bullish sign. But it underperformed big time as inflation fears heightened throughout April and May. And more recently, strong employment data has no doubt boosted the prospects of beaten down consumer discretionary stocks.

While I have my doubts, this chart is telling you the worst is over for the US consumer. It is worth keeping an eye on.

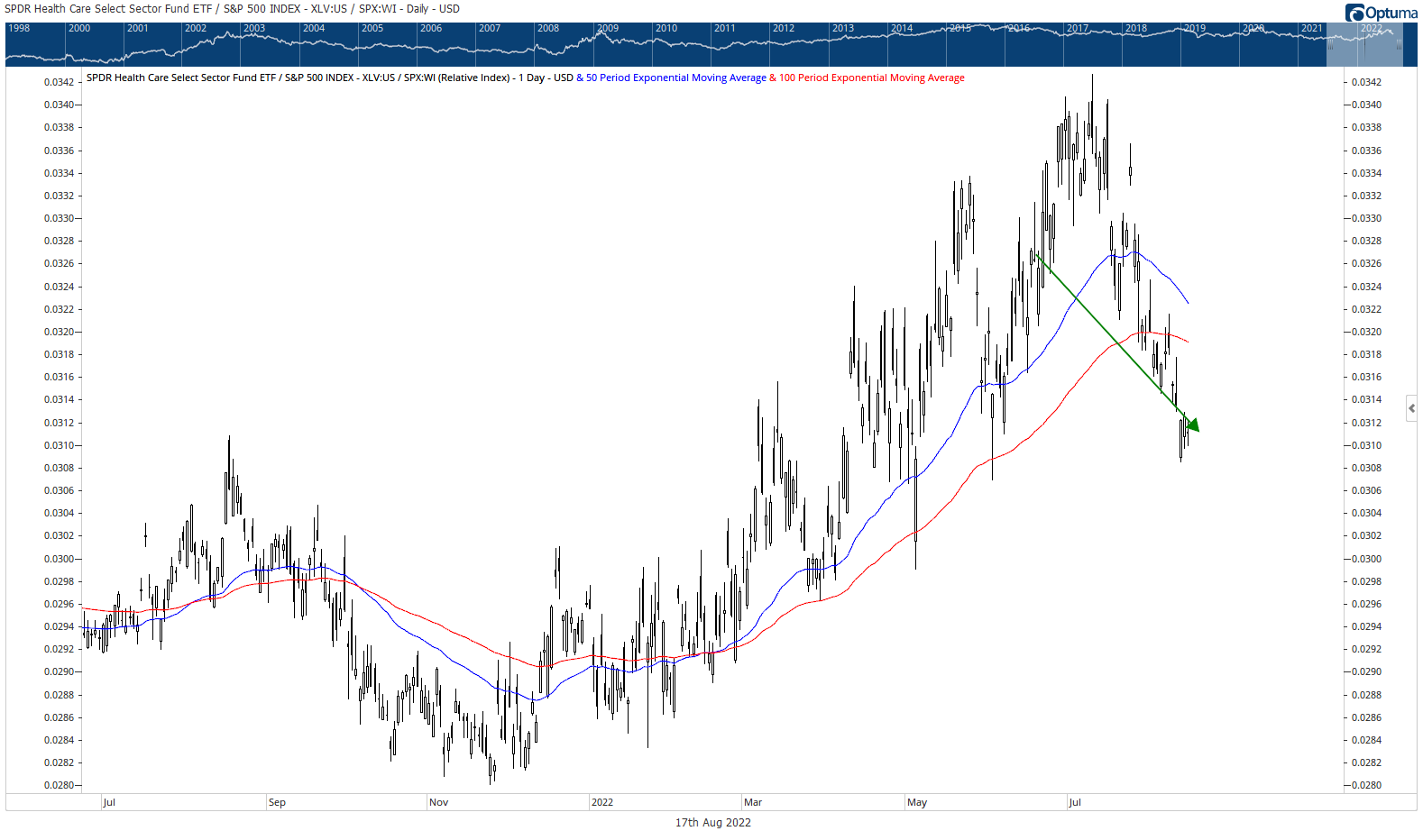

And adding to the bullish case, capital has been rotating out of defensive sectors like healthcare and consumer staples. You’d expect to see that happen as investors embrace a ‘risk-on’ environment.

Here’s the SPDR Healthcare Select Sector ETF relative to the S&P500…

And the SPDR Consumer Staples Select Sector ETF…

What does it all mean?

The overall picture is no doubt confusing. On the one hand you have cyclicals underperforming but then so are some defensive sectors.

Capital is flowing back into tech as a ‘peak inflation’ trade. That is, peak inflation means falling bond yields, which means higher asset prices (if you ignore earnings risks).

But the stock market has continued to head higher over the past few weeks at the same time as bond yields have stopped falling. And the yield curve remains deeply inverted. Meaning more economic pain is coming down the track.

Based on my interpretation, this all has the feel of short-term positioning and capital rotation, rather than a fundamental change to the bigger picture.

Which is why I think probability favours the view that this is a bear market rally. Due to the lagged effects of monetary tightening, there is earnings pain ahead. Yet the market is prepared to ignore this and focus on the prospect of future monetary easing.

But that is a long way off.

So think about taking some money off the table here, then have the patience to see what comes next. I don’t know what that will be. But I don’t know that it will be very different to FY22.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics