4 high growth ETFs for 2024

When a severe recession was the base case of the global investing community and interest rates were increasing by multiples of 25 basis points at a time, investors were rushing into defensive investments and paying huge premiums as a result.

Now that we are near or at the peak for this part of the interest rate cycle, however, investors are slowly but surely dipping their toes back into growth. And that's especially true for investors who believe that rate cuts are coming as soon as the second half of next year.

With this in mind, the teams at Betashares and Global X have each put forward two ETF products that could provide strong capital growth in 2024. And while some of these products are aimed at investing in American mega-cap tech stocks, others provide exposure to burgeoning equity markets in other parts of the world.

This wire is part of a series we are running with both Betashares and Global X. Future pieces in the series will focus on income investing and thematic investments.

ETFs Featured in this Piece:

- Global X US 100 ETF (ASX: N100)

- BetaShares NASDAQ 100 ETF and BetaShares NASDAQ 100 ETF - Currency Hedged (ASX: NDQ and ASX: HNDQ)

- Global X ETFs Australia-NAM India Nifty 50 ETF (ASX: NDIA)

- BetaShares Japan ETF - Currency Hedged (ASX: HJPN)

Getting exposure to the American mega-cap tech stocks

Global X US 100 ETF

When investors think of stocks that have huge growth potential, they often think of the American mega-cap tech stocks. In 2023, "The Magnificent Seven" each returned, on average, around 90%, with chipmaker NVIDIA returning approximately 240% in the last calendar year alone. Indeed, The Magnificent Seven could be viewed as the "established" choice for investors seeking growth worldwide.

"The 100 largest non-financial companies listed on the US Nasdaq exchange performed very well in 2023, buoyed by mega-cap growth. The year consisted of relative resilience in the US economy, decreasing inflation, weakening labour stats, and long-term interest rates down materially from their peak. Add it all up, and a soft landing is not out of the question," Global X Senior Product and Investment Strategist David Tuckwell said.

"As we head into 2024, investors have cause for optimism as increasingly favourable market conditions suggest the potential for continued growth for innovative companies. Additionally, artificial intelligence (AI) looks as though it will be an ongoing point of growth for the ‘Magnificent Seven’ and other US-listed companies. Already in 2023, we saw their leap into AI pay off as these stocks gained 102% on average for the year through December 11. More companies will likely grow thanks to the increased adoption of AI, from those directly involved in its development and manufacturing to industries that stand to benefit from its implementation like agriculture and healthcare," Tuckwell added.

The Global X US 100 ETF (ASX: N100) tracks the Global X US 100 Index to capture the performance of the largest 100 companies listed on the Nasdaq exchange (excluding financials and REITs) to provide investors with exposure to a core portfolio of high-growth technology stocks driving the strongest gains in the world’s largest share market. N100 is market cap weighted meaning it has and should continue to benefit from the growth of the ‘Magnificent Seven’ which make up a significant portion of the index, as well as other large-cap technology-focused stocks.

- Top five holdings: Apple, Microsoft, Amazon, NVIDIA, Alphabet

-

Index: Global X US 100 Index

- Inception date: 21 August 2023

- Management fee: 0.24% per annum - The new index represents the most affordable ETF of its kind in Australia with a management fee of 0.24% per annum – up to half of what customers are paying for other similar ETFs quoted on the ASX.

Betashares NASDAQ 100 ETF

In contrast to Global X's offering, Betashares' product tracks the NASDAQ 100 directly. The Betashares Nasdaq 100 ETF (ASX: NDQ), has returned 19% p.a. over the last five years and has been the best-performing Australian equity fund including listed, unlisted, active and passive strategies over that period.

"Home to the world’s largest technology companies, such as Microsoft (NASDAQ: MSFT), Google (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN), the Nasdaq 100 has significant exposure to the areas driving the greatest growth for companies globally like cloud computing, robotics, and artificial intelligence," they say.

"Dubbed a research and development (R&D) powerhouse it comes as no surprise that the Nasdaq’s constituents are some of the world’s most innovative companies with five of the largest seven R&D spenders globally featuring in the index. In 2023, companies in the Nasdaq 100 spent 7x the amount on R&D than companies in the S&P 500 (when excluding Nasdaq 100 constituents)," the Betashares team say.

