3 quality ASX stocks for 2025

Last year, we wrote about three quality stocks that were well-placed to outperform in 2024: Xero (XRO), Beach Energy (BPT) and Light & Wonder (LNW). Both XRO (+50%) and LNW (+13%) outperformed the ASX200’s 7.5% return in 2024, while BPT disappointed (-10%).

XRO was the best performer, as it transitioned from a focus on unprofitable sales growth to a balance of growth and profitability. The FY24 result in May 2024 finally demonstrated the financial strength of the business and XRO achieved the aspiration of the Rule of 40 well ahead of the market’s expectations. In our opinion, XRO now sits firmly in the top quartile of high-quality businesses on the ASX.

While LNW outperformed, investors were left to lament what could have been. The company’s strong operational performance drove a 32% share price rally to the end of August 2024. However, in late September, the market was shocked by revelations that a LNW employee stole IP from rival Aristocrat to create the Dragon Train blockbuster. LNW management has attempted to remediate the situation while also highlighting its significant and diverse content library. We believe LNW will showcase the business performance beyond Dragon Train and, in 2025, deliver earnings approaching their US$1.4b target.

BPT was the worst performer. Last year, we were excited about BPT’s FCF transformation post Waitsia start-up, but disappointingly, BPT struggled to deliver the project on time and on budget. It was only in December (almost 12 months late) that Waitsia finally reached mechanical completion, and the stock had a year-end rally after a tough year. BPT is now back on the path towards FCF transformation in the second half of 2025. We do note that the share price has rallied a further 7% in January 2025.

After an eventful 2024, 2025 is likely to throw up even more surprises and challenges: a second Trump presidency, US fiscal and debt issues, stubborn global inflation and continued China and EU economic malaise.

In the face of this challenging backdrop, we believe quality investing offers a robust framework for navigating the uncertainties and capturing sustainable returns.

High-quality companies tend to outperform markets over the long term, with their quality attributes of durable competitive advantages, supportive industry structures and aligned management teams, allowing the companies to thrive regardless of the economic cycle.

At Blackwattle Mid Cap Quality, we focus on investing in high-quality businesses over the longer term. We discuss three high-quality stocks, diversified across industries, that we believe are well-placed in 2025:

Seek (ASX: SEK)

