Winners and losers from Australia's AGM season

The Annual General Meeting (AGM) season in Australia is really a quasi 'third earnings reporting period' that investors can use to better understand companies and their drivers.

Over the last six weeks, most of the ASX 200 companies have held an AGM or announced their half or full year results. For investors, we always find this period is rich in useful news flow. This has especially been the case this year, as companies have been much more forthcoming with management guidance statements than they had been at their August 2022 results.

In the following note, we have looked at the investment thematics arising from the AGMs and what this means for our Value and Income strategies going into 2023.

EPS revisions relatively flat

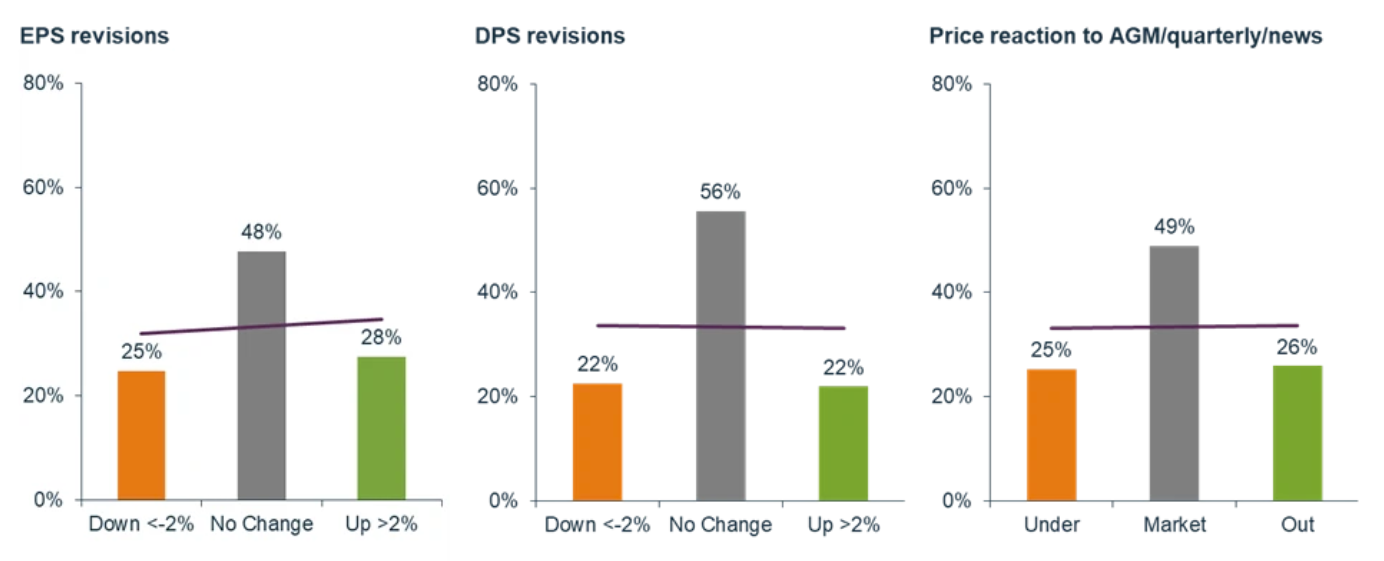

Overall, earnings per share (EPS) and dividend per share (DPS) revisions over the AGM season showed only a modest positive skew, with near equal positive and negative price reactions to news announcements.(1)

Martin Currie Australia, FactSet; as of 29 November 2022. Data for the S&P/ASX 200 Index.