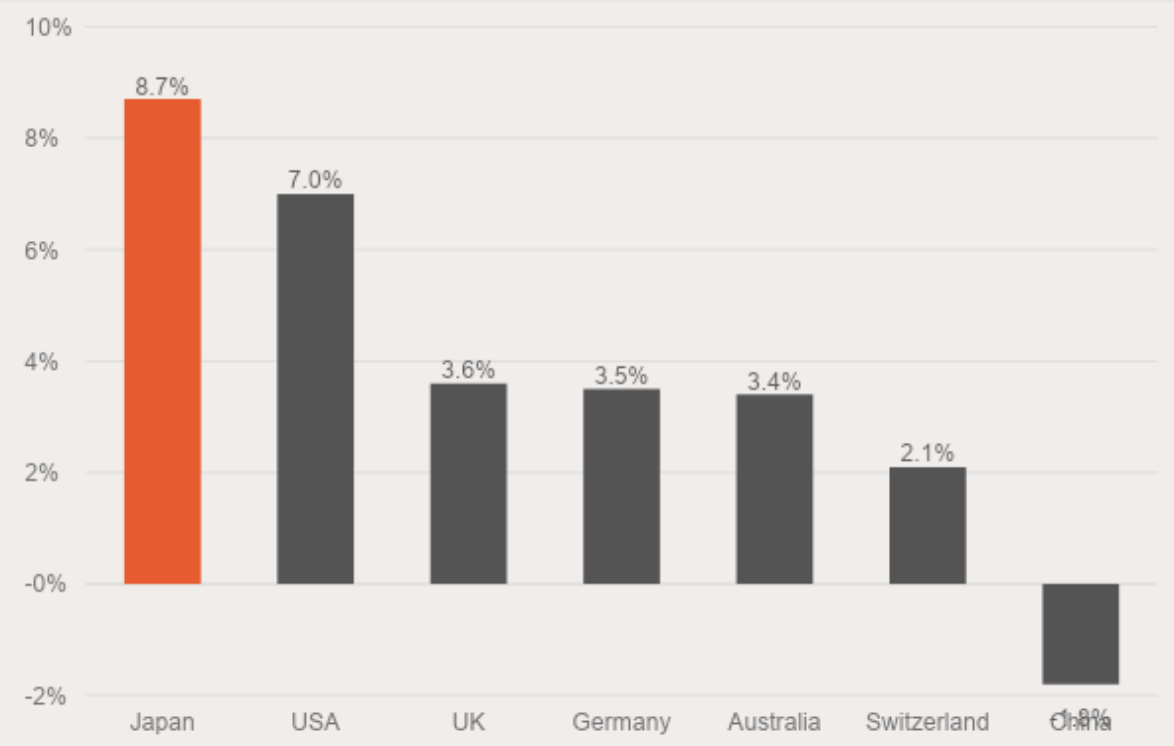

Looking ahead, the Nasdaq 100 has consensus earnings growth of 13.4% p.a. through 2025. This is the highest amongst developed market indices, with the second highest being Japan’s TOPIX at 8.7% p.a. Over the same period, Europe’s STOXX 600 expects 4.2% p.a., while our own S&P/ASX 200 is only expected to grow earnings at 0.5% p.a.

Developed market consensus earnings growth

Source: Bloomberg. As of 4th December 2023.

For Australian investors, the Nasdaq’s technology focus can act as a diversifier as the S&P/ASX 200 only has a 2% allocation to the technology sector.

For those considering currency risks, Betashares also offers a currency-hedged version (ASX: HNDQ).

- Top five holdings: Apple (NASDAQ: AAPL), Microsoft, Amazon, NVIDIA (NASDAQ: NVDA), Meta Platforms (NASDAQ: META)

-

Index: Nasdaq 100

- Inception date: 26 May 2015

- Management fee: 0.48% p.a.

- Currency hedged: Betashares Nasdaq 100 – Currency Hedged (ASX: HNDQ)

- Investment risks include: market risk, country risk, currency risk and sector risk

There's more in Japan than just the Warren Buffett Effect

Betashares Japan ETF - Currency Hedged

The Japanese stock market came back into vogue in 2023 after many years in the wilderness. Sluggish corporate earnings growth, a lack of corporate governance, difficult demographics, and a Bank of Japan that couldn't fend off deflation were all reasons why Japan was - to quote Lazard Asset Management - the "easy underweight" in global equities for many years.

