Will 2023 be the year of the bond or the small cap? Why not both!

This is our March 2023 quarter outlook which, given we are recording this a few weeks prior to the close of the calendar year, also enables us to lift our eyes and make some broader outlook comments about 2023.

In our last two quarterly videos, there were a couple of key themes that I hope I left you with.

Despite a rather obvious and looming negative EPS cycle which should come to a head in the February reporting season, the starting position for the December quarter was:

- a strong consensus view of recessions being imminent for most major developed economies;

- ongoing growth struggles for China;

- hawkish rhetoric from most major central banks; and

- bearish positioning by most portfolio managers.

Nevertheless, since mid-2022 we placed our flag in the sand and declared that the start of Q4 would mark the commencement of a risk rally. The thrust of the argument was that our forecasting framework suggested the tone of the global economic activity data would continue to cool and inflation would start to surprise on the downside as we moved through the second half of the calendar year.

We argued that this would be sufficient for interest rate markets to look through central back guidance for ever higher short-term rates and for long-dated bond yields to peak and commence a rally.

The conclusion was that a rally in risk assets would commence from the start of Q4, with equities likely to do best and the Australian dollar would likely appreciate relatively quickly.

Recorded 8th December 2022

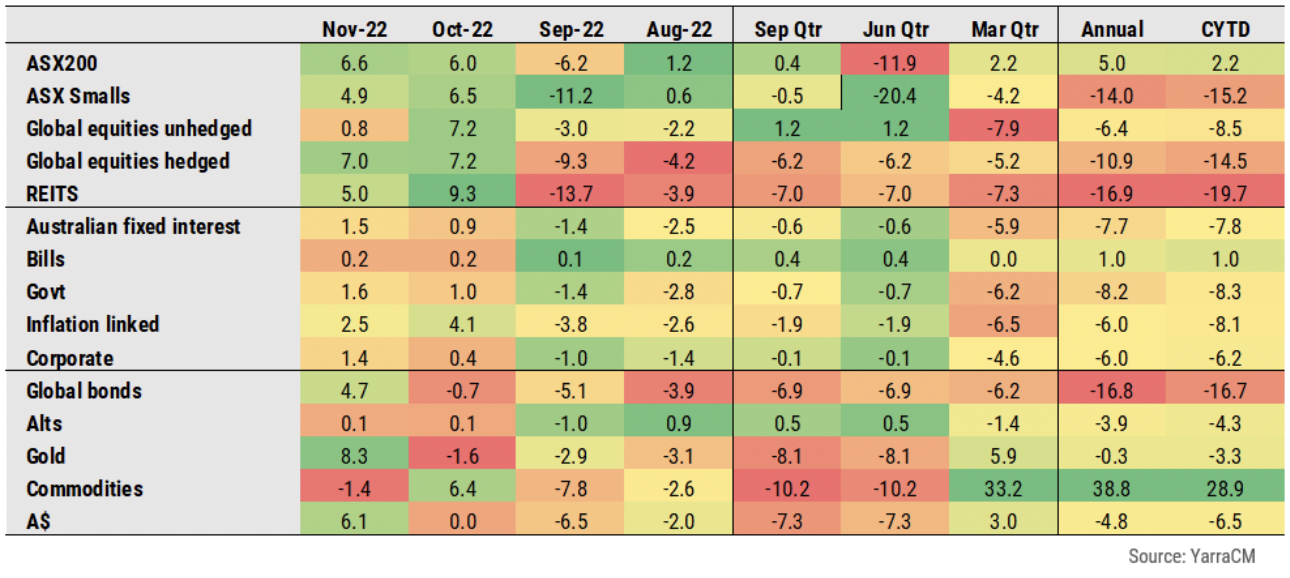

Recent Market Performance

As of the end of November, it's certainly been a very solid 2 months. The ASX 200 returned over 12.5%, only bested by a 14.3% return from REITs. Gold had a stellar November, up 8.3%, and while this may seem paradoxical in a risk-on period, the cause can largely be traced to gold’s familiar stalking horse - a fall in real bond yields.

The Australian dollar bounce was notable – up 6.1% so far in the December quarter. It was a sufficient move to really take the gloss off global equity returns for the unhedged. Unhedged investors in global equities received a solid 8% in the past two months, however, for the hedged investor the return has been a very tidy 14%.

The lesson here is that the Australian dollar's turning points really do matter for wealth generation if you’re prepared to think through the implications for your hedged vs. unhedged offshore investments.

As someone who has spent far more time than anyone really should think about a better mouse trap for FX forecasting, let me assure you that no one can lay claim to successfully forecasting the dollar in a systematic and repeatable manner. But frankly, this time around it was relatively foreseeable and it should extend into 2023.

In the fixed income space, despite some better returns over the past two months, non-cash strategies are all down between 6-8% CYTD, ensuring 2022 will be a year for the record books and a year to forget for most fixed income managers. In this respect, a tip of the hat to our Enhanced Income Fund and Higher Income Fund strategies, which both look set to return positive annual returns in a sea of red.

The concluding comment last quarter was:

“To be clear, we are not talking about a large cyclical recovery in the global economy, we are not talking about near-term rate cuts and we are not talking about earnings surprising expectations."

"What we are talking about is central banks taking their foot off the throat of financial markets and valuation adjustments supporting a better re-entry point for risk markets.”

I can only repeat that message as we approach 2023.

Reasons to be hopeful

China appears to be finally relenting on its zero-COVID policy, and our conviction that inflation will continue to surprise on the downside through 2023 has only grown. And despite what Central Bankers are currently saying, our view is that come February the Fed and most other central banks will talking about an extended pause in this tightening cycle.

This should be enough for equity markets to climb the wall of worry and move into the ‘hope’ phase of the cycle. However, can we really traverse the next two months where companies will likely be downgrading in earnest?

My bias is that equity markets have run to the top of the range for now. We can see that across a raft of technical indicators. So the risk of some pullback in market enthusiasm is likely through December.

If our predictions for US and local economic growth are correct, then the next US reporting season should present a 5-7% correction in equity prices. Taking some risk off the table through December and January before adding it back again in and around the February reporting season is warranted if your objective is to trade the news cycle.

The natural place to go into Q1 is bonds. We are already overweight bonds and have increased our exposure across our multi-asset and fixed income strategies in recent months.

We funded the move by reducing our cash positions. We added to our equity and our bond holding, yet our time horizons for the payoff for these trades are slightly different.

Our belief was that equities and the Australian dollar would do better on the first signs of weaker inflation and stability in bond yields. So far this has worked well but we expect Q1 to really be the time when our fixed income positioning pays off.

This is not a mean reversion trade.

This is a fundamental view on a bond market that has been so belittled by the size and velocity of the losses sustained through 2022 as inflation raged and central banks stepped back from buying under the guise of quantitative tightening, that they seem to have forgotten themselves.

If a recession is indeed looming in G7, inflation pressures are rapidly dissipating, and central bankers’ conviction in the need for further aggressive tightening is wavering, then bond managers will at some point remember what bonds tend to do at this part of the cycle.

Perhaps some reflective time over the holiday period, some distance from the trauma of 2022 and a few mulled wines will jog their collective memory. But for mine, Q1 is looking like a particularly interesting setup for a fixed income rally.

So if the bottom line for Q1 2023 is a bond rally, some giveback in equity prices, and a market more driven by company earnings announcements than policymakers, what might the rest of 2023 look like?

Naturally, the normal caveats apply. The further you look out, the wider the confidence intervals around any forecast. Nevertheless, our central position remains that there is no white knight riding to the rescue in 2023 showering financial markets with policy relief and renewed bouts of excess liquidity.

It’s important to note that almost all prior economic upswings are policy-led. To be more specific, they tend to be more reliant on tangible and more immediate fiscal relief than interest rate relief.

In this respect, the Treasuries of most Western governments are looking pretty bare, and the appetite by politicians to take on more debt post the COVID stimulus is next to nil. Fiscally the world, ex-Australia, is tapped out.

The rationale to own equities has to be because the drawdown opened up valuation anomalies that good active stock pickers can harvest and because the economic downturn is already more than priced.

Australian small caps are still down 15% CYTD and we maintain that there are good opportunities to profit from investing in some of the quality companies caught up in the indiscriminate selling of 2022. In this respect, our small and microcap teams are as excited about the opportunities as I have seen them.

Of course, small caps are a higher beta version of large caps, and they still need large cap equity markets to be trending higher to do well. Moreover, Aussie large caps rarely can sustain a rally without a lead from global markets. So we will need some global leadership for equity markets to sustain a risk rally through 2023.

It’s a pretty consistent commentary in financial markets that equities are still overvalued and equity fund managers are very cautiously positioned. Equities will have to present as good relative value for a rally to be sustained if policy easing proves elusive in 2023. From our perspective, equity markets are not as expensive as many suggest.

