Wilson: Have we seen the top of the market?

This year’s Wilson Asset Management shareholder presentations marked a changing of the guard at the firm; for the first time in nine years, the meeting was not headlined by Chris Stott as Chief Investment Officer. “Stotty” recently announced his retirement to spend more time with family, so this offered an opportunity to investors to peer inside the minds of the next generation of leaders at WAM.

In this wire, I’ll seek to summarize some of the key points and themes raised by the four Lead Portfolio Managers, and share some of the stock ideas they presented.

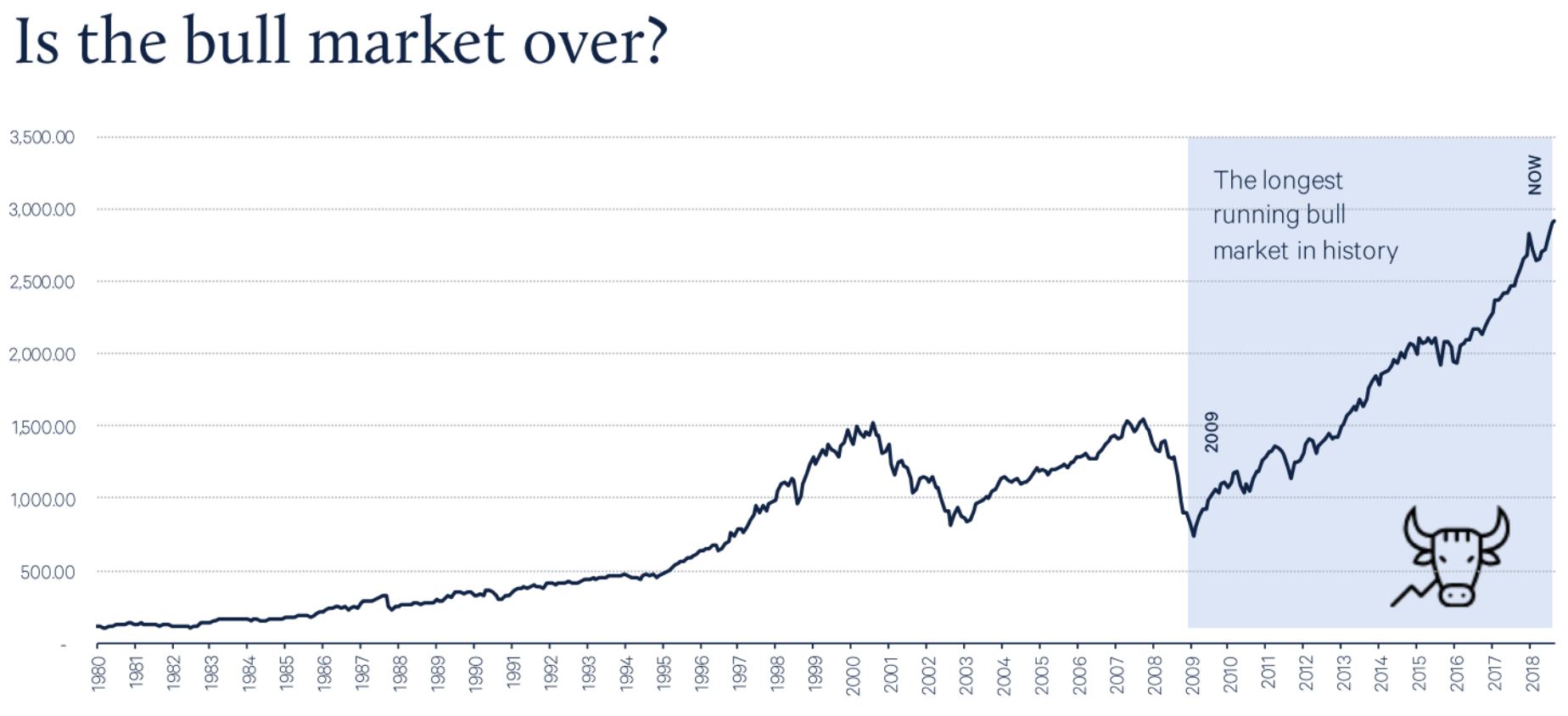

Geoff Wilson: Is the bull market over?

While Wilson has been openly bearish for some time, he’s now concerned that we’ve “seen the top of the market”. And as the adage tells us, shares go ‘up the escalator and down the elevator’.