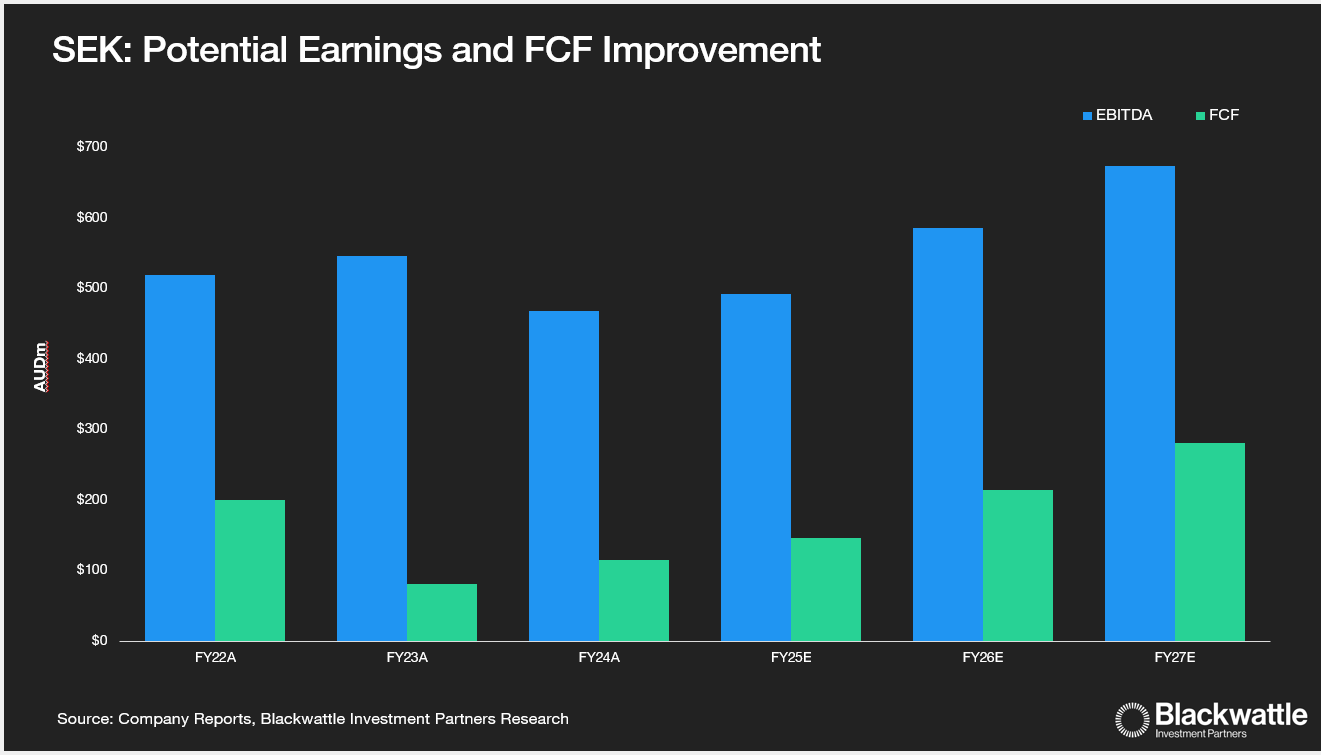

SEK is the leading online employment classifieds business in Australia. SEK was a significant underperformer in 2024 compared to technology peers, on the back of cyclical volume headwinds (reversing COVID gains) and disappointing cost control.

We see 2025 as a potential turning point for SEK. The November 2024 AGM was the first update in a few years that did not result in an earnings downgrade. SEK even slightly reduced their cost guidance range for FY25. This change has built our conviction that SEK management have finally begun to shift focus to improved cost control and shareholder returns.

Over 2025, SEK has the potential to improve earnings with strong pricing power, cost control and potential listing volume growth in the second half of 2025 (cycling 2 years of negative 15-20% listing volume CAGR). SEK also has the ability to improve the capital structure with a potential partial monetization of the SEEK Growth Fund in 2026.

We see strong upside for SEK as an ‘improving/enduring quality’ business with significant earnings and capital optionality combined with a materially cheaper valuation multiple to peers.

Block (ASX: XYZ)

