3 portfolio themes to consider for growth investors in 2025

As we close out 2024, the Australian ETF market has demonstrated remarkable performance, with nearly 94% of equity ETFs set to end the year in positive territory and an average year-to-date return of 14%(1).

Broad-market equity ETFs have captured the lion’s share of flows, yet thematic ETFs continue to lead the way in performance, highlighting investors' growing appetite for innovation-driven growth(2).

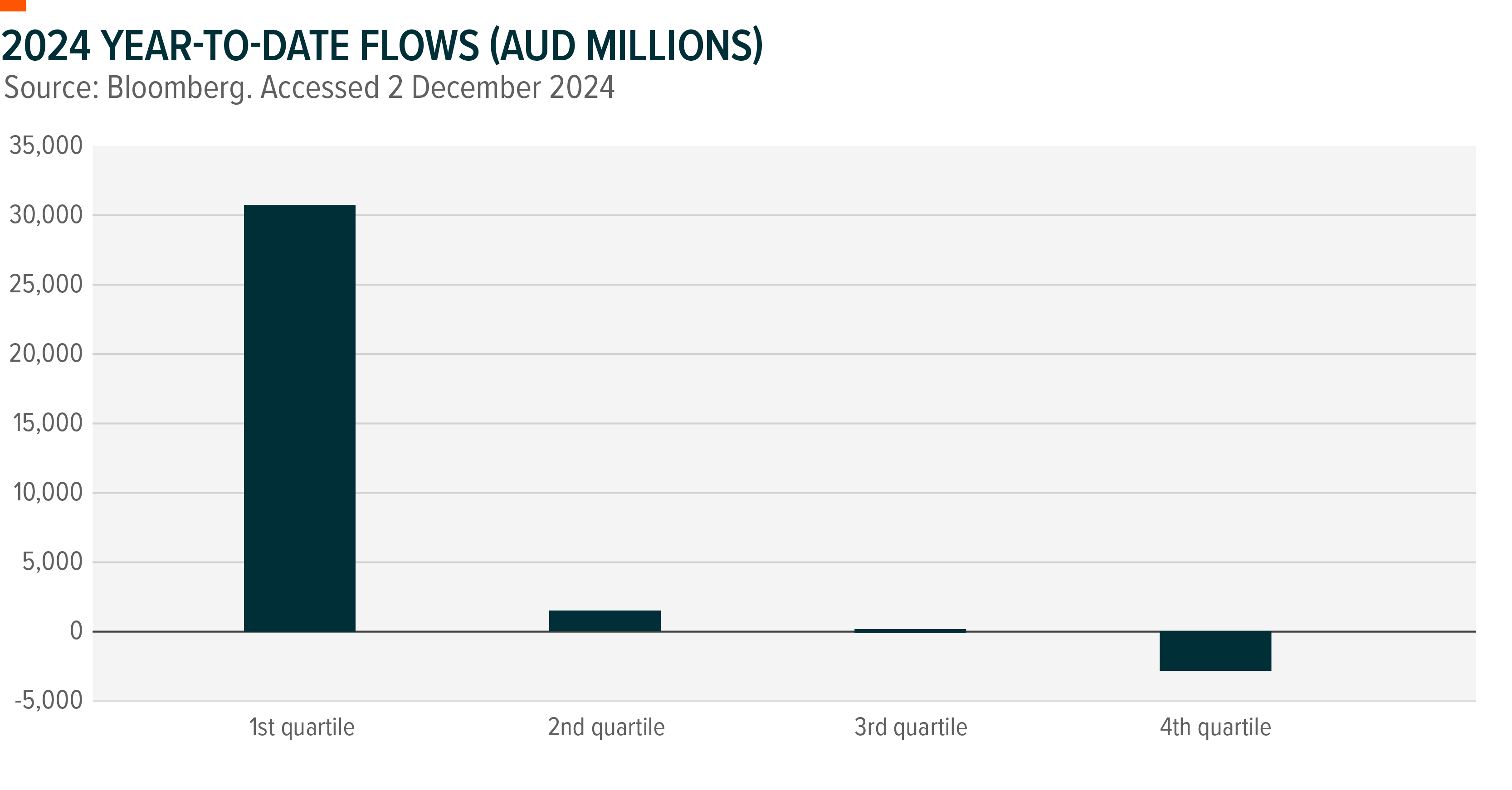

Looking at net inflows, 78% of equity ETFs have posted positive inflows year to date, with the first quartile leading the charge with an impressive AUD30.5 billion in net flows(3).