Quantitative Easing and record low rates, which have driven valuations higher, are now over. Quantitative Easing has now reversed, and Quantitative Tightening began in October. He believes the market has now entered “a different phase.” With 38% of their portfolio in cash, he’s put ‘his money where his mouth is’ when he says that he’s nervous about markets.

The good news is that bear markets are generally short (and painful), and offer ample opportunity to put the large cash pile to work.

Catriona Burns: The 3 forces moving markets

As Lead Portfolio Manager of WAM’s Global LIC, Burns largely focused on the big picture issues for global markets. In her view, there are three primary forces influencing global markets today:

- Conjecture over the Fed

- Trump’s next move

- Trade wars

On the plus side, the US economy is flying; GDP growth over 4%, strong jobs growth, the lowest unemployment rate in decades…

But what happens next?

As always in financial markets, the current state of play matters less than what’s changing at the margins. The Fed is now firmly on a path of normalising monetary policy; liquidity is being withdrawn, and rates going up.

What does this mean for equities?

Higher rates have two main impacts for equity investors.

First, the cost of debt goes up, which means higher interest costs for companies with larger debt loads.

Secondly, investors’ discount rates go must increase, which results in lower valuations. Lower earnings on lower multiples can result in large, sharp moves to the downside.

Inflation is the one thing we haven’t seen yet. Meetings with companies in the US show that inflation is starting to pick up. Companies are complaining that they have to pay higher wages. A key headwind for earnings growth.

When wage inflation goes up this will validate the Fed.

Geopolitics

Burns says the US-China trade war is really moving markets right now. This is not a new policy for Trump and his advisors, their views about China and intellectual property theft have been long-held.

Importantly, from January 1st 2019, Trump’s tariffs will rise from 10% to 25%. Global supply chains are already struggling at 10%, but if it goes to 25%, she believes it will significantly slow down global growth.

