10 Australian equity funds that delivered more than 27% in 2024

Some victories are years in the making, built on grit and resilience, and that applies as much to funds management as it does sport.

Just as the Australian cricket team reclaimed the Border-Gavaskar Trophy after its ups and downs, the top-performing fund managers of 2024 smashed it out of the stands, navigating a market shaped by the lingering economic aftershocks of COVID, soaring interest rates, rising geopolitical tensions, and Donald Trump’s return to the global stage.

In a year where the ASX 200 climbed 11.2%, 65 of the 128 funds in our database beat the index. The real headline, however, came from small-cap managers hitting big sixes, with 15 funds delivering explosive 20-40% returns, far outpacing the Small Ords' modest 8.36% gain.

While index funds and ETFs continue to grab the spotlight, this year’s results highlight that high-quality active managers can deliver significant value, reminding us to weigh both lower fees and higher performance on their merits.

So, how did the top funds dominate the scoreboard? In this wire, we’ll break down the stocks and strategies that powered these managers to peak test-cricket-level performance, and look at the hints they’ve dropped on 2025 positioning.

How we compiled these lists

Our performance data is sourced from Morningstar, and the funds listed are available on Livewire’s Find Funds menu (located in the top-right corner of the webpage). Note that this is not an exhaustive list of all Australian equity funds in the market.

Here’s how we filtered the results:

- Fund Type: Managed Fund

- Asset Class: Shares – Australian

We then manually refined the list based on 1-year returns.

It’s important to consider that rankings can shift when using longer-term metrics, such as 5-year returns. Evaluating performance across cycles is essential when researching funds or making investment decisions. Among the top 10 funds, four have less than a 5-year track record, and two have less than a 3-year track record.

The 10 top-performing Australian Equity Funds in 2024

Rank |

Fund name |

1 year return |

1 |

Ausbil MicroCap |

40.64% |

2 |

Lakehouse Small Companies Fund |

36% |

3 |

Ellerston Australian Emerging Leaders Fund |

35.87% |

4 |

Seneca Australian Small Companies |

34.49% |

5 |

Hyperion Small Growth Companies Fund |

31.07% |

6 |

Lennox Australian Microcap Fund |

30.49% |

7 |

Ausbil Australian SmallCap |

29.74% |

8 |

First Sentier Geared Australian Share Fund |

29.29% |

9 |

Hyperion Australian Growth Companies Fund |

28.96% |

10 |

First Sentier Wholesale Geared Share Fund |

27.68% |

We focused on the top two performers for their standout results and robust track records, and included #10 (First Sentier) to ensure large caps were represented in this analysis.

- Ausbil MicroCap

Ausbil MicroCap, managed by small-cap aficionados Arden Jennings and Andrew Peros, delivered a monster year, earning the only “4-handle” on the leaderboard. True to form, the duo even gave us the cricket analogy we craved in their year-end report:

“2024 was a year to carefully pick which ball to hit, as opposed to attempting to hit every ball. The Fund’s 2024 scorecard reflected this, with the largest detractor smaller than the Fund’s 9th largest winner,” they said.

Read that again - these guys weren’t swinging blindly. They played a calculated game, managing positions with precision. The fund’s top 10 holdings made up less than 45% of the portfolio.

It’s a strategy that’s paid off handsomely, with the fund boasting 20.30% p.a. since its 2010 inception - earning its title as the Bradman within the microcap world.

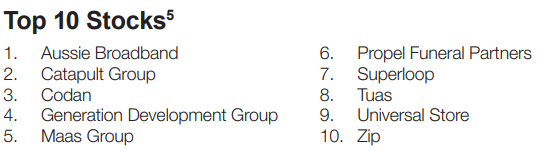

Standout performers included Life360 (+198%), Superloop (+227%), Tuas (+99%), Codan (+93%), and Generation Development (+114%). Jennings and Peros are heading into 2025 with high conviction in these names, alongside Aussie Broadband and Maas Group, which they believe are yet to fully deliver.

Looking ahead, the duo expects robust economic growth and stabilising interest rates to support small-cap performance - but with a warning:

“There will be a high degree of dispersion between geographies, industries, and companies within sectors, making judicious stock selection especially important - as always.”