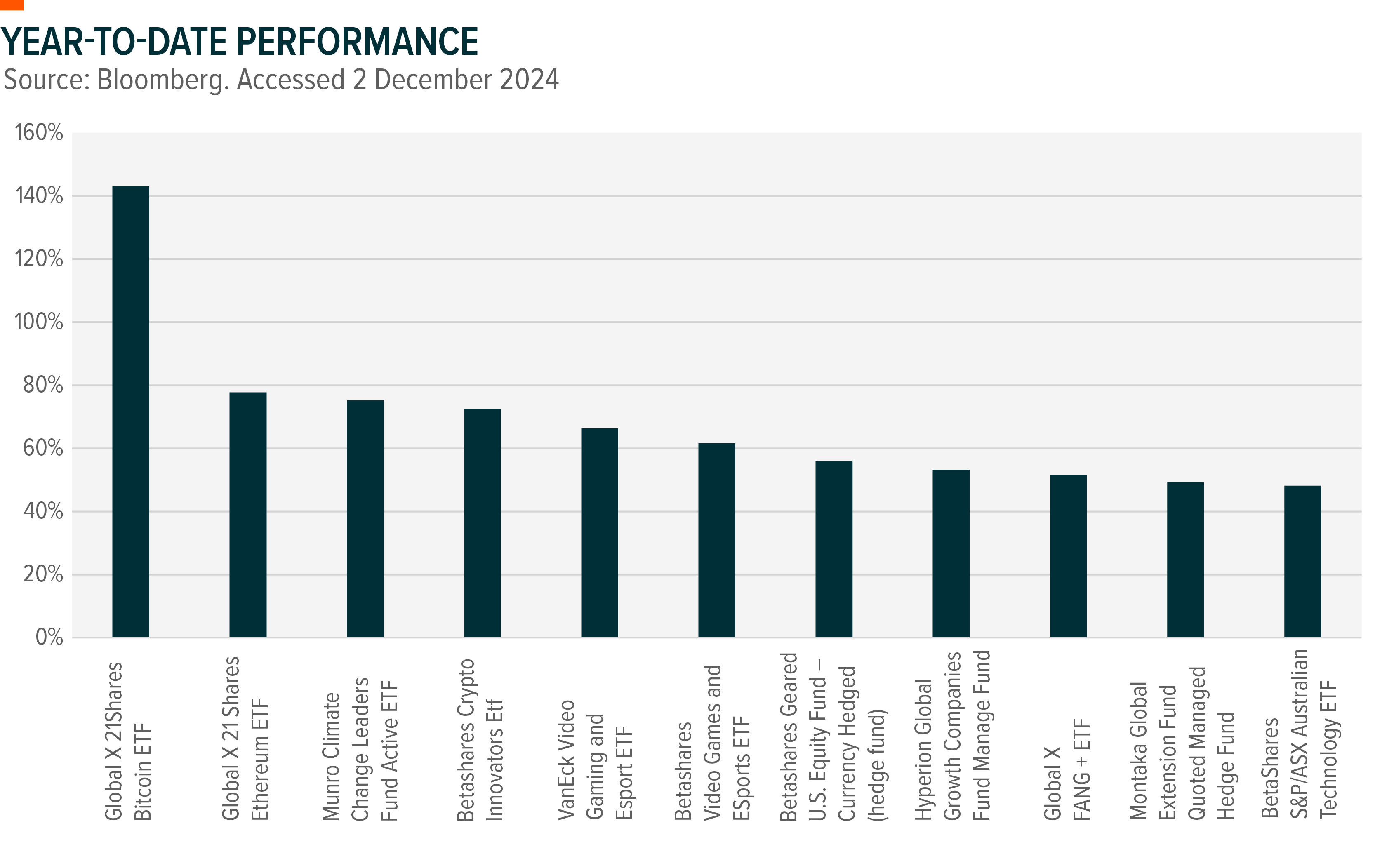

While broad-market ETFs have garnered substantial interest, thematic strategies, particularly in emerging sectors like technology and cryptocurrencies, continue to capture attention.

.png)

Source: Global X ETFs, Bloomberg. Accurate as of 3 December 2024.

