Is it time you loaded up on growth stocks?

Have Australian investors mistaken their strategy all these years? As markets emerge from the “Corona Crash”, it’s evident that high growth stocks continue to be the best performers. For those expecting a great rotation whereby cheap, dividend-paying businesses would finally be prized for their cashflow generation in an uncertain economy; that theory never materialised.

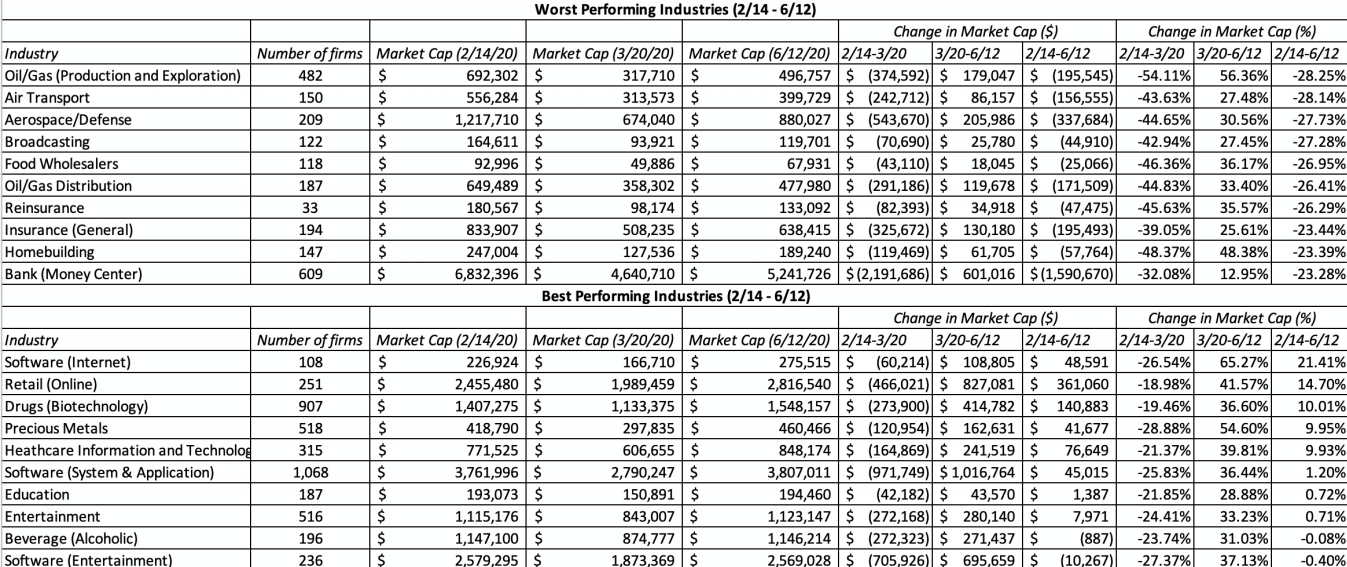

To quantify this point, a recent study found that software stocks worldwide gained 21.41% from 14 February to 12 June. Meanwhile, capital-heavy banks, commodities, and industrial businesses – the backbone of domestic portfolios – are down ~25% (see below chart). That’s an outperformance gap of over 40%.

This begs the question: should investors change tack and load up on the Afterpays and Altiums of the world? Here, Ben Clark of TMS Capital and Roger Montgomery from Montgomery Investment Management discuss this topic and share their approach to growth investing as well as 7 stock ideas offering growth at a reasonable price.

Notes: Watch, read or listen to the discussion below. This episode was filmed on 1 July 2020.

Access the podcast

Chart: Worst and best-performing industries (14 Feb-12 June 2020)

Click to enlarge image

SOURCE: Aswath Damodaran, STERN SCHOOL OF BUSINESS AT NYU (access blog post)

Edited Transcript

Vishal Teckchandani: Welcome to Buy Hold Sell, brought to you by Livewire Markets. My name is Vishal Teckchandani, and today, we're talking about whether we, as investors, have gotten it wrong all this time. If we think about where the returns have come from over the last 5-10 years, it hasn't been from the banks, it hasn't been from BHP, or Telstra, it's been from growth stocks. The CSLs, the Altiums and the Xeros of the world.

