2 undervalued opportunities amid the market mania

The atmosphere in the investment world of late has been nothing short of electric. In the space of a mere few days the VIX has spiked and fallen, GameStop - and now silver - has gripped the world, Jeff Bezos has stepped down from his cardboard-clad throne, and it seems everyone and their dog wants in.

Yet, there's something undeniably eerie about this major market mania ... After all, electric shocks tend to burn.

US households, according to the Fed, currently have 41% of their wealth allocated towards equities - just shy of the 47% record set prior to the tech wreck.

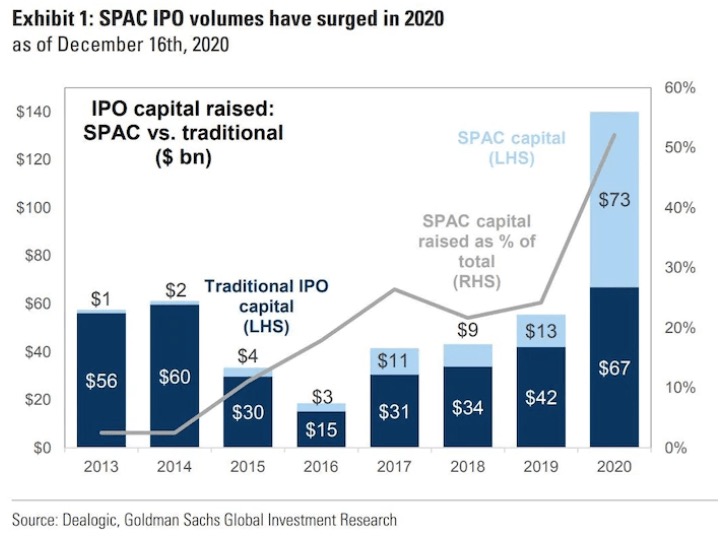

The special purpose acquisition company market – SPACs are essentially blank-cheque companies with no commercial operations, that raise capital to acquire other companies – raised an almost unbelievable A$105 billion in 2020 and has already raised $26 billion over the past month alone, as VGI Partners' Robert Poiner explains below.

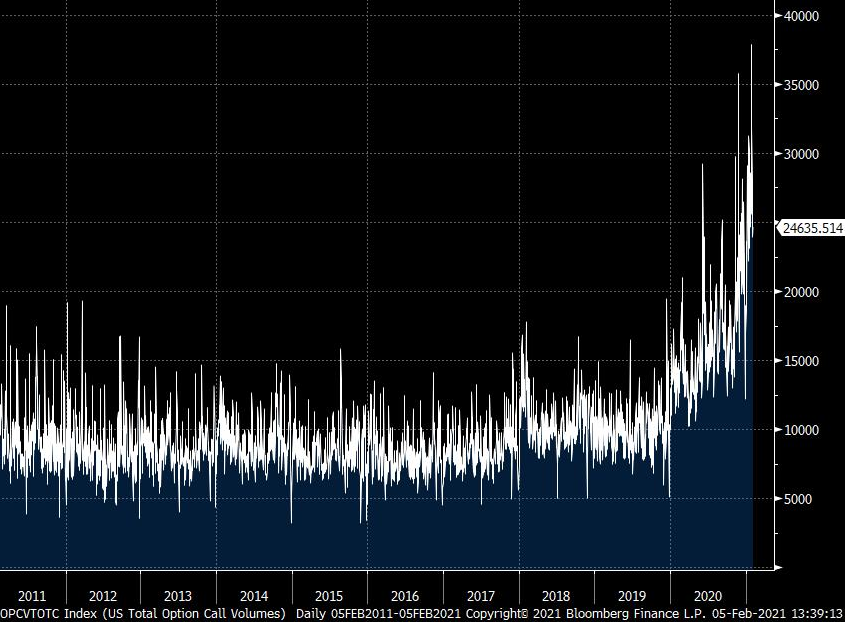

Meanwhile, contracts of 10 call options or less increased eightfold in 2020 from the previous year. Five of the top 10 largest option volume days in history have happened in 2021. And in case it needed to be said again, we're only one month in.

