Your guide to ASX AGM Season + Do defence stocks work in a time of market defence?

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,614 (-0.72%)

- NASDAQ - 10,927 (-1.02%)

- CBOE VIX - 32.54

- USD INDEX - 113.13

- US BOND MARKETS CLOSED FOR COLUMBUS DAY HOLIDAY

- FTSE 100 - 6,959 (-0.45%)

- STOXX 600 - 390.12 (-0.40%)

- UK 10YR - 4.5050%

- GOLD - US$1668/oz

- WTI CRUDE - US$90.83/bbl

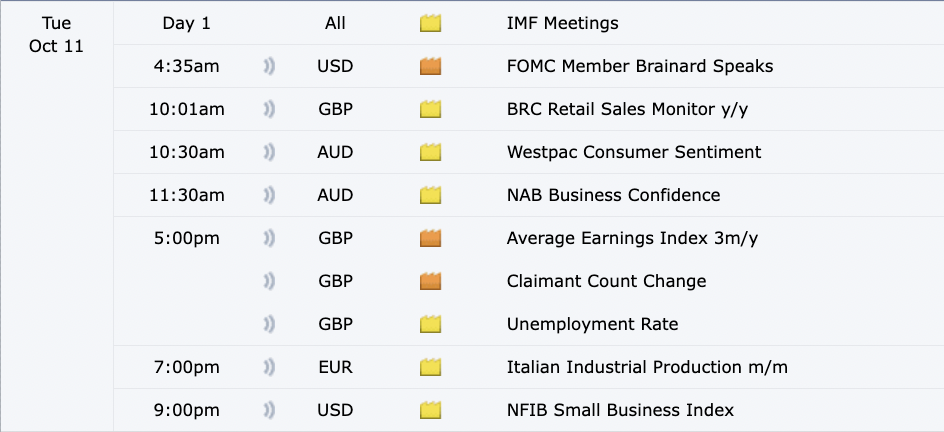

THE CALENDAR

It's a day for second-tier data around the world, but you shouldn't think of today as a day to just sit and forget about. In Australia, it's all about consumer sentiment and NAB business confidence - both are key readers on the state of the economy at the ground level, and how decisions made at the RBA and at the government level are affecting everyday spending habits.

Overseas, it's all about the UK labour market (spoiler alert: it's tight) and the US small business index which gives us a good reading on how US SMEs are digesting inflation, labour shortages, and more.

One thing to note for this month's survey - last month's report suggested 49% of surveyed owners had job openings they could not fill. That will be key to the US Fed's opinion of the labour market - and particularly - where it goes from here.

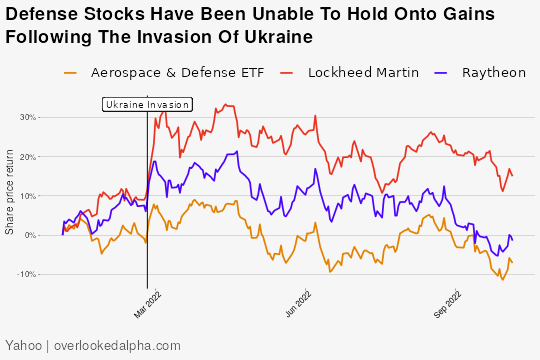

THE CHART

Today's chart is an unusual one as it preaches to a Dad joke - how do you play defence? With defence! This chart is a correlation of the major US-listed defence-related equities and related ETFs, and it shows that returns haven't held up since the Russian invasion of Ukraine. While commodity companies had a much larger boom (and are still elevated in some cases), these stocks had a much shorter honeymoon period.

Kind of gives GUNg-ho a new meaning, doesn't it? (Cue groans)

STOCKS TO WATCH - YOUR GUIDE TO AGM SEASON

August is earnings season. September is money counting season. October is long luncheon season. If you follow this logic, then you should know what's coming up in November - Australian AGM season. This year's AGM season will be particularly interesting given the backdrop that was set in August, especially around the return of outlook statements. But there's no doubt that giving any outlook in this environment is an achievement - as we covered earlier this year:

.png)

So what will AGM season bring? Morgan Stanley has this preview:

To us, it is the locally sourced pressures that are building into macro and trading outlooks that should be most focused on in the aftermath of results. The sentiment signals are poor, indeed near recessionary levels, and when looking at volumes and nominal spending – the price has taken over. We expect reality to bite with a combination of category mean reversion of post-Covid trends and thrifting in spending behaviour to deal with inflation and interest rates. The AGM season could be the start of this realisation.

This week, expect to hear from these names: Baby Bunting (ASX: BBN), Telstra (ASX: TLS), Commonwealth Bank (ASX: CBA), CSL (ASX: CSL), Aurizon (ASX: AZJ), Woodside (ASX: WDS), and Perenti Global (ASX: PRN).

Bank of Queensland ASX: BOQ also reports earnings this week, and we'll have a full rundown in Thursday's report.

THE STAT(S)

95%: The percentage of S&P500 stocks that fell on Friday following a stronger than expected jobs report in the US. Investors are now betting on a 75 point rate hike in November. (Bloomberg)

Not only did Friday's falls kill the two-day bear market rally into the jobs report, but it also killed any idea of (all together now) a Federal Reserve pivot. Equally of interest, Simply Wall St had this stat in its recent newsletter - and it will probably weigh on traders' minds as well later this month.

Analysts reduced their S&P 500 earnings expectations for Q3 by 6.6%, the biggest downward revision since mid-2020. (Simply Wall St)

A lot of the analysts I speak to say earnings will be the next "shoe to drop" - and if this is anything to go by, it sounds like the shoe is going to be making an almighty thud very soon.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

8 stocks mentioned

1 contributor mentioned