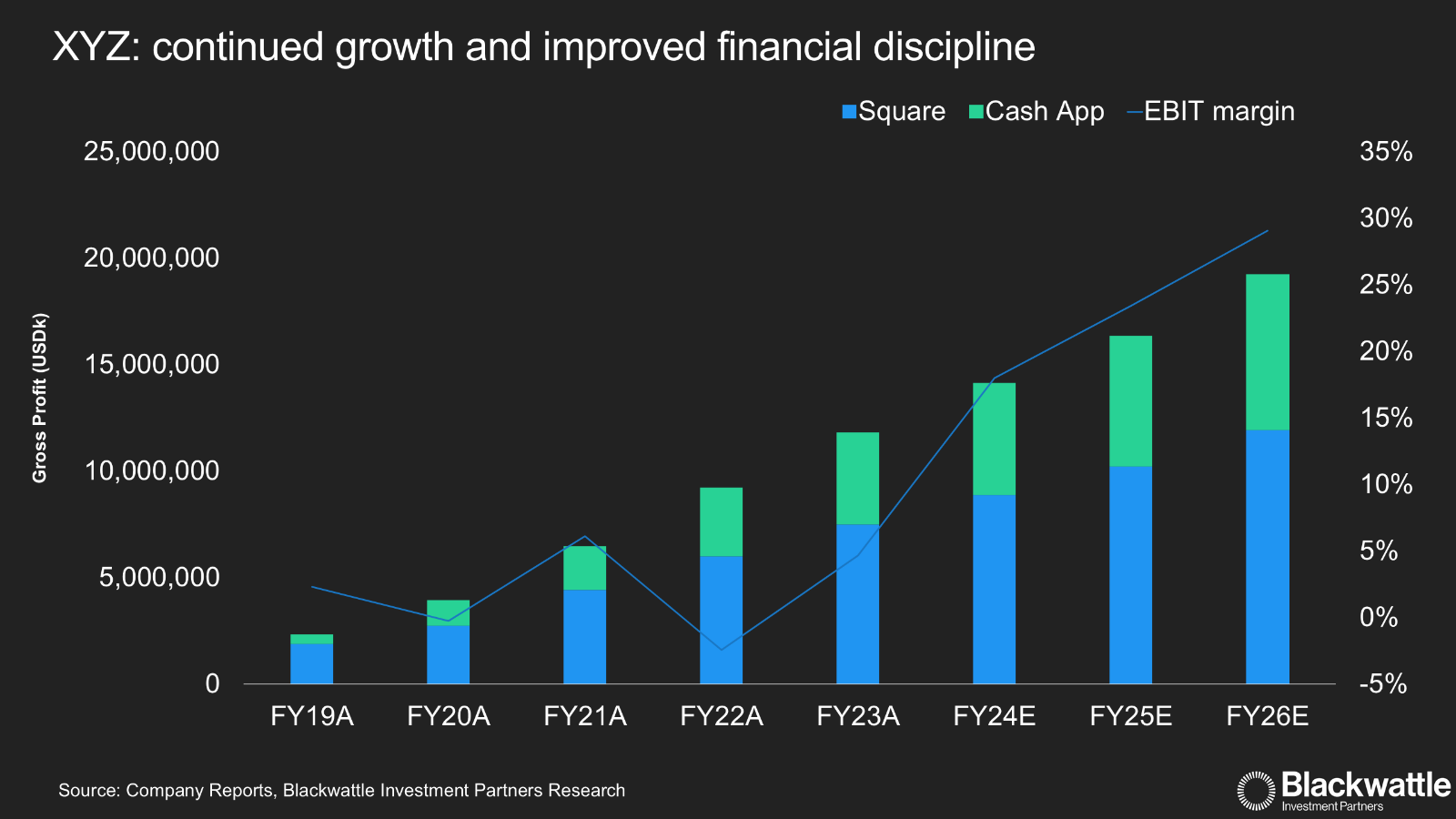

XYZ is a leading US-based fintech focused on SME payments and consumer fintech. XYZ has significantly underperformed other technology names since its 2021 peak. In response, founder and Group CEO Jack Dorsey reinstated himself as Square CEO in October 2023 with a mission to reaccelerate growth and improve financial discipline. The financial discipline included a headcount freeze over 2024, a Rule of 40 (Gross Profit growth + Operating Income Margin) target by 2026 and improved shareholder returns with share buybacks. XYZ has demonstrated strong execution through 2024, incrementally upgrading earnings guidance at each quarterly result driven by solid top-line growth and strong cost control.

We view 2025 as an acceleration of the momentum built in 2024, and believe the market is finally rewarding XYZ for this significant turnaround. Top-line growth should improve, with Square (merchant payments) rolling out improved features, in combination with Afterpay founder Nick Molnar now leading an expanded sales team to take market share. For Cash App (digital wallet for consumers), 2025 sees the launch of Afterpay on Cash App card, another leg to the monetisation of Cash App’s huge 60 million active user base.

XYZ has also maintained its strong cost discipline (headcount freeze), heading towards their Rule of 40 target at the back end of 2025, and will also ramp up shareholder returns in 2025, likely completing their US$3b share buyback. XYZ trades at a significant discount to peer valuations, providing a material valuation re-rate opportunity if XYZ can again execute.

We believe there is significant upside for XYZ in 2025 as an ‘improving quality’ business with reduced execution risk given their recent turnaround track record.

The Lottery Corporation (ASX: TLC)