2024 in review: resilience, innovation, and lessons learned

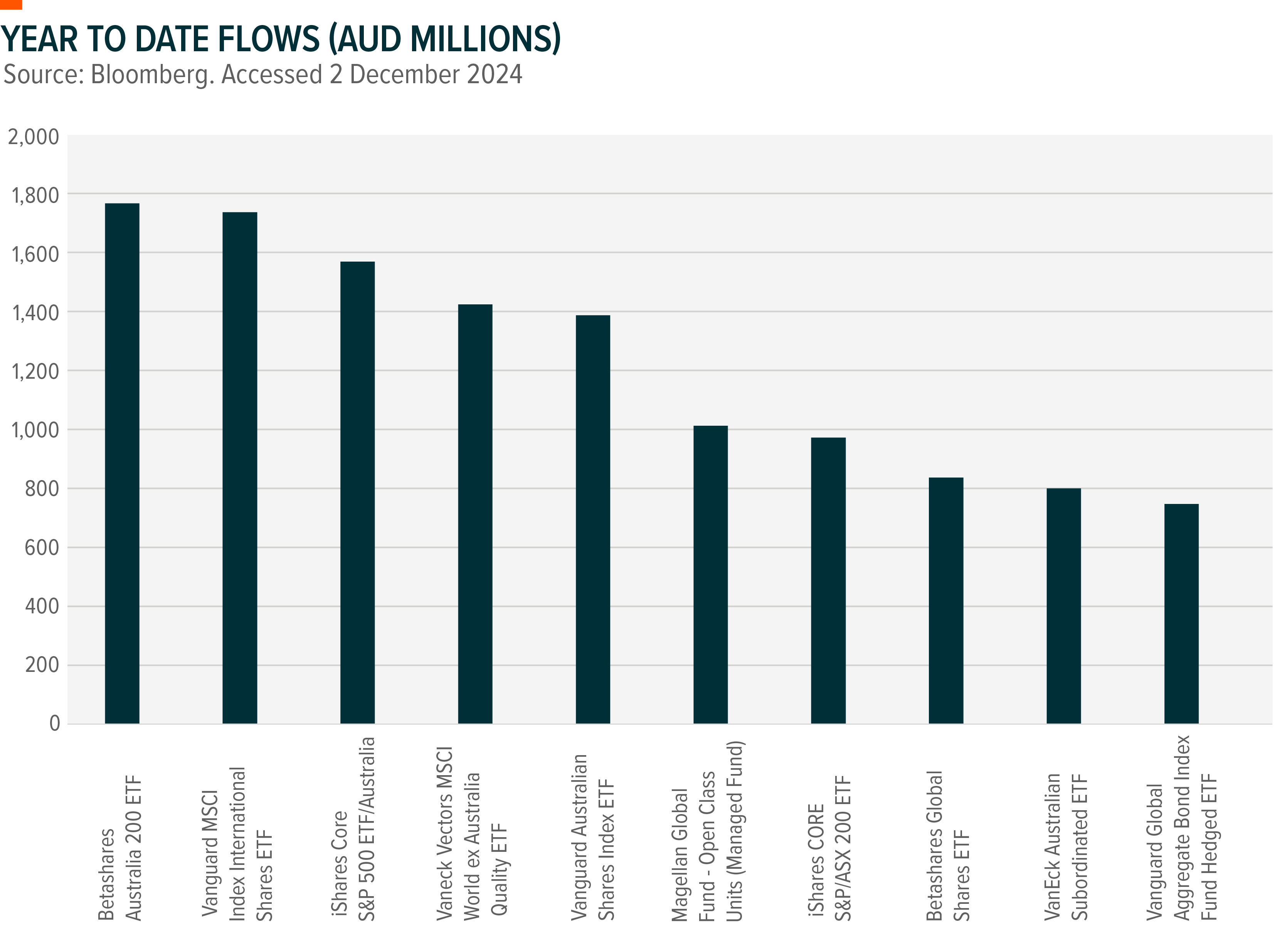

In 2024, broad-market equity ETFs led the way in terms of net inflows, with the top ten flow leaders accounting for AUD13.4 billion of the total AUD30 billion in inflows(4).