In this wire, Poiner, VGI Partners' head of US research, discusses these risks and how the investment manager is positioning its portfolios given these concerns. He also outlines the investment thesis behind local gaming group Crown Resorts (ASX:CWN) and global luxury retailer Richemont (SWX: CFR), both which he believes have been mispriced by the market.

Notes: You can access the video or edited transcript for this interview below. This interview was filmed on 28 January 2021.

Edited transcript

Eddie Orchard: You've been living and working in New York throughout the COVID-19 pandemic. What's your take on the current state of play of markets in the US?

Robert Poiner: We're seeing some pretty interesting cross-currents in the market over here and I think globally. Whether that be the havoc that we saw last year with COVID closing down both the US and many economies around the world, and that resulting in unemployment rates we haven't seen since the Great Depression here.

The other factors that have been pretty important, not only through COVID but certainly over the last numerous years has been this ongoing polarisation of political views in the US. And then the other thing that we've seen over here is this ongoing wealth disparity, and that's something that has been building for many years, if not decades, and certainly, when we look at the earnings power of labour in this country on an inflation-adjusted basis, it's been going backwards. So those are some of the challenges that we are facing both here and globally.

I guess on the other side of it, as we know, there's been this very real and pretty extraordinary monetary and fiscal stimulus effort. We've seen things like wage replacement schemes, we've seen not only historically low-interest rates but the promise of historically low-interest rates for many years, and then there's this kind of wave of liquidity through central bank money printing, which certainly at the moment seems to be limitless. So, we're certainly seeing these cross-currents at the moment.

On top of that, we are starting to see some pretty clear pockets of frenzied speculation; I think that it's pretty hard to deny that we're seeing some of that in the market. One area that we talked about in the letter is this SPAC market, which are blank-cheque companies where investors are essentially parting with their cash before knowing what they've actually bought. And that's a market that exploded in 2020.

During the year, the SPAC market raised almost US$80 billion dollars of proceeds. Just to give you a sense of how large that number is, that's a six-fold increase on the year before and if you look at the IPO market, not just for SPACs, but for all companies, the amount that was raised last year was greater than the total IPO proceeds of 2018 and 2019 combined. And we've actually seen that accelerate in 2021. So year to date, just in the last few weeks, we've seen a further US$20 billion raised in that SPAC market. And so, if anything that seems to be accelerating.

So, there's definitely some pretty clear signs of excess. But I think no one knows what's going to happen over the next 12 months. If we ever needed proof of that, I think 2020 was a great example, where anyone who made a prediction at the beginning of 2020 was proven pretty wrong.

We're very focused on our research process, we try to be patient and prudent with our capital, and then we've got to move decisively when those opportunities present themselves. So, despite the environment, the last six months for us has actually been one of the most prolific periods for new idea generation that we've had in many years. So, there's a number of cross-currents in the market, but I think from our perspective, we've just got to stick to our research process and look for opportunities.

Eddie Orchard: US households currently have a 41% allocation to equities, just shy of the 47% record set before the tech wreck. Should that have investors concerned?

Robert Poiner: It's certainly a signal. I think the household ownership of equities in itself is not necessarily a strong indicator of speculation. Probably the more troublesome trend that we've been seeing is this gamification of equity trading and there's been a number of factors that I think has driven that. Certainly here in the US you've seen this proliferation of commission-free brokerage services and if you look at some of these apps that these retail brokers have put to market, it's very difficult to ascertain the difference between these apps and a sports betting platform or even online casino games; they're designed to create some of the speculative behaviour that we've been seeing more recently.

And then, a day trading mentality has only been accentuated by some of the social media platforms, whether it be videos on TikTok, or chat rooms on Reddit, it's created some pockets of speculation in that retail space and we've seen that accelerate in recent weeks in 2021.

