13 stocks making 52-week highs (and why it matters)

This article was first published on Market Index on Thursday 2 February 2023.

Ever watch a stock rally into a 52-week high and, contrary to your expectations, continue to grind higher? That’s momentum, my friend.

In this article, we've searched far and wide for why the 52-week matters, some tips and tricks for the scan as well as a closer look at names running into fresh yearly highs.

The Research: A better predictor of future returns

They examined the performance of stocks based on the nearness to 52-week highs from, 1963 to 2001 and noted:

- The closer a stock’s current price is to its 52-week high, the stronger the stock performs in the subsequent period

- Nearness to the 52-week high is a better predictor of future returns than past returns

- Price levels are more important determinants of momentum effects than past price changes

The Fundie: Follows the data 'religiously'

Stott's fund, which focuses on emerging companies, has delivered more than 12% per year since its inception. The fund says it uses the data to both work out continuous winners and generate fresh ideas.

“For example, in March 2020 there were hundreds of names hitting rolling years lows and vice versa for November 2007.”

- Liquidity and market cap: “... the higher liquidity the better while a market cap below $50m can be too small to get a meaningful position in the Fund.”

- Catalyst behind the move: “Researching and understanding the reasons as to why a stock is hitting a rolling year high/low are critical. Often it can be obvious by reading through historical company announcements.”

The Trader: The more the merrier

This reminds me of a few sector-wide advances including:

