3 ASX stocks with P/E ratios of less than 10 (and another that’s gone below 1)

This equity market is full of contrasts right now. On the one hand, the NASDAQ 100 has a P/E ratio of nearly 31. Inflows have surged and the Barclays AI stocks basket is up 48% year-to-date alone. Then, there’s the ASX 200 which is up only 0.5% year-to-date and has a P/E ratio of 15. Naturally, there are many nuances within these statistics but it proves just how varied the opportunities in equity markets are of late.

Underneath the hood, it appears there’s also been some movement at the very cheap end of the market. The Market Index Low P/E scan reveals there are 45 companies with a trailing P/E ratio of under 10. That’s the same as last month.

But do a little digging and you will find that the names and positions in that list have changed materially since our last review.

In this piece, I’ll show you the current list as well as provide analysis of the three new additions to the list. Plus, read on to find out which company has a trailing P/E of under one. That same stock is also up 60% in the last year.

Ticker |

Company |

Price |

PE |

Mkt Cap |

1 year |

|---|---|---|---|---|---|

ANZ Group |

$22.84 |

9.94 |

$68.6 B |

5.08% |

|

Woodside Energy |

$33.94 |

7.96 |

$64.43 B |

10.86% |

|

South32 |

$3.71 |

7.44 |

$16.85 B |

-7.14% |

|

Pilbara Minerals |

$4.85 |

8.71 |

$14.54 B |

117.49% |

|

Bluescope Steel |

$20.33 |

5.53 |

$9.29 B |

30.07% |

|

Spark New Zealand |

$4.69 |

8.23 |

$8.65 B |

6.24% |

|

Ampol |

$29.78 |

9.81 |

$7.1 B |

-10.17% |

|

Yancoal Australia |

$4.39 |

1.62 |

$5.8 B |

-15.25% |

|

Whitehaven Coal |

$6.52 |

1.83 |

$5.69 B |

44.25% |

|

Incitec Pivot |

$2.70 |

6.92 |

$5.24 B |

-17.68% |

|

Iluka Resources |

$11.22 |

9.23 |

$4.78 B |

28.69% |

|

JB Hi-Fi |

$41.75 |

7.9 |

$4.56 B |

5.88% |

|

Viva Energy |

$2.92 |

8.82 |

$4.51 B |

6.18% |

|

New Hope Corp |

$4.83 |

3.42 |

$4.26 B |

49.07% |

|

Brickworks |

$27.52 |

6.44 |

$4.19 B |

48.28% |

|

Harvey Norman |

$3.23 |

5.39 |

$4.02 B |

-14.68% |

|

Beach Energy |

$1.34 |

6.15 |

$3.05 B |

-15.77% |

|

Sims |

$15.00 |

6.74 |

$2.9 B |

8.46% |

|

Genesis Energy |

$2.53 |

9.37 |

$2.7 B |

5.86% |

|

Zimplats Holdings |

$23.76 |

7.47 |

$2.56 B |

-1.00% |

|

Coronado Global |

$1.48 |

3.22 |

$2.48 B |

-11.38% |

|

Super Retail Group |

$10.73 |

8.9 |

$2.42 B |

24.62% |

|

Stanmore Resources |

$2.59 |

3.09 |

$2.33 B |

33.85% |

|

Perseus Mining |

$1.69 |

7.47 |

$2.31 B |

-1.89% |

|

BSP Financial Group |

$4.93 |

2.13 |

$2.3 B |

3.57% |

|

Summerset Group |

$8.64 |

7.42 |

$2.01 B |

-1.26% |

|

APM Human Services |

$2.11 |