The other thing I think that's worth highlighting is option activity. Contracts of 10 call options or less increased eightfold in 2020 on 2019. And the one that I found fascinating was, if you look at the option volume days in history, five of the top 10 largest option volume days have happened in 2021, so in the last three weeks alone. On top of that, we're seeing retail margin debt levels back at record highs. All of these are features of the current market environment, which are obviously not sustainable trends.

US Total Daily Option Call Volumes (Thousands)

Source: Bloomberg

Eddie Orchard: How are you positioning your holdings given these concerns?

Robert Poiner: Looking at the portfolio and how we approach that hasn't changed meaningfully in the recent past. I think we deal with that risk in three ways. The first one is that in the funds we have a reasonably sized cash balance at the moment and that's something that we will put to work as the opportunities present themselves.

Secondly, VGI will continue to stick with high-quality businesses; we're very focused on finding businesses with strong, defendable, economic moats - that's going to allow the business to earn high returns on invested capital over the long term. And you tend to see in more volatile times that these businesses will tend to outperform.

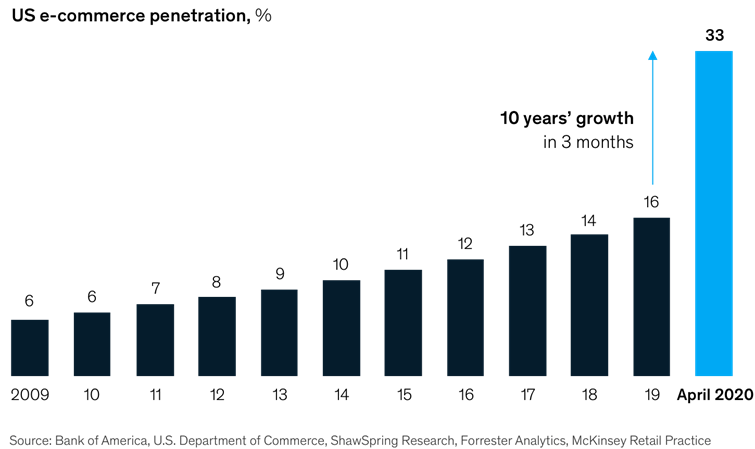

I think the third point is that we're focused on companies that will benefit from long-term structural growth. One of the amazing things that we've seen over the last 12 months with COVID has been this acceleration in structural trends that have been taking place for many years. We've seen a pretty rapid acceleration, whether that be in online marketplaces, gaming, electronic payments, we've seen this corporation shift to the cloud, and even the application of artificial intelligence is something that has really accelerated in the last 12 months.

The best example is e-commerce penetration in the US. Prior to COVID, penetration went from 5% of US retail sales to about 15% over 10 years. Through that initial shutdown period that we saw in April, the penetration levels increased the same amount that we saw over the last 10 years over a 12 week period. So we essentially saw 10 years of e-commerce penetration happen in about three months. So the reason I raised this structural growth dynamic, is that's something that we've always been highly focused on, ensuring that the portfolio companies are exposed to that structural growth and that's something that I think is only becoming increasingly important over the last 12 months, as we see continued acceleration in those trends.

Eddie Orchard: VGI's portfolios have cash levels around 20-25%. Is this cash level indicative of you trying to wait for that perfect opportunity or is there something else at play?

Robert Poiner: The way that we manage the portfolios at VGI Partners is we don't solve to an exposure. So our exposure is really an output of the opportunities we're finding on the long side and secondly the opportunities we're finding on the short side. The net exposure that we talked about today has actually increased versus where we were three months ago. So we have put capital to work in some pretty interesting opportunities. And we continue to pretty relentlessly work at other new opportunities, a number of thematics and industries.

So, that net exposure, where we sit in three months, six months, 12 months, that will really be a reflection of the opportunity set. Certainly, where we think we can put capital to work with a margin of safety so that we're focused on capital preservation and we're not putting ourselves at risk of permanent loss of capital. So that exposure is really a reflection of the opportunities we're seeing, we continue to find new opportunities, and certainly, that's been reflected in a higher net exposure more recently.