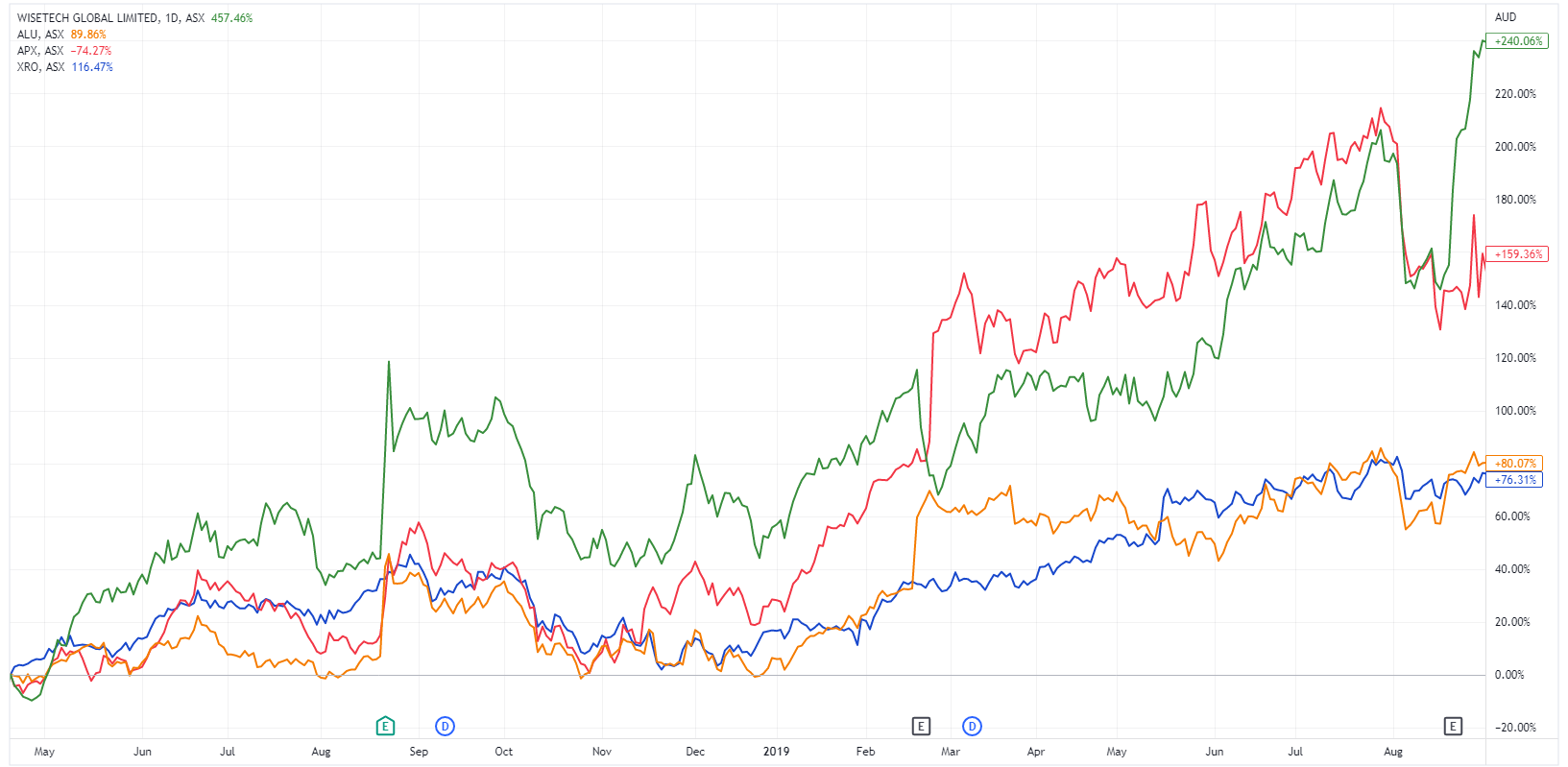

WAAAX (WiseTech, Altium, Afterpay, Appen and Xero) in mid 2017

Lithium stocks bottoming and moving out together in late 2020

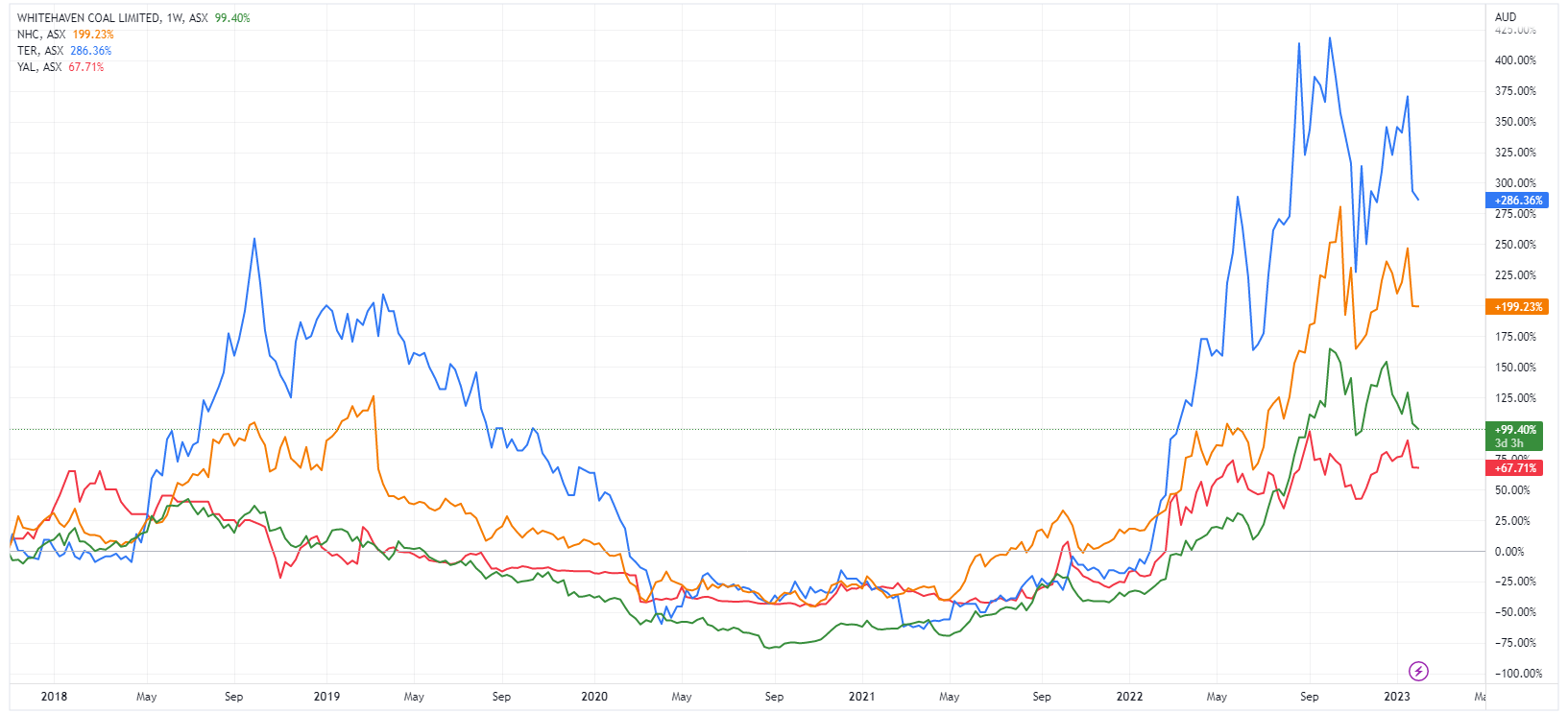

Coal stocks starting to run in early 2022

The bottom line

Whether you’re a short-term trader or a long-term investor, you have probably heard of the term ‘the trend is your friend’. It's a saying that has stood the test of time because there is some merit to following stocks in a strong upswing.

The process isn't as easy as buying stocks around 52-week highs. Though, the experts suggest that the 52-week high is certainly a price point worth keeping an eye on at both the individual stock and sector level.

Stocks making 52-week highs

Here's a list of larger cap (>$1bn market cap) stocks that have made 52-week highs in the past week.

We'll also list some of the smaller cap/explorer names that have also hit yearly highs.

Accent Group (ASX: AX1)

- Mkt cap: $1.2bn

- Sector: Discretionary (footwear and clothing retailer)

- Story so far: Accent was in a downward spiral between November 2021 to June 2022, falling around -55%. During this time, we saw several growth-related sectors take a hit amid hot inflation prints and aggressive central bank tightening efforts.

- Catalyst: Accent shares started to bottom out around late 2022. A trading update on 11 November 2022 helped the stock rally 11.6% and its been trending much higher ever since. The update was rather positive, with management noting a strong recovery in margins and total sales up 52% year-on-year.

Commonwealth Bank (ASX: CBA)

- Mkt cap: $185.7bn

- Sector: Financials

- Story so far: Nothing too exciting. Banks are currently experiencing an upswing in earnings thanks to higher interest rates, which helps expand all-important net interest margins

- Catalyst: CBA hasn't released an earnings-related announcement since 15 November (which didn't have much of an impact on the share price).