S&P 500 Analysis

Let’s first take a quantitative look at the largest and most expensive major market, the US. You might have to bear with me a bit here.

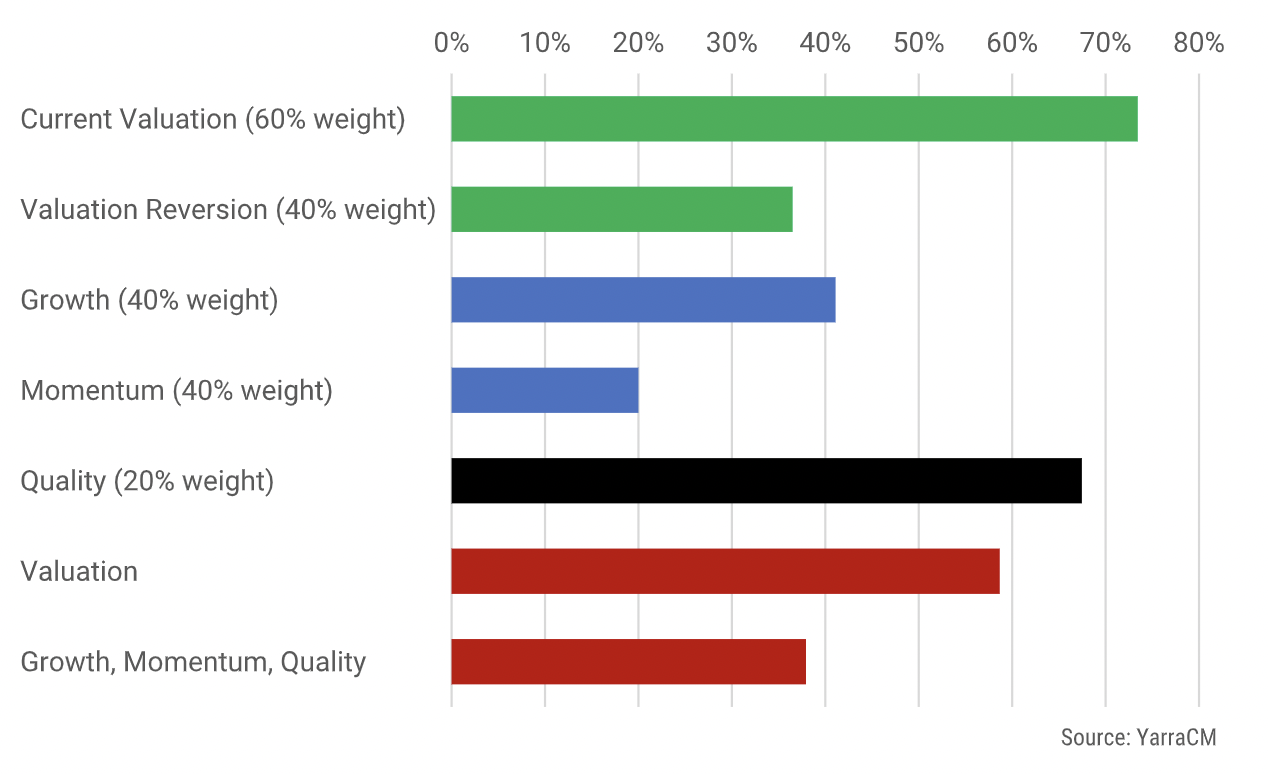

We try and look well beyond a 12-month forward P/E when assessing a market, which for the S&P500 is at its 67th percentile relative to history. So not cheap on this single measure, but not an extreme overvaluation either.

A more comprehensive approach is to include other equally relevant market indicators. Indeed, forward yields, expected EV/EBITDA, Price to Book, and Earnings yield to bond yield ratios are all quantitatively important factors in assessing valuation in an absolute sense. But so is each of these measures relative to their own 5 or 7-year moving average.

That is, we place almost as much importance on valuation reversion as absolute valuation when assessing tactical shifts. Similarly, for earnings: expected earnings and margins are important, but so too are momentum in those earnings estimates as well as the equity price momentum. We use these indicators to break the market into ‘Growth’ and ‘Momentum’ indexes. The third dimension is the health of balance sheets. An examination of the return on equity, shifts in the expected ROE, leverage, interest coverage and the realised and expected volatility are used to assess the quality of the earnings stream on offer.

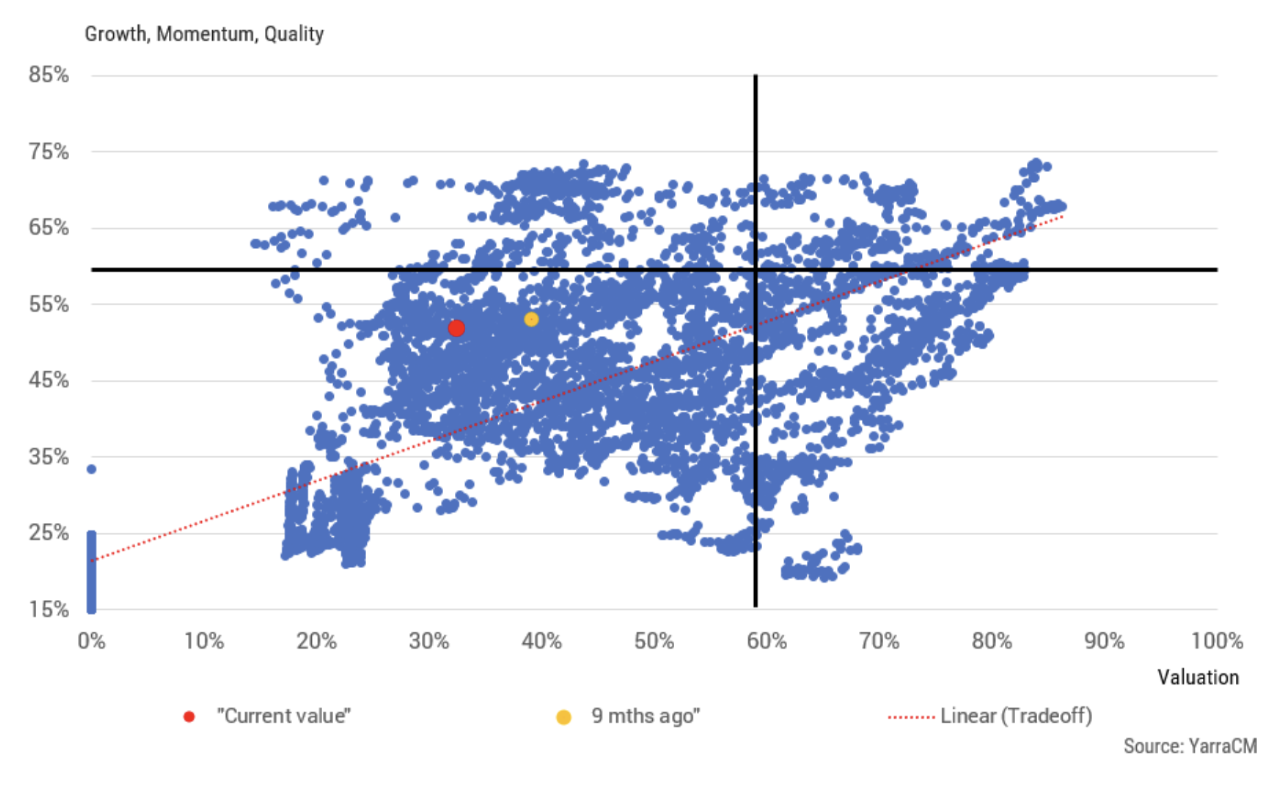

Chart 2 – S&P500: Key Quantitative Factors

A summary of the S&P 500 measured on these Valuation, Growth, Momentum and Quality factors ranked as percentiles relative to the daily history over the past 30 years is shown in the above chart.

The chart shows that the US market is not cheap in an absolute valuation sense. It currently sits at the 73rd percentile relative to history.

However, valuation reversion in the US market is only at the 36th percentile. That means a lot of ‘steam’ has already come out of the market.

Combined, absolute and relative valuation is at the 58th percentile – only slightly over the historic average.

When we aggregate the Growth, Momentum and Quality factors, we find that the US market is only at the 38th percentile relative to history.

In summary, across a whole range of metrics, the S&P500 is less concerning than it was 12 months ago. Valuation metrics have crept higher in recent weeks, but are not extreme.

The Growth and Momentum factors are well below the historic average – that is, the market is not overpaying for the earnings growth on offer nor is it ignoring the risk of negative earnings revisions.

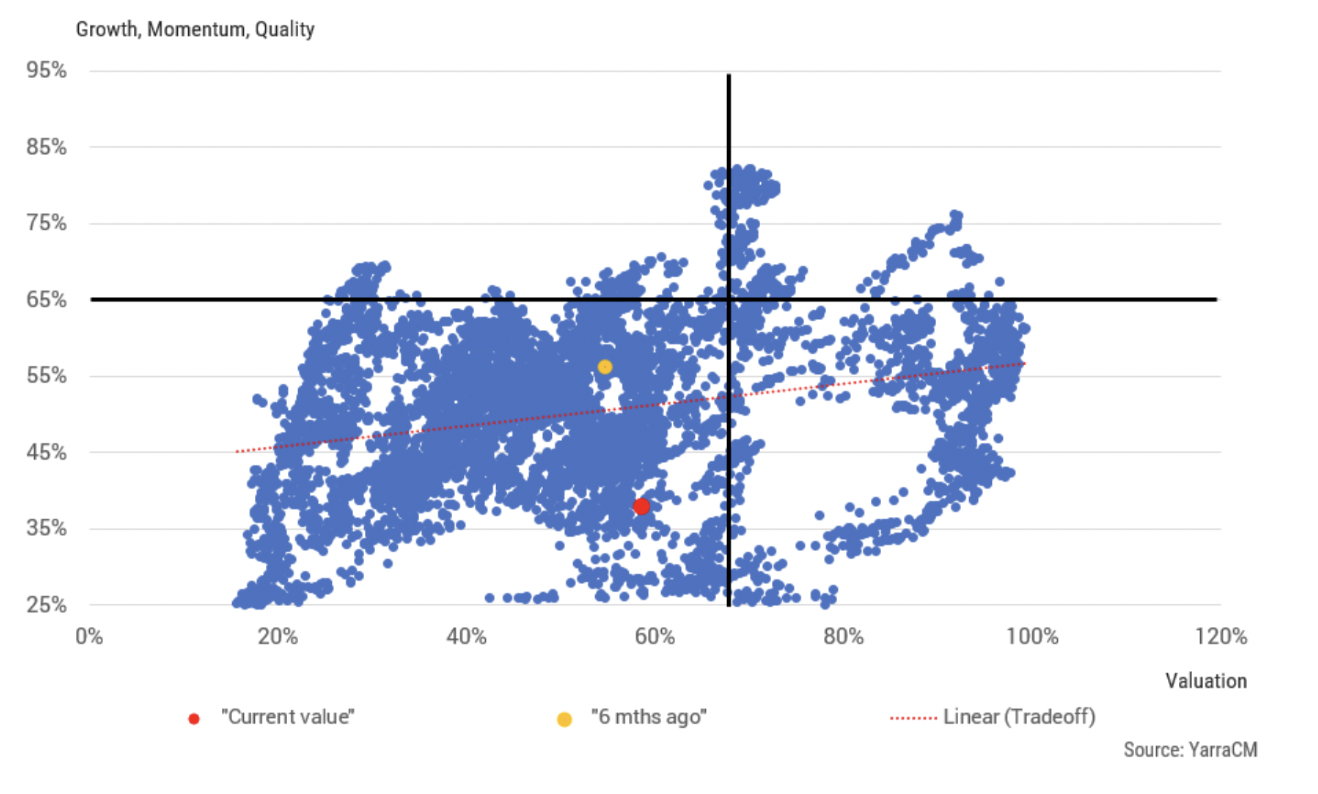

Chart 3– S&P500: Valuation and Growth/Momentum/Quality Tradeoff

To get a sense of how the current intersection between Valuation and Growth, Momentum and Quality factors look consider chart 3. The blue dots represent all daily observations since 1995. The Red dot is where we are today.

We find that when the red dot is in the top right quadrant of the chart, a major equity market correction is imminent.

The bottom line is that S&P500 is quite some way from ‘sell the market territory’, in contrast to most commentary. In some ways, this is the best valuation entry point we have had for several years.