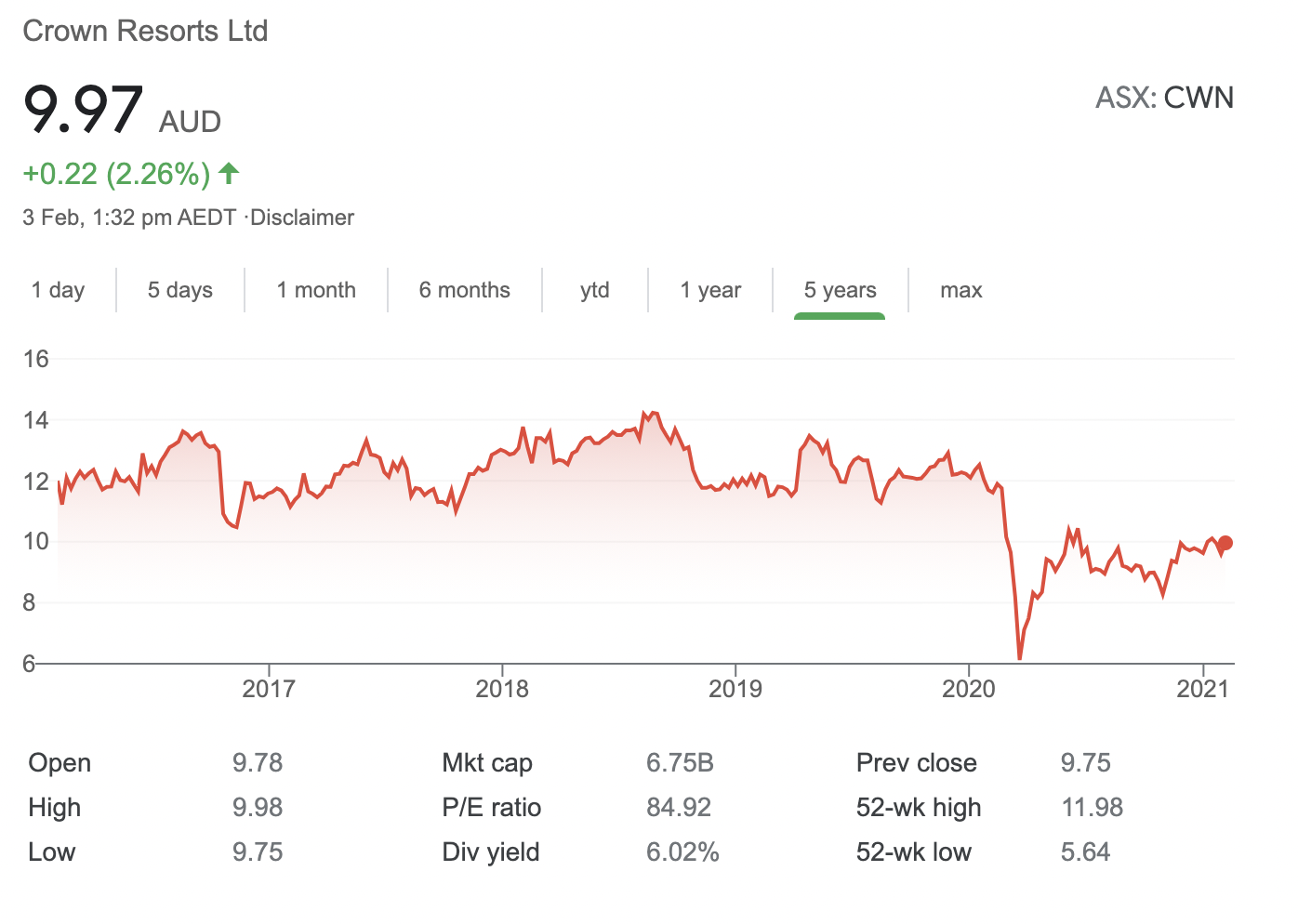

Eddie Orchard: One of the new holdings in your Asia portfolio is Crown Resorts (ASX:CWN). Can you take us through your investment thesis behind buying into Crown?

Robert Poiner: Crown, as I'm sure everyone knows, operates a number of casinos and hotels around Australia. They've got the exclusive licence in Melbourne and Perth, and then they've got additional casino licences in London and potentially the rights to operate the second casino in Sydney.

We've followed the Australian casino industry closely for a very long time; we were large shareholders in Echo Entertainment, from 2012 to 2015, that's now been renamed Star Entertainment, so we know the space quite well.

We became interested in Crown following the share price decline that was initially caused by the concerns around COVID and lockdowns. And we saw that opportunity as a pretty rare time to build a position in what we think is a high-quality asset at a very attractive price.

The lockdown, understandably, had a significant impact on the company's operations, short-term. But what we found at the time that we were buying is that the market was extrapolating a pretty unrealistic scenario and implying that the asset was essentially permanently impaired. So that's something we didn't agree with. We were very happy to take a long-term view. We also, at the time, didn't have any concerns around the balance sheet - we thought that the company would be able to limit the cash flow burn rate after it moved to right-size the cost base. And then we had another chance to size the position after Crown faced a government inquiry in New South Wales around its corporate governance practices.

That sort of inquiry is very public and received a lot of media attention. That gave us an opportunity because it caused quite a share price decline. We see a small probability that Crown loses that Sydney licence. However, again at the time, our analysis pretty clearly showed that the share price, where we sized our position, wasn't attributing any value to that Sydney casino licence.

At VGI we like investments with upside optionality and where we're perhaps not necessarily paying for that optionality. And we thought that was the case when we took that position in Crown. On the inquiry, I think there's no question that they made some errors around corporate governance and compliance and we are of the view that the inquiry is likely to lead to a significant improvement in corporate governance at Crown. It's most likely going to make it a better and more sustainable business long-term. We also know in the past that Crown has been approached by both Wynn and Melco. That's not something that we're banking on in the investment thesis, but it's certainly another aspect that we thought provided some downside protection at those levels.