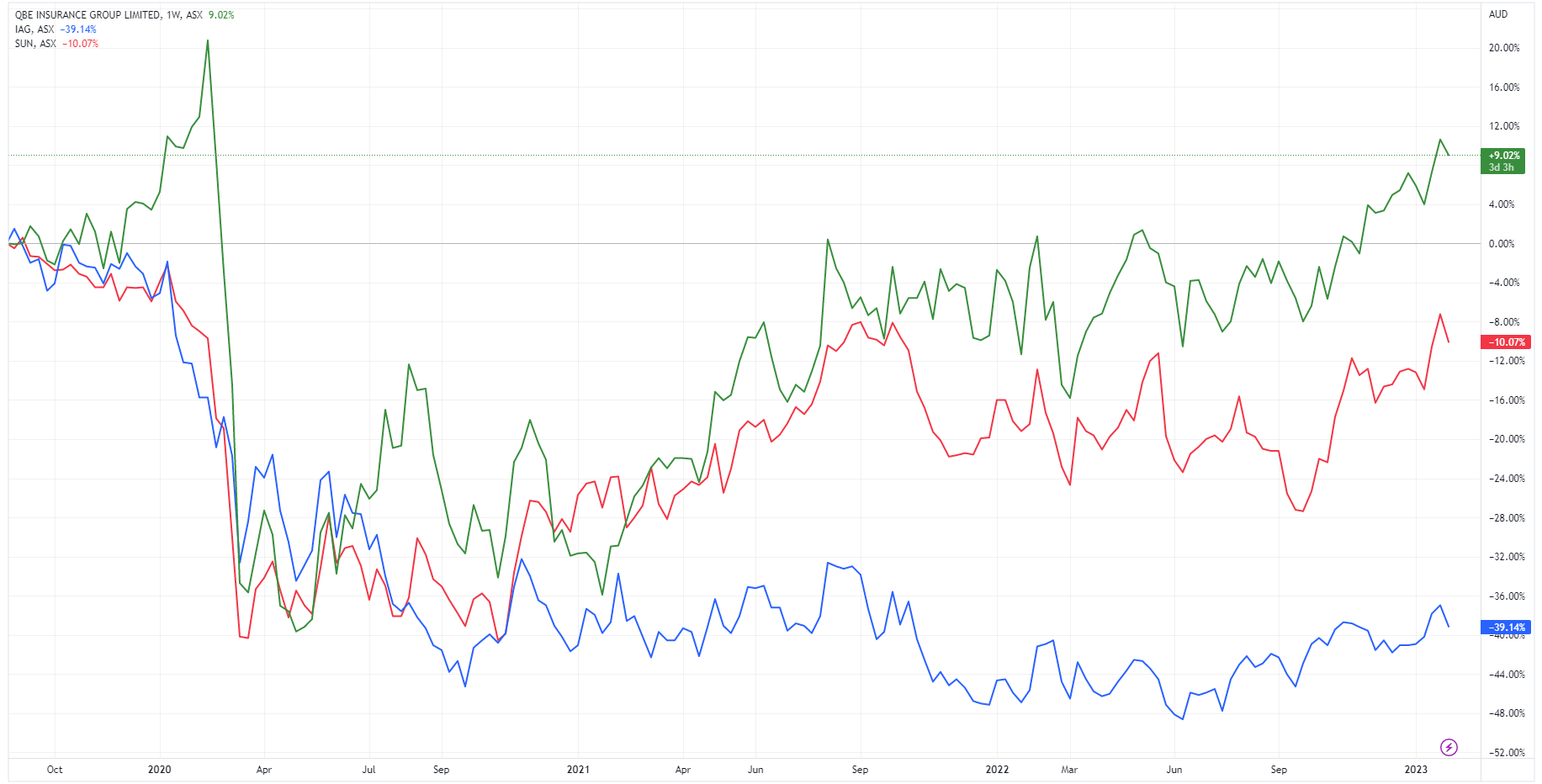

Three insurance stocks: QBE, Suncorp, IAG

- Mkt caps: $20.3bn, $15.9bn and $12bn respectively

- Sector: Financials (Insurance)

- Story so far: Insurance stocks are leveraged to the rising rate environment as they can earn higher returns on their fixed income portfolios, which they use to pay insurance claims. In addition, Macquarie estimates claims inflation of approximately 11.5% in the December 2022 quarter for Personal Motor and 11.9% for Home. This means that insurance prices are also pacing well ahead of inflation.

Rio Tinto (ASX: RIO)

- Mkt cap: $185bn

- Sector: Materials

- Story so far: Rio Tinto shares have rallied almost 50% from October lows on hopes of China's economic reopening. The latter has inspired a broad-based move among metal prices including iron ore, copper and aluminium. On Tuesday, China's NBS manufacturing PMI bounced back into expansion territory, up to 50.1 in January from 47.0 in December. Though, the question remains: Is the iron ore rally fuelled by speculation of a reopening or will the fundamentals follow through?

Treasury Wine (ASX: TWE)

- Mkt cap: $10.4bn

- Sector: Consumer Discretionary (wine)

- Story so far: Treasury Wine was effectively bullied out of China after the government imposed a 167% tariff on Australian wine containers of 2 litres or less in early 2021. It wasn't until August 2022 that the stock manage to recoup some of those tariff-driven share price declines. Now, TWE is focused on building out its premium/luxury portfolios across North America, Europe and ANZ.

- Catalyst: TWE shares rallied on both its half-year and full-year results for FY22. Both instances witnessed a big move up, followed by a few months of sideways action and then another leg higher. For the August 22 full-year results, margins inched higher, net profits rose 5.3% and management said they expect further growth and margin expansion heading into FY23.

Pro Medicus (ASX: PME)

- Mkt cap: $7.0bn

- Sector: Healthcare

- Story so far: Like most growth-related stocks, PME experienced a ~40% derating between January and June last year. But it was able to bounce back just as fast, finishing the year down around -11%.

- Catalyst: January brought about a massive turnaround for global equity markets, especially for beaten up growth and tech names. The ASX 200 had its best ever January in 36 years (up 6.4%) but PME was able to far outpace that, up 21%. Of note, the company trades at a PE ratio of 158. In the past month or so, the company has announced three separate deals that span across 7-8 years worth a combined $52.8m.

PWR Holdings (ASX: PWH)

- Mkt cap: $1.23bn

- Sector: Consumer cyclical (automotive cooling products)

- Story so far: PWR has only had one negative growth year since 2016, which was 2020, for obvious reasons. During that time, its net profit has grown at a compound average growth rate of 16.4%. It's one of those low profile stocks (can I get a raise of hands for who has an interest in automotive cooling parts) that quietly outperforms the market. In the last 12 months, the stock is up 53%.

- Catalyst: The company's last three major announcements: FY22 results (18 Aug), AGM (4 Nov) and acquisition of Bespoke Motorsport Radiators (31 Jan) witnessed share price rallies between 3.5% to 5.0%.

Honorable mentions

- Arafura (ASX: ARU) – Mkt cap: $1.3bn, Emerging rare earths producer

- Myer (ASX: MYR) – Mkt cap: $813m, Retail

- Talga Group (ASX: TLG) – Mkt cap: $570m, Emerging graphite producer

- Aura Energy (ASX: AEE) – Mkt cap: $173m, Uranium explorer

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics

13 stocks mentioned

1 contributor mentioned