6.94 |

$1.94 B |

-20.08% |

|

Virgin Money Uk |

$2.72 |

8.07 |

$1.91 B |

19.30% |

|

Graincorp |

$7.60 |

5.11 |

$1.7 B |

-16.36% |

|

Magellan Financial Group |

$8.67 |

7.46 |

$1.57 B |

-37.35% |

|

Karoon Energy |

$1.97 |

9.87 |

$1.11 B |

18.73% |

|

Heartland Group |

$1.52 |

9.84 |

$1.08 B |

-7.62% |

|

Helia Group |

$3.29 |

6.72 |

$1.06 B |

43.45% |

|

Elders |

$6.13 |

7.95 |

$958.42 M |

-50.72% |

|

Mesoblast |

$1.13 |

0.48 |

$918.02 M |

62.23% |

|

West African Res |

$0.82 |

5.14 |

$836.77 M |

-34.07% |

|

Nick Scali |

$8.34 |

6.62 |

$675.54 M |

0.00% |

|

Australian Clinical Labs |

$3.29 |

8.99 |

$664.03 M |

-26.23% |

|

Fleetpartners Group |

$2.40 |

8.11 |

$648.24 M |

6.67% |

|

Pepper Money |

$1.36 |

4.33 |

$595.88 M |

5.45% |

|

Seven West Media |

$0.38 |

3 |

$590.13 M |

-1.32% |

|

Genesis Minerals |

$1.22 |

1.01 |

$579.06 M |

-9.82% |

|

Winton Land |

$1.91 |

8.45 |

$566.53 M |

-44.64% |

|

Peet |

$1.20 |

8.6 |

$563.25 M |

24.48% |

|

Grange Resources |

$0.48 |

3.21 |

$549.74 M |

-60.42% |

The new names

There are three new names on this list. All of them have a P/E of between 9 and 10.

ANZ (ASX: ANZ) may have a dividend yield of 6.4% and a P/E ratio of 9.91 but it’s not exactly a capital grower. In the past year, the stock has only made a 4.7% return on investors’ capital. And there may be more bad news coming, with Morgan Stanley analysts expecting a 15bps fall in net interest margins over the next 18 months for the Big Four banks. The one consolation is that ANZ is their preferred bank.

In addition, longtime Livewire contributor Hugh Dive of Atlas Funds Management wrote recently that he believes 2023 will not be 2008 Mark II for the Big Four banks. With dividends increasing across the major institutions by 17%, Dive says the Big Four's earnings will likely outperform some otherwise very pessimistic expectations.

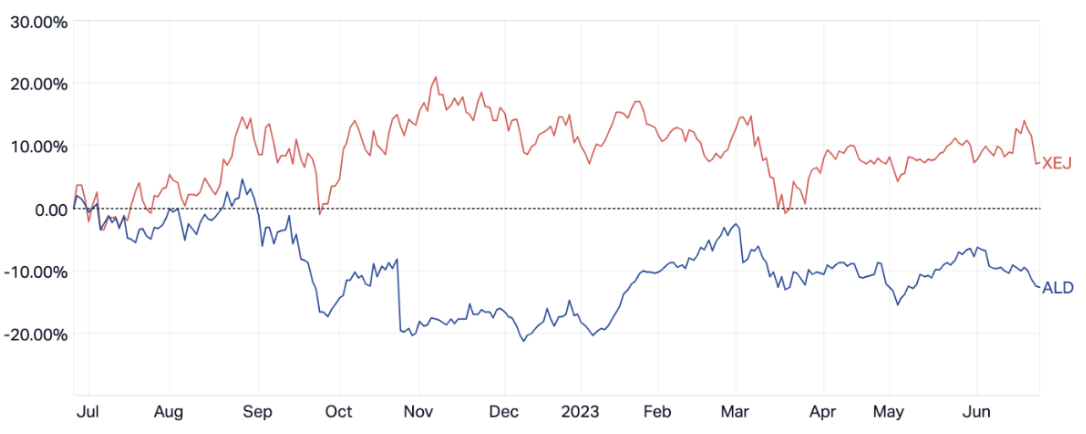

Ampol (ASX: ALD) also finds its way onto our refreshed low P/E list but it’s not likely for the reason it would like. The share price has fallen 10% in the last 12 months and continues to lag the energy index significantly. For those who want to play the renewable energy thematic, Ampol has been touted by Credit Suisse analysts as a way to play investing’s most important megatrends. The stock is also on the brokers’ side with Macquarie, UBS, and Ord Minnett all having outperform, buy, and accumulate ratings respectively.

Ampol was also recently flagged by Tim Johnston at Tyndall Asset Management as an example for an ASX company that may benefit further from the transition to electric vehicles thanks to a recent strategic review.