So is it time that we asked ourselves: "Is it time to load up on growth stocks?" Joining me to discuss is Roger Montgomery from Montgomery Investment Management and Ben Clark from TMS capital. Ben, let's start with you.

Change of thinking required?

Vishal Teckchandani: The data says it all. Technology stocks globally are up 20% since February. Industrial names are down over 20% over the same period. Is it time for investors to rewire their thinking and go for growth?

Ben Clark: Well, from my point of view, ultimately, you always want to invest in a business which you think can grow, so I don't think there needs to be a change of thinking. I think it more comes down to looking at the areas of the market where you think you can get growth and pay a reasonable multiple. And that's the debate that's been going on for most of the last decade, really in the Australian market.

But growth has clearly been a winner. It's winning because the forces that are changing technology in particular and also in healthcare are accelerating, so I think it's an area of your portfolio you definitely want to have exposure to.

Vishal Teckchandani: Okay, so what Ben is basically saying is GARP, growth at a reasonable price. Are you subscribing to that, Roger?

Roger Montgomery: We're value investors, so, yes. Having said that though, if I could just layer on what Ben has said, equities form the growth part of anyone's portfolio, so it makes sense to invest in companies that are growing. You want to own a business that's going to be materially larger in five, 10 or 20 years time. But, at the moment, it comes down to simple arithmetic. And by that I mean to say that if interest rates drop by a given percentage, the present value of a dollar earned in 20 years time, it jumps proportionately more in percentage terms than a dollar earned in five years time.

That's why all the companies that are earning no money today, but have hopes of earning money in the future have done so well in recent years, particularly since the GFC. And it's because interest rates have been on a steep decline and a consistent decline. And we've heard from the RBA, there's no plans of raising rates anytime soon. And so people can feel fairly comfortable buying growth at the moment.

The role of interest rates

Vishal Teckchandani: Okay, so simple arithmetic. Should we be jumping on board if low interest rates is what's going to drive growth stocks, should we be jumping on board?

Roger Montgomery: Well, the time to jump on board was when Afterpay was down 78%, that was the time to buy it. Not when it's subsequently bounced 560%. The time to be buying it is obviously when the baby's being thrown out with the bathwater. And so I'm more circumspect now because I think a lot of the good news factored into these companies.

Vishal Teckchandani: Ben, what do you reckon? Good news factored in, or are interest rates going to take Afterpay up to a hundred dollars?

Ben Clark: Yeah, I think there's definitely some logic in what Roger's saying, but I also think you could say Facebook was a platform that didn't exist 15 years ago and it had zero users and it's now got 1.8 billion users every day, logging on. And that hasn't grown because interest rates have fallen. I think maybe the valuation has grown somewhat as a result of it, but there is still growth occurring for other reasons.

And I've gone back and looked at that 2000s period in America. There was a very similar debate happening back then as well. People were saying, "You're mad to buy Salesforce, to buy Amazon, to buy some of these companies", because they had no earnings. The valuations just looked insane. But if you fast forward to where we are now, they're actually not that expensive. And so to me, I agree there's probably some excessiveness at the moment, but I think the market can see the earnings coming. And that is a theme for me; trying to work out which businesses that's going to play out correctly for because there'll be some that we're expecting that, where it doesn't actually occur.

Roger Montgomery: Yeah. And that's the key. It's the beta of those stocks. It's been said, there's been a lot of growth in the revenue streams of these and the customers of these businesses, but there's also been massive PE expansion. And so if you get any disruption to that growth or any disappointment around that growth, they are high beta stocks, so you've got to be prepared to look, as Ben said, you've got to be prepared to look beyond the current volatility and accept that that could happen and believe in the growth long term.

