3 shock absorbers for investors expecting turbulence

The S&P/ASX 200 and S&P 500 are both on track to surpass record highs. While markets recovered quickly from the recent market rout, some investors have been slower to regain confidence with slim risk compensation priced in.

Numerous economic and geopolitical risks continue to remain on the horizon and are keeping many people up at night, not just investors.

While the markets were quick to course-correct from the recent volatility spike, we know some investors anticipate more turbulence. We believe allocations to gold bullion and global healthcare, infrastructure and gold equities are well placed to minimise the impact of any unexpected developments.

Healthcare, infrastructure and gold miners stand out from broader equities due to their relatively stable earnings growth profile. We also like gold bullion as a portfolio diversifier and hedge against inflation and geopolitical disruptions.

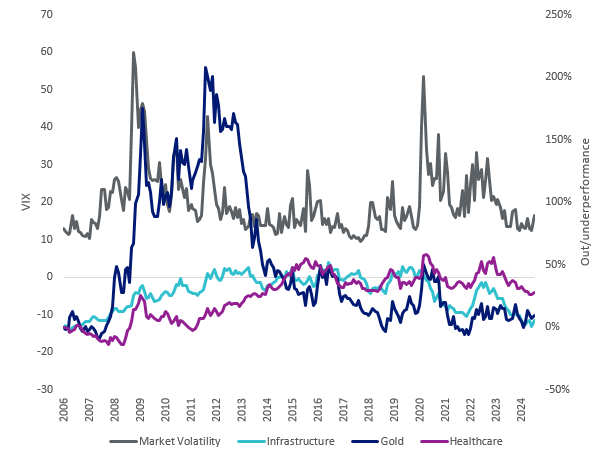

Defensive strategies (gold bullion, global infrastructure and healthcare) have outperformed relative to MSCI World when market volatility increases

.png)

Source: Bloomberg, VanEck. Data as of 20 August 2024. Market Volatility as Chicago Board Options Exchange Volatility Index, Infrastructure as FTSE Global Core Infrastructure 50/50 Index, Gold as LBMA Gold Price PM USD, Health Care as MSCI World Health Care Index. Past performance is not indicative of future performance. You cannot invest in an index.

Global equity/alternatives allocations

Healthcare

Serving a basic need, healthcare has a relatively low correlation with the state of the global economy. Structural growth is supported by ageing demographics (over-65s set to more than double by 2050[i]), the prevalence of chronic diseases, and growing healthcare expenditure by emerging economies. Global healthcare has been very attractive for long-term returns; only the technology sector has performed better since 2008.

Infrastructure

Critical infrastructure remains essential despite tough economic conditions. An estimated US$69.4 trillion in aggregate spending is required to meet population growth[ii], and US rate cuts bode well for utilities in particular due to heavy reliance on debt financing. Demand for infrastructure assets from super funds is expected to grow given the favourable risk/return profile and investment life (30+ years). Significant infrastructure investment is needed for nations with emission reduction goals by 2030[iii].

The biggest Australian companies in healthcare and infrastructure are CSL (ASX: CSL), a global leader in biotechnology and Australia’s third largest listed company, and Transurban Group (ASX: TCL), which develops and manages toll road networks in Australia, USA and Canada.

However, the health and infrastructure sectors are relatively small in Australia.

Investors can best take advantage of the defensive characteristics of healthcare and infrastructure through a diversified global portfolio. The VanEck FTSE Global Infrastructure (Hedged) ETF) (ASX: IFRA) gives investors currency-hedged exposure to more than a hundred listed infrastructure companies around the world. The VanEck Global Healthcare Leaders ETF (ASX: HLTH) offers a diversified portfolio of 50 of the largest international companies in healthcare across sub-sectors such as pharmaceuticals, equipment and supplies, life sciences and biotechnology.

Gold bullion and equities

We’ve seen record-breaking gold prices multiple times this year and expect the rally will continue with weakening in the US Dollar, ongoing geopolitics and central banks reportedly looking to increase gold reserves. Historically, the price of gold has increased an average of 15% in the year following the start of a Federal Reserve rate-cutting cycle [iv].

Another opportunity is gold mining stocks, which traditionally outpace the price movements of gold. While gold stocks reported a net positive for quarterly earnings as of 31 July 2024, prices remain well below historic peaks.

To gain exposure to gold price movements, consider the VanEck Gold Bullion ETF (ASX: NUGG), which gives investors investment in physical Australian-origin gold bullion bars and is redeemable at an Australian vault. Additionally, the VanEck Gold Miners ETF (ASX: GDX) is the largest gold miners ETF in the world.

For more insights from VanEck, visit our website here.

5 topics

6 stocks mentioned

4 funds mentioned