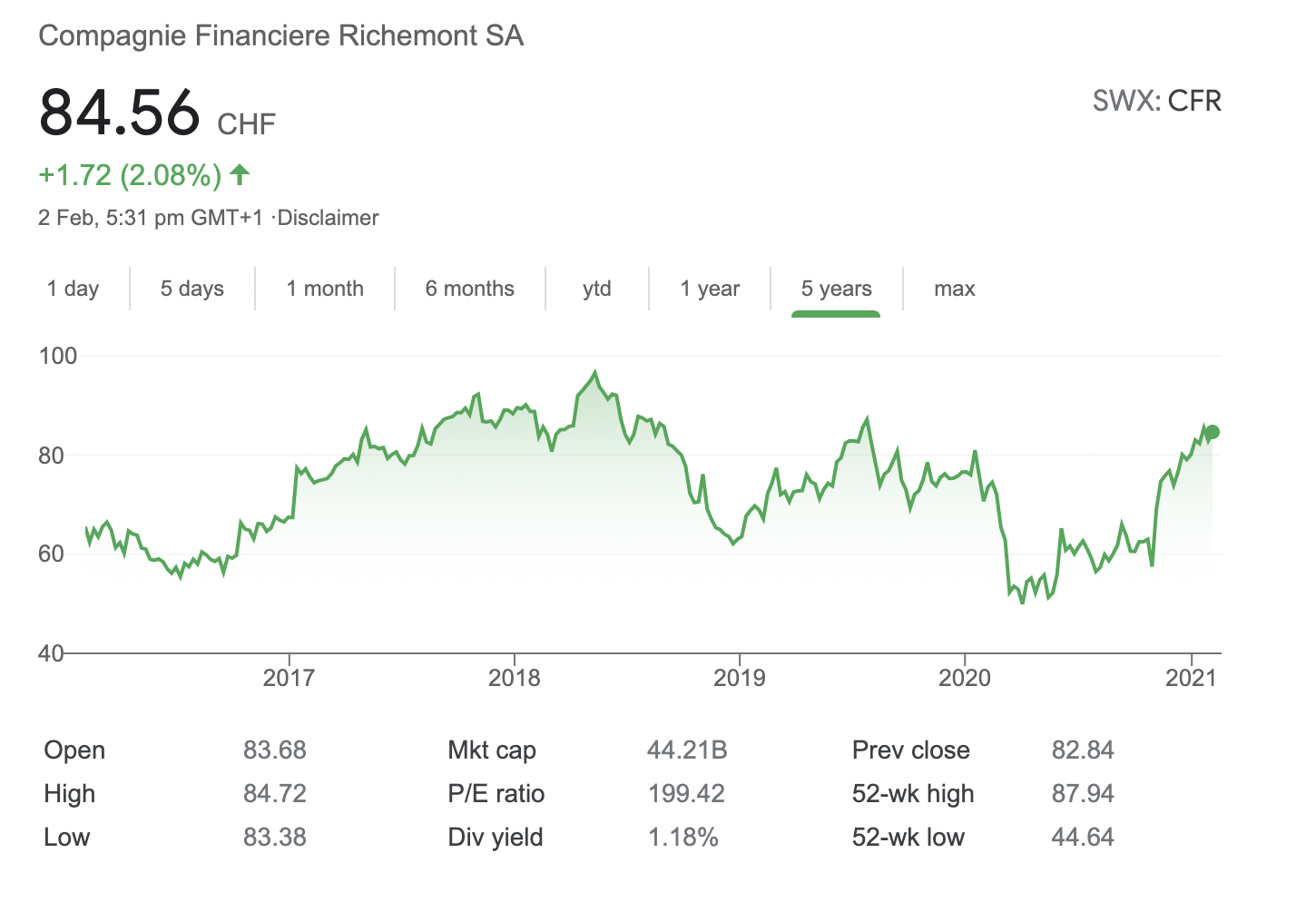

Eddie Orchard: Another of VGI's major holdings is Richemont (SWX: CFR). Like a lot of stocks, they have had a pretty hard run since the COVID-low, and are up around 80%. Do you still think Richemont is an attractive holding?

Robert Poiner: Sure, so Richemont is essentially a portfolio of luxury brands. But when you actually look at the earnings and value driver at Richemont it really is their jewellery division. And their jewellery division is two brands, Cartier and Van Cleef, and we think that those two brands are not only two of the strongest luxury brands, but they're certainly the two most valuable brands in the jewellery space. Cartier is a brand with 170 years of unrivalled heritage, they have a long history of designing pieces for generations of royalty. And then similarly, Van Cleef has over 110 years of very rich history.

So when we look at these brands, we look at a number of factors, both quantitative and qualitative, to determine brand health. There's a number of key indicators, things like resale value. If you look at Sotheby's and Christie's, both brands are consistently ranked in the most expensive jewellery sales. We look at the RealReal which is a luxury consignment store, and they rank Van Cleef and Cartier as number one and two in terms of jewellery brands' ability to hold their resale value.

Another attractive thing about the jewellery space is there's actually a number of secular trends that are driving growth in the category itself. The branded jewellery space is still only one third of the jewellery market globally. So that third has been increasing over time, as branded jewellery such as Cartier and Van Cleef take share, but it's still only one third penetrated. So we think that there's a long runway of growth, both in the category and also in their ability to gain share within the category.

When you look back over the past 10 years, the Richemont jewellery portfolio has grown at double-digit revenue growth per annum, and we think this will continue. The share price has certainly had a good run since the bottom but if you look at it pre-COVID prices it's less exciting. So we still think the shares are attractive here and believe they are attractive just based on the jewellery franchise alone. There's a number of pieces to Richemont which we don't think the market is ascribing that much value to - if anything and all. They own leading e-commerce platform YOOX Net-a-Porter, multibillion-dollar watch brands IWC and Panerai, and a number of accessory brands like Mont Blanc, Dunhill, and Chloé. So, we think it's a very high-quality business.

Eddie Orchard: So that's on the long side, what about the short? How has your shorting process developed over the past 12-18 months? Are there any areas that you believe to be fertile hunting ground for shorts?