Then, seemingly out of nowhere, this headline hit the press:

The moves from the Oracle of Omaha sent Japanese stocks north - so far north that the TOPIX ended 2023 as the best-performing asset class in 2023.

But Betashares think there is more on the horizon.

"The Japanese share market has been long-suffering. It’s still trading below its peak from 34 years ago, but under the surface, reforms have been restructuring the region’s corporations to foster a new era of growth," they say.

"Acknowledging historical weakness in corporate governance and a lack of shareholder value creation, the Japanese government has been mandating corporations to improve for over a decade. Companies have been expected to strengthen board independence, enhance shareholder rights, and encourage greater disclosure and transparency among other initiatives to encourage domestic and foreign investors. Most recently the Tokyo Stock Exchange weighed in on these reforms and gave companies an ultimatum – enhance corporate value over the mid-to-long term, specifically by bringing P/B ratios above 1x, or risk delisting," they add.

The response has been swift:

- Record levels of share buybacks and dividends.

- Dividend growth of 10% p.a. over the past decade.

- The highest level of CAGR EPS over the past 10 years (in local currency).

- The second-best performing broad market developed world index in 2023.

And even despite the rally we saw last year, the Japanese market is still trading at a P/E ratio of 15.2x, compared to 18.6x for the MSCI World, and earnings are expected to grow at 14.8% p.a. over the next two years, compared to 11.8% for the MSCI World.

Select developed country trailing EPS 10-year CAGR (local currency)

Source: Morgan Stanley Research, Datastream, MSCI. Note EPS is calculated in local currency. Based on MSCI indices.

Betashares has a Japan-centric ETF in its stable. The Betashares Japan ETF, Currency Hedged (ASX: HJPN) has been the best-performing Japanese equities ETF in Australia over the past one, three, and five years, outperforming the TOPIX Index by 4% p.a. over the last five years.

"With a thoughtful investment approach favouring Japanese exporters and a currency hedging strategy applied, HJPN benefits from the relatively weak Japanese Yen and structurally lower interest rates in the Japanese economy – currently generating an additional 5.53% p.a. in returns from currency hedging carry," the Betashares team say.

Some of the fund's top holdings include Japan's most well-known multinational firms and conglomerates like Toyota, Sony, Mitsubishi, Keyence, and Tokyo Electron.

- Top five holdings: Toyota, Sony, Mitsubishi, Keyence, Tokyo Electron

-

Index: S&P Japan Exporters Hedged AUD Index

- Management costs: 0.56% p.a.

- Inception date: 10 May 2016

- Currency hedged

- Investment risks include: market risk and country risk

The new China?

Finally, if China's reopening was the great disappointment of 2023, then the surge in Indian equities could take the title for the biggest positive surprise. Indian stocks finished 2023 up by nearly 20% and at all-time highs. And there may be more to come in 2024.

"Global X believes India is one of the best structural opportunities in the world which is backed by significant economic, social and political drivers," says Tuckwell.

"Despite India offering many growth opportunities, accessing its share market is quite difficult for individual, international investors due to regulations. Hence, ETFs which are domiciled in Australia help remove these barriers to entry in an accessible, cost-effective vehicle," Tuckwell adds. The Global X India Nifty 50 ETF (ASX: NDIA) was the first and remains the only ETF in Australia tracking the NSE Nifty50 Index.

On the macro front, India had a stellar 2023 compared to many other countries, with the country’s third-quarter GDP jumping to 7.6% - well over the 6.5% that was projected by the Reserve Bank of India and international analysts. In addition, India has overtaken China and now has the largest population in the world, with 65% of people being younger than 35 years old. Although Indian GDP continues to benefit from increasing manufacturing, exporting, government spending, and private investment, the Global X team are most encouraged by the long-term prospects of the country’s domestic consumption opportunity.

"As investors, we are comforted not only by these powerful tailwinds but also by the fact that India relies on a democratically elected government. As Prime Minister Modi likes to say, India is the world’s largest democracy. While development across India has happened unevenly amongst the different states, which has raised political concerns, we believe that India will ultimately resist centralising power like neighