2 factors weighing on the Australian dollar

IFM Investors

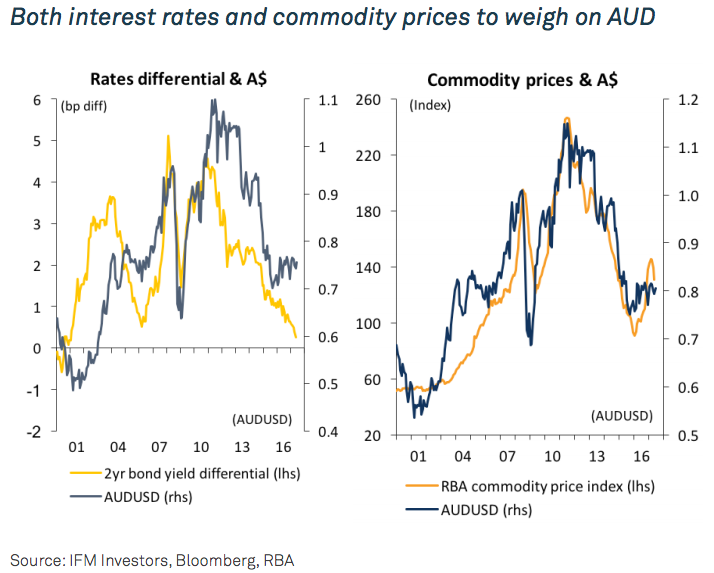

US ten-year bond yields have fallen approximately 25bp since March and are at around 2.1%. Australian government bond yields have likewise fallen by around 60bp to 2.4%, after briefly looking to breach 3% back in February. However, what is more notable is the narrowing of the spread between the two, which has come in to as little as 16bp over recent weeks. This has not been seen since early 2001 and reflects the market’s expectation that while the US economy is performing relatively well, the outlook for the Australian economy has deteriorated.

Given the current outlooks for both economies, there is a strong possibility that policy rates, and possibly bond yields as well, will ‘invert’. That is to say, the Federal Reserve in the US will continue to raise policy interest rates beyond the 1.5% level the RBA will likely keep rates at for an extended period. This will likely weigh further on the Australian dollar, which consensus still expects to depreciate over the coming year.

Another drag on the Australian dollar has been the broader sell off in the commodities complex – in particular bulk commodities. Most notable amongst these was Australia’s single largest commodity export, iron, that fell 17% in May alone to US$58 per tonne. This represents a very sharp 39% decline from the highs of the recent cyclical upswing to US$95 per tonne back in February. Driving this decline has been ongoing increases in supply, reduced speculative pressure, ample inventories in China and ongoing fears of a slowdown in growth in that economy.

Spot thermal coal prices have also receded from recent peaks, down from US$110 per tonne in late 2016 to US$74 currently. Similarly, metallurgical coal prices have halved over the same time frame, from US$309 per tonne to US$150, with a spike in the aftermath of Cyclone Debbie (that interrupted supply in Queensland) retracing rapidly. These trends in commodity prices will likely persist. Consequently, the sharp increase in Australia’s terms of trade in recent quarters will continue to pull back. This will not only weigh on resources sector profits and government taxation revenues but nominal GDP and income growth as well.

RBA on hold despite weak GDP

It remains clear that the RBA has little appetite to move official interest rates in either direction. In its June press release accompanying its policy decision, the RBA continued to carry a relatively positive, glass-halffull tone. It noted that “Business investment has picked up”; recently “Employment growth has been stronger” and that “inflation is expected to increase gradually as the economy strengthens”. On this basis, it seems the RBA sees no immediate justification to even consider lowering rates further. And in terms of a hike that had been considered by some earlier this year, the RBA noted that dwelling “Prices have been rising briskly in some markets, although there are some signs that these conditions are starting to ease”. It also seems confident that the prudential regulator’s tightening of conditions “should help address the risks associated with high and rising levels of indebtedness”. Both of these factors suggest a rate hike to address these issues is far from warranted.

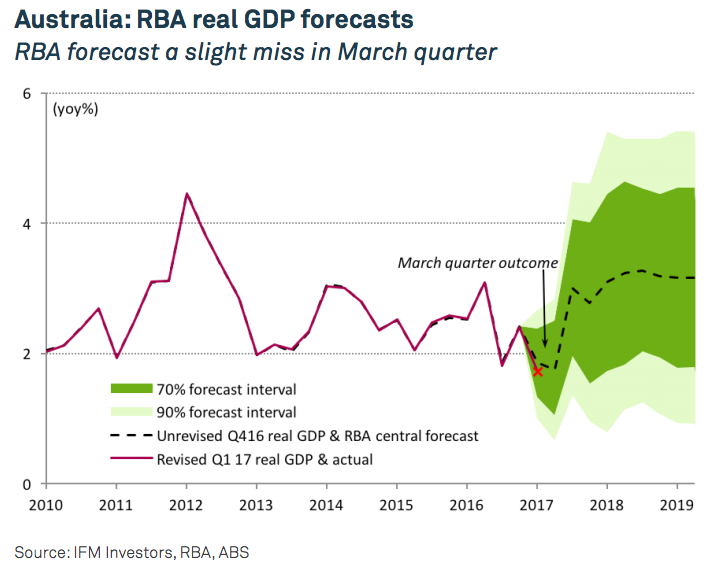

March quarter GDP figures were released and the outcome was disappointingly soft but more than likely transitory. Real GDP growth was a modest 0.3%qoq and through the year growth decelerated to just 1.7%yoy – the lowest rate of growth since 2009. One-off impacts from weatherrelated interruptions to dwelling construction and exports were to blame, as was the drag from engineering investment. Residential construction should rebound next quarter, yet exports are likely to be interrupted still as Cyclone Debbie impacted Queensland coal production (in late March).

Consumers continue to be prudent with spending up a modest 0.5%qoq to be 2.3%yoy higher – well below the longer term average of 3½%. Strength in services spending offset weak retail growth in the quarter. And it is the services sectors driving the vast majority of growth in the broader economy. However, even this level of spending is reliant on a run down in the savings ratio that edged down to 4.7% from 5.1%.

Therefore, in the absence of wages growth, spending is likely to stay subdued. The RBA to some extent expected this slowdown, foreshadowing the previous day that “GDP growth is expected to have slowed in the March quarter”. On our estimates, the quarterly forecast miss was modest and a ¾% qoq rebound in the June quarter will see the RBA’s forecast come to fruition. This may not come to fruition, although partial domestic data to date has been supportive.

Higher frequency and more timely economic data showed a welcome rebound in retail sales of 1.0%mom in April. This comes despite unimpressive consumer sentiment and soft wages growth. The NAB business survey continues to be strong and points to ongoing solid labour market performance. This was evidenced by the unemployment rate falling 0.2pp to 5.7% in April. And the economy adding 106,000 jobs this year, prompting a stabilisation of employment growth. Building approvals were sharply lower in April and, although volatile, continue a downward trend that is expected. House prices in Sydney and Melbourne also softened in May after their recent strength. However, this was likely due to seasonal factors and we await further evidence to confidently conclude the market has peaked.

For the full IFM Investors June Economic update, please click here

6 topics

Alex is IFM Investors’ Chief Economist and has well over a decade of experience in the field. He is responsible for the firm’s economic, financial market and policy analysis and forecasting and is also a member of IFM’s Investment Committee....

Expertise

Alex is IFM Investors’ Chief Economist and has well over a decade of experience in the field. He is responsible for the firm’s economic, financial market and policy analysis and forecasting and is also a member of IFM’s Investment Committee....