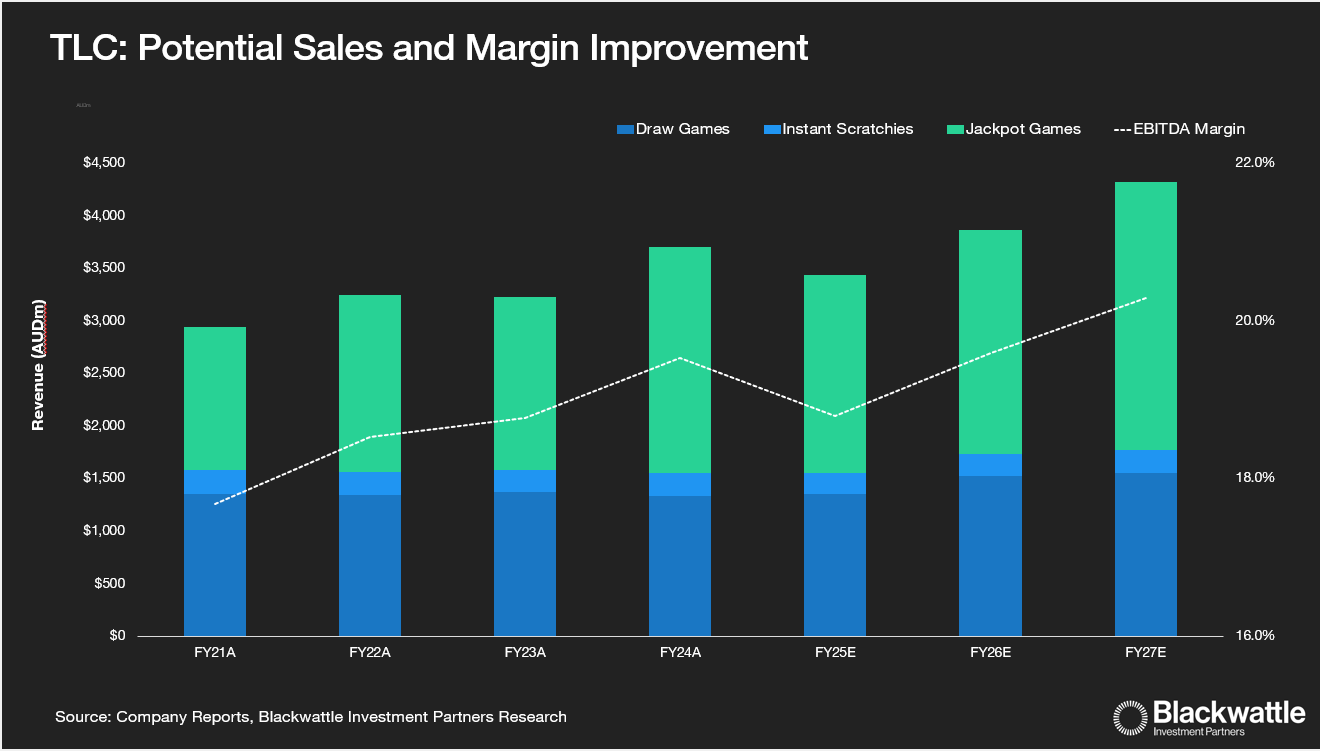

TLC is the monopoly lottery operator of the state lottery concessions in Australia (except WA). TLC has become a somewhat forgotten stock on the ASX after being spun out of Tabcorp in 2022, only periodically entering the news cycle when there is a record-breaking lottery jackpot. However, we believe TLC is one of the highest quality franchises on the ASX, as a defensive, compounding monopoly business with pricing power, product innovation, structural digital tailwinds, strong cash generation and capital optionality.

Even with TLC’s high-quality attributes, the stock has struggled recently with earnings downgrades from a poor run of luck: TLC has faced a mini jackpot drought since the $150m Powerball jackpot in May 2024. TLC’s two jackpots lotteries, Powerball and Oz Lotto, are over 50% of Lottery revenue and these sales are primarily driven by the size of the jackpot. We believe it’s a matter of when, not if, TLC receives some “normal” luck, and TLC delivers an improved jackpot sequence in line with mathematical model probabilities, which would drive earnings upgrades.

Beyond an improved jackpot run, TLC has an upcoming price increase and a potential game improvement in mid-2025 for its main non-jackpot game, Saturday lotto, which is over 25% of Lottery revenue. Price increases and shifting sales to digital allow TLC to continuously improve their margin over time. TLC also has a strong balance sheet below its target gearing, which provides capital optionality; either for an accretive deal (multi-decade extension of the Victorian lottery license expiring in 2028) or an on-market buyback.

We view TLC as one of the most attractive defensive ‘enduring quality’ stocks in the ASX for 2025.

Quality Investing

At Blackwattle, we are constantly on the lookout for these mis-priced, high-quality and improving-quality businesses with internal levers. We understand the exceptionalism of these businesses in generating significant shareholder returns, so when we do discover one, we look to become long-term shareholders and capital partners, enabling our portfolios to capture the potential long-term compounding of outperformance through market cycles.

1 topic

3 stocks mentioned