13 stocks that benefit from a weaker Australian dollar

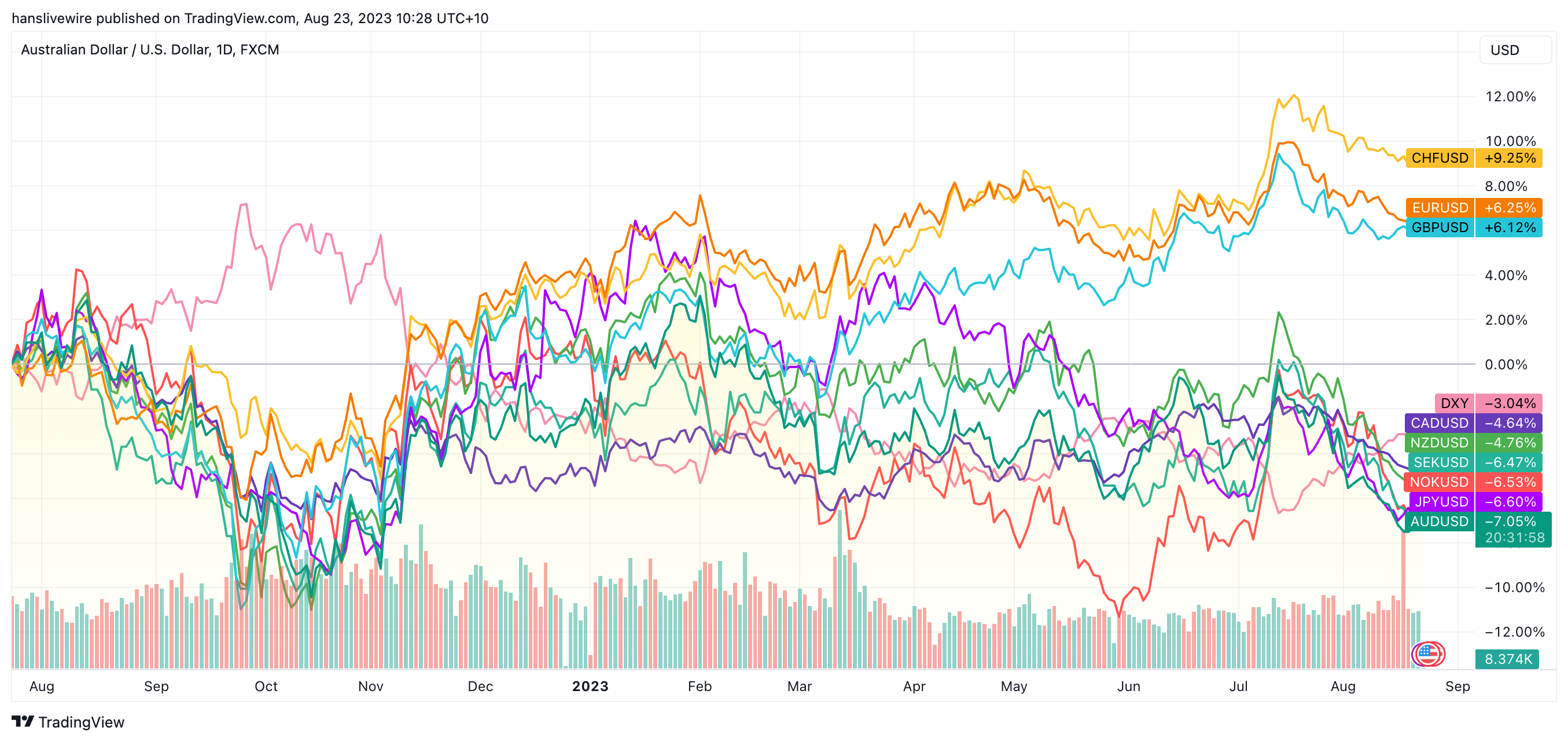

If your equity portfolio is feeling a little battered and bruised, spare a thought for currency traders. The Australian dollar is sitting near nine-month lows, at a level we have not seen since November 2022. Compared to the other G10 currencies, we're also dead last in returns over the last 12 months.

There are several domestic and international reasons why the Australian currency has lagged behind our global peers. And while you may not think a lot of it, the fact that the Australian dollar is languishing actually holds serious implications for every investor.

But never fear, this is Livewire. And around here, we are always trying to find new ways for our readers and viewers to make money even in a market where the opportunities are becoming less obvious by the day.

In this wire, I'll explain why the Australian dollar has been on a downward slide and why that's not necessarily a bad thing for your equity portfolios with the help of Mathan Somasundaram from Deep Data Analytics.

Firstly, why is the Australian dollar falling?

In short, there are three main reasons why the Australian dollar has been in a rut.

The first is linked to domestic factors - including both the Reserve Bank of Australia and the economic data.

When the Reserve Bank was knee-deep in its interest rate hiking cycle, the Australian dollar was rising. A higher interest rate helps push a currency's value higher because it (in theory) attracts more foreign investment. But now that is coming to an end, the local currency has been in a slide. Rate cuts (or pauses) will likely extend that slide.

