You never get hit by the bus you’re watching

The flood of promises made, and the lack of accountability for them, is common to almost every political campaign, and in every country. Good examples include Biden telling you he would secure the border (not done, quite the opposite), Trump telling you that Mexico would pay for the wall (not a dime changed hands), Labor’s promise to cut your energy bill by $275 (not done, your bill went up by double that), the Greens promise to cap rents and grocery prices (not done, won’t ever be done), and the Coalition’s promise to deliver genuinely high-speed broadband internet (not done).

The recent US Presidential election is no exception. One thing about US politics is the next-level lack of accountability that exists. Promises are often made, often broken, and there’s much less accountability than we have, as well as much less scrutiny of those promises. There is no Access Economics, for example, to cost and to account for campaign promises.

The reason this is interesting is because markets have moved, and some markets have moved a lot, since the said US Presidential election. They actually moved a lot going in. A good example is Bitcoin, which is up 40%-ish since the end of October and it has more than doubled so far in 2024. Many of these moves are largely premised on what was said during the campaign.

On Bitcoin in particular, Trump made a special effort to reach out to the broader crypto community, and more specifically, he committed to firing the head of the SEC in the US, Gary Gensler, who has been hard on crypto investment options, calling crypto a security, therefore making those ideas open to more scrutiny and more regulation.

Gary Gensler has subsequently resigned.

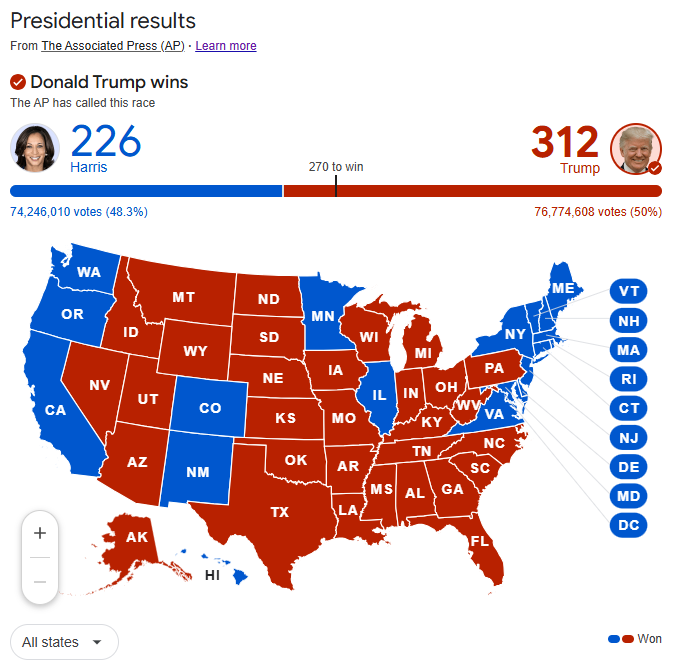

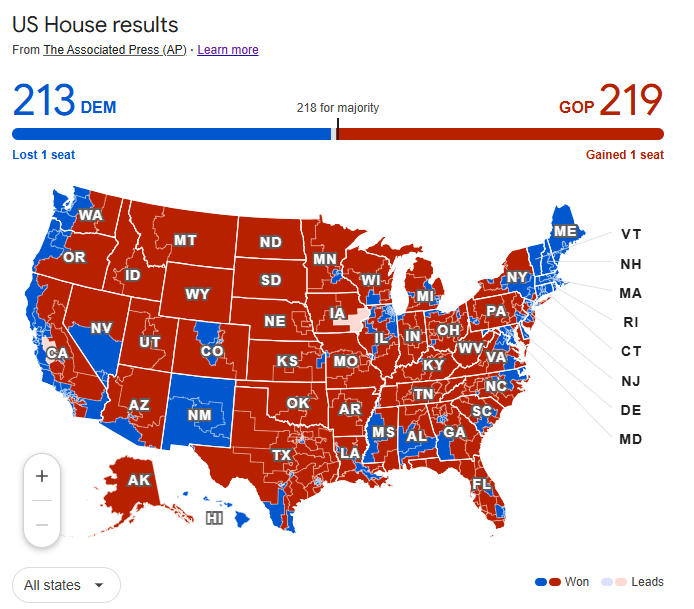

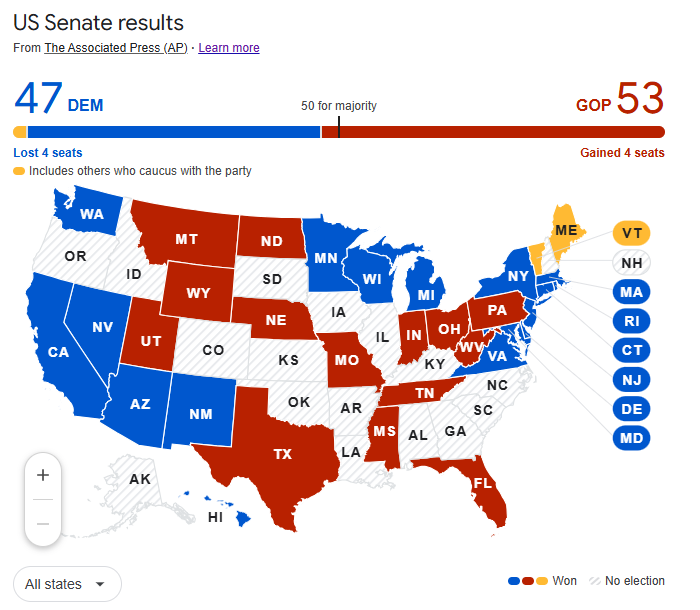

Part of why markets have moved so hard since Trump won is because of the magnitude of the win. Not only has the GOP already got a friendly US Supreme Court, they lost no ground in the Governor races, they won the Senate (as expected, see below), and they (unexpectedly) retained the House (also see below). And Trump won the popular vote (see above).

It was a literal clean sweep.

But be careful – one of my favourite sayings is that you never get hit by the bus you’re watching. That means, if you’re waiting for something to happen, or you’re watching for it, you’re protecting against it, or market participants broadly believe it, it’s probably not going to come to pass.

All of this talk of Donald Trump being a dictator and of taking away your rights (whatever that means) and of ending democracy, they won’t happen because we all know they are supposedly coming. I’ll give you a good set of examples.

In Trump’s first term, it would have been safe to assume, as it is for his second term, that he will be friendly to big oil and that fossil fuels will be given a somewhat free reign (“drill baby drill” was a commonly used phrase through the 2024 campaign). During his first term, the S&P 500 went up about 12% per year, even in spite of the 2020 COVID market crash.

Interestingly, fossil fuel stocks as a whole went DOWN about 20% per year.

Read that again – the market went up strongly, and the traditional energy sector was down, big. Conversely, the broad solar sector was UP, and up a lot – about 50% per year.

Now let’s look at Biden’s term. It would be safe to assume that the last 4 years have been a boon for renewables and a financial valley of death for fossil fuels, right?

Wrong. So, so wrong.

During Biden’s term, the S&P 500 went up about 13% per year and at the same time, the traditional energy sector also went up, at about 25% per year. Conversely, and tell me if you see a pattern here, the broad solar sector was DOWN, and down a lot – over 20% per year.

So as you start crafting investment strategies for the upcoming 4 years of Trump 2.0, consider that maybe, just maybe, the sectors you’re so sure will take off, or will tank, might chart a different journey…..a very very different journey.

Good luck out there.

5 topics