3 ASX companies with a competitive edge (and 1 Citi rates as a BUY)

The network effect is commonly cited as a powerful source of competitive advantage for companies. In short, this is a phenomenon where the price of a good or service becomes more valuable as more people use it.

Three Australian companies often mentioned in this context are online property portals REA Group and Domain Holdings, and digital automotive marketplace CAR Group.

A long-term owner of REA Group, Montgomery Investments’ Roger Montgomery, sums up the company’s network effect like this: “The company lists the most houses for sale because it attracts the most buyers. And it has the most buyers because it has the most houses for sale.”

“This network effect helps REA Group increase prices to their customers without a detrimental impact on unit sales volume,” he wrote in November.

Montgomery also cited Warren Buffett’s late business partner Charlie Munger’s view that this is the most valuable competitive advantage of all.

The sell-side analysts at Citi recently put out a research report comparing their views on REA Group, CAR Group and Domain Holdings.

CAR Group (ASX: CAR)

- Rating: NEUTRAL

- Price: target: $34.70

The Citi analysts note that used car transactions were up 14% year-on-year (yoy) in April, from 12% in March: “We see this as a sign of strong used car demand and we continue to see upside to Australian dealer and private revenue in 2H24.”

Dealer listings in Carsales Australia are up 13% year-over-year in April 2024 but remain below pre-COVID levels. Private listings were up 22% year-over-year for the month.

“We see the greater mix of Private listings vs. Dealer listings as a negative for yield,” says Citi.

A further negative is reflected in the comparison with non-automotive marketplaces in Australia, which are trending upward in April 2024 versus the same period a year earlier.

Overall, Carsales’ website visits + app sessions are up +7% yoy in Citi’s forecast for 2H24 so far, accelerating from +2% yoy growth in 1H24

The number of app downloads has also accelerated, up 17% yoy in Citi’s 2H24 forecast so far.

But the analysts also cite softer numbers in terms of web visits and other online audience metrics among some of the groups offshore business units, where “user metrics are soft as the bottoming process continues.”

Among RVTrader, CycleTrader and Commercial Truck Trader – part of CAR’s US-based Trader Interactive business, the last two are expected to see combined website and app visits decline -15% and -12% yoy for 2H FY24.

Webmotors, the Brazilian automotive marketplace CAR acquired around 12 months ago, has seen app visits and website visits up 19% yoy in April 24. It is also on track for 25% growth in 2H24 but the Citi analysts believe this is likely already factored into the share price.

"Overall, we see a tough macro backdrop, especially in RVs in 2H24e, with a slower than expected start to Spring selling season, as dealers appear to be waiting for the MY25 models to ramp up orders,” says Citi.

CAR Group shares closed at $34.90 on Monday 20 May 2024.

Risks to achieving target price:

- Exposure to fluctuations in the property market;

- changes to housing related tax rules (e.g. stamp duty);

- lower- or higher-than expected traction of consumer services business;

- structural change to existing classified business;

- security or compliance breaches;

- technological obsolescence; and

- loss of key employees.

REA Group (ASX: REA)

- Rating: NEUTRAL

- Price target: $192.60

Key insights based on REA Group include its continued outperformance versus Domain, with three times the user traffic. REA’s traffic is also on track for 2% growth in 2H24, versus -8% at Domain.

The volume of engaged web site visits (those where the user visits more than one page) was up 3% yoy in April – versus 4% at Domain.

REA Group's number of app sessions and web visits combined also grew 2% yoy in April, versus a -8% decline at DHG – but the rate of decline at DHG is reducing.

Both REA and Domain have seen number of app downloads decline in recent months –down -2% yoy at REAs but up 8% yoy for Domain.

On REA India, the “demand environment looks positive,” say Citi analysts.\

REA Group shares closed at $188.40 on Monday 20 May 2024.

Risks to achieving target price:

- Exposure to fluctuations in the property market;

- changes to housing-related tax rules (e.g. stamp duty)

- lower- or higher-than-expected traction of financial services business;

- under- or over-performance in its Indian business;

- structural change to existing classified business’

- security or compliance breaches;

- technological obsolescence;

- loss of key employees.

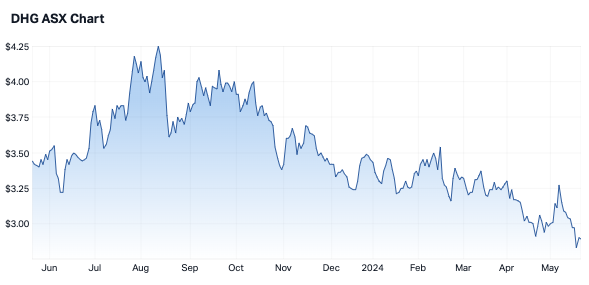

Domain Holdings (ASX: DHG)

- Rating: BUY

- Price target: $3.85

Beyond the headline level of website traffic, which still favours REA as indicated earlier, “engaged” website visits at DHG are up 2% yoy but are flat for REA. Engaged web visits exclude single page visits.

Domain is also clawing back REA’s lead on app sessions, the lag declining to 2.4 times in April 2024 from 2.8 times in December 23.

“While we are concerned about Domain's market share loss in 1H24, revenue per listing grew strongly and was in-line with REA and we expect Domain to benefit from an improving housing cycle especially driven by rates peaking,” says Citi.

“With Domain trading on an approximately 45% discount to REA on EV/EBITDA basis, we see valuation as compelling.”

Domain Holdings share price closed at $2.90 on Monday 20 May 2024.

Risks to Citi’s valuation:

- Exposure to fluctuations in the property market;

- changes to housing related tax rules (e.g. stamp duty);

- lower- or higher-than expected traction of Consumer services business;

- structural change to existing classified business;

- security or compliance breaches;

- technological obsolescence; and

- loss of key employees.

This article was originally published on Market Index on Tuesday 21 May 2024.

4 topics

3 stocks mentioned

1 contributor mentioned