Will China's move to "big" stimulus work?

Cyclical slump

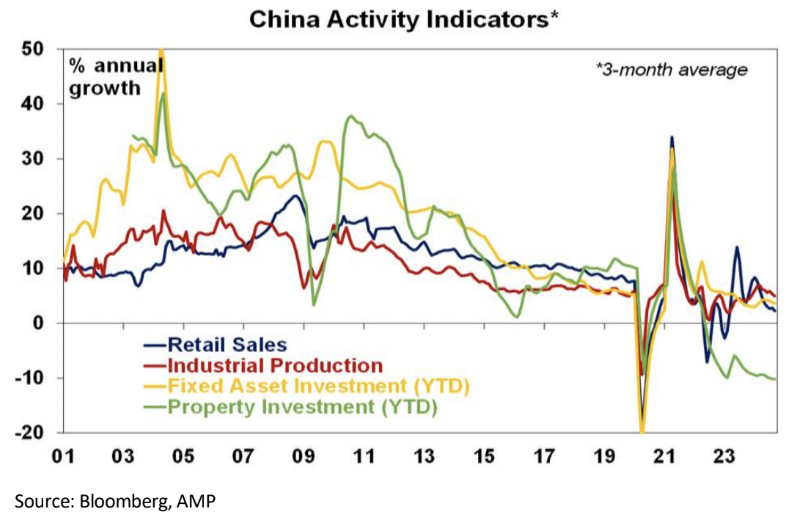

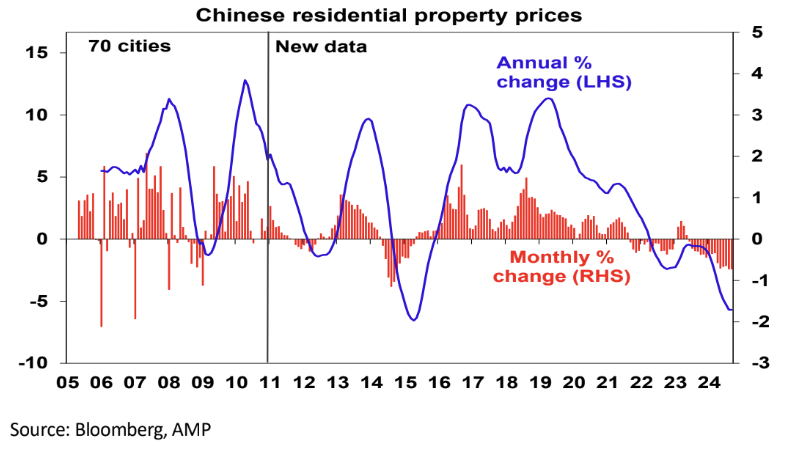

- The ongoing property collapse – home prices have been steadily sliding and property sales have slumped (down 25% year to date) reflecting an oversupply. This has led to big problems for developers (eg, Evergrande and Country Garden); local governments that rely on land sales for revenue; and households that have seen property-related investments sour. Property investment has also collapsed.

- Households remaining cautious in the face of falling property and share market wealth and relatively high unemployment.

Structural problems

- Excessive savings- China has a very high total saving rate of around 45% of GDP, roughly double Australia’s.

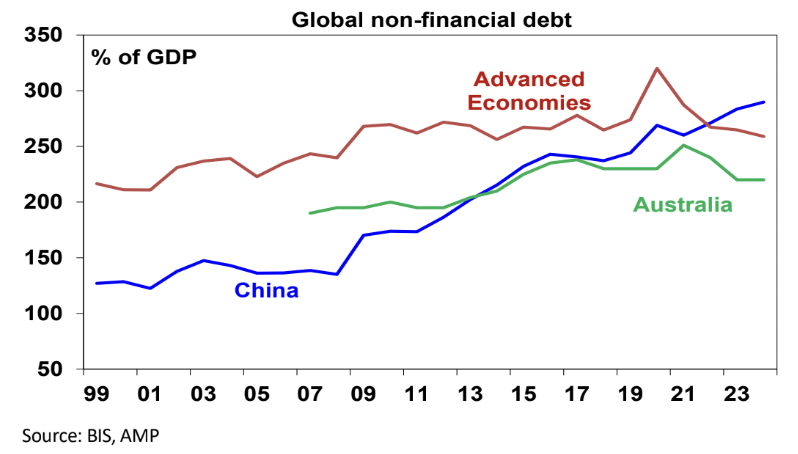

- This makes China’s debt problems very different to other countries as China has borrowed from itself. But it means the savings have to be recycled (usually via debt) into demand or else high unemployment and chronic deflation can result. China did this for many years through corporate borrowing for investment focussed on driving exports and then into property which has resulted in a rapid rise in China’s debt levels. China’s non-financial debt to GDP ratio is now above the advanced economy average and Australia's.

- Problems in export-related investment – recycling excess savings into export-related investment has soured as rising levels of fresh capital and debt are leading to a diminishing payoff in terms of GDP and geopolitical tensions and trade restrictions have led to slowing export growth.

- Problems in property-related investment - using property to recycle high savings has also soured. This was viable when urbanisation was rapid but it’s now led to an oversupply of property and collapsing prices.

