22 ASX companies in the P/E "centurion club"

It's one of the most commonly cited market metrics used to sort companies. But the P/E ratio is also deeply flawed if you're relying on this alone. That's the view of growth-focused portfolio manager Jason Pohl of ECP Asset Management.

“We try to look ahead five to 10 years, so the P/E isn’t particularly useful,” he says. That’s why companies like Audinate (ASX: AD8), which is one of those unearthed by our screen, are held by ECP Asset Management – albeit in small quantities.

.png)

As Pohl explains, the P/E provides little information about the expected earnings trajectory or dividend returns investors might expect from a company.

But before we delve any further, let's explain exactly what a P/E ratio is.

What is the P/E ratio?

It’s a number generated by dividing a company’s share price by its annual earnings per share. To compile the list of companies laid out below, we focused on Australian companies with market capitalisations of $1 billion or more, to eliminate the micro-caps. We also used stock broking tool Halo, which uses FactSet company data, to find companies in this cohort with one-year forward price-to-earnings ratios of 100 or higher.

The price-to-earnings ratio (P/E) shows how much money you have to invest to get $1 of a company's earnings. You can think of it as a gauge of how willing investors are to pay for each dollar the company makes.

How to use P/E ratios

It’s a mistake to use this metric in isolation – something that’s true of all individual data points. Even when looking just at the P/E ratio, there are ways you can make it a more meaningful tool.

For one thing, you should look at the P/E ratio over a longer timeframe, to see if there are any changes.

You should also compare the P/E ratio of the company in which you’re interested to other similar listed companies – those in the same sector and industry, ideally. This gives you a more reliable baseline against which to compare the company.

Many investors will simply steer clear of such companies because they believe they are too expensive. But there is also the very real possibility that high P/E stocks are expensive for a reason.

ECP Asset Management's Pohl says the stakes are higher when owning such firms: “As soon as something goes wrong, that’s when those high P/E companies get absolutely slammed,” says Pohl.

As an example, he points to Carbon Revolution, a maker of lightweight automotive wheels for brands such as Ferrari, Renault, Ford Motor Company, General Motors Company, Jaguar Land Rover and a major German automaker program. Carbon Revolution was listed on the ASX in 2019 and was briefly regarded as a glamour stock – one in which ECP owned a small position before getting “burned”.

From an issue price of $2.90 in late 2019, the company hit some hurdles along the way, its share price trading around 11 cents in mid-September 2023 – when it was negotiating a complicated re-listing on the Nasdaq exchange. It was de-listed from the ASX on 19 October and in November re-listed as (NASDAQ: CREV).

Another firm that makes the high-P/E list outlined below, Pro Medicus (ASX: PME), has also been on ECP’s watchlist for a while now.

But for all its limitations, the P/E ratio remains a popular metric for many investors. A simple screen of ASX 300 companies with a P/E multiple of 100 or more presented 22 company names, as shown here. The five largest of these, by market cap, are discussed below.

| Company name | Ticker | PE 1 year fwd |

| Xero Limited | ASX: XRO | 109 |

| Pro Medicus | ASX: PME | 117 |

| Liontown Resources | ASX: LTR | 673 |

| Chorus Limited | ASX: CNU | 110 |

| Sandfire Resources | ASX: SFR | 116 |

| Sigma Healthcare | ASX: SIG | 125 |

| Costa Group | ASX: CGC | 251 |

| Life360 | ASX: 360 | 473 |

| Audinate Group | ASX: AD8 | 239 |

| Polynovo | ASX: PNV | 286 |

| Adriatic Metals | ASX: ADT | 119 |

| Temple & Webster | ASX: TPW | 202 |

| Chrysos | ASX: C79 | 1,680 |

| Cobram Estate Olives | ASX: CBO | 102 |

| Nuix | ASX: NXL | 102 |

| Meteoric Resources | ASX: MEI | 339 |

| Genex Power | ASX: GNX | 514 |

| Dropsuite | ASX: DSE | 101 |

| Task Group | ASX: TSK | 176 |

| Ansarada Group | ASX: AND | 3,260 |

| Acusensus | ASX: ACE | 174 |

| Hipages Group | ASX: HPG | 200 |

Xero Limited (ASX: XRO)

- Market cap: $16 billion

- P/E ratio: 109.15

The established accounting software firm frequently polarises commentators, largely because of management’s….

