3 reasons why real estate debt appeals to income investors

.png)

Freehold Investment Management

Real Estate debt has been one of the faster-growing property asset classes in recent years. Here, I discuss the growth and why it's an attractive option for investors that are seeking yield in this current low-interest rate environment.

Freehold estimates that there is currently circa $10 billion invested across Australian real estate debt deals by the non-bank sector, with continuing demand for future growth. This figure excludes the direct investments by big super funds and the larger offshore funds. The non-bank finance sector in Australia is relatively small by global standards but has grown over the past four years in response to APRA imposed restrictions on the banking sector.

Drivers behind the growing investment in real estate debt

Real estate debt's growing importance since the GFC as an asset class can be attributed to two key factors - the ongoing demand for debt finance from real estate developers and hunt for yield by investors. A simple supply-demand issue. There has been no let-up in demand for finance from developers, particularly across the east coast of Australia. The residential demand dynamics remain strong. This comes partly from a combination of low unemployment and population growth and more recently, as a result of the loosening of credit, with auction clearance rates back to the healthy levels seen in mid-2017. Rental growth also remains positive following the recent residential price increases, growing at around 1% nationally, although still below 2017 levels.

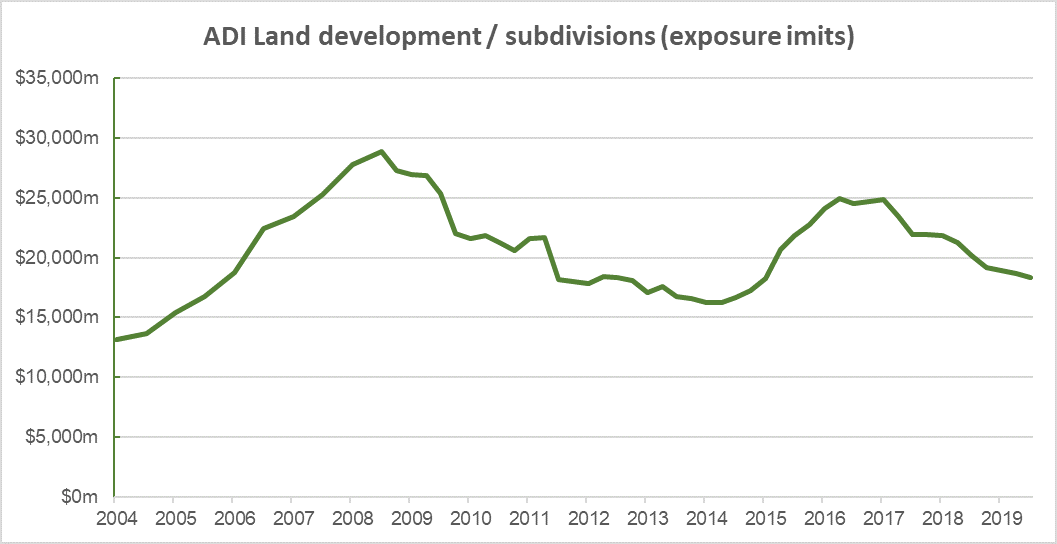

Despite this demand, there has been a pull-back from real estate debt by Authorised Deposit Taking Institutions (ADIs), as illustrated in the chart below. The trend started post-GFC at the corporate and institutional side and more recently, has impacted the consumer end of the market as a result of ASIC and APRA's moves post-Hayne Royal Commission.

Source: Quarterly ADI Property Exposures, APRA September 2019

New housing supply across the east coast has been restricted as a consequence of the reduction in bank loans and despite the growth in the availability of non-bank finance over the last few years. Illustrating this, the total number of Sydney and Melbourne building approvals declined 27% and 26%, respectively, over the year to September 2019.

So let's explain Real Estate debt and its attractiveness.

1) Capital secured by underlying real estate

From an investor's perspective, real estate debt is not dissimilar to traditional bank debt.

The lender, in Freehold's case, the fund, provides capital to finance the purchase of an asset, or for the development or redevelopment of an asset and in return, receives interest on the loan. The interest on the loan is either paid to the lender monthly, quarterly, or capitalised and paid at the end of the loan term.

The underlying real estate will secure the capital provided, and the level at which the loan is secured against the underlying asset – senior, subordinated, or unitranche (a hybrid of the two) will have a material impact on the interest paid. Put simply, the higher the level of security, the lower the interest paid.

Many real estate debt investments will offer enhancements such as the provision of corporate and director guarantees by the asset promoters. In most instances, the personal guarantee should be regarded as limited in terms of financial value, but important in terms of alignment. For the Freehold Debt Income Fund, we have structured covenants in place, along with active management to ensure, for example, that the project is progressing according to plan. Additionally, we try to have a clear line of sight to exit – that is, getting your capital plus interest back with plenty of headroom.

2) Attractive returns

Historically, private debt (and real estate debt as a sub-class) has largely been an opportunity for family offices and large institutional investors due to the deal sizes and typically, its lack of liquidity. This is rapidly changing.

Several new managers, listed vehicles, and the transition by syndicators from real assets to debt syndicates, are now offering investment options to SMSF and self-directed investors who are attracted to real estate debt because of the attractive returns available that offset the yield loss in direct assets and deposits - typically yields are about 7% above the current bank deposit rates.

3 ) A positive demand outlook

In recent years, increasing amounts of capital have been allocated to Australian senior real estate debt from non-bank lenders. Notwithstanding this, we are continuing to see a strong debt pipeline with attractive risk-adjusted return characteristics.

On the residential front, our development partners are seeing higher demand for purchases of completed dwelling in comparison to off-the-plan purchases. This is partly due to past concerns about apartment construction standards following several recent construction failures, including faulty cladding and structurally unstable foundations. State governments have now implemented a range of new initiatives to reduce the risks for off-the-plan purchasers and the chance of sub-standard construction of new buildings that, over time, will change views.

Additionally, there has been a more consistent demand for low-end and ultra-high-end dwellings and the areas located nearer to existing infrastructure or proposed infrastructure spending, continue to see higher demand. First home buyers now comprise a larger share of new home purchasers.

In terms of pre-sales risk, residential pre-sale default rates remain at acceptable levels, anecdotally well below 10%.

Our views are that this ongoing market support is primarily driven by the reduction in regulatory-led credit restrictions throughout 2019, plus the continued strong market fundamentals. We believe the residential markets in our core sub-regions in Sydney and Melbourne have limited price downside from the current levels. The obvious caution, is if any upside is capped by affordability issues or, more apparent global economic headwinds.

Focus on capital preservation and regular income

Decades of diverse experience come together to provide stable and reliable returns. We are specialist providers and managers of domestic property and infrastructure with highly differentiated client service. Learn more about our strategy.

Click to 'FOLLOW' button below to be notified when I publish my next wire.

1 topic

.png)

Omar has over 15 years' experience across funds management and real estate. His experience extends across structuring, due diligence, capital raising, as well as managing and growing funds management businesses.

Expertise

.png)

Omar has over 15 years' experience across funds management and real estate. His experience extends across structuring, due diligence, capital raising, as well as managing and growing funds management businesses.

.png)