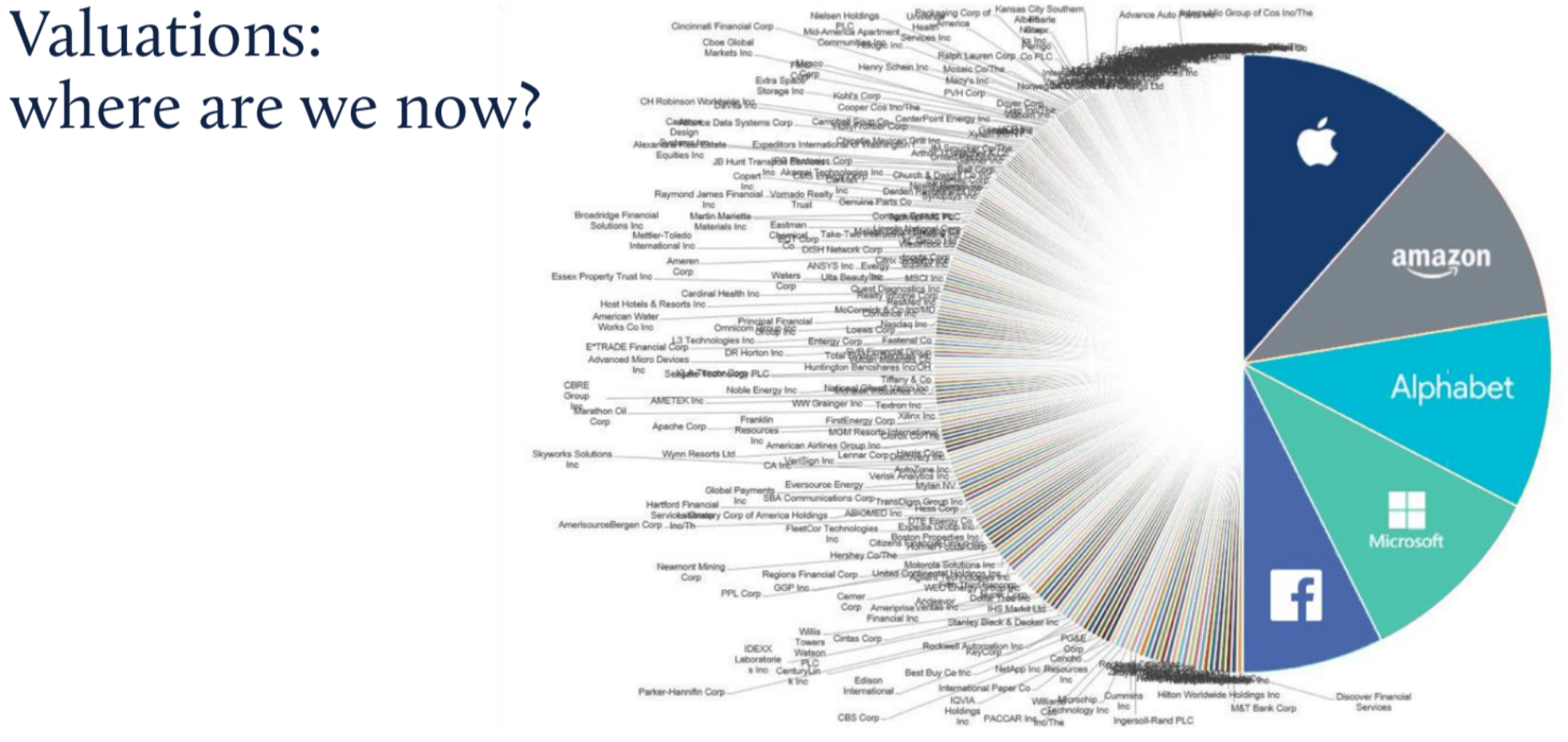

Valuations

As is often seen towards the end of a bull market, returns have been highly concentrated in recently. Since 2013, 37% of S&P500 returns have come from the ‘FANGs’ stocks. But the first half of this year saw this become even more pronounced; from 1 January to 30 June this year, 99% of the S&P’s returns came from tech, and 82% from FANGs.

Opportunities

It’s not all doom gloom though, there are still opportunities to be found for those who look (and have cash). Burns says they’re finding opportunities in Japan, where there’s been a major push to improve corporate governance. She’s specifically looking at companies that are improving their governance, which has been shown to be a strong driver of returns.

Consistent with their macro views, Burns also says they’re shifting from cyclicals to defensive stocks. This means looking for companies that can grow despite any macro issues. The portfolio retains a significant cash buffer at 34% of assets.

Stock ideas

Thermo Fisher Scientific. Burns says the company is comparable to CSL, but much cheaper. Thermo Fisher trades on a PE multiple of just 19x, compared to 30x for CSL. Despite the lower price, the company has grown earnings by 15% p.a. over the last 6 years. She believe the company can deliver earnings beats, which she says is the catalyst for a re-rate.

Entertainment One. This company is UK listed, but earns most of its revenues outside the UK. The company owns a suite of intellectual property, including well-know childrens’ content Peppa Pig and PJ Masks. She expects Peppa Pig to perform well in China next year on the back of the Chinese Year of the Pig.

Matt Haupt: The biggest drivers of Australian shares

Matt Haupt, Lead Portfolio Manager of WAM’s large-cap Australian equities strategies, believes there are two primary factors driving earnings in Australia:

- Credit growth, and

- Commodity prices.

“These two factors account for over 80% of earnings changes in the Australian stock market.”

Credit growth

With regulatory issues getting in the way, credit growth in Australia is currently benign. With APRA’s macroprudential measure, plus pressure from the Royal Commission, there’s currently little room for banks to lend more to consumers.