Xero recently reported a miss on earnings due to gross margins and softer subscription growth in the UK.

But it’s one of a few stocks called out recently by Yarra Capital’s Dion Hershan, who cited Xero – alongside Car Group and Seek – for its strong pricing power, good organic growth, and high incremental profit margins.

What the brokers think

Market Index Broker Consensus: BUY (15 buy, 4 hold, 2 sell)

Macquarie downgraded Xero to UNDERPERFORM from neutral on 10 November, cuttings its price target to $87 from $119.

E&P downgraded the company to NEUTRAL from positive on the same day, cutting its price target to $100 from $138.

CLSA on 30 October upgraded Xero to BUY from outperform, lifting its price target to $134 from $115.

Xero shares closed at $109.75 on Monday 15 January.

Pro Medicus (ASX: PME)

- Market cap: $9.37 billion

- P/E multiple: 117.18

A medical imaging software business, Pro Medicus has seen impressive growth in revenue and, indeed, most financial metrics in its recent history.

PME was one of 11 companies we unearthed recently when sifting the ASX for stocks with strong sales, solid return on equity and healthy margins – which you can read here. But as you can see, it also screens as quite expensive, at least on a superficial basis.

Even at this level, many investors think PME has plenty of valuation growth ahead, including First Sentier Investors’ Dushko Bajic, who cited the company among a handful of others he believes have solid fundamentals.

Broker views

- JPMorgan added Pro Medicus to its coverage on 15 December, with an OVERWEIGHT rating and a $100 price target.

- Wilsons downgraded Pro Medicus to MARKET-WEIGHT from overweight on 27 September, but analyst Melissa Benson lifted her price target to $81.20 from $79.73.

- CLSA upgraded PME to OUTPERFORM from sell on the same day, analyst Andrew Paine lifted his price target to $88.80 from $69.

PME shares closed at $96.79 on Monday 15 January.

Liontown Resources (ASX: LTR)

- Market cap: $3.73 billion

- P/E multiple: 673

The lithium miner’s fortunes have followed the battery metal’s slumping price of late. The underlying material, spodumene concentrate, now fetches between US$950 and US$1000 a tonne, well below the US$1400-$1800 range of November, as Livewire’s Carl Capolingua wrote recently.

Liontown’s share price is currently around half what it was back in October, when Gina Rinehart scuttled Albemarle’s $6.6 billion bid.

Broker views

- Macquarie downgraded Liontown to NEUTRAL from outperform on 21 December, cutting its price target to $1.60 from $2.70.

- Goldman Sachs on 21 November upgraded LTR to NEUTRAL from sell but reduced its price target to $1.55 from $1.85.

- Bell Potter rates the company SPECULATIVE BUY, with a $2.75 price target, as of 27 October.

Liontown shares closed at $1.42 on Monday 15 January.