A slew of less-than-stellar economic data is also not helping matters. Downside surprises (against economist expectations) in the recent labour force and GDP data have not helped our cause.

The second is linked to international factors - namely our exposure to China.

Negative headlines and sentiment around the Chinese property market have caused traders to flee the Australian and New Zealand dollars. Internationally, we are seen as proxies for the Chinese economy. Weakening economic data from retail sales to a slump in new loans has all played a key role in illustrating a difficult story to come for the Chinese economy.

Any news on stimulus from Beijing generally leads to a temporary spike in sentiment. But as usual, it's all about expectations. For instance, the People's Bank of China's interest rate cuts should have provided a boost to the Australian dollar. But because the cuts were less than expected (and one rate was not cut at all), there was little to no lasting reprieve.

Beyond the China story, the Australian dollar is generally seen as a risk proxy.

When risk sentiment is in the doldrums, so is the Australian dollar. And because of our risky reputation around the world, there is a notable correlation between our stock market's performance and the dollar's levels.

"Currency is a massive part of the Aussie market," explains Somasundaram. "Taking away short term volatility, the Aussie market generally trades in line with the currency in the medium to long term," he adds.

So who is a weaker Australian dollar bad for?

In short, a weaker Australian dollar is bad for businesses that import a lot. That's because the value of our currency is less so firms will have to pay more to get the same amount of goods. And yes, you may have worked out that a weaker currency is not good for inflation if, all other things being equal, people continue to spend for goods that are manufactured overseas and shipped out to Australia.

But wherever the dollar goes, investors know how to allocate accordingly given our four largest sectors are directly impacted by the currency.

"Given the dominant nature of resources to the GDP, currency is highly correlated to the resource sector and commodities. Global investors trade our banks for the currency exposure. Healthcare and tech stocks are mainly global models and benefit from the weaker currency," Somasundaram says.

For the record, Somasundaram expects the Australian dollar will continue to structurally decline.

"Global growth is going to remain subdued for a lot longer than the market expects as central banks and governments are unable to move the economy away from extensive debt. The RBA is one of the worst and will continue to do very little to fight inflation," he says.

"Despite the fast hiking cycle, they moved late and slower than most other comparable economies. It fed the narrative that they will cut rates when inflation is at double their peak range and leading indicators suggest inflation is moving higher. China's worries are going to add to weakness," Somasundaram explains.

"We do not see an easy V-shaped recovery on the horizon when economies are loaded with debt and inflation remains elevated."

And Somasundaram isn't the only one. Technical trader Tony Sycamore of IG warns that if the Australian dollar falls below 63.5 cents against the US Dollar, the next stop is a sub-60 cent handle.

So, what's this good news you promised?

The answer to this question lies in sectors and stocks that can buck the wider trend of lower economic growth and a weaker consumer. To quote what the European strategist Andreas Steno Larsen once said, "Go long what people need, and short on what people want".

"Healthcare is the obvious choice along with select tech stocks. Most tech stocks have a substantial consumer spending link while some are more stable than others. A lower currency will also support local defensives like supermarkets, telecommunication companies and the utilities sectors," Somasundaram says.

In the healthcare space, Somasundaram points to CSL (ASX: CSL) and Ansell (ASX: ANN), two firms with large offshore earnings. While CSL's current story is more valuation-focused, Somasundaram says Ansell benefits from a bigger story that's playing out.

"It has more industrial health and safety exposure and is linked to the PMI cycle. The global PMI cycle has had the longest contraction since GFC. We think the risk/return in ANN is attractive despite the last result being weak," he says.

In the tech sector, all the above factors should be considered as well as finding companies that don't have extreme multiples or have been broadly left behind by the rally.

"We are paying attention to recovery in the services sector linked techs like RPMGlobal (ASX: RUL), auto-related tech like Infomedia (ASX: IFM), and utility tech like Hansen Technologies (ASX: HSN)," he says.

And although it's a fallen angel, Somasundaram is even willing to take a closer look at Domino's Pizza (ASX: DMP). His reason is simple.

"It looks so bad that it looks good. We like the long term recovery cycle and are backing management," he says.

In the consumer staples space, Woolworths (ASX: WOW) is his preferred play although he did recently just sell the fund's position. He also nominates Metcash (ASX: MTS) as a high-quality option.

In the telecoms space, Telstra (ASX: TLS) is the obvious play but a relative minnow is starting to look interesting - Aussie Broadband (ASX: ABB).

"[ABB] is a recovery story in a defensive sector. It will be a indirect beneficiary of the cycle," he says.

In the utilities space, the M&A story has been well-flagged for some time now. Both AGL (ASX: AGL) and Origin Energy (ASX: ORG) have been the subject of media speculation over the last year over whether a larger private equity firm would buy them out. In the case of Origin Energy, that's likely going to come to fruition. Among what's left, Somasundaram is taking a closer look at APA Group (ASX: APA).

"It is basically a bond proxy," he points out.

For another opinion on the Origin Energy story, you can read this story by the very talented Kerry Sun:

.jpg)

5 topics

13 stocks mentioned

2 contributors mentioned