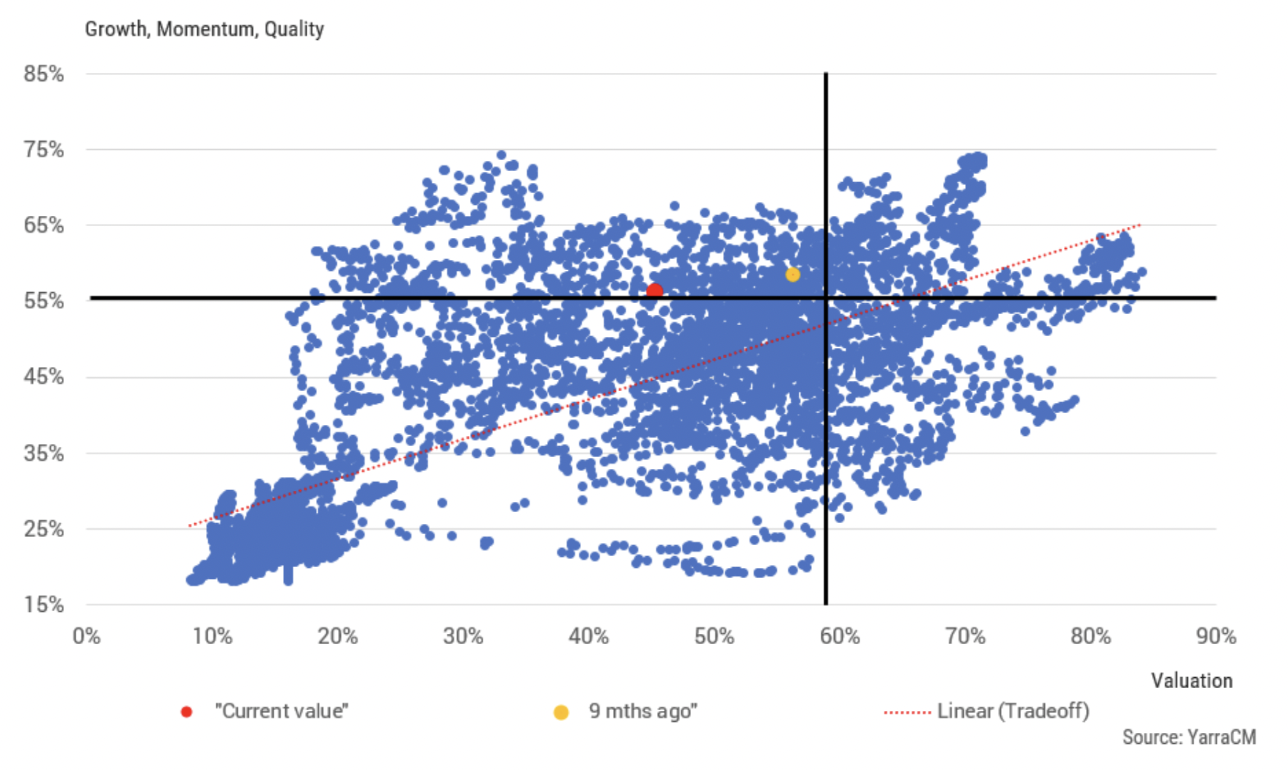

How about the Australian market? When we conduct the same excise for Australia in Chart 4, we find that at an aggregate level the ASX200 is reasonably priced for the prospective earnings, earnings momentum and balance sheet risks.

Chart 4 – ASX200: Valuation and Growth/Momentum/Quality Tradeoff

We are always very conscious of the distortions that resources and banks can have in Australian calculations. In aggregate, Valuation sits at the relatively cheap 45th percentile whilst the Growth, Momentum and Quality factors are only just above the average experience since the mid-1990s.

At a sector level, financials offer an ‘average’ valuation against relatively elevated expected earnings.

Chart 5 – ASX200 Financials: Valuation and Growth/Momentum/Quality Tradeoff

Resources offer historically cheap valuations relative to the ASX200 for below-average prospective earnings.

Chart 6 – ASX200 Resources: Valuation and Growth/Momentum/Quality Tradeoff

There are some greater challenges in the ex-banks and ex-resources part of the market from an earnings and margin risk perspective, but again this is the task for active stock pickers in 2023.

Admittedly these charts may take a bit of time to absorb the broader message. But the key conclusion is that the US market is not as expensive as many perceive and the Australian equity market is offering even better value.