- Poor demographics – China’s workforce is shrinking and its population is rapidly aging. This weighs on property demand and economic growth.

- Increasing government intervention – the easy gains of industrialisation have been seen and China runs a high risk of falling into the “middle-income trap” (where countries fail to transition to being high-income countries). This is partly because of increasing state intervention in the economy and regulatory crackdowns on tech companies and other sectors which are acting as a disincentive to future entrepreneurs at a time of tightened access to foreign technology.

- There is a fiscal imbalance between the central and local governments – with the former having most of the revenue and the latter doing much of the spending resulting in local government debt problems.

- As a result of all this, estimates of its potential real GDP growth have fallen from around 10% in 2006-10 to around 5% now & around 3% next decade.

Will policy stimulus work?

Over the last year or so, China has been providing just enough support to the economy to avert a major crisis. It looked like the Government was: more focussed on trying to avoid reflating credit and housing bubbles (like Japan in the early 1990s); wanted to avoid “decadent” consumer stimulus as seen in various Western countries; or was not aware of the problem.

But with the economy and property market continuing to slide there was increasing concern that China would not meet its 5% growth target for this year and worse still might slide into a decades-long period of slow growth and deflation like Japan did after its 1980s boom years as it fails to address its structural problems.

A run of soft economic data last month appears to have galvanised the government into action, so, starting in late September there has been a steady flow of stimulus announcements:

- The People’s Bank of China announced a long list of measures to ease monetary policy including a cut to the reserves banks need to keep, lower interest rates, lower required down payments on second homes and allowing funds and brokers to tap PBOC funds to buy shares.

- The Politburo committed to increased counter-cyclical policies, “necessary” levels of fiscal spending and measures to halt the property decline. A move towards much bigger fiscal stimulus has been confirmed by the Ministry of Finance with more bond issuance to resolve local government debt, allow local governments to buy unsold property and help banks rebuild capital.

- Monetary stimulus on its own would have been like pushing on a string as the supply of money is not an issue in China but the lack of demand for it is.

Based on what we have heard, something of this order is likely and it could boost growth in 2025 to maybe 5.5% and at least stabilise property prices.

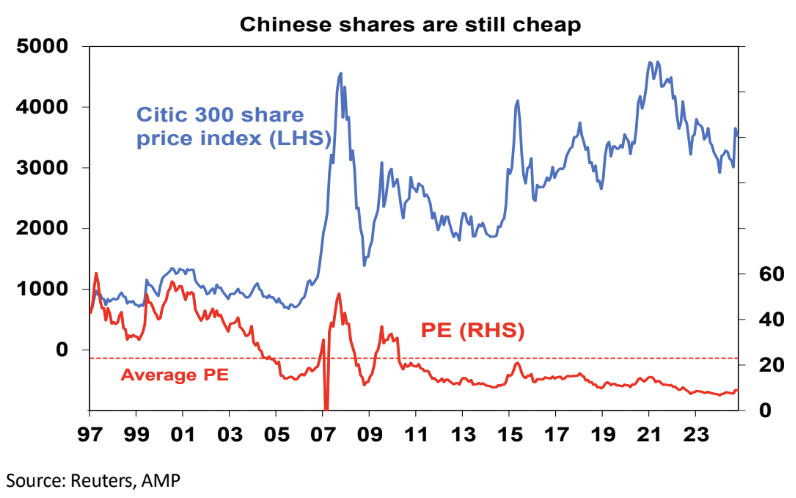

The Chinese share market

Implications for Australia

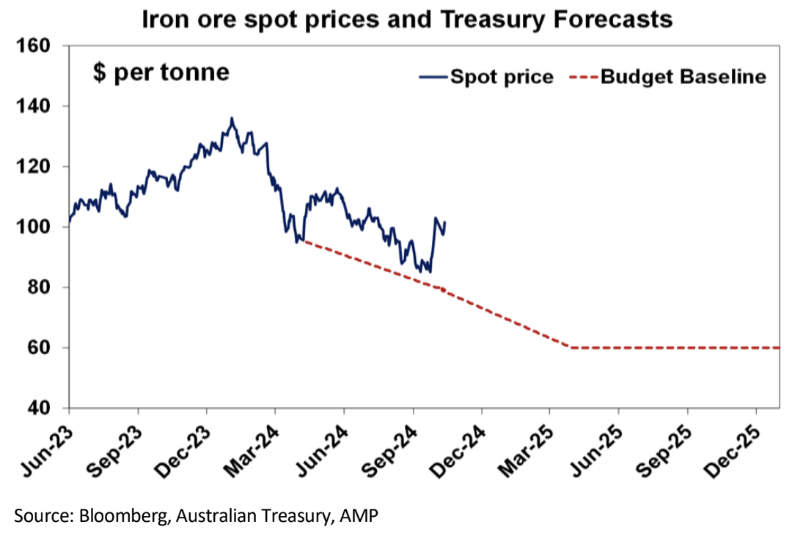

And it will likely help keep the iron ore price tracking above the Federal Government’s budget assumptions albeit the boost to the budget (via stronger mining profits) won’t be as strong as it has been over the last two financial years.

Implications for investors

It may not be enough to reverse the Australian share market’s relative underperformance, but it may help reduce it.