Jennings builds on the case for small caps in 2025 in the wire below.

2. Lakehouse Small companies fund

Next, we have the Lakehouse Small Companies Fund, which delivered a standout 36% return by taking a markedly different approach from Ausbil Investment Management. This performance extends its annualised returns to 14.2% net of fees since its 2015 inception, surpassing the Small Ords’ 6.6% return over the same time.

As of December, the fund’s sector allocations leaned heavily into information technology (47.2%), financials (18.0%), and healthcare (12.4%), contrasting with the Small Ords’ focus on materials (23.8%), consumer discretionary (15.4%), and financials (13.0%).

The Lakehouse team is unapologetically focused on long-term growth sectors, saying:

“We expect to have material allocations to these sectors over time, as they are overweight in business models with strong intellectual property, network effects, and loyalty.”

At the portfolio level, their conviction shows: the top five holdings - Catapult, Pinnacle, SiteMinder, Xero, and Netwealth - accounted for 41.3% of the portfolio (down from 45% in November). By contrast, Ausbil’s top 10 holdings make up less than 45% of its fund.

While this isn’t a judgment call, it’s fascinating to see the contrasting levels of concentration, areas of conviction, and the markedly different stocks that drove these funds and how differently they both ended their 2024 innings.

Lakehouse opted to take profits and significantly boost dry powder, while Ausbil heads into 2025 with a modest ~4% cash weight. The Lakehouse team explains:

“We made several changes to the portfolio throughout December, most notably reducing several positions that had run hard, reallocating more capital to businesses we are most optimistic about at current prices and increasing our cash allocation to above 10.6% to increases the fund’s optionality as we enter the half year reporting season.”

In cricketing terms, they’re ready to smash sixes when the right stocks land in their sweet spot.

3. First Sentier Geared Share Fund

Lastly, we turn to the First Sentier Geared Share Fund - a completely different beast from the other nine on the list due to its large-cap focus and its ability to use leverage.

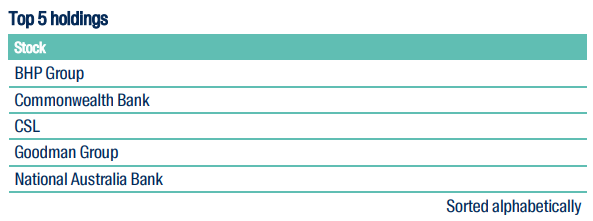

With 50-60% gearing, the fund can deliver exhilarating highs, but the lows can pack a punch. Borrowing to invest is, after all, a double-edged sword. But leverage alone doesn’t cut it - you need stocks that can run hard to justify the interest payments to the bank. On that front, Dushko Bajic and David Wilson, the head and deputy head of First Sentier’s Australian equities growth team, respectively, delivered.

Aside from its top 5 big-cap holdings, a good year in overweight positions in QBE and Aristocrat Leisure boosted performance, while weaker results from James Hardie and exits from Mineral Resources (governance issues) and NIB (profit concerns) tempered gains.

Intriguingly, the team hinted at a new addition to their portfolio, an enterprise software company they’re betting on for 2025:

“The stock has a clear Australian market leadership position, providing ERP management systems for local councils and universities, as well as a small foothold in the UK university sector.”

Any guesses? Drop them in the comments below, we’d love to hear what you think it is!

Looking ahead to 2025, Bajic and Wilson offered this insight:

“We are focused on businesses that can ‘run their own race,’ delivering strong growth without relying on lower interest rates or inflation-driven pricing.”

Important notes about the table

- We excluded listed products (namely ETFs) from this list as they will be covered in other wires and to keep the focus of this piece on Australian equities

- Fund performance is typically viewed over longer timeframes than one year (i.e. three-year and five-year rolling periods). Past performance is not a reliable indicator of future return. The tables above simply capture the best-performing funds, in their respective categories, for the past 12 months.

- All data is supplied by Morningstar. If you would like to conduct your own research into top-performing funds, you can do so by clicking here.

- We excluded Australian Unity Future of Healthcare Fund from the table. This strategy recently underwent a trustee change and invests in global stocks rather than focusing solely on ASX-listed companies, which is the purpose of this wire.

3 topics

20 stocks mentioned

3 funds mentioned

5 contributors mentioned