Interestingly, a significant portion of these flows, one-third of their total year-to-date, came in the third quarter, reflecting growing investor confidence as the year progressed. However, it was the thematic ETFs that stole the spotlight in terms of performance, demonstrating the ongoing shift towards innovative strategies.

Figure 2: Core ETFs have dominated the Australian ETF market in terms of flows.

.png)

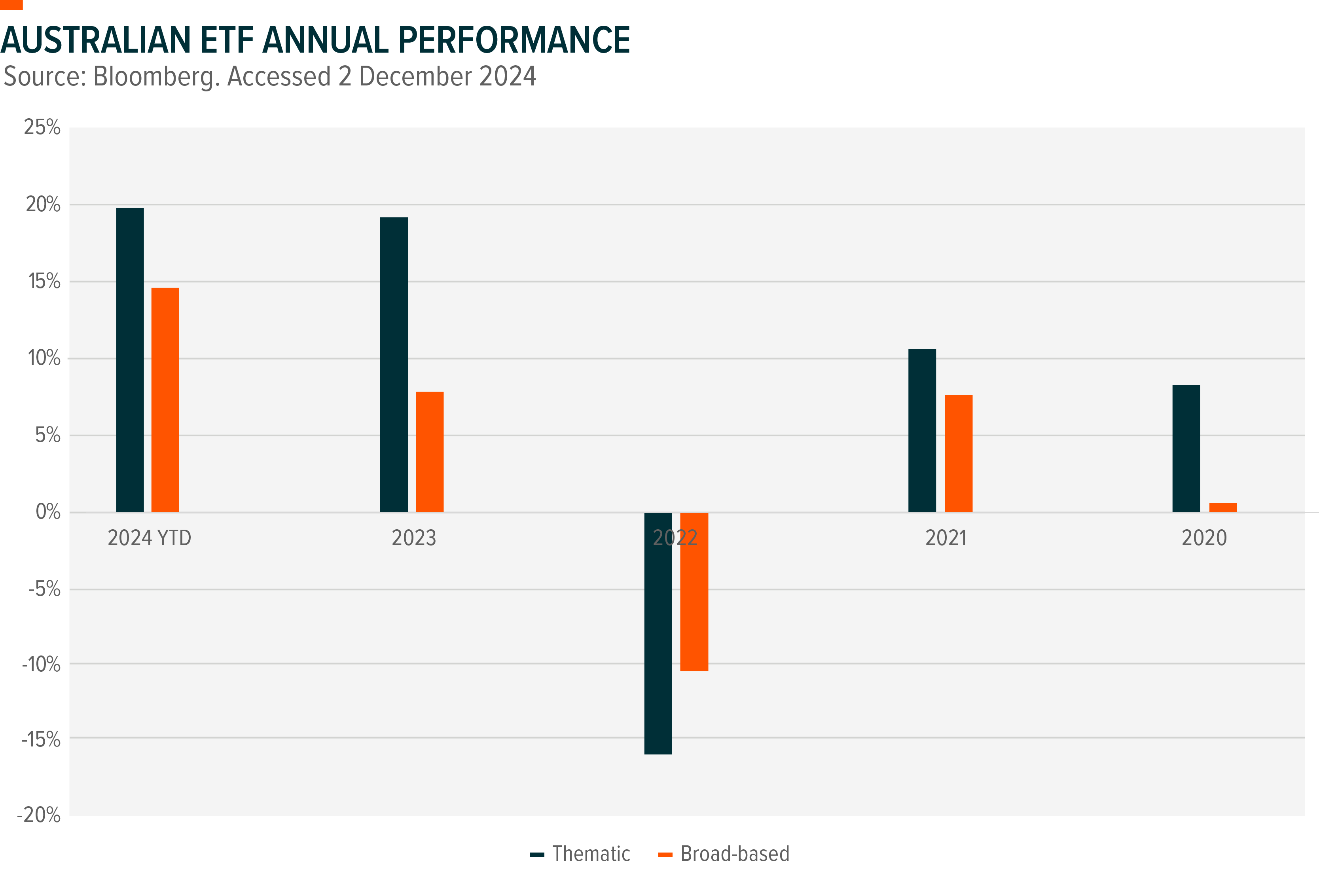

While broad-market ETFs have offered essential stability, thematic strategies have consistently outperformed core strategies.

