10 new stocks added to the ASX 300 - 7 actually profitable!

For the past few of years, QVG Capital has been tracking index changes with a particular focus on the proportion of unprofitable companies entering the S&P/ASX 300. For example, at the last bi-annual rebalance in March, only 4 of the 12 made a profit. But change is afoot! For the first time since we started writing these articles a majority of 300 entries make money.

Why the ASX300 is a big deal

For those wondering about the significance of the S&P/ASX 300, it’s the benchmark that index funds such as the $12.3 billion Vanguard Australian Shares Index (ASX:VAS) seeks to replicate. It’s also the pool that many fundamental portfolio managers use as a cut off for their potential investable universe. With a new batch of additions entering the index last Friday, we felt it was worth reviewing the current crop.

Here goes:

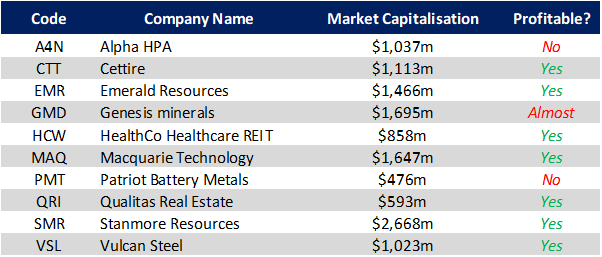

The table above shows the 10 stocks that have recently been promoted into the index. Every 6 months - in March and September - the dark cabal that is the S&P’s index committee gets together and ‘promote’ and ‘delete’ stocks from various indices. The index committee doesn't make exactly clear what criteria they use to make their decisions, but we do know entry and exits are largely dependent on the stock’s market capitalization, rank versus peers and its trading volumes.

We have discussed previously the lack of quality of 300 entries but this batch is a little different with 7 of the 10 companies making a buck. Lithium stocks and battery minerals companies have dominated recent entries and there are a few here such as Alpha HPA and Patriot Battery Metals but with greater variety in this graduating class it appears the tide may be turning against the battery minerals thematic.

The diversity of entries is striking. From eCommerce player Cettire, to Hospital REIT HealthCo, data centre developer Macquarie and Steal distributor Vulcan. Before we get too excited, it’s worth remembering it’s the durability of profitability, not just profitability itself that will determine the long-term performance of these companies. Nevertheless, compared to the recent crop of highly speculative resources names, the class of September 2023 looks like above average students.

What to make of all this?

We suggest the following:

- Be aware there are technical factors, such as index inclusions, that can drive share prices well above fair value. Index funds don’t care about the long-term prospects of a business; they’re buyers at any price until they’ve got the size they need to replicate the benchmark.

- If you buy an index product, be aware you’re buying the good, the bad and the ugly.

- Fundamentals such as profitability, durability of those profits and efficiency (i.e. how much capital is required to generate those profits) is what drives share prices in the long run.

- And finally, stocks with weak fundamentals that are over-valued for technical reasons can present great shorting opportunities; ones the QVG Long Short fund seeks to take advantage of.

Find out more via QVG's upcoming investor webinar

If you're interested in hearing more from the QVG Capital team please register for our upcoming invest webinar to be held on Tuesday September 19.

The webinar will cover the recent reporting season, QVG's portfolio positioning and the outlook for our funds.

10 stocks mentioned