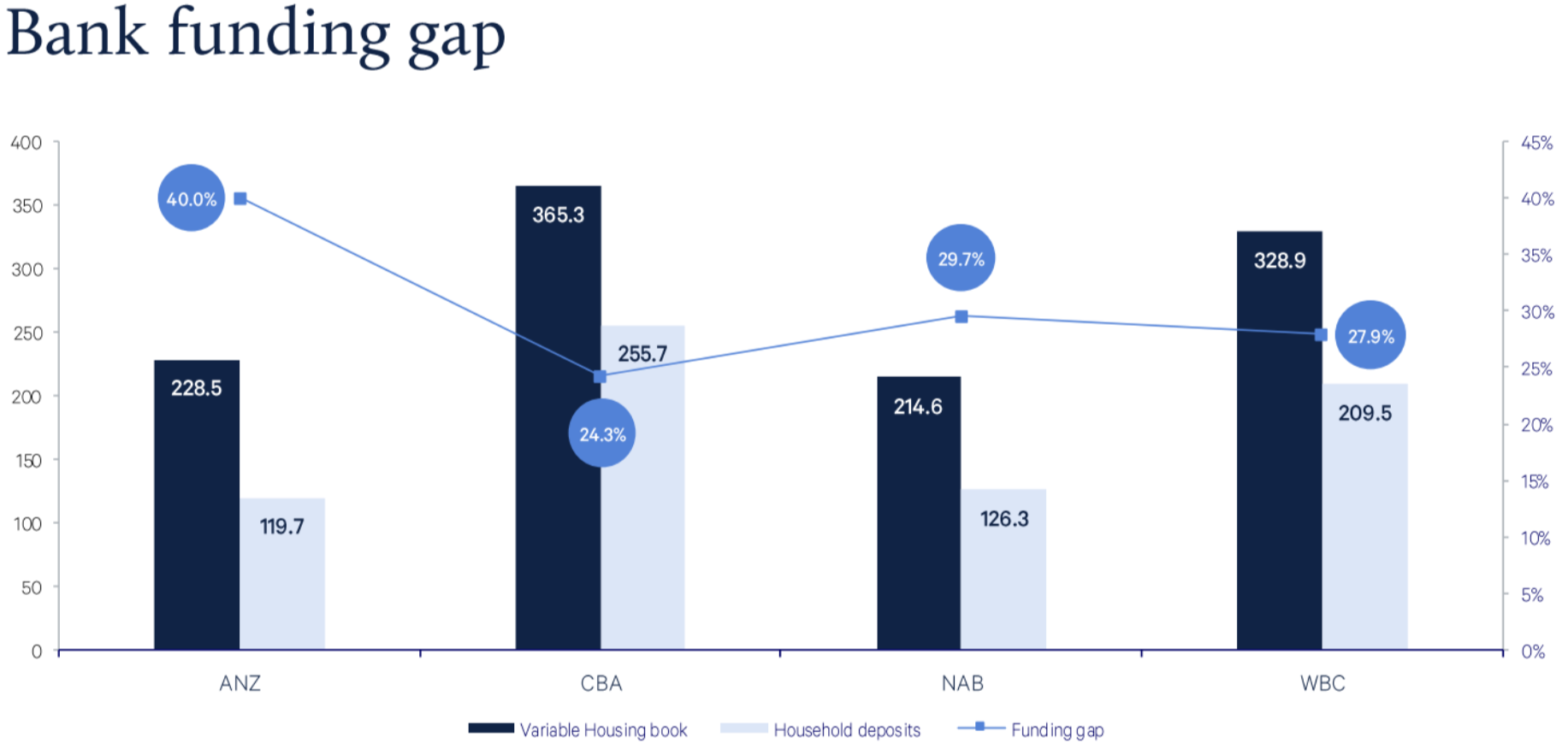

Adding to this pressure, the banks facing increasing costs of wholesale funding - hence the banks’ recent ‘out-of-cycle rate hikes.’ The banks rely on the wholesale funding market to fund the gap between their housing book and their deposits, which means some banks are more exposed than others to this pressure (see image below).

If wholesale funding costs continue to rise, ANZ is most at risk.

The housing market

Haupt says the current housing correction is driven by regulatory concerns, not macroeconomic issues. For this reason, it should be short lived… Unless we see a macro shock such as a rise in unemployment. If Labor gains power at the next Federal election, their policies could change this.

Regardless of the government, credit growth should remain weak over the next 12 months. This will be a headwind for the Australian market.

Commodities

Commodity prices are largely driven by Chinese demand. Following the recent uncertainty, China has already lowered rates in order to stimulate the economy. It’s not taken effect yet, but there’s usually a delay before results are seen in the economy.

China will pull the levers (fixed asset investment) if things slow again.

Haupt expects commodity prices to hold for now. In the current cycle, capex has been spent on replacement volume, rather than developing new capacity, meaning there’s very little new capacity coming to market to drive prices down.

Earnings outlook for Australian shares

Haupt expects earnings growth for the next 12 months in Australia to be ~3.6%, compared to a current consensus of ~5%. Any deal between the US and China to end the trade war could result in a better outcome.

Stock ideas

QBE Insurance (QBE). This company has been a perennial disappointment, but is at the right point in the insurance cycle now. The company is a major beneficiary of higher rates, with much of its investment portfolio sitting in short-dated instruments. A number of major divestments could be a catalyst to drive the share price higher.