Robert Poiner: On our shorts process, we've always been focused on what we call fads, frauds and failures. We talked earlier about this rapid increase in the penetration of online retail, and that is just one of the many accelerated trends that we've observed over the last 12 or so months, the other ones being electronic payments, gaming, this acceleration of the corporation moving their operations into the cloud. The reason I raise this acceleration of structural trends is the flip side to that is an equally rapid acceleration in the creative destruction of some of these traditional business models.

When we look back over the past 10 years, our best performing shorts have been operating in structurally challenged industries, or where we think the business model is susceptible to this creative destruction. In terms of process, I think the only thing worth highlighting is that overlaying this process, we've got this pretty acute focus on identifying what we call red flags. And so a red flag, for us, can consist of anything from aggressive accounting masking an underlying issue in the business, it can be as simple as a key management executive leaving the company, or it could be an auditor change. And so on a weekly basis, we run a process where we screen for those 100 or so red flags that we're tracking, and we can screen across every company that is listed globally.

And then on top of that, we've created our own proprietary scoring system, which we backtested, and it ranks those companies from highest concern to lowest concern in terms of those red flags. That's been a pretty robust source of ideas for us historically, and we think it's going to be a robust source of ideas for us going forward. And that's something that we've focused on building out certainly over the last five years, but has accelerated over the last 12-24 months. We've hired a data scientist over here in New York who has really taken charge of that process.

Eddie Orchard: Could you take us through a historical example of this shorting process?