The anatomy of a growth stock

Vishal Teckchandani: Let's talk about how you find out your comfort levels around that growth. What is it that you look for before investing in a growth business, Roger?

Roger Montgomery: Look, there's a few things and it depends if we're talking about the Montgomery Fund and the private fund, or whether we're talking about small companies fund. But generally what we want is we want a really solid thematic. We want to make sure that there's growth in that particular sector. Cloud computing, for example, is one of those that we know a lot about. And then within that, we want a business that is going to grow and has a strategy for that growth. And most importantly, has resources to execute on that strategy.

I'd just add that sometimes we know they're going to raise money. And provided we believe in the management team, we think they're really good at what they're doing and they've done this before, then we'll back them if they have to raise capital and they haven't got the resources today.

Vishal Teckchandani: Okay. Ben, what is it that you're looking for in growth companies?

Ben Clark: Yeah, I think the point Roger just made at the end there, to grow a business from something that's very small to hopefully something that's a global, dominating business, it requires complete relentless management ability to get through so many different hurdles. And anyone that's started a business from scratch would know what that's like.

For me, it's that the management team, a key. How we generally start out is listening to what the CEO ideally is saying about where he thinks the business could be in three, five years. And then just as often as we can, listening to him and just wanting to hear that same narrative ticking off the milestones that he's giving you. And what we tend to do is build a position as we gain confidence that the company is executing on what it said to the market that it could deliver. Maybe a smaller investment at the start, not too much capital risk initially, and actually buying on the way up at.

I actually think the hardest thing with these businesses is not selling. When a stock goes up 40%, 80%, 140%, and you're watching it closely, it's incredibly hard to not pull the trigger and sell. And that's been, I think one of the biggest mistakes that you can make.

A closer look at Afterpay

Vishal Teckchandani: Ben, that's a really good point. And I'd like to throw in a case study here. Let's look at AfterPay. It is one of your holdings. Tell us about what you found about the company that made you so attracted to it and why isn't it that you're jumping off-board. It's been a five, six bagger already since March.

Ben Clark: That's probably one I could say is a good exhibit of what I was talking about before. We got into Afterpay when it was about $6. It was really more on what we heard from merchants in terms of how thrilled they were with the platform and the results that it was giving them. It was also looking at things like Google analytics and stuff like that, which I think can be quite a good tool to try and work out what's going on, speaking to customers. And then let's start to listen to the management and listen to what they've thought. And it was building that position.

I would say in recent times, the way we manage, we've been trimming down the position. It's become a larger weighting. And as we think the market's now factoring in a much higher probability of success and that's how we played it out. And that's typically how we will invest in a growth stock.

Vishal Teckchandani: Okay. Roger, I'd love to know about the lens that you look through with a company like Afterpay. Are you holding it currently?

Roger Montgomery: No, we don't own Afterpay.

Vishal Teckchandani: Why aren't you jumping on the bandwagon?

Roger Montgomery: Well, being dyed-in-the-wool value investors, we thought at six bucks, it was expensive. I'll admit to that. Yeah. It's been phenomenal. It sits now at about $16 billion market cap, about $500 million of revenue. It's probably going to make a loss this year of about $24 million bucks. There is a lot of growth there, but there's also a lot priced in. We think that cloud computing, the data centre space is where there's a lot of growth and we don't have to pay as much for it.

Roger Montgomery: Macquarie Telecom, for example, is a business where we think they're executing incredibly well. We think the thematic is really good, obviously. And we believe that that company has a lot of unrealised value potential in its car park, believe it or not. We'd like to call it the $2 billion car park. And we've been to see the company twice in the last couple of weeks. And we can see that they're actually doing a better job than what they expected. They'd be able to do in terms of signing up customers.

Portfolio positioning

Vishal Teckchandani: Okay. Let's take a step back and talk about your portfolio construction. How much cash are you holding right now? And what's the breakdown of your portfolio? Have you made any significant changes since March?