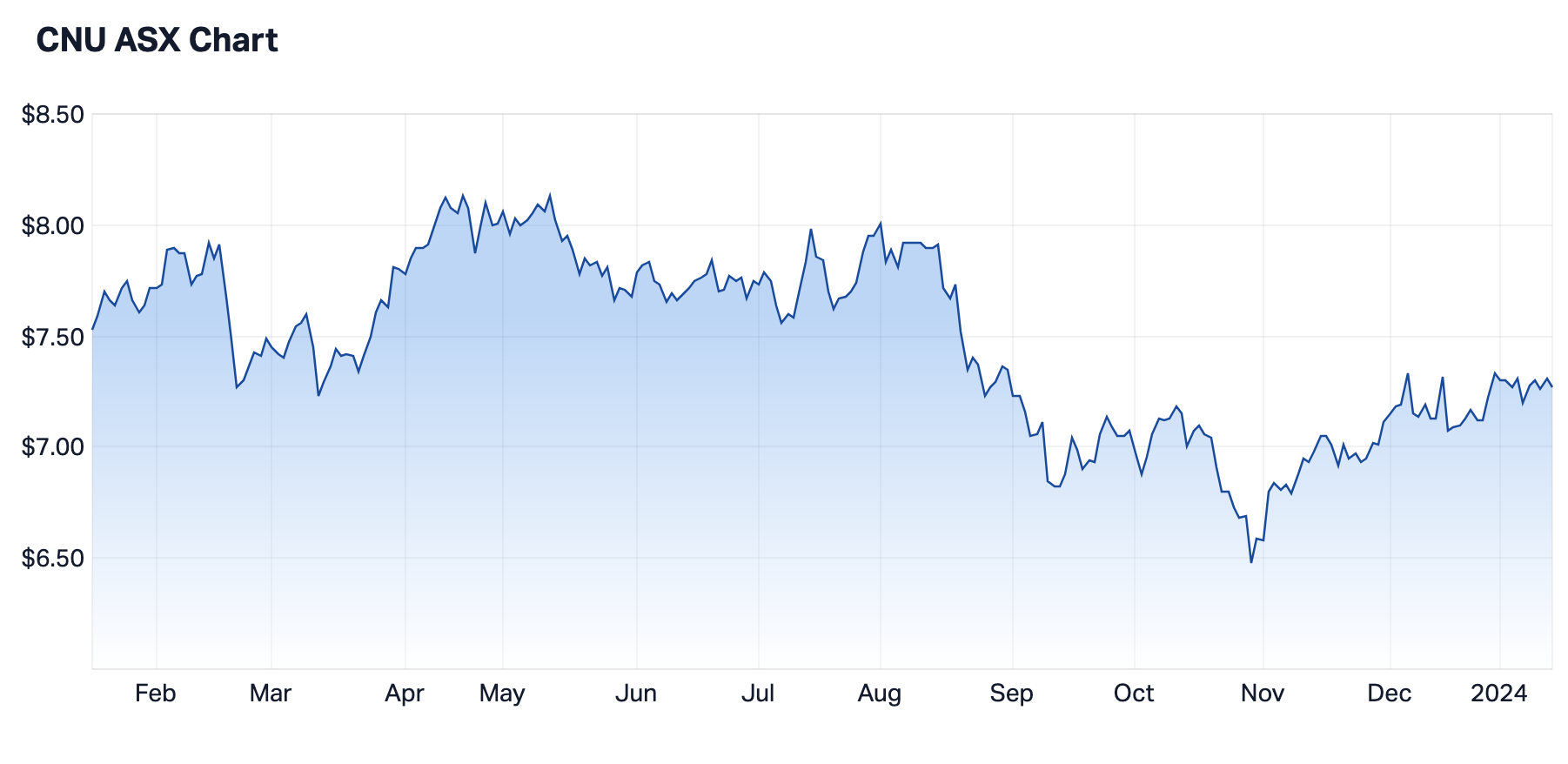

Chorus Limited (ASX: CNU)

- Market cap: $3.12 billion

- P/E multiple: 110.48

Chorus owns and operates most of New Zealand’s high-speed broadband infrastructure and has just completed its decade-long investment in its fibre network. In the back end of 2023, the investment team behind the L1 Long Short fund nominated it as an infrastructure company likely to surprise on the upside.

Broker views

- Market Index Broker Consensus: STRONG SELL (1 buy, 3 hold, 7 sell)

- Macquarie upgraded Chorus to OUTPERFORM from neutral on 9 November, with a price target of $8.32.

- Jardens rates the firm as UNDERWEIGHT with a NZ$7.66 price target as of 19 July.

Chorus shares closed at $7.29 on Monday 15 January.

Sandfire Resources (ASX: SFR)

- Market cap: $3.09 billion

- P/E multiple: 115.68

One of only a small number of pure-play copper producers on the ASX, Sandfire owns three copper mines across the same number of countries. As the largest mainly copper play remaining on the ASX since BHP swallowed OZ Minerals, Livewire’s Carl Capolingua recently wrote that “it’s worth keeping an eye on as it could become a takeover target regardless of whether copper prices plunge or boom.”

Broker views

- Market Index Broker Consensus: BUY (11 buy, 7 hold, 1 sell)

- Goldman Sachs upgraded Sandfire to NEUTRAL from sell on 11 January, increasing its price target to $6.70 from $5.40.

- Wilsons added the company to its coverage list, with an OVERWEIGHT rating and $8.45 price target, on 31 October.

- Ord Minnett upgraded Sandfire to BUY from accumulate on 27 October, with a $7.10 price target.

Sandfire Resources' shares closed at $6.81 on Monday 15 January.

2 topics

22 stocks mentioned

4 contributors mentioned