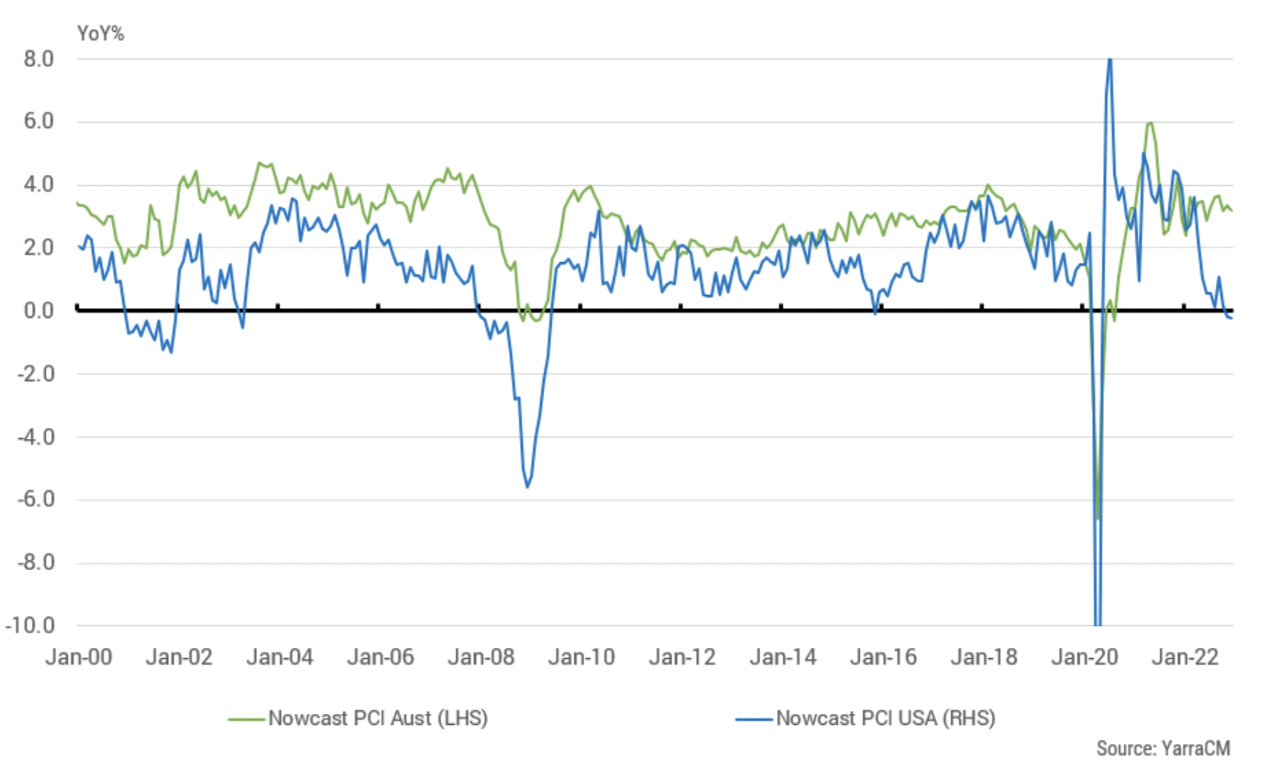

The simple fact is that Australia is not only cheaper, but it also has better earning protection. The Australian economy has barely commenced its long-expected slowdown. Our Nowcasting estimates of real-time economic growth show a large gulf has opened up between US growth and Australian growth. Indeed, for the US our nowcast suggests the US is now entering a modest contraction in activity growth. You can see this in Chart 7.

Chart 7 – Australia vs. USA Nowcasting

Make no mistake. Earnings estimates have to be reduced. This has been our constant refrain for much of this year, however, we are some way along that journey to more realistic earnings numbers.