Thematic ETFs, which focus on sectors like technology, digital assets, and semiconductors, delivered a year-to-date return of 20% in 2024. In comparison, broad-market ETFs, which provide stability, recorded a more modest 14% year-to-date return (5).

The outperformance of thematic strategies highlights the growing investor appetite for high-growth opportunities, even as they balance this with the more stable foundation provided by broad-market ETFs.

Figure 3: Thematic ETFs Show Strong Recovery in 2024, Continuing Recent Outperformance

.png)

Technology and innovation-focused ETFs continued to outperform, particularly in sectors like semiconductors and artificial intelligence. Funds such as Global X FANG+ (ASX: FANG), which returned 49% year-to-date, and Global X Semiconductor ETF (ASX: SEMI), which gained 27%, attracted significant flows, proving the resilience of these innovative sectors even in volatile markets.

Cryptocurrencies, despite market volatility and regulatory concerns, saw a strong resurgence in 2024.

The Global X 21Shares Bitcoin ETF (CBOE: EBTC) posted an impressive 137% return, while the Global X 21Shares Ethereum ETF (CBOE: EETH) returned 48%. These funds capitalised on the increasing institutional adoption of digital assets, further cementing their position as viable investments despite the high-risk nature of the sector. This performance underscores how digital assets are maturing and becoming a more stable investment option, even amidst regulatory uncertainty.

Figure 4: Thematic ETFs have been strong performers in the Australian market during 2024.

.png)

Looking at the broader picture, the combination of strong thematic performances and broad-market stability reinforces the importance of balancing innovation with resilience. The success of the top-performing funds speaks volumes about the shifting investment landscape, where growth sectors like technology, digital assets, and infrastructure are becoming key drivers of portfolio performance.

Looking Ahead to 2025: themes and opportunities

As we enter 2025, three dominant themes are expected to shape Australian ETF portfolios, driven by structural and macroeconomic shifts.

1. Resilience in a Slowing Global Economy

With global growth expected to moderate, investors will prioritise resilience in their portfolios.

Companies with strong balance sheets, stable cash flows, and leadership in key sectors are well-positioned to withstand economic headwinds.

Technology, especially in software, is expected to remain a defensive growth area, supported by its recurring revenue business model, and ongoing digitalisation.

Innovative large-tech firms like Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN) or Apple (NASDAQ: AAPL), with their strong financial foundations and reliable shareholder returns, are poised to anchor portfolios navigating a slower-growth environment. Such businesses can be accessed via funds focusing on FANG+ companies, NASDAQ or S&P 500.

2. Pro-growth policies and AI momentum

Anticipated tax cuts and interest rate reductions are set to stimulate corporate spending and market participation. Small- and mid-cap companies stand to benefit from increased M&A activity and rising investment, offering unique growth opportunities. Artificial intelligence will remain a dominant theme, transitioning from infrastructure building to monetisable applications across industries. An example of a fund in this space is the Global X Artificial Intelligence ETF (ASX: GXAI) which offers focused exposure to companies advancing hardware, software, and AI-driven solutions.

3. Domestic resilience amid supply chain disruptions

Persistent supply chain challenges and a stronger US dollar are expected to drive reshoring and infrastructure investment in 2025. Opportunities in manufacturing, logistics, and infrastructure are poised to grow as businesses prioritise domestic production. Infrastructure-focused funds like the Global X US Infrastructure Development ETF (ASX: PAVE) provide exposure to companies modernising critical infrastructure and leading reshoring efforts, positioning portfolios to capture this structural shift.

Conclusion

The Australian ETF market is closing 2024 on a high note, driven by the complementary forces of broad-market diversification and thematic innovation. Performance leaders such as FANG, SEMI, and cryptocurrency-focused funds captured investor confidence, illustrating the appeal of transformative growth themes alongside steady core allocations.

As we approach 2025, resilience, pro-growth policies, and domestic transformation will define the next wave of investment strategies. Portfolios positioned towards these, such as FANG or GXAI, can help investors align portfolios with these emerging opportunities. By embracing both stability and cutting-edge trends, Australian investors can confidently navigate the challenges and possibilities of the year ahead.

Beyond Ordinary ETFs™

At Global X, we have an ETF lineup that spans disruptive tech, equity income, commodities, digital assets and more. Or simply put, we strive to offer investors something beyond ordinary. Discover our approach to thematic and income investing here.

3 topics

15 stocks mentioned

6 funds mentioned