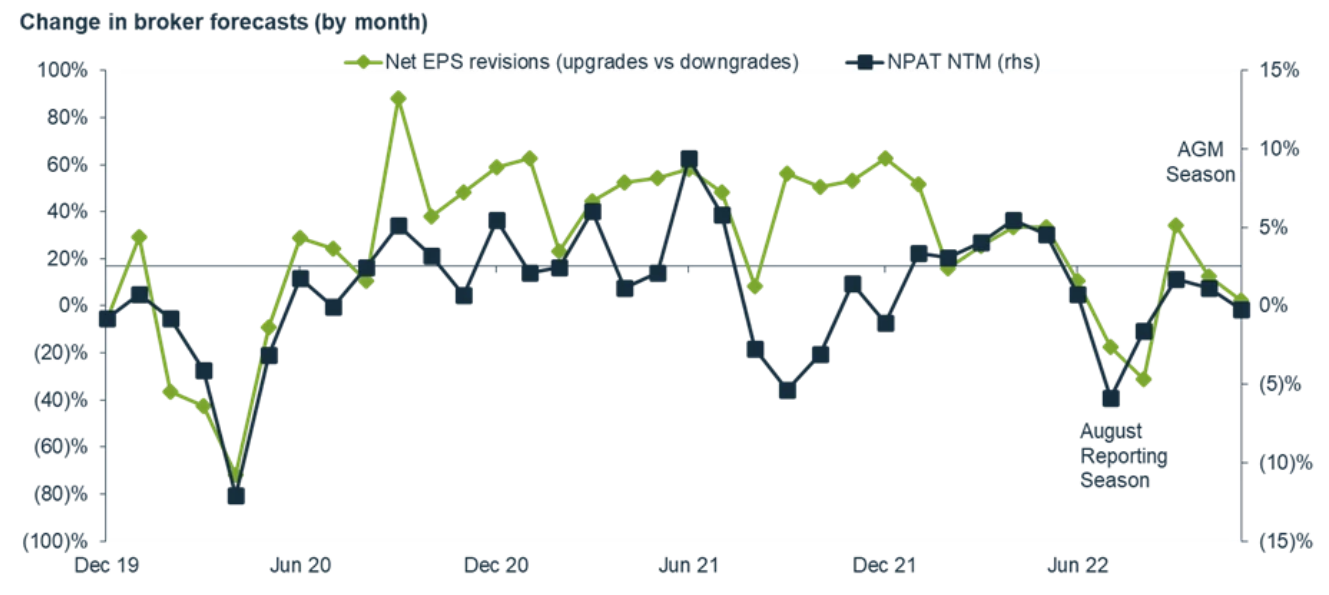

Looking at the breadth of broker upgrades to downgrades, this shows that EPS revisions have returned to a positive state since the negatives of the August reporting season but are still below longer-term trends.(2)

Martin Currie Australia, FactSet; as of 29 November 2022. Data for the S&P/ASX 200 Index.

Companies more willing to provide positive guidance

Despite the flat revisions environment, the qualitative updates and guidance provided by companies have been, on balance, more positive than the market had extrapolated in the vacuum created when so many management teams avoided providing guidance outlook statements in August.

This guidance generally confirmed the continuation of many of the positive themes that we discussed in our reporting season wrap, such as strong revenue, and broadly positive trading conditions.

But inflation continues to hit margins…

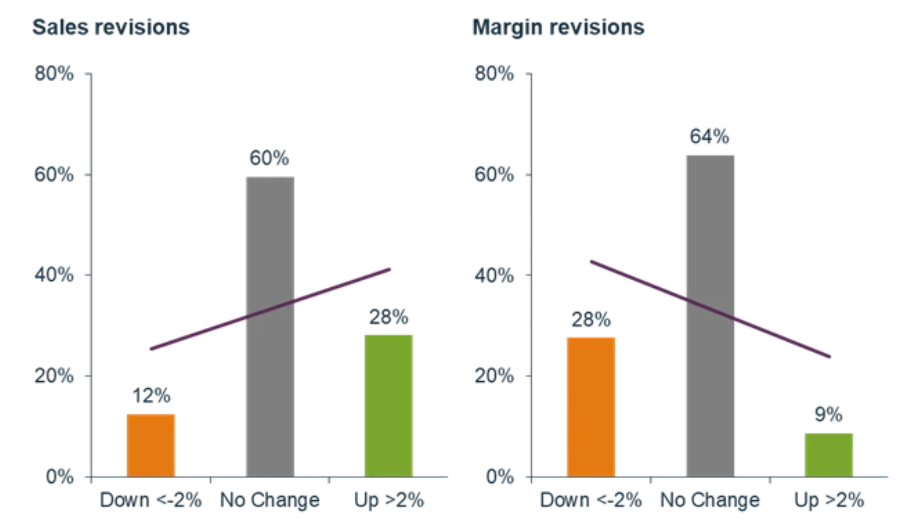

The strongest theme was the continued upgrades for sales/revenues, but with it comes a reduction in profit margins. We are seeing that companies are generally getting the benefit of inflation in their top line, but not necessarily managing to hold the benefits of inflation into the bottom line due to their own cost pressures.(3)

Martin Currie Australia, FactSet; as of 29 November 2022. Data for the S&P/ASX 200 Index.

…with cost pressures everywhere

A lot of this is coming down to labour cost pressures. This is also a continuing theme from August reporting season, but interestingly, there is little suggestion in company guidance that it has gotten worse.

In fact, the reopening of migration has switched the discussion to be more about adequately trained labour. For example, BHP Group is focusing on reskilling staff in its future academy for its upcoming decarbonisation needs. NIB, Medibank Private and IDP Education have also noted a rising student migration intake.

In terms of other costs, higher energy costs, and shortages, have become a threat to the energy transition as consumers and businesses face the dual challenge of decarbonisation and affordable and reliable energy.

