TOL - 5th Jan, 2023

Your predictions for 2023

Here are your Predictions for 2023 - collected from Livewire and Marcus Today Members.

Let's start with a few of your statements:

- No-one knows so what follows is not prediction, its guesswork.

- My prediction for 2023 is that I will be wrong most of the time but right when it counts.

- Follow the trend - it is your only friend.

- On a daily basis the ASX 200 will go up 53% of the time (20 year statistical fact) - it's not much of an edge.

- React don't predict.

Surprises for 2023

- Central bankers falling on their swords and admitting incompetence.

- China gets back on track (looks like they have given up already - 250m people or 18% of the population has had COVID in December and they are lifting quarantine restrictions and opening borders).

- Rate cuts.

- Crypto will either go significantly down or significantly up from current levels by 31 Dec 2023. So on that basis the 'surprise' will be if crypto goes nowhere!

-

Global Covid 2.0. But we won't care.

- Beginnings of a second wave of inflation by the end of 2023.

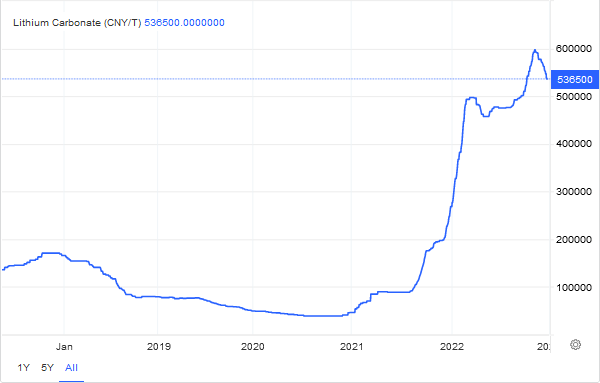

- Lithium crashing (this comment created a polite Facebook backlash)

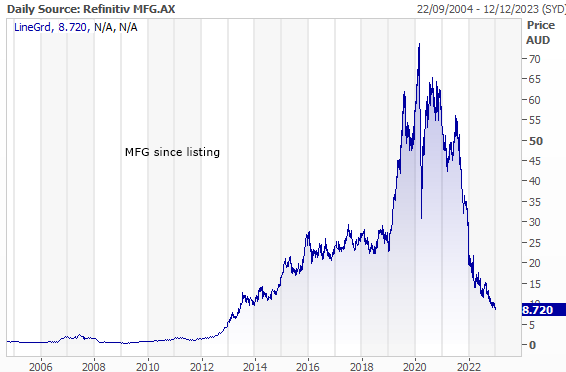

- The rise of MFG.

-

A property boom when the Central Banks are revealed as having massively overcooked it and have to rapidly backpedal on rates.

-

Uranium stocks up as people and markets move from "Uranium !? nah" to "Uranium … hmmm" (uranium gets a lot of mentions in your predictions).

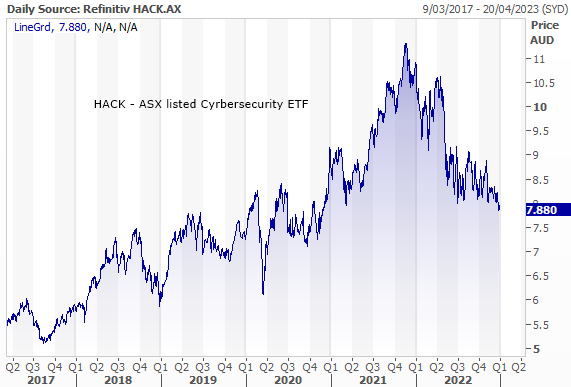

- Cybersecurity stocks spike on record revenues. When Facebook, a Bank, or the NYSE is hacked Medibank will look like a Tea Party.

- Global recession. Don't pretend otherwise. Accept and exploit.

- Bad news will become good news - Inflation and a strong labor market will become good news as evidence of soft not hard landing.

- There will be a decade long boom in fossil fuels once over the recession hump. This year was just the beginning.

- Nuclear power - it has the highest ROI of any power option and the over "reaction" to nuclear related accidents is out of all proportion to the slow "burn" impact of global mining pollution.

Macro

- Cash is King.

- The years of earning interest are back.

- Mortgage rates at 8% plus (investment loan mortgage rates are already there).

- Inflation here to stay.

- Buy Bonds.

- Aussie dollar up to 75c again (US dollar down further).

- The US market will bottom after another leg down.

