3 reasons why iron ore is falling, and why it could slash BHP’s dividend

Iron ore is big business for Australia. It’s the backbone of the WA economy both in terms of employment and royalties, and billions in royalties also flow through to the Federal Government’s budget too.

As a born and bred West-Aussie, I can tell you there’s definitely a spring in locals’ steps when the iron ore price is riding high – as it did for most of 2023. Unfortunately, that spring has largely sprung now, with iron ore prices trading well off the high above US$140/t set just at the start of this year.

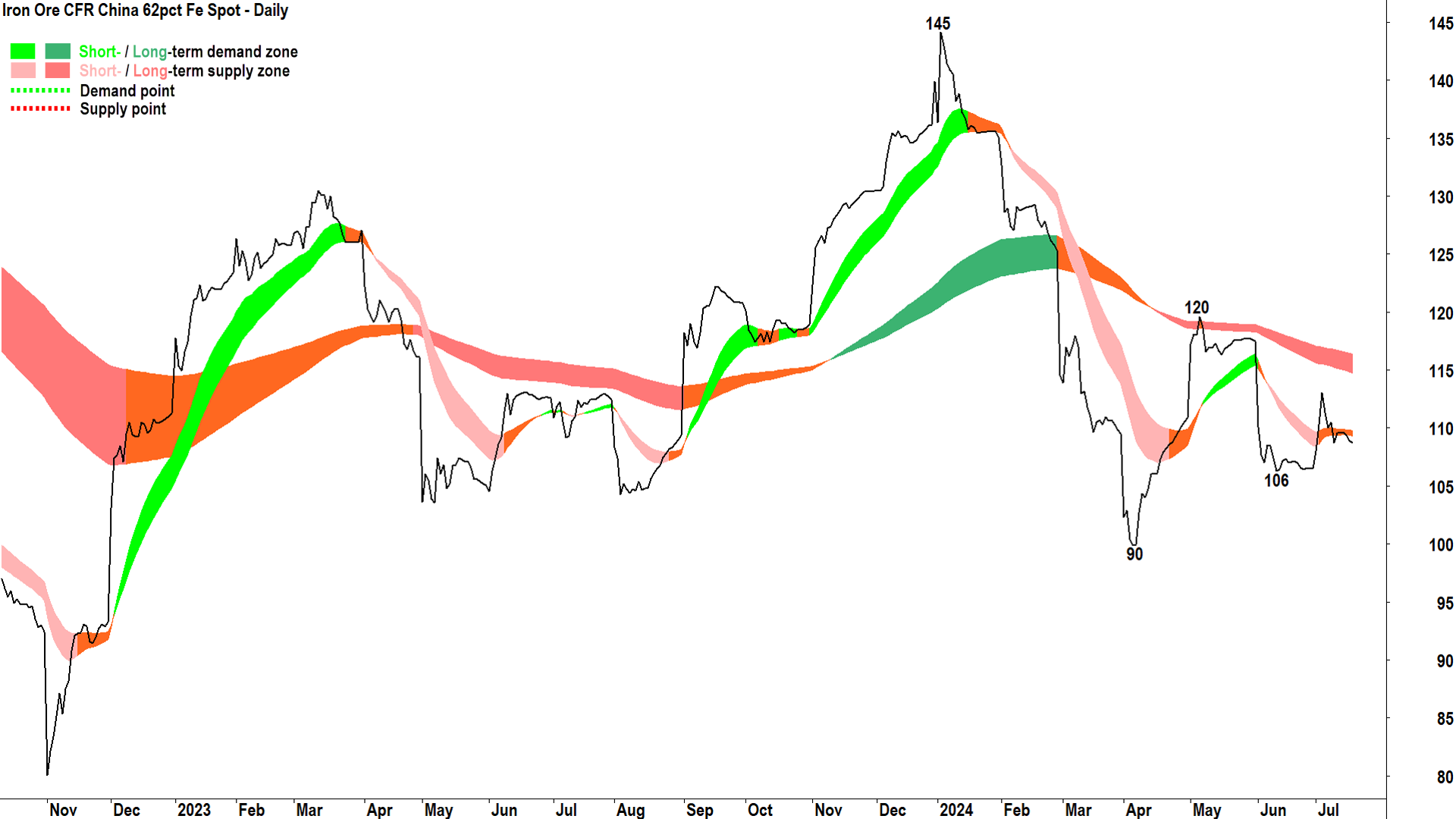

As you can see from my technical analysis chart below, the short and long term trends are firmly set to the downside. Worse, the bounce from US$106/t appears to be failing beneath the long term downtrend ribbon, and if it should break, we may see prices trickle back down toward April’s US$90/t low.

I keep a close eye on anything iron ore related that lands on my desk from the big brokers, and therefore I jumped at the chance to cover for you this latest research report from UBS on the topic called “Iron Ore & Coal Jun-24 dividends: Who is set to surprise?”.

In the report, UBS notes the “fundamental signals remains weak” for iron ore, laying the blame on three major reasons. The broker also extrapolated the impact of continued iron ore price weakness on the dividends on our two biggest iron ore miners BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO).

3 reasons why the iron ore price is falling

Reason 1: China port inventories are increasing and are at an elevated level

Iron ore is a key ingredient in the steel making process, and China is the world’s dominant producer. According to the World Steel Association, it was responsible for approximately 55% of global production in 2023, but this was down 7% on the previous year.

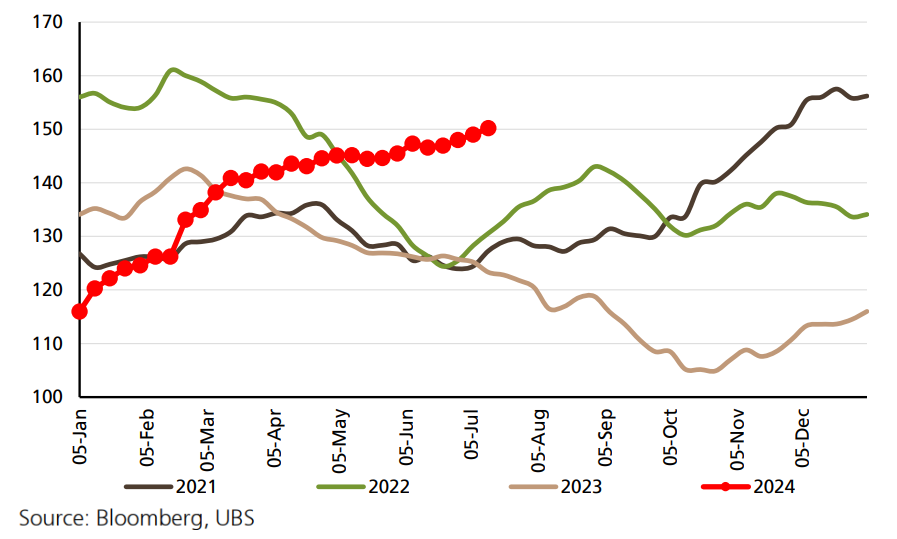

For this reason, China is crucial to the iron ore price equation. In this figure, UBS plots the level of port inventories in China over the last 4 years. Higher inventories tend to be bearish for the iron ore price because steel producers are more inclined to run down stocks than acquire new ore.

Note that inventories are both rising and at a high level compared to previous years. Also, they’re high at what tends to be a usual low point from a seasonal perspective. Chinese steel production is highly seasonal, and inventories are usually being drawn down around this time of the year due to the peak spring production period.

Reason 2: China steel production is off to a weak start in July and is down compared to last year

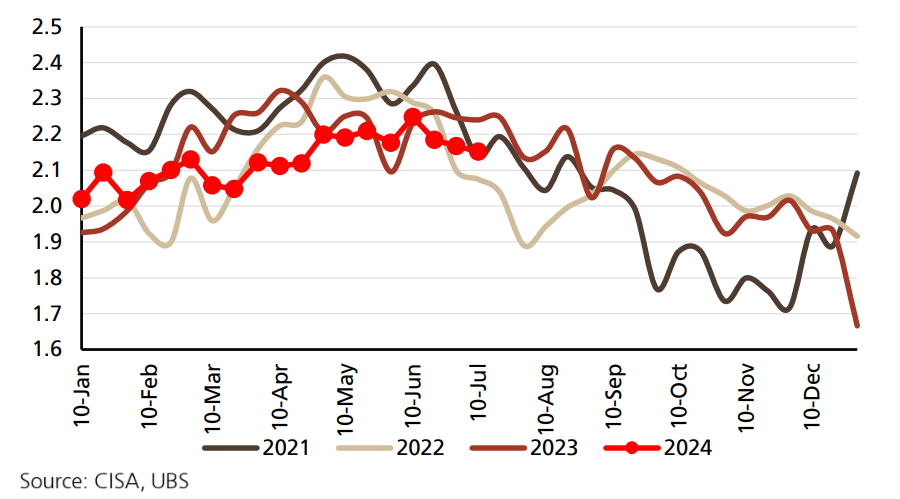

Moving to steel production itself, it’s been a slow start to the peak spring production period, with production down for the first 2 weeks of July, and also weaker compared to this time last year.

In this figure, UBS plots China’s steel production on a rolling 10-day basis. Production is down from 2023, but is roughly the same as 2022, and is slightly above 2021. In terms of seasonal trends, note the typical rise into the spring peak was well down on previous years.

Reason 3: Global iron ore supply is robust with shipments from traditional markets increasing year to date

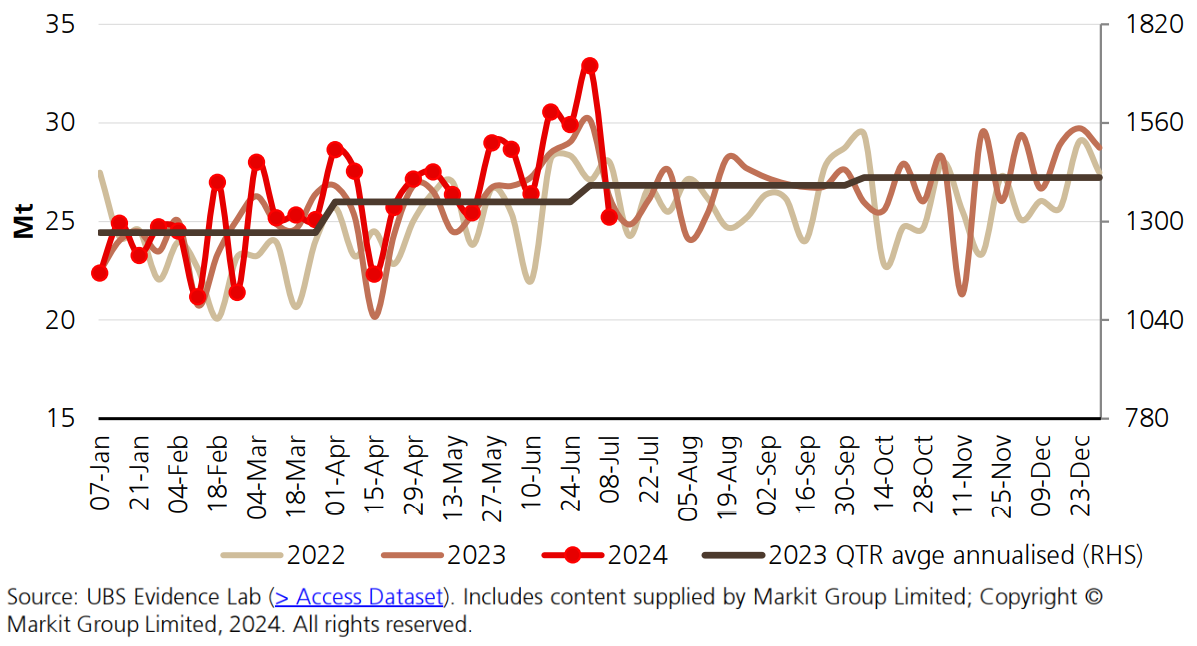

Commodity prices are derived from market demand versus market supply. We’ve discussed the demand side factors contributing to a weak iron ore price, but UBS suggests there’s a double-whammy coming from the supply side also. The broker notes that supply from traditional markets like Australia, Brazil, and South Africa are up 4% to the week commencing 8 July on a rolling basis.

In this figure, UBS plots weekly iron ore shipments from major global producers in Australia, Brazil, and South Africa. Because this is a supply-side chart, bullish indications come from the plot line being as low as possible (compared to lower readings equating to bearish indications in the demand-side charts above).

It does appear that the plot line has taken a steep downturn at the start of July, but this is typical for this time of the year (iron or supply is also very seasonal!). The key to understanding this plot is that iron ore shipments, that is supply, has not taken a backward step despite growing demand-side concerns.

Basic economic theory suggests that if supply remains robust during a period of subdued demand, price will typically fall.

BHP & RIO dividend impact

It’s not a pretty picture for the outlook for the iron ore price. If you’re a sandgroper like me, you’re probably thinking about putting your house up for sale and moving East! (No, it could never be that bad!)

It might not be so bad for the two major Aussie iron ore producers, though, suggest UBS. BHP’s dividend is likely to be lower than it was in 2023, but it’s still going to pay out a whopping US$3.5 billion in dividends – and that's just for the current June half. Rio’s payout is likely to add around US$3.1 billion to shareholders’ coffers.

BHP’s final FY24 dividend should be US$0.69 cents, says UBS - well down from FY23’s corresponding US$0.80 cents. This means for the whole of FY24, BHP would have paid out a total of US$1.41 or $2.10 Australian at current exchange rates ($0.67). This puts BHP on a dividend yield of 5.0% for shareholders that held through FY24.

In contrast to BHP, UBS tips RIO’s final FY24 dividend is going to increase. RIO is going to pay a final FY24 dividend of US$1.93, the broker says, up from the US$1.77 it paid for the second half of FY23. RIO’s total FY24 dividend therefore would be US$4.51 or $6.73 Australian, putting it on a FY24 dividend yield of 5.9%.

I suggest both dividend yields remain robust compared to the S&P ASX 200 forecast FY24 dividend yield of around 3.5%. Both dividends are also expected to be fully franked.

This article first appeared on Market Index on Monday 22 July 2024.

5 topics

6 stocks mentioned