3 commodity plays among UBS's top China picks

The China reopening thematic was widely anticipated in the backend of 2022, when the world’s second-largest economy began rolling back its restrictive COVID-zero policy. But the “bang” that many global investors hoped for after the policy was officially ended in January has turned out to be much more of a whimper.

This is acknowledged in a recent UBS research note, which describes what has unfolded in China as a “measured, even muted, recovery.”

“The wave of positive reopening sentiment and rapid recovery expectations in the March quarter has faded into the June quarter,” says the report, which was authored on the back of a research tour undertaken by several members of the investment bank’s analyst team.

It refers to four core segments of China’s economy to illustrate the lacklustre nature of the rebound.

Households - The UBS analysts noted the troubling global macro environment has spurred caution among households and prompted a winding back of debt. This situation is exacerbated further by job market concerns and layoffs in the second half of calendar 2022 that are weighing on consumption.

Construction – This is “expected to stabilise in the second half, with property sales steadying at low levels,” say the analysts. But they also anticipate construction will be down between 5% and 10% by the end of calendar 2023 as excess supply of buildings draws down.

Infrastructure – The UBS analysts expect this sector to grow between 3% and 4% in calendar 2023, “possibly with an acceleration in activity in the fourth quarter, partly offsetting property weakness.”

Manufacturing – Dependant on global versus domestic growth, the analysts point to a lack of upward pressure on prices as highlighting insufficient demand for goods and services. They say on-the-ground feedback indicated “mixed expectations” regarding the possibility of additional stimulus measures that might see China hit its 5% plus growth in 2023.

Key commodity insights

UBS’s preferred China commodity plays are lithium, aluminium and copper. Though regarding the risk-reward proposition of iron ore as improving, the analysts believe it offers limited upside.

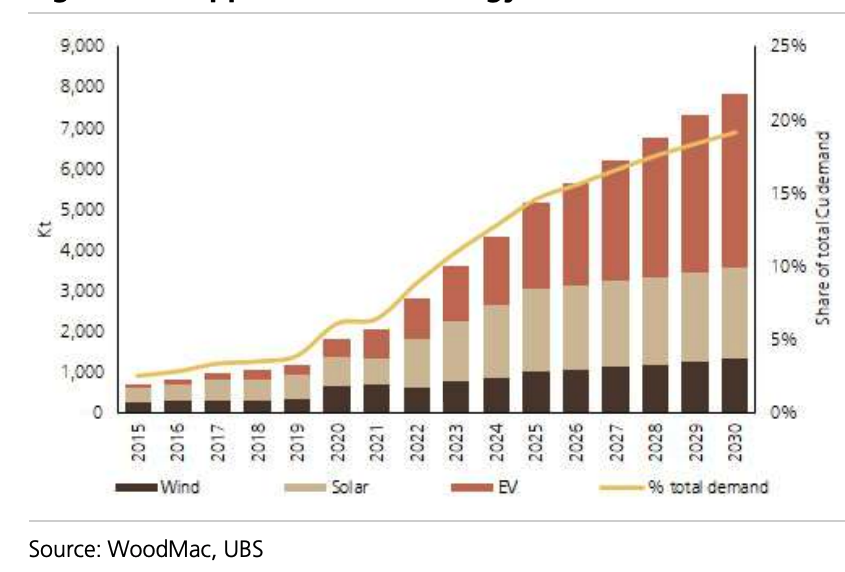

“We prefer the outlook for commodities exposed to (electric vehicles) EVs and the broader energy transition, with EV sales recovery well under way and structural demand for EVs remaining very strong."

“On the other hand, we are more cautious on the construction outlook near term, and even though iron ore risk/reward has improved, there would appear to be a limited upside to iron ore from current levels.”

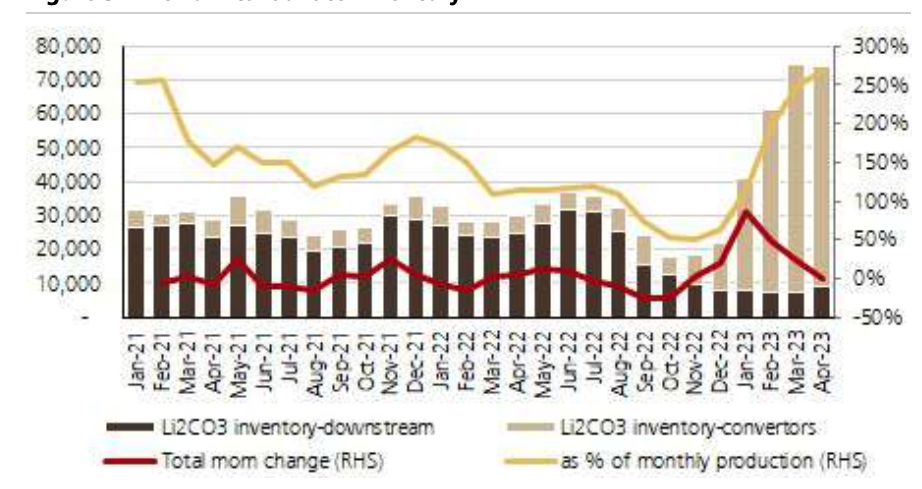

Lithium carbonate inventory

Copper demand – energy transition

Macro outlook

The research team’s contacts in China express “lower than usual confidence” that the Chinese government’s 5%-plus growth target for 2023 would be comfortably achieved.

“Low inflation and price pressure is seen to provide authorities with more latitude to stimulate through the second half of calendar 2023 and into 2024, but most contacts expect stimulus and growth acceleration to be weighted more toward consumption/services than construction,” said the analysts.

Bearish on commodity prices

The UBS team noted mixed views on whether government policy would continue to emphasise consumption and service growth in an effort to foster broader economic growth – or whether it would prioritise the role of traditional infrastructure and property construction. On the latter point, they point out property’s contribution to China’s GDP was less than 10% in 2022, down from 14% a year earlier.

“The read-through here would be bearish for commodity prices into the second half of calendar 2023 and into 2024,” said the UBS analysts.

“The key takeaway is that households are cautious, tending to delay consumption and deleverage due to concerns surrounding the labour market, directly challenged this narrative.

“Most contacts thought the household sector likely needs more time to rebuild confidence after COVID restrictions and widely reported layoffs in the labour market in the second half of calendar 2023.”

2 topics