When a stock misses earnings expectations: What's your next move?

It's every investor's worst nightmare – When your stock reports a weaker-than-expected earnings and set for a massive gap down at market open.

Missing earnings expectations is generally a bad omen for stocks. In the last 16 reporting seasons, companies that missed expectations saw their stocks down an average 6.3% on the day of reporting, according to data compiled by Bell Potter's Richard Coppleson.

Worse yet, they were still down an average of 8.4% four months later. So what should you do if your stock misses earnings? Here are a few tips.

Keep calm and carry on

This might sound simplistic – like telling a sad friend – “hey, just don’t be sad”. But it’s arguably the most important thing to do in a volatile and high-stakes environment.

When you're staring down the barrel of a massive gap down – the last thing you should do is make a decision that throws all of your original plans out of the window.

How bad was the result?

When you read the result – You should ask yourself:

- What was the magnitude of the miss?

- Does this challenge my original hypothesis?

- Does this result change the company’s underlying narrative?

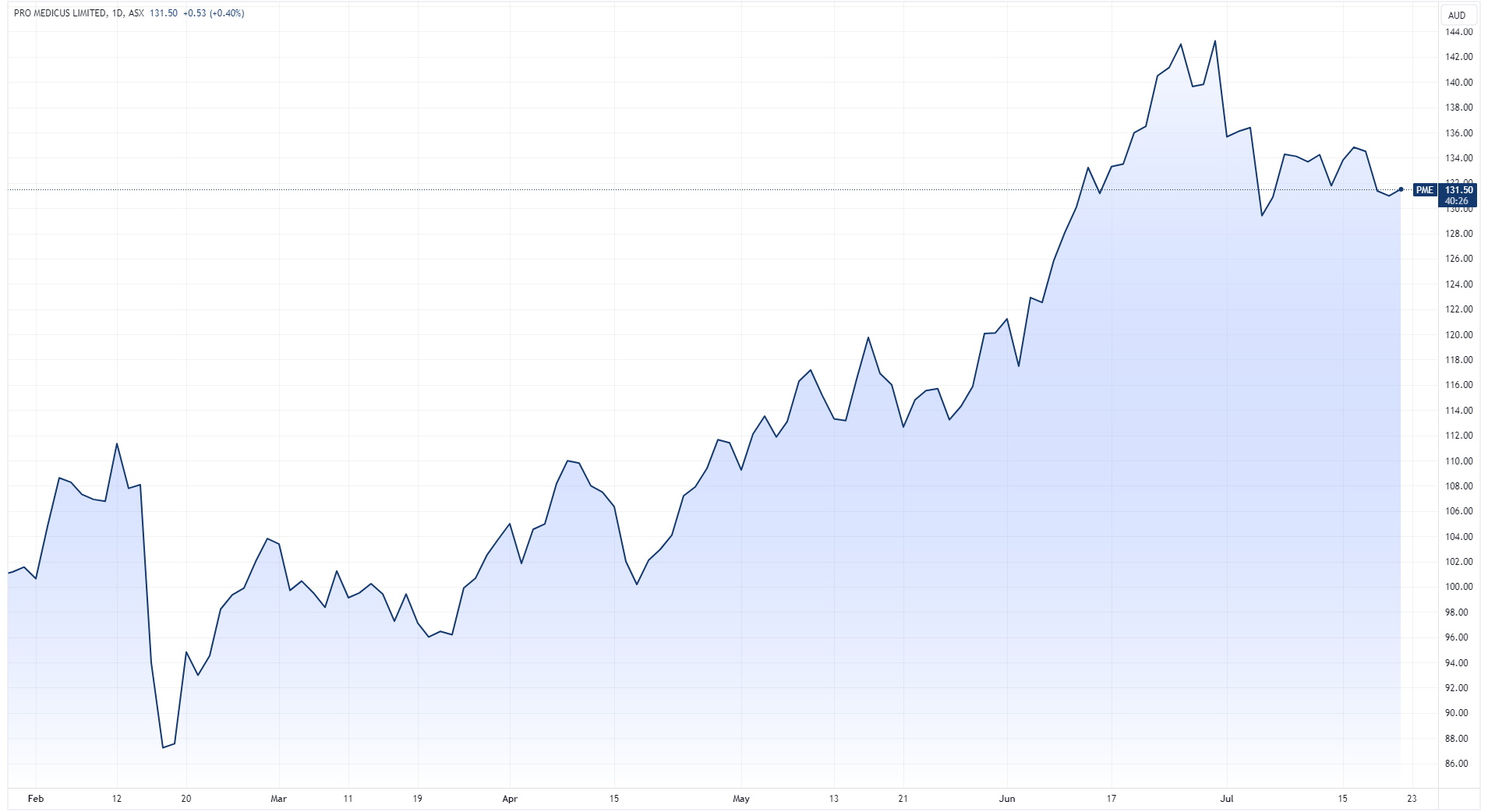

Pro Medicus (ASX: PME ) might be one of the market's favourite ASX 200 growth stories. But the way the stock traded during its half-year FY24 result on 15 February might have scared off some long-term investors.

Pro Medicus experienced a sharp 20% two-day tumble after reporting a slightly weaker-than-expected set of numbers, including:

- Revenue of $74.1 million or 3.7% below consensus

- Pre-tax income of $478.8 million or 13% below consensus

- Net profit after tax of $36.3 million or 5.9% below consensus

As one of those perfectly priced stocks that can't afford to miss earnings, it was severely punished. However, multiple analysts remained bullish, with expectations that the company is poised to double its market share over the next five years.

Pro Medicus managed to recover the earnings-related selloff over the next two months and it's now trading around 25% above pre-result levels.

A miss is generally bad

But Pro Medicus is a rare example of an earnings miss that managed to V-shape its way back into record territory. As I mentioned above, companies that miss expectations experience an average 6.3% decline on the day of reporting and four months later, still down 8.4%.

And that makes sense right?

If the company is reporting numbers that are below what’s already priced in – then its new price floor should be somewhere below what it's currently trading.

