3 ASX stocks with growing dividends (and why headline yields are misleading)

There are currently 40 stocks with yields higher than 7% on the ASX - with stocks like Yancoal (ASX: YAL) yielding a whopping 18.87%. And while these yields look attractive to the naked eye, high headline yield figures can sometimes be deceiving.

That's according to Medallion Financial's Michael Wayne, who believes investors should focus on dividend per share growth and earnings per share growth instead, and argues that focusing on high headline yields can be counterproductive to long-term returns.

"In the last 10 years, we've been fortunate to have very low inflation, which meant cost of living pressures weren't as great. However, that whole dynamic has shifted, as we all know, in the last 18 months or so with the emergence of inflation," Wayne says.

"So over time, as an investor, you want the income you're receiving from your investments to be growing as fast as inflation, or if not, a lot faster than inflation over time so that you're essentially better off from the income you're receiving."

In this episode of The Pitch, Wayne outlines why investors should focus on growth in earnings and dividends over high yields, points to data from the past decade as an example, and names three stocks that boast attractive dividend growth today.

Note: This interview was recorded on Wednesday 21 February 2024. You can watch the video or read an edited transcript below.

Edited Transcript

Michael Wayne: Thanks for having me. It's always good to be on Livewire.

Ally Selby: High yields are obviously appealing to investors, particularly those who are looking to generate passive income from their investments. Can high yield be deceiving?Michael Wayne: Look, we certainly think so. There's definitely a tendency from a lot of investors just to focus on that headline dividend yield for no other reason other than the business might be a well-known household name, a very large company that pays that attractive headline number. But the reality is, we think such a focus is counterproductive to long-term investment returns, and instead, investors should be focusing on the growth of that income over time rather than what the headline dividend yield is today. So in many ways, we're of the belief that growth over the long term will generate the income that investors are looking for, regardless of what today's headline dividend yield might appear to be.

Ally Selby: Let's dive a little bit deeper into that. Why dividend-per-share growth? Why is that so important?Michael Wayne: In the last 10 years, we've been fortunate to have very low inflation, which meant cost of living pressures weren't as great. However, that whole dynamic has shifted, as we all know, in the last 18 months or so with the emergence of inflation. So over time, as an investor, you want the income that you're receiving from your investments to be growing as fast as inflation, or if not, a lot faster than inflation over time, so that you're essentially better off from the income that you're receiving. So from our standpoint, earnings per share is incredibly important when it comes to the long-term trajectory of a company's valuation, but equally as important and it's been proven academically as well. Dividend per share growth is the other component of your total return. Obviously, there's capital growth and there's dividends. So if dividends are growing over time on a per-share basis, then there's a very good chance that the valuation of the company is growing as well.

Ally Selby: Is it possible you could provide an example just to illustrate this a little bit more, perhaps of a stock with high headline yield numbers and then also a stock with high dividend per share growth?

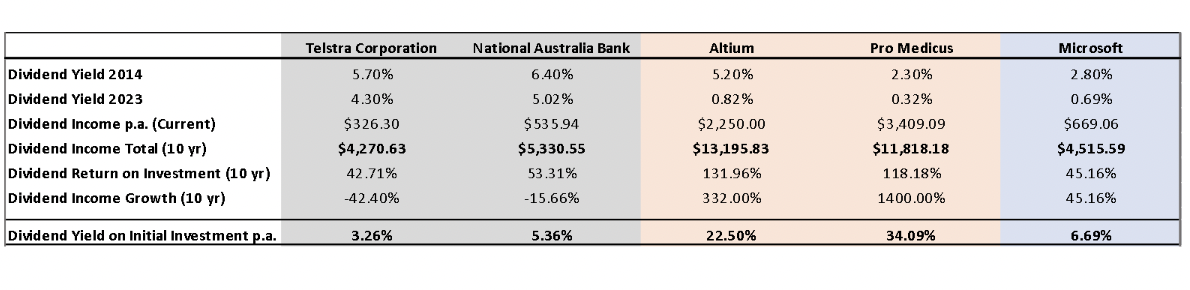

Michael Wayne: So looking at the above slide, I've selected five companies. What we can see in the grey-highlighted sections are two household names, familiar businesses to most people who are invested in the Australian stock market. You've got Telstra Corporation (ASX: TLS) and National Australia Bank (ASX: NAB). Both of these companies are favourites of many investors. They're perceived to be high-dividend-paying stocks.

But if we look at some of the details in this table, it might not be all that it appears to be when it comes to the dividend front for these businesses. So Telstra and NAB historically have always had high dividend yields. However, if you look at the total dividend income received over a 10-year basis on a hypothetical $10,000 investment - if you look at the bolded section, you can see Telstra has generated about $4,270 worth of dividends. And NAB has generated about $5,300 worth of dividends over that 10-year timeframe.

