3 candidates for tax loss selling that Market Matters might consider buying

Most of us have been guilty at least once for changing our spending habits in June as we start considering the EOFY. I know my “tradie” friends adopt an if in doubt buy it attitude this time of year to avoid paying too much tax for the FY.

Similarly in the stock market around this time investors usually start considering putting the broom through their portfolios with positions that are showing decent losses for the financial year prime candidates to offset any profits that may be realised – obviously details should be discussed with an accountant before actions are taken.

The characteristic can often send already depressed stocks down into oversold / deep value areas which can be attractive for the well-informed investor, the key is determining the difference between value and a company simply in trouble.

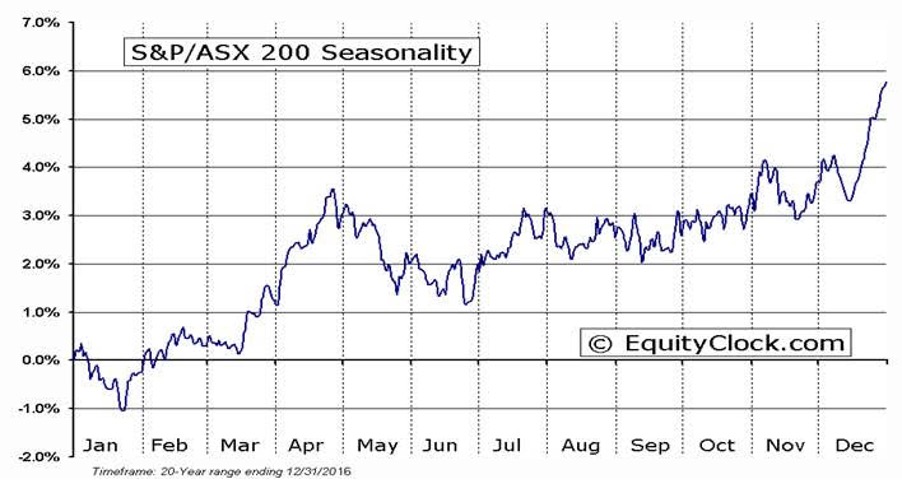

Hence by definition, June can witness some significant stock/sector rotation although that’s nothing new for the last 6-12 months. June often forms a platform for a run-up into Christmas which does dovetail with our current bullish stance towards stocks although it's very hard to imagine risk assets losing the shackles of a rising interest rate environment in a meaningful manner anytime soon. The local market has followed its seasonality clock perfectly in 2022 but we feel its likely to be harder to maintain over the next 6-months.

MM is bullish on the ASX200 short-term but cautious further ahead

ASX200 seasonality chart

A quick glance at the US market whose EOFY is on September 30th shows that the tax man has relatively little impact on the core indices themselves with moves far more noticeable under the hood although both the ASX200 and S&P500 do appear to fall for the last few weeks of their respective financial years.

MM is bullish on the US S&P500 short-term but cautious further ahead

US S&P500 seasonality chart

Today we have simply looked at three quality businesses that are candidates for tax-loss selling which in our opinion could present opportunities if things go too far i.e., not at today’s prices but into further exaggerated weakness. This time of year, we must remain open-minded, not many people would have picked Whitehaven Coal (WHC) to be one the year’s top performers while Magellan Financial (MFG) sulked in the opposing corner.

ARB Corp Ltd (ARB) $30.61

The 4-wheel drive accessories business ARB has corrected 45% from its end of 2021 high and now finds itself down 29% for the financial year after witnessing a trifecta of a slowdown in sales, shortages of staff, and supply chain constraints which has created a new car back log many of whom would usually purchase ARB’s products. When we combine this with margin contraction due to rising commodity prices the picture has looked bleak for ARB which has clearly been reflected by its share price fall.

It’s starting to feel like things are as bad as they can get for ARB.

This remains a retailer we like and its now trading on 19.6x FY22 earnings compared to a 5-year average of 27.5x, MM has largely avoided the Australian consumer through 2022 but this is one retailer we like into excessive weakness. A month ago, we wrote that we were neutral around $33.60 but would be interested closer to $30 i.e., it's getting very close.

MM likes ARB under $30

Ansell Ltd (ANN) $26.90

ANN has corrected 46% from its mid-2021 high and now finds itself down 38% for the financial year after disappointing the market with its post COVID performance, who would have thought the stock would be trading well under its 2020 highs in today’s new health & safety world. Januarys major downgrade courtesy of rising cost and falling margins hasn’t been forgotten and for MM to be interested another leg lower is required for this health and industrial safety protection business.

The stock is fairly cheap - trading on a 15.5x valuation for 2022 earnings but it's currently lost the market's confidence hence MM needs another down leg to spark our interest.

MM likes ANN under $23

REA Group Ltd (REA) $109.65

REA has corrected 42% from its mid-2021 high and is currently down 35% for the financial year after finding itself in two unpopular naughty corners i.e. property and growth high valuation names. This is a quality almost monopolistic style business with some useful pricing power but it currently is in the wrong place at the wrong time, the question is when has real value been restored – its still not cheap per se trading on an estimated valuation of 35.2x for 2022 but a little lower and it will become compelling although I would add that MM has no interest in increasing our tech exposure even though we anticipate a bounce from current levels.

MM likes REA into weakness under $100

The Bottom Line

Short-term MM can see opportunities courtesy of tax-loss selling, it's simply the market's normal modus operandi:

Of the 3 stocks looked at today our preference into EOFY selling is ARB, ANN and then REA.

Is it too late to buy battery metal stocks?

By 2030, it’s expected that ~145 million electric vehicles globally will be on the road, up from just ~7m in 2021. Power grids are transitioning to more sustainable means and governments are being rolled as a consequence of their climate policies. The global energy transition is clearly underway. But is it time to make the most of the opportunity? Join Market Matters' primary author James Gerrish and Shaw & Partners analysts Peter O’Connor and Michael Clark to hear how they’re investing to maximise this tectonic shift. Register here.

3 stocks mentioned