Why you should pay attention to global microcaps

Spheria Asset Management

One of my former sell-side colleagues used to say, “analysts pick the top of the market, the sales desk picks the bottom”.

Part of this stems from the observation that sales people tend to be optimists, whereas analysts are more risk conscious. But it also indicates that the title of market seer can move from one group of investors or asset class to the other.

Historically, it’s been the bond market which has earned a formidable reputation for its economic forecasting. However, recent history suggests it has either lost its mojo or is now heavily distorted by the Central Bank Cartel.

Bonds were late to recognise the threat of COVID – it wasn’t until mid-March when yields started to tumble, but there were signs of trouble much earlier.

Similarly, the bond market was less convinced about the development of COVID vaccines. US 10-Year Treasuries stayed anchored until the end of September 2020. By then equity markets had already screamed back (microcaps in particular).

And more recently the bond market fell for the Central Bank Cartel’s “transitory inflation” narrative with US 10-Year Treasuries hovering around 1.5% until the beginning of 2022.

The asset class ahead of the curve

Intuitively, it makes sense that microcaps are often pricing ahead of the curve. While not given recognition as a bellwether asset class, smaller companies are often further up the supply chain and more often than not feel the economic impact first.

The mix of industrials and materials in the asset class is also higher than larger peers, making it more economically sensitive.

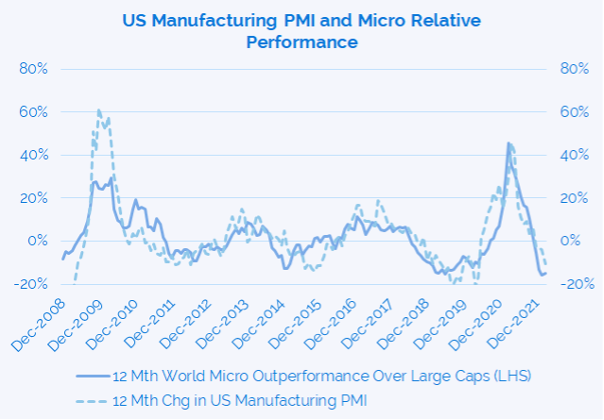

We closely watch the relationship between microcaps and the US Manufacturing Purchasing Managers Index (PMI) and it continues to hold ex-ante and even through COVID.

Source: Bloomberg, Spheria

The US Manufacturing PMI is a survey of purchasing managers in the US. Purchasing managers typically have early access to a firm’s data which can be a leading indicator for the wider economy. The survey asks the manager whether they think business and industry conditions have improved, remained constant or deteriorated compared to the previous month.

Our chart above shows that the change in US Manufacturing PMI is closely linked to the performance of microcaps relative to large caps. In this instance, the US manufacturing PMI was a breakneck 63.7 in March 2021 (>50 means expansion), showing rapid economic expansion.

However, by the end of January this year, microcaps had underperformed large caps by 13.0%, the most since the MSCI Microcap Index started in November 2007 (including GFC and COVID). This is consistent with a PMI of 51.7, signalling a sharp slowdown in economic activity.

Indeed, when the March PMI reading was released in early April, it had fallen to 57.1, below expectations of a more mild slowdown to 59.0. Only two out of 61 economists forecast a PMI below 57.5. Microcaps had seen the slowdown more than two months ahead, and had front-run a flattening US yield curve (January 2s-10s US Treasury spread 63bp compared to current 14bp).

Microcaps during market turning points

Our view of the world when talking with microcap companies’ management is that indeed the economy is slowing. Price elasticity from rising prices is biting, oil is impacting, EU consumers and businesses are nervous about the Russia-Ukraine conflict, and most of all, companies are holding significant excess inventory to manage ongoing supply chain problems. When this inventory normalises, it will leave a significant hole in economic growth.

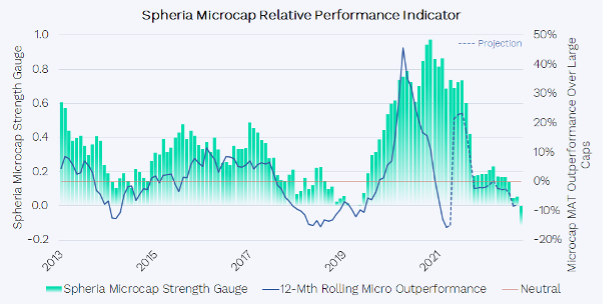

Another gauge we use to sense how microcaps may perform relative to large caps is our model below.

This uses the bond market as a forward-looking signal (18 months forward). However, as I mentioned above, bonds are off their game. The model worked well until recently when microcaps have rushed to price in a weakening economy, and yet bonds have only just signalled the kind of underperformance microcaps have already delivered relative to large caps.

Source: Bloomberg, Spheria

There’s strong historical evidence that shows allocating to stocks outside of the big end of town can strengthen portfolios when the market turns. The MSCI World Small Cap Index outperformed the larger MSCI World by 14% on the way down during the dotcom bust. While the MSCI World Microcap Index does not extend that far back, if the GFC and COVID are a guide, it would have outperformed by a similar magnitude. Since microcaps have already underperformed larger peers, and are factoring in a slowing economy, the odds of microcaps outperforming a shaky broader market seem high.

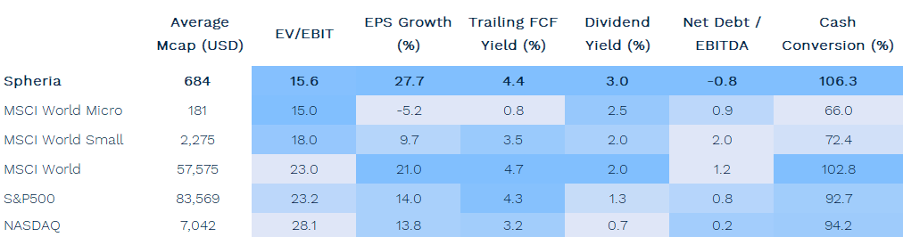

Furthermore, in this uncertain environment of geopolitical tension and slowing economic momentum, investors could be well served sticking with high quality companies. However, quality in large caps is priced for perfection, and these stretched valuations are susceptible to the Central Bank Cartel unwinding its asset purchase program (Quantitative Easing). On the other hand, investors can achieve quality at far lower multiples in microcaps.

Source: MSCI, Bloomberg, Spheria. Cash Conversion = Free cash flow before interest and tax / EBIT.

With an unrivalled universe to choose from, microcap investors can construct a portfolio of high free cash flow, high returning businesses, at a fraction of the earnings multiple.

Despite this, investors largely remain unaware of the global microcap asset class. In some ways, the less that know about it, the better.

Discover more about how an allocation to global microcaps could strengthen your investment portfolio.

Watch Gino Rossi's latest investor update here and click the follow button to be notified about his next wire.

1 topic

1 fund mentioned

Expertise