Insurance costs are also an increasing issue, including for Directors & Officers liability insurance for Real Asset stocks a specific concern, but more broadly there are increasing questions about affordability of insurance for consumers following further flood events.

Freight rates and supply chain issues are seen to be improving, but at an uneven pace across industries and companies.

Cyber is a growing risk

Cyber security incidents also rose to the fore over the past few months with the hacks on Australian Clinical Labs, Optus and Medibank Private revealed. In their guidance, several other companies highlighted their existing investment in this space, but also the need for bigger investment into security and prevention. For example, Coles Group highlighted the need for a broader national solution involving government.

Summary of the winners

Banks: The Banks are doing well on positive Net Interest Margin (NIM) outcomes from higher rates helping deposit spreads, especially in their Commercial banking deposit books. The best performers were Virgin Money UK and Bank of Queensland, which are more highly levered to NIM improvement. We would note that cost pressures are still a concern for banks, and this is especially so for Westpac Banking Corporation.

Energy: Energy was highly topical with a bid for Origin Energy, high cashflows boosting coal producer shareholder returns and questions raised over the cost of energy transition. The maturity of oil & gas fields produced downside for Santos’ production, but Woodside Energy upgraded current year guidance given their higher quality fields.

Consumer discretionary: The resilience of the Australian consumer was evident by strong year to date, like-for-like sales performance for discretionary retailers such as Super Retail Group, JB Hi-Fi, Harvey Norman and Premier Investments, but more weakness was evident in offshore focussed consumer stocks such as Domino’s Pizza Enterprises.

Travel exposed stocks such as Qantas Airways, Auckland Airport and Webjet provided strong updates on travel recovery, though those exposed to capacity rebuild, such as Corporate Travel Management and Flight Centre Travel Group, were weaker.

Insurance: Insurers and insurance brokers had solid updates despite higher weather-related catastrophe costs. This is because they are still getting strong premium rate increases and benefitting from high investment yields. Questions on affordability and reinsurance costs do exist for 2023.

Mining: Gold stocks were strongest in the mining space. This was more to do with the lower than forecast US inflation rather than company updates, which continued to focus on cost pressures.

Where are the cracks emerging?

However, there does now appear to be a few signs of cracks emerging in certain segments of the market:(4)

Offshore cyclicals: The weakest segment of the market was stocks that we see as most exposed to the deteriorating US or offshore economic cycle. These stocks include James Hardie Industries and Reliance Industries (exposed to US housing), Sims Metal (exposed to global manufacturing), Lendlease Group (exposed to global development).

We also noted US stocks Walt Disney, Target and Sealed Air downgrades indicate that the US consumer is slowing/trading down, and this is impacting volumes at the margin for ASX-listed companies such as Amcor and Brambles.

Information technology: Tech companies highlighted continued pressures from fading Covid-19 tailwinds, weaker demand and higher staff costs. Most exposed were Appen, Iress, Xero, Wistech and Megaport.

Energy: The fuel refiners Ampol and Viva Energy Group have suffered from a rapid decline in refining margins due to slowing Asia demand and lack of Jet Fuel demand growth on restricted international airline capacity.

Housing-related: Housing listing volumes have fallen high single digits as consumers respond to higher interest rates. This adversely impacted the updates from Domain and REA Group. The Banks have highlighted the serviceability buffer of consumers is falling rapidly as mortgage rates go over 6% and new repayment schedules are provided to customers.

Consumer staples: The Australian supermarkets highlighted softening volume trends despite high dollar sales growth due to inflation. This is an early indication of trading down by consumers, and in contrast to the strong sales of Consumer Discretionary retailers - suggesting the high-end consumer is faring better.

Fund managers: Fund managers suffered weak net flows, but we are beginning to see increasing signs of corporate activity for Pendal Group, Perpetual, and Magellan (founder selldown).

Summary and outlook

The AGM and quarterly updates have reinforced our view that Australian earnings growth in 2023 will become more difficult. This is due to the impact that rising interest rates have on slowing demand, persistent inflationary pressures on margins, and broadly lower commodity prices as global growth slows.

Market forecasts in the Resources space reflect expected negative growth, but we are more confident that Real Assets and Financials will benefit from ongoing reflation. Industrials are where we expect to see the most divergence and risk to earnings growth forecasts, with issues mostly coming from the rate sensitive housing, manufacturing and consumer companies.

Our stock selection, driven by our proprietary fundamental analysis process, is positioned to benefit from this divergence in winners and losers. Our Value and Income strategies are focused on companies that can withstand changes in growth and margin conditions yet retain valuation and income appeal as the economy slows into 2023.

Learn more

For further insights from Martin Currie, please visit our website or fund profiles below.

39 stocks mentioned

2 funds mentioned