You don't get more blue chip than Wesfarmers, but does it deserve a spot in your portfolio?

You don't get more ASX blue chip than Wesfarmers (ASX: WES). The company's FY24 result released today might not have been completely well received by the market, but it's hard to argue against Wesfarmers' longevity, and more importantly, its consistency.

%20price%20chart%20last%2020%20years.png)

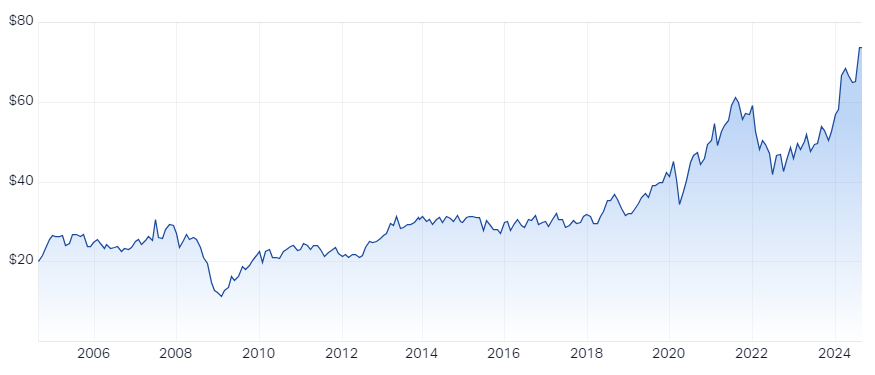

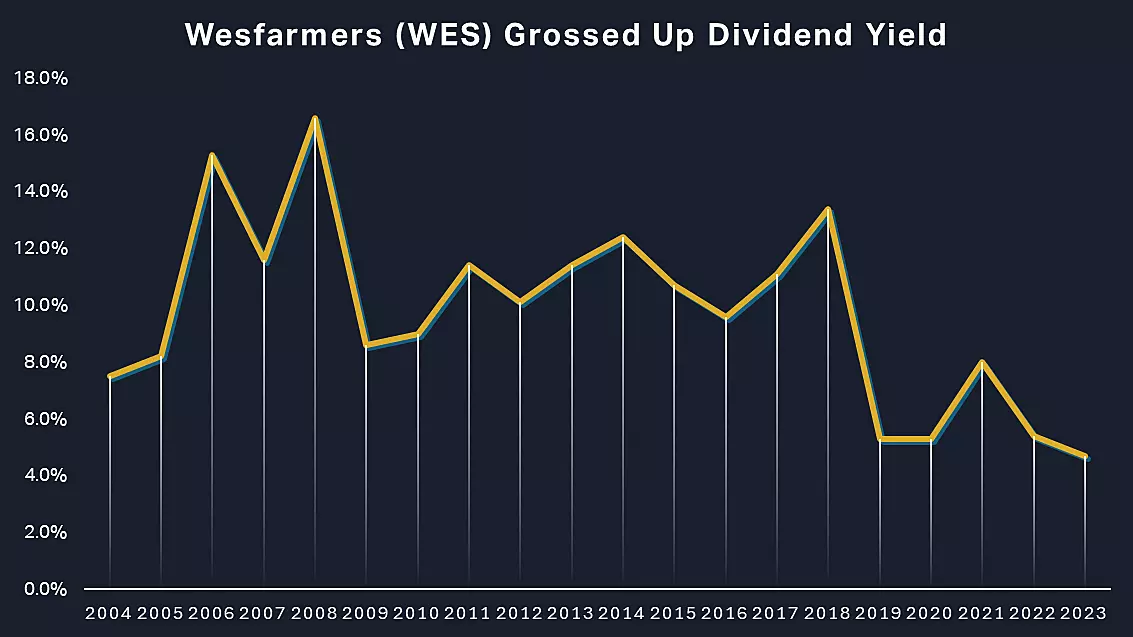

As can be seen from the chart above, today's roughly 3% fall is but a tiny blip in an otherwise nearly impeccable last 20 years of capital returns. When you add the company's excellent dividend yield - an average 9.8% p.a. on a grossed-up basis over the same period* - it's hard to argue Wesfarmers' blue-chip credentials.

%20dividend%20yield%20last%2020%20years.png)

WESFARMERS FY24 REsults overview

Revenue: +1.2% to $44.19 billion vs consensus $44.38 billion (all consensus numbers via StreetAccount by Factset)

- Bunnings $18.94 billion vs consensus $18.87 billion

- Kmart Group $11.16 billion vs consensus $11.16 billion

- API (Health) $5.62 billion vs consensus $5.38 billion

- Officeworks $3.42 billion vs consensus $3.42 billion

- WesCEF $2.75 billion vs consensus $2.59 billion

- Industrial & Safety $2.02 billion vs consensus $2.06 billion

- Catch $227 million vs consensusA$260.1 million

EBIT: +3.3% to $3.99B vs consensusA$3.95B

Final dividend: +3.7% to $1.07/share, fully franked (FY24 dividend +3.7% to $1.98/share, fully franked)

Outlook comments/trading update:

- Bunnings saw continued positive sales growth, but growth has moderated from the second half of FY24, due to a pervasive slowdown in building activity

- Trading update for first 8-weeks showed sales at Kmart Group broadly in line with growth seen in the second half of FY24, while Officeworks was slightly ahead

- The company noted its retail businesses are well-positioned to meet demand for value-based products as the cost of living crisis continues, and it remains confident it can maintain cost control.

- Commissioning of its lithium hydroxide refinery is expected by mid-2025, with first sales expected in 2026

Interview with Adam Alexander, Portfolio Manager at Schroders

In one sentence, what was the key takeaway from this result?

The real highlight for FY24 was the result in Kmart which grew EBIT an impressive 23% to over $1 billion. It was a clean, in-line result for the group, and typical of Wesfarmers' strong management team.

Were there any major surprises in this result that you think investors should be aware of?

Given the number of divisions within the group, the fact that all divisions delivered a result that was in line with market expectations is a pleasant surprise.

Would you buy, hold or sell this stock on the back of this result?

Rating: HOLD

The stock is trading at record highs, so there is no doubt it looks expensive versus its history. But the management execution across Bunnings and Kmart is exceptional, and these businesses will continue to grow. It’s a Hold.

What is the main risk to the outlook provided above?

Bunnings, Kmart, and Officeworks are roughly 80-85% of group earnings, so the group is very dependent on the health of the consumer. From what we have seen in the retail results to date, the consumer has held up much better than expected over the last 12 months. Arguably from here, the environment gets better with tax cuts flowing through, and a possible rate cut on the horizon. We have seen that fourth-quarter sales and early trading updates in FY25 across JB Hi-Fi (ASX: JBH) and Super Retail Group (ASX: SUL) have been better than expected, and Bunnings and Kmart sales are also growing.

The main risk is persistent or even higher inflation which either delays a rate cut or even causes an additional rate rise. That would shift sentiment completely on retail stocks and certainly drive a derating.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 4.5

It’s no doubt expensive, the industrials and banks particularly so. It’s very hard to find value in this market. Anything with a hint of earnings growth or momentum is being bid up aggressively, with gains being driven largely by multiple expansion rather than underlying earnings. This can’t go on for too much longer.

2 topics

3 stocks mentioned

1 contributor mentioned