10 most tipped big caps: 8% ahead of the market

The market has become a different place since we published the findings of our annual Predictions and Top Picks survey in January, and it's time to revisit the stocks and see what the experts are saying about them following the worst quarter for a generation.

As a refresher, as part of the survey we asked you for a stock idea. From the 7,000 responses, we shortlisted the stocks that received the most tips and published a list of the ten most tipped big caps.

The ten most tipped stocks for 2019 ultimately returned an average total return of over 50%. The list for 2020 received a great deal of interest though I warned: "last year's strong equity market provided a strong tailwind which likely won't repeat". I must admit that I never dreamed that just ten weeks later, the entire market would be 35% lower.

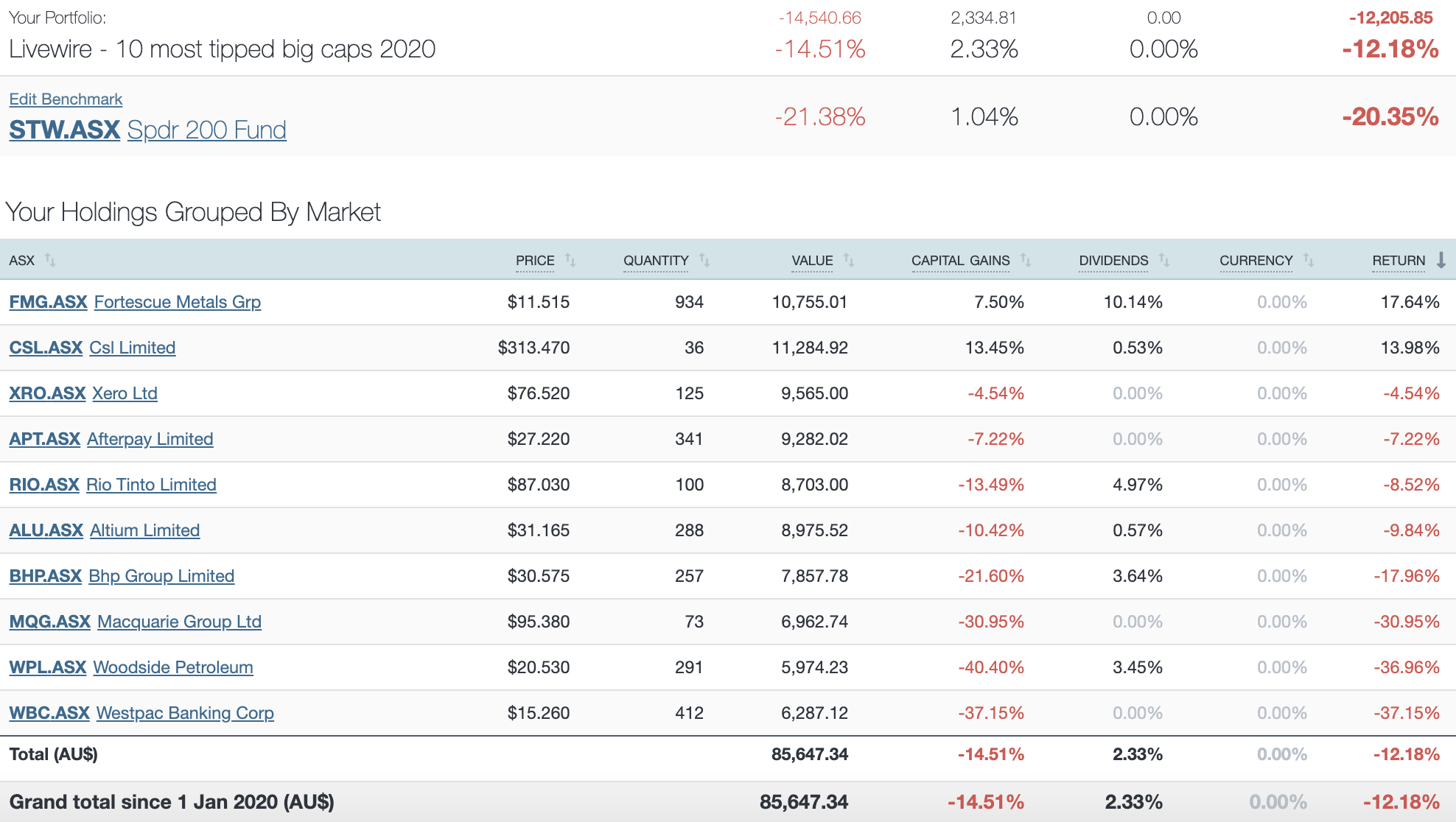

Since then, the market has had a decent bounce, however, is still down by 20.4% for the year. The most tipped big caps, while underwater too, are faring much better than the index, leading by 8.2% on a total return basis. Here's the table tracking the most tipped big caps kindly made available by Sharesight.

Source: Sharesight

If you missed the original wire discussing the results of the survey, you can read it here. The most tipped stock of the entire survey was CSL with nearly 10% of all 7,000 tips, and the share price has been the best performer on the list, gaining by an incredible 13.5% (or a 14.0% total return).

The next most tipped stock, with 4% of tips, was Afterpay, whose year to date fall of 7% tells nothing of the mind-boggling volatility it has seen on the way, with an initial gain of 35%, being followed by a plunge of 80% and then a bounce of over 230%.

Most stocks have a similar tale of extreme volatility to tell, and with most investors disorientated by recent events and confused by what might comes next, I thought it would be timely to dig a little deeper into each stock.

Deep dives on each stock coming soon

The list covers energy, mining, tech, financials and healthcare, and with wildly differing dynamics in play across the group, we went out to ten leading fund managers with expertise in each area and asked them for a deep dive on one nominated each.

We asked how the business been impacted by COVID-19, how it might fare for the rest of 2020, how they are valuing the business, whether a cap raise may be likely, if their target differs from consensus, and what the market might be missing about the stock.

So over the next week or so, look out for the following reports:

-

Fortsecue (FMG) by Stephane Andre at Alphinity

- Rio Tinto (RIO) by Anton du Preez from Pengana

- Macquarie (MQG) by David Poppenbeek at K2

- CSL (CSL) by Kelli Meagher at Sage Capital

- Xero (XRO) by Camille Simeon at Aberdeen

- Altium (ALU) by Jun Bei Liu at Tribeca

- BHP Billiton (BHP) by Matt Williams at Airlie

- Westpac Banking Corporation (WBC) by James Gerrish at Market Matters

- Afterpay (APT) by Simon Shields at Monash Investors

- Woodside (WPL) by Romano Sala Tenna at Katana Asset Management

With Fortescue the best performer on a total return basis, first up we will hear from Stephane Andre at Alphinity about what the rest of 2020 could look for the stock. So look out for that shortly.

FOLLOW the managers to get their reports first

If you want to be the first to read their reports, click on each of the managers you want to hear from, and then click FOLLOW on their profiles. This way you will receive the report directly by email soon after it goes live. I hope you find them useful.

10 stocks mentioned

7 contributors mentioned

Alex happily served as Livewire's Content Director for the last four years, using a decade of industry experience to deliver the most valuable, and readable, market insights to all Australian investors.