Fortescue Metals Group (FMG). The company has been selling low grade to China at a discount for many years. Due to its ~58% iron content in its ore, FMG gets 30% than Rio, BHP, and Vale. The company is currently working on a new blend with ~60% iron content. This would result in a realised price much closer to what the majors receive, and a boost to earnings of 15-20%.

Oscar Oberg: Extreme valuations in the Australian tech sector

Valuations matter. As we saw earlier in Catriona’s presentation, valuations in US technology are high. But Oberg says the valuation in the Australian tech sector are “extreme.”

Similar to “FANGs” in the US, the Australian tech sector is driven by four companies: the “WAAA Index”. Wisetech, Afterpay, Altium, Appen. The returns for these companies have mirrored the FANGs stocks, with prices jumping 30% in August despite some companies disappointing with their earnings reports.

“WAAA” represented 80% of the Small Industrials index performance for the month August (reporting season). The Small Industrials index is now trading at 13% higher than it was in 2007.

Despite the high prices, “WAAA” do not have the same business economics as “FANGs”. “WAAA” have much smaller markets than their US counterparts, so they’re more exposed to falling growth. “WAAA” also have much larger customers, making it harder to increase prices. They’ve come off their highs since August, but Oberg remain cautious.

WAM’s research criteria:

- Valuation lower than growth (e.g. PEG ratio below 1)

- Management must have skin in the game and a track record

- Industry leader.

Finally, they need a catalyst – something that will change the market’s perception. For example, an acquisition, divestment, upgrade.

Stock ideas

Intellectual Property Holdings (IPH). This company was the first listed intellectual property law firm when it listed. It suffered from a poor first half result, but Oberg believes the slow down is only temporary, and the company will recover and grow market share. Importantly though, most of its revenues are in Euro and USD, so it benefits from lower AUD. A strong balance sheet also means that it’s well placed to make acquisitions.

Specialty Fashion Group (SFH). This company used to have five underperforming brands, plus one high performer (City Chic). In April, they sold the underperformers to Noni B (NBI). It now has a very strong growth profile. It’s a beneficiary of Afterpay due to its strong online sales channel. It is attractively valued, and has net cash on the balance sheet, leaving room for acquisitions or capital returns.

Martin Hickson: A tough market for IPOs

As leader of WAM’s market-driven process, Hickson focuses on some of the more short-term or ‘trading’ opportunities across the portfolios. The first item on his agenda was discussing the companies’ cash positions.

Cash is king

Cash is the default position. Hickson explains that they only invest when they think they can make positive returns. Cash levels are usually between 19% and 42%, and are currently towards the upper end of that bracket. If a bear market starts, they’ll have plenty of cash to splurge.

Strategies/process

The market-driven approach uses a number of strategies to boost returns:

- Investing in companies with a large discount to net tangible assets, including other LICs

- Trading around events, such as reporting season, AGMs, investor days, and quarterlies

- Takeover arbitrage, which involves buying after a takeover announced to earn better-than-cash returns

- Short selling, which profits when share prices falls – however, he notes that this is not a big part of their strategy

- Buying IPOs and placements where profits can be achieved.

He says the IPOs market is a tough place to make money right now due to volatility. A number of major IPOs been pulled, examples include Catch Group, Viva Leisure, PEXA - $2b property exchange, National Dental Care.

Two companies have made it to market recently though, Coronado Coal (down 15%), Pinch Me (down 48%), showing the risks of investing in these listings during volatile times.

Due to these issues, IPOs are not an area of the market they’ve been focused on recently.

Stock ideas

Collins Foods (CKF). The company owns ~200 KFC restaurants across Australia, the Netherlands, and Germany. They saw a catalyst for an upgrade recently in the form of an Investor Day. Hickson says they expected management to announce a rollout of Taco Bell restaurants. The company did this (50 new Taco Bells across Australia), which led to arerating.

Capilano (CZZ). This is a takeover arbitrage position. WAM purchased after the announcement of the bid in order to benefit from the estimated 6% annualised return. Due to the strategic nature of the assets, they also saw potential for a counterbid. Bega started buying shares, so the private equity bidder increased their bid. WAM achieved a 20% annualised return on this position.

6 stocks mentioned

1 contributor mentioned