Wondering how to Invest in AI? Take a look at ASX data centres

Everyone knows that AI is developing as a potentially generational investing opportunity. If you’re keeping active tabs on markets, you would no doubt be aware of the buzz around companies like OpenAI, Microsoft, Amazon, Google, and Apple, who are each rushing to develop and incorporate generative AI into their products.

In the next rung of companies, you’ll find those looking to capitalise on the demand for essential hardware and infrastructure required to facilitate the AI boom. By far the most prominent of these is NVIDIA, which produces the powerful processors required to run generative AI applications.

Ok, we don’t have any NVIDIAs on the ASX, nor the likes of Microsoft et al – not even close. Of course, nothing is stopping you from investing in any of those big names, but for those shopping for ASX exposure, there are a handful of ASX companies gearing up to support the AI push through infrastructure.

In this article, I’ll point out the scope of the opportunity for data centre operators, as well as highlight the main ASX-listed players.

Cloud + AI = Storage (and lots of it!)

Major broker Citi describes data centres as “One of the compelling emerging themes globally across Real Estate”. Rival Morgan Stanley suggests that the world’s growing hunger for data presents a substantial “long-dated growth opportunity”.

According to Morgan Stanley, data centre demand will grow at around a 20% compound average growth rate (CAGR) from 2024 to 2027. Citi suggests that the market, which is typically measured in terms of its IT load in gigawatts (GW), will grow from 33GW at the end of last year to 166GW by 2030 – a 26% CAGR.

Both brokers agree that generative AI, whilst likely to be a major contributing demand-side factor, represents but an additional component of growth to an already rapidly growing industry traditionally focused on servicing the world’s increasing cloud storage requirements.

.%20Source%20Morgan%20Stanley%20Research.png)

Certainly, cloud storage is the mainstay, representing around 60% of global centre demand. Morgan Stanley sees this component growing five-fold by 2032. AI is likely to be around 25% of the mix, with the remaining portion largely taken up by data sovereignty.

Data sovereignty is perhaps the least known of the three but is arguably the most important. It is tasked with protecting data from “external interference from foreign states and third parties” says Morgan Stanley, as well as satisfying country-specific legislation requiring certain data to be processed within a corresponding jurisdiction.

ASX data centre stocks to watch

Growth, growth, growth! So far that’s all you’ve heard. I think you get it. But this is an important consideration because in the investing world earnings growth is a key priority, and investors will pay a tidy premium for it.