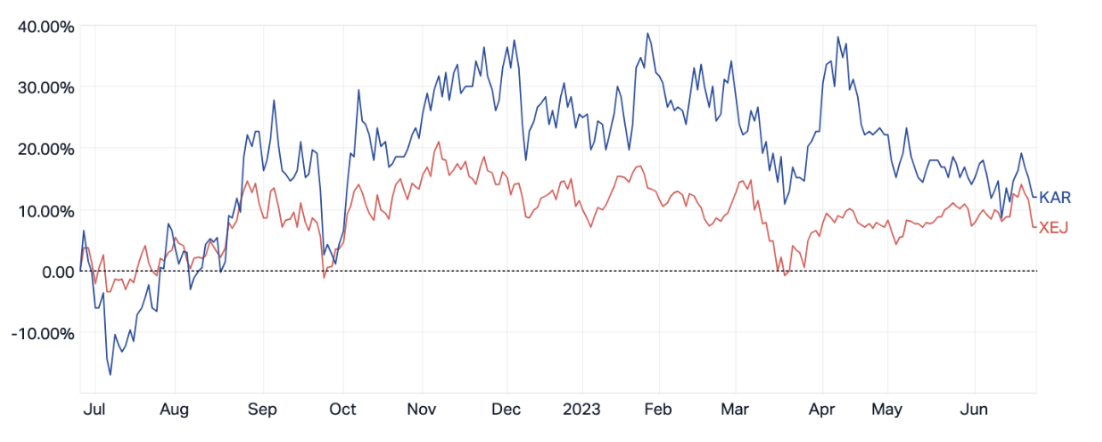

Karoon Energy (ASX: KAR), in contrast, is actually performing in line with the ASX Energy Index. It’s up 18% year-on-year and has a P/E ratio of 9.82. It’s also a favourite among the brokers with 11 buy ratings and just 2 holds. Morgans has a price target of $3.55/share, more than 80% above the current share price! It’s also a favourite stock of Rick Squire of Acorn Capital who first invested in the company in September 2020. He calls it a perfect case of how the Lassonde Curve can help you pick winners in the resources market.

And the 1 under 1

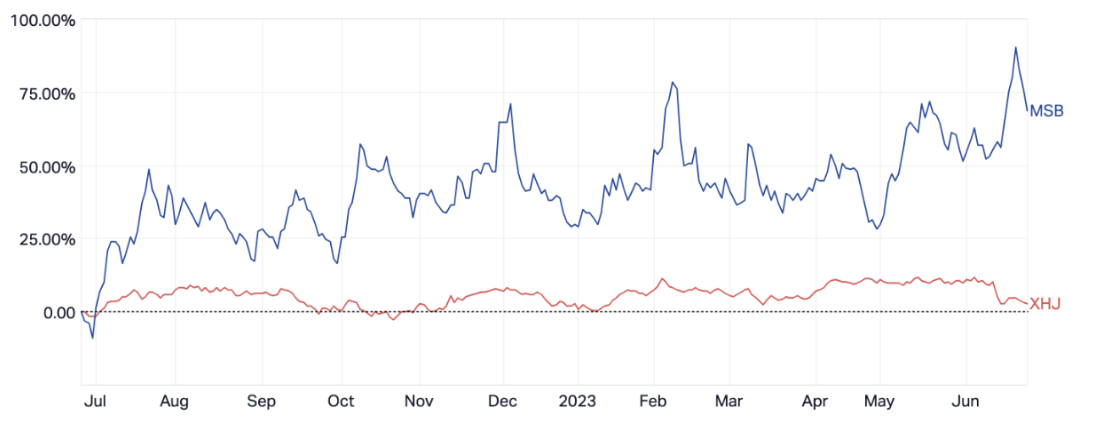

Mesoblast (ASX: MSB) has never turned a profit but it’s popped up as a company with a PE of just 0.5. My hunch is that this is an error associated with our data vendors.

Nevertheless, the stock is up more than 60% in the last year and far outperforming its benchmark sector.

The company is a homegrown biotech dealing in regenerative medicine which hopes to produce and sell treatments for cardiovascular disease and back pain. It’s loved by the brokers with 9 out of 11 on the Market Index scan rating the stock a BUY. Bell Potter has a $2 price target on the company, some 75% above its current share price. It’s also been flagged by independent researcher Claire Aitchison who says the company’s freshly restocked balance sheet could be good news for its future plans.

This piece was first published on Market Index on Monday 26 June 2023.

2 topics

4 stocks mentioned

2 contributors mentioned