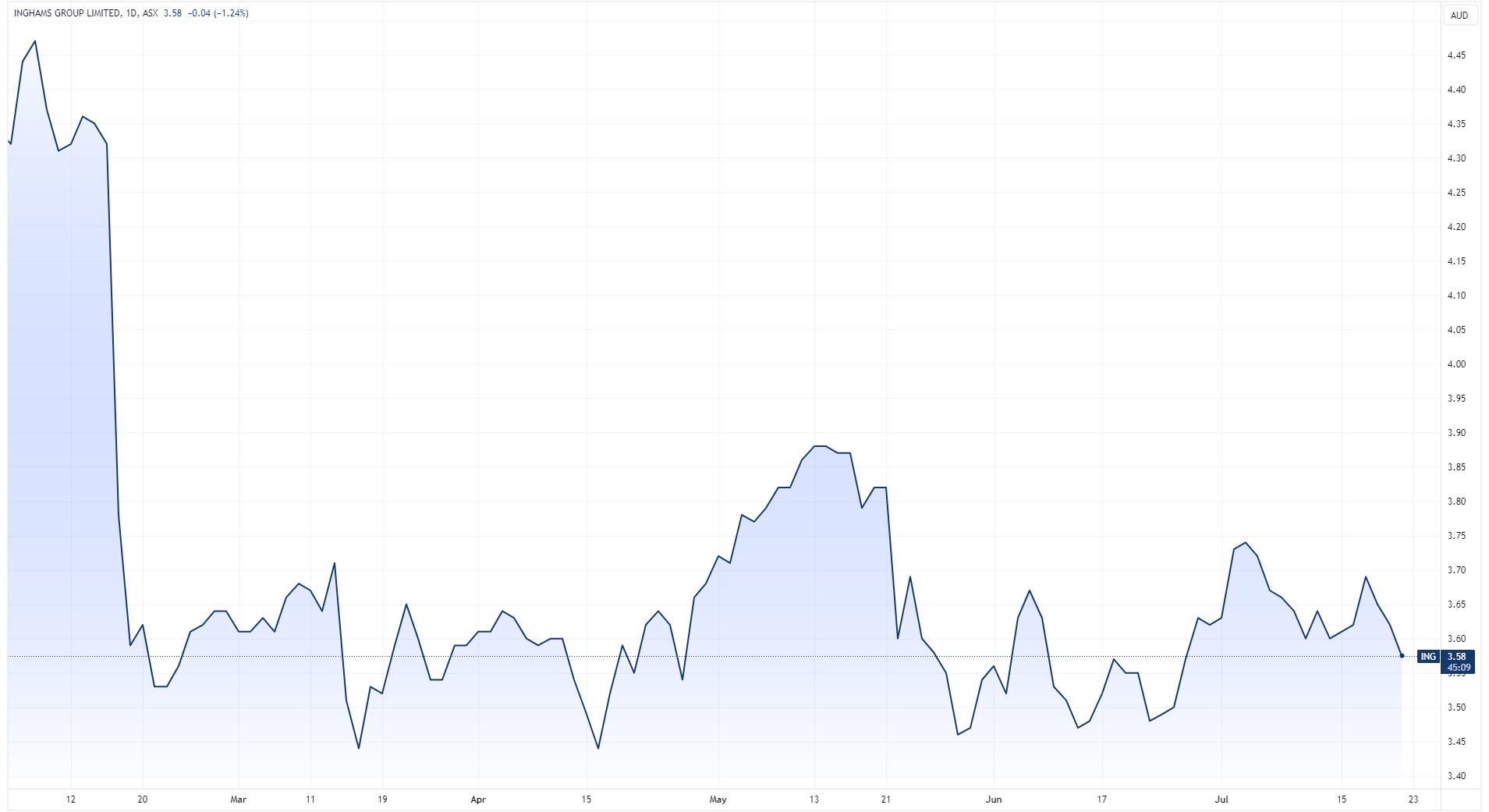

Inghams (ASX: ING) reported a first-half FY24 result that was slightly ahead of market expectations but management flagged a much more challenging second-half, noting:

- Softening in the QSR (Quick Service Restaurant) channel as consumers respond to cost of living pressures

- No material price increases in the second half

- Persistent cost inflation including wages and distribution

Inghams opened the session (16 Feb) down 3.9% and finished 12.5% lower. It fell another 5.0% the next day to $3.65 and continues to trade around these levels.

A few other names that come to mind from February reporting season include:

- Corporate Travel (ASX: CTD) reported 1H24 earnings that missed consensus by 6% and downgraded its full-year guidance by 15%. The stock fell 20% on results day and has declined 35% since February, contrasting with Flight Centre's 6% gain over the same period.

- Data#3 (ASX: DTL) reported weaker-than-expected 1H24 gross margins and earnings (30 bps and 5% below consensus). The stock dropped 13% on results day and an additional 9.5% the next day.

- Sonic Healthcare (ASX: SHL): 1H24 results were operationally in-line but higher-than-expected depreciation and amortisation resulted in a net profit miss of 16%. The stock finished the results session down 7.7% and and has continued to trend lower since then.

Corporate Travel was never quite the same after its 1H24 result (Source: TradingView)

Data#3 has struggled for upside despite all the hype around AI (Source: TradingView)

The price is right