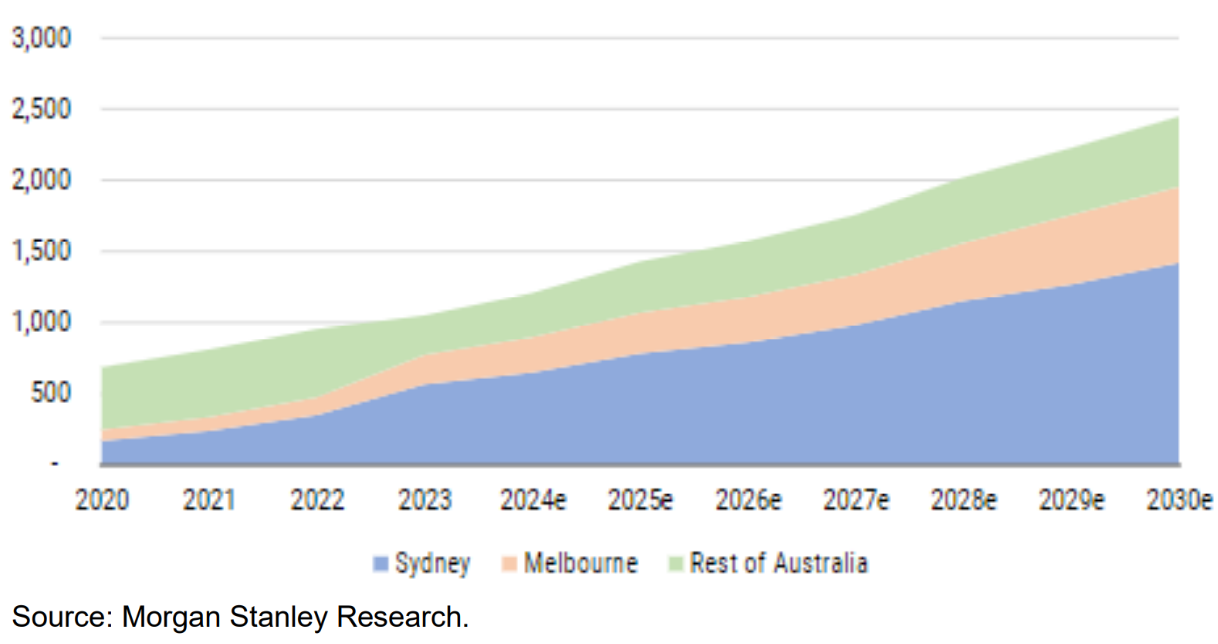

Let’s bring things back to the local data centre environment, and the ASX-listed companies that are poised to take advantage. First, note that Australian data centre demand is also expected to experience health growth over the rest of the decade. Morgan Stanley predicts the local data centre market will grow by 1,500MW to 2030, a CAGR of around 13%.

One advantage working in favour of local data centre operators’ is that “big tech” (i.e., Amazon, Alphabet, and Microsoft) are struggling to navigate local councils, power utilities, costs and complexities of development approvals, etc. This means local operators that have already secured large land banks close to major population centres are in a prime position to service the big overseas players (thank goodness for good old Aussie bureaucracy and red tape!)

There are two major ASX data centre companies that Citi and Morgan Stanley are keen on, Goodman Group (ASX: GMG) and NextDC (ASX: NXT). See below each broker’s latest rating, price target, and commentary on the two companies, as well as corresponding data from other major brokers I have on file:

Goodman Group (ASX: GMG)

Citi BUY | Price Target $40

The broker believes the conversion opportunity of Goodman’s assets from traditional warehouses into data centres presents “a robust growth opportunity”

GMG’s data centres are being developed in cities with lower vacancy rates, and this is translating into “robust” demand

GMG’s forecast earnings growth remains “higher than key global peers”

Macquarie OUTPERFORM | Price Target $36.37

“We remain attracted to GMG's ability to deliver low double-digit earnings growth into the medium term, with line-of-sight continuing to improve, underpinned by the data centre opportunity.”

Morgan Stanley OVERWEIGHT | Price Target $35.65

Goodman has acquired land and pre-arranged council approvals and power connectivity it can use to develop its own data centres or sell as a ready parcel to big tech.

The company’s current data centre pipeline opportunity is around $20 billion, but the market is currently pricing “less than half of this potential opportunity at ~A$9 billion”.

This could translate into “material earnings upside”

NextDC (ASX: NXT)

Citi BUY | Price Target $19.53

Strong demand in Sydney and Melbourne are assisting in selling remaining capacity (one of NXT’s customers is TikTok), with S3 to be fully contracted within 12 months

“We remain confident on the medium-term outlook and continue to expect strong bookings in the near-term.”

Goldman Sachs BUY | Price Target $18.80

The broker notes that NXT’s pipeline of growth exceeds 1GW for the first time

Over 100MW+ of AI-related contracts have been secured

“We believe the company has a compelling growth profile and a proven and profitable business model, noting it trades on a growth-adjusted discount vs. peers, which we view as unjustified.”

Macquarie OUTPERFORM | Price Target $20.00

NXT will double in size in the next few years, driven by a record contract year expected in FY24

Contracted utilisation from hyperscale customers provides visibility and the medium-term story for AI & transition to cloud remains

Morgan Stanley OVERWEIGHT | Price Target $20.00

NXT has a track record of high-quality data centre developments and operations

The broker likes NXT’s scalable model, structural drives, and network effect.

The company is also moving into international markets, which the broker believes could “bring higher risk/return for equity holders”

Add to this, the company’s annuity model that brings “strong earnings probability and comfort”

UBS BUY | Price Target $20.10

This article first appeared on Market Index on Monday 8 July 2024.

5 topics

2 stocks mentioned