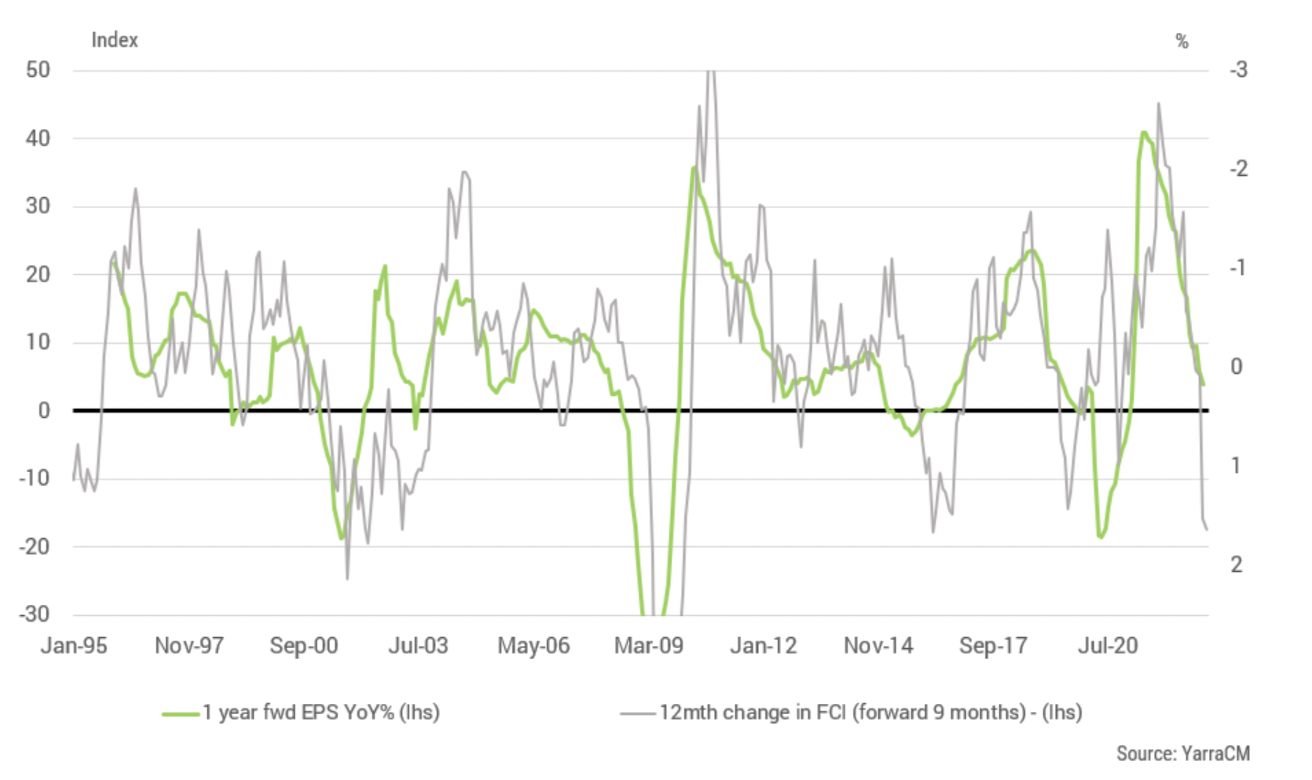

I have shown Chart 8 several times this year through this video series. The reason why I am showing it again is to not only show the progress in the reduction in 12-month forward expected earnings growth but also to note that US financial conditions have eased considerably in recent weeks.

The implication is that the depth of the US economic contraction is likely to be less, and the corollary of that is that the depth of cuts to future earnings expectations is also less.

Chart 8 – MSCI USA: EPS momentum and financial conditions

As I’ve mentioned previously, you tend not to get the opportunity to buy equity markets at trough earnings and trough prices. Equity markets tend to move into the ‘hope’ phase of the cycle well before the last downgrades in earnings have been announced.

If you believe that the G7 economic contraction is limited to the 1H23 before showing signs of economic recovery in Q4 2023, then the time to buy the market in size is nine months in advance of that. We are already inside that time window.

The conclusion is to enjoy the bond rally in 1Q 23 and then position the portfolio in quality stocks through February and March for the Hope phase of the market.

It’s still too early to pencil in consumer and housing-exposed names, but it’s not too early to consider those sectors that will continue to benefit from the bond rally and those pockets of the market that look oversold.

As a final comment, Australia has an excellent chance of standing tall in its peer group in 2023. Net migration is rapidly improving, nominal income remains strong, saving buffers are high, the modest Budget deficit may soon record a surplus and external accounts remain in excellent health.

Moreover, Australia remains incredibly well placed to benefit from the global energy transition. Lithium is already a A$10bn export industry for Australia and Australia is the world’s dominant producer. Electric Vehicle sales are forecast to increase by 10 times by 2030 and Australia has the world’s 2nd largest copper resource. There is simply not enough copper to meet the demand for the global energy transition.

LNG is an important energy transition fuel and currently accounts for 23% of global electricity generation. Australia just happens to be the world’s equal largest exporter of LNG. Iron ore obviously remains Australia’s biggest export and China is the dominant customer. However, we expect the global energy transition to be steel intensive, opening up new customers.

Plus, there is the added benefit that China may well succeed in moving away from zero-COVID settings and the attempts to jump-start their economy may well bear some fruit in 2023. In that, environment we expect the Australian dollar to do very well in 2023.

We are targeting 76 cents by mid-23 so if you are thinking about investing in global equities in 2023, you may want to consider lifting your hedge ratio.

We hope you all get a decent and relaxing break over the holiday period and wish you all the best for 2023.

Never miss an insight

Stay up to date with all my latest macroeconomic insights by hitting the follow button below and you'll be notified every time I post a wire.

3 topics