The Coppo Report says the market’s initial reaction to a stock’s earnings is accurate about 70% of the time.

“Buy the stocks that are up on day one (or more importantly, don’t sell them after a big move to the upside) … and sell the stocks down on day one,” the report says.

A stock that misses earnings tends to face persistent selling pressure for a number of reasons. Let's take a look at Corporate Travel from a few perspectives:

- Fundamentals: Corporate Travel downgraded its full-year earnings due to factors such as a subdued travel sentiment, North American travel budgets being exhausted and a substantial decrease in the UK Bridging contract contribution.

- Brokers: The average price target among 13 analysts was cut by 9.2% after the first-half result to $21.03.

- Technicals: The sharp decline in share price has likely left many investors underwater, potentially creating excess supply as holders seek to sell at breakeven. This significant drop has also pushed the stock below key technical indicators, including both the 50-day and 200-day moving averages.

- Short selling: Short sellers covered into to the results, with short interest dropping from 2.31% on February 20 to 1.62% on February 22. However, following the announcement, short interest in Corporate Travel surged to 2.85% within days. By early May, it had more than doubled to 5.6%.

This article first appeared on Market Index.

Reporting Season Calendar

As part of Livewire and Market Index’s August Reporting Season coverage, we’ve created a handy PDF calendar, which can be downloaded below.

1 topic

5 stocks mentioned