-

Buy the Bottom – whenever that comes - to find out read the Marcus Today Strategy section every day. (Thank you John)

- Don't Worry – they'll manage a Soft Landing.

- It's the "Lull before the Bull Market".

- Cash is king (finally), anything underperforming – sell it and earn some interest!

- Central banks are behind the curve as always.

- Policy will overshoot again (already has), they are risking deflation & recession.

- The next bottom will flag the last hurrah for the stock market before we see a major decline.

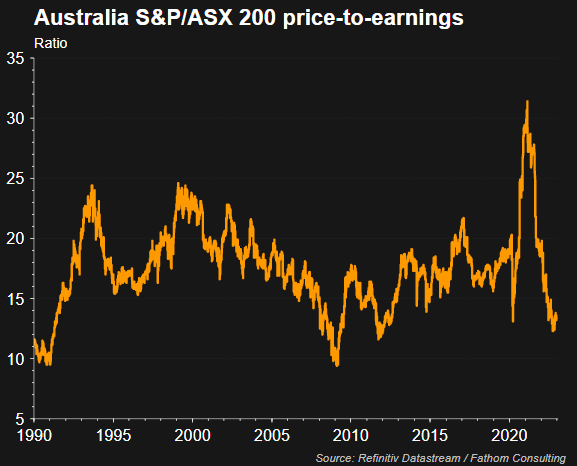

- The market PE is the lowest in a decade. We're going to bottom sometime in 2023.

- Inflation drops rapidly back to 4% by end 2023.

- The recession is going to be nowhere near as bad as some suggest.

- China moves on Taiwan.

- China won't get any worse. Buy iron ore stocks at the bottom.

- There is a big easing cycle coming – very bullish.

- Inflation will collapse.

- Rates are too high.

-

Avoid Crypto (again) even if it goes up. It's not about price, it's about volatility. It should not be on the radar of an "investor". It's not an investment it's a gamble.

- The time to buy Residential Property is coming.

- WFH (Work From Home) – there’s no going back. Resist at your peril. Sell Offices. Buy Lifestyle. Employees are so 2000. Employ contractors.

- Travel will never recover.

- Shopping Centres are survival plays not recovery plays.

- EVs are coming slowly not quickly.

Themes

- The biggest stocks in the US will include AI related stocks by the end of 2023.

- AI is coming big time. Sell Google.

- Buy Lithium on weakness.

- Only buy Lithium producers (not explorers – too late now).

- Biotech makes a comeback.

- Lithium batteries trashed by new technology, no lithium, no cobalt required.

- Avoid Office REITs.

- Buy REITs with fulfilment warehouses for internet based businesses (GMG – Amazon).

- Graphite.

- Cybersecurity stocks spike on record revenues.

- Uranium.

- Uranium will have its day – See the final scene of Three Days of the Condor - Higgins says it all.

- Uranium goes up.

- Lithium, lithium, lithium.

- Vanadium – new tech process such as RVT.

- Long Lithium and Graphite.

- Graphite, Nickel & uranium.

- Gold -the US dollar is coming off.

- Uranium ETFs – ATOM in Australia – LIT, BATT, ICLN, QCLN, ARKQ in the US.

- The biggest US stocks next year will be the old names not the Tech names.

- Copper and Nickel Boom. EVs dictate.

- US dollar down, commodities up.

- China can't get any worse. Buy iron ore stocks at the bottom.

- Buy Hot stocks whenever they come on sale (Lithium, Copper, Tech).

I have also been collecting your 2023 STOCK TIPS. There are a lot of them already. They are going to be made progressively available on Livewire and on the Marcus Today website over the break. Let me know yours in the comments below and I will include them if I am not overwhelmed.

Marcus Padley and Henry Jennings are the authors of the Marcus Today Stock Market Newsletter established in 1998. For a free trial of the Marcus Today newsletter, click here.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Marcus Padley founded Marcus Today in 1998 and leads the team of analysts and market commentators that publishes a daily stock market newsletter, presents four podcasts and runs an $80m Australian equity fund. He is passionate about educating and informing private investors with insightful, honest, straight-up independent stock market research and ideas. Marcus likes to call it as it is without agenda, puts subscribers first, and this has paid off for real people with real money.

........

Marcus Today offers information that is only general in nature. It does not take into account your personal financial situation, needs or objectives. Nor does it take into account the financial needs of any specific person. You should consider your own personal financial situation and needs or seek financial advice before making any decisions based on this information. For more information please see our Financial Services Guide.

2 topics

Comments

Comments

Sign In or Join Free to comment