However, if you go to the second last row, you'll see the dividend income growth on a 10-year basis for Telstra. The dividends have fallen on a 10-year basis, and it's the same situation with NAB. So if you took the dividend that you're receiving today on Telstra and divided it by what you would've paid for Telstra 10 years ago, the effective dividend yield on your initial investment is 3.2% in the case of Telstra. If you look at the NAB, your effective dividend yield, or your dividend yield on your initial investment, is about 5.3%. So that's the two companies in the grey-shaded section there.

We'll now turn our attention to two perceived growth companies, and often people disregard growth companies under the impression that they don't pay high dividend yields or that the income that you're going to receive from those investments is going to be less compelling. However, what we're going to see from this pink section here is two companies, Altium (ASX: ALU), which is a bit topical at the moment given it's being taken over, and Pro Medicus (ASX: PME). So I'll start with Altium, and you can see that Altium, if we go to that bolded section, that bolded row, over a 10-year basis, has paid you $13,000 in dividends versus what we saw for Telstra, $4,000 odd, NAB, $5,000 odd.

The dividend yield that you are receiving now on your initial investment 10 years ago is 20.5% per annum, which is not a bad dividend yield at all, even though that headline yield today is roughly 0.8% to 1%. It's a very similar situation with Pro Medicus. Just to finalise things, I threw in there, Microsoft (NASDAQ: MSFT). Often, the technology companies in the US are perceived to be high-growth, poor dividend payers.

But you can see, that even a very large company like Microsoft, over that 10-year timeframe, has paid similar amounts of income to Telstra and NAB, despite the fact that its headline dividend yields have always been significantly lower.

That chart, I think, or that table, although it's very detailed, I think it's worthwhile, people taking the time to understand the point there. The point is that companies might appear to have low income paid today, but the reality is, over time, if that company can grow its revenues, its earnings, and its free cash flows, then the reality is that dividends per share will grow over time as well.

So I think it's important for investors to focus less on the income today, but on the potential for compounded income growth over time, which can very quickly justify the investment not only from a capital growth standpoint but also from an income standpoint as well.

Michael Wayne: Yeah, so I'll give you three stocks, a variety amongst those three. The first one is CSL (ASX: CSL). Again, it's a household name and an ASX top 10 business, but on the face of it, trades on a very low headline dividend yield. But the reality is, for something like CSL, which, over the last 10, 20, 30 years, has compounded its earnings growth at double digits, revenue growth at double digits, it's still expected to deliver those double-digit revenue and earnings growth in the years to come, and there's a very high probability that the dividends per share will grow at a double-digit rate compounded over the long term.

So the reality is, for something like CSL, looking at it on a 20- or 30-year basis, it is paid a lot more in dividend income to investors than, say, even Commonwealth Bank (ASX: CBA), even the likes of Telstra, because that dividend per share has grown so much over time, and we are backing the company to, again, deliver similar sorts of numbers in the years and decades to come. So that's one, CSL, a healthcare company not traditionally associated with high dividends, but what's important is the growth in dividends there.

The second business that we like more on a five-year basis when looking at the dividend growth profile, is Santos (ASX: STO), the energy producer. Santos has managed their business a lot better in recent years than at various points in the past. The reality is, they have a lot less debt on their balance sheet today. Their growth profile, or production profile, is looking very attractive. They're going through a fairly comprehensive CAPEX programme at the moment in order to bring on that production.

But in the years to come, as that CAPEX profile starts to taper off, as things like the buybacks start to taper off as well, this business will be generating a fair amount of free cash flow from their production, and off the back of that free cash flow management is committed to paying out a large chunk, 40%, 50%, of that free cash flow in dividends per year. So we think that is a good growth story when it comes to the dividend profile. We also think that as the dividends per share grow over time, there's the opportunity for capital growth there as well.

Finally, I'll give you a small-cap investment. Often, people disassociate small caps with dividend yields, but there's a company called XRF Scientific (ASX: XRF). It has increased its dividend per share threefold in the last three years or so. We expect that their dividend profile will continue to grow, perhaps not at those numbers, but will continue to increase and deliver on some of those points that we were just touching upon earlier, that this is a business that is growing its revenue, growing its earnings, its margins are expanding. That will enable them to pay up more in dividends per share, which will be beneficial not only again from a dividend standpoint but from a capital growth standpoint, we think.

Michael Wayne: Thanks, Ally.

Ally Selby: I hope you enjoyed that as much as I did and learned something as well. If you did, why not give this episode a like and remember to subscribe to our YouTube channel? We're adding so much great content, just like this, every single week.Invest in tomorrow's leaders today

To learn more about the Fund, click the link here.

Or, for more insights like this, follow my profile on Livewire.

5 topics

11 stocks mentioned

1 contributor mentioned