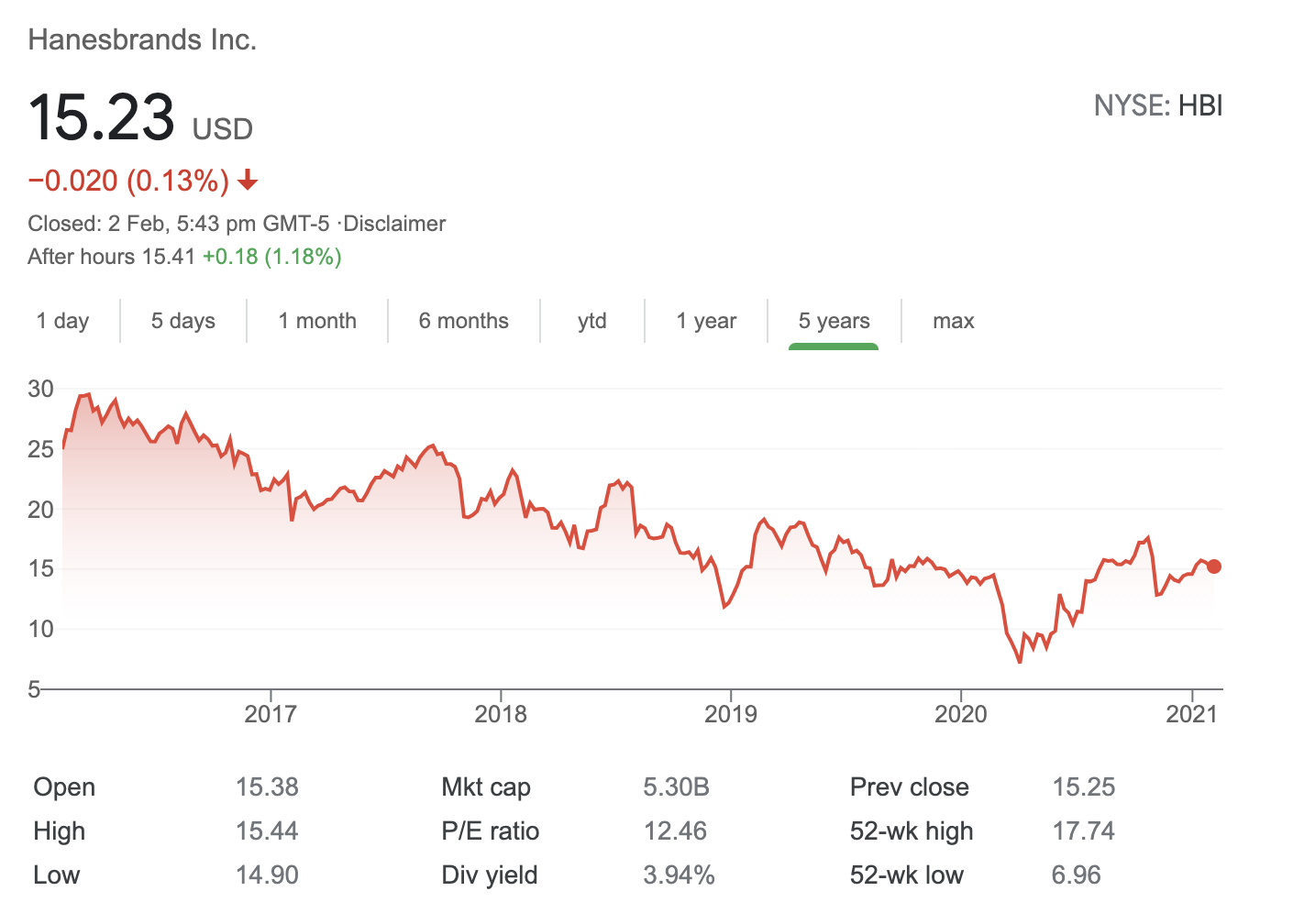

Robert Poiner: Yea sure, one of those was Hanesbrands and it's a good one to discuss because that came out of this red flags process that I was just talking about. You had key management leaving the company in relatively quick succession (both the CEO and CFO), we saw incredibly aggressive accounting, cash flow conversion was very weak and that was driven by very aggressive recognition of accruals and aggressive add-backs of restructuring charges. And then we found some other pretty unique red flags, one of which was the tax rate for the company every single quarter rounded perfectly to five decimals. And we thought that was very interesting and unusual. And so we went back and screened for that across every listed global company and from memory, we found one or two other instances. So that was another red flag for us.

Typically, when you see these red flags they're masking an underlying issue. And what we found was these flags were being driven by a series of acquisitions which were getting larger and larger, and we found that this activity was actually hiding what was essentially an underlying deterioration in the core business. And just to give you a bit of background, they sell undergarments in the United States, but their largest customer base is large retailers here in the US. And essentially, what we've seen is a shift towards private label. And so that was the underlying issue that we found in the business, the structural challenge that they faced, and the red flags that we found were clearly being used to try and mask those underlying issues.

Eddie Orchard: And just finally, we noticed the two LICs are trading at a discount to NTA (Net Tangible Assets) at the moment. Can you take us through VGI's plans for the year on closing that gap?

Robert Poiner: The discount is something that we're focused on correcting. And I think looking at the listed investment companies there are two ways to really lift the share price. One is obviously through fund performance. And on that front, I think the team is more engaged and determined than I've seen ever before. But the second is to close the discounts. And to us, that really means keeping your existing investors engaged, but also finding new ones. And we've taken a few steps in that direction; we've expanded our monthly update disclosure, which is hopefully more helpful. We're participating in more conferences, and we're doing sessions like today, which is hopefully helpful in communicating with our shareholders.

But a key part of what we're planning for this year is holding more meetings with investors and advisers. So to help us with this, we're in the process of hiring a number of business development managers, and that is a real focus for us certainly near-term. I should also mention the unlisted funds are closed to new investors and so any demand that is generated for the portfolio and the strategy would come through those listed investment companies, which should help to close the discount to NTA over time.

So, to sum up, we know these things can take time, we want to do it sustainably, we've looked at a number of other funds that have been able to close the discounts and the strategies that they undertook, and we're aware that we need to increase the dialogue. But most importantly, we've got to deliver strong risk-adjusted returns.

Learn more

VGI Partners is a high conviction global equity manager, focusing on businesses with secular growth, attractive industry structures and where they believe they possess insights not appreciated by the wider investment industry. For further information, please use the contact form below.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

2 topics

3 stocks mentioned

1 contributor mentioned