Roger Montgomery: Well, it depends on the fund. We were fortunate to be about 40% cash in the small companies fund. I'll talk about that one first because that was the one where we swung the most dramatically. We were about 40% cash before the market really started to sell off. And then we just... look, it wasn't a fluke, we had a strategy, but it happened to be close to the bottom of the market that we went to about 10% cash. It could have gone further down, we didn't know. It just happened to be when the market bounced, so we went from 40% cash down to about 10% cash.

We now believe that the market is... We're more circumspect about its prospects. So what we've done is rather than selling out and raising cash again, what we've done is we've broadened the diversification of the portfolio, so we have probably 47 positions, whereas previously we might've only had 35 or 40 positions.

Vishal Teckchandani: Okay, Ben, same question to you. I believe you've gone down to 15% cash. Is that right?

Ben Clark: Yes we're at around 12-15%. In the high conviction fund, I never really had more than about 15. And look, I learned probably long ago that my skills that picking the market's direction in the short term are pretty poor. And I've probably got a higher hit rate at picking good businesses and trying to stick with them. What we've been doing since March is, we've been adding to some of our defensive growth names. I think there have been some fund managers pulling money out of stocks like CSL ResMed, etc., to get some risk on in their portfolios. As we saw this rocket go up on the risk-on trade.

We've been buying a couple of stocks that we think have been unfairly beaten up and still got good long-term growth prospects, despite some short term issues that they're facing.

Top growth ideas

Vishal Teckchandani: Can you give us an example?

Ben Clark: A couple of examples. One would be Sydney Airport, which I know sounds like madness at the moment to be looking at an airport. And I can't rule out that cart these guys won't do a capital raising at some stage in the next year, but having seen Qantas CEO Alan Joyce's presentation, if he's right and the data he's looking at plays out, three years to a repeat of calendar year 19, passenger movements, I think could see quite a big re-rating.

And it's one of those assets, I think it's a great longterm asset. If you wait until you can see that things are starting to get closer, you'll look back at the share price and it'll be seven, 750. You got to try and train yourself to buy those things in peak bad news. I think the airports and Auckland Airport I think was pretty good as well.

It's not the hyper-growth stock that we've been talking about, but this has an asset that has grown consistently for years. And there's no reason it can't continue to do it. It's an amazingly resilient area of the economy.

Vishal Teckchandani: Okay. Roger, earlier, you mentioned cloud computing, any other parts of the market where you've seen growth at a reasonable price?

Roger Montgomery: Sure. In small companies, we think Bapcor still looks cheap. We believe that's a business that has less economic sensitivity than a lot of other investors realise. Even if the economy is not doing well, people have to fix their cars. If they're not travelling overseas, they're going to be travelling locally. They're going to have to get their car ready for a local driving trip.

In our larger-cap funds, we've bought businesses like Wesfarmers, we think that they've just been a great stay at home trade with Officeworks and Bunnings. We've bought Woolworths. They've managed to sign on a million new customers, both online and through their awards business. And we think that they have an incredible ability to convert that through their data analysis to more sales, so there's a bit of growth, believe it or not. And as Ben mentioned, we also bought Sydney Airport, we've also added to our holding Atlas Arteria. In fact, it's our largest holding - they own the majority of the French toll roads, about 2,800 kilometres, or thereabouts. And in our small-cap fund, we also bought Auckland International Airport. And in our large caps, Transurban.

Vishal Teckchandani: Okay. Looks like Ben and Roger agreed that it's not all about growth, it's not all about value, it's something in-between. And hopefully that sentiment helps you grow as an investor.

Enjoying Buy Hold Sell?

- Hit ‘follow’ below to get notifications of when we publish Buy Hold Sell

- Last week, Ben and Roger faced off on the 6 most googled ASX stocks

- Stay tuned for Friday, when the duo discuss if it's time to drop your ego and buy growth, as well as reflecting on the performance of growth stocks during the COVID-19 period

- View the full Buy Hold Sell archive here

1 topic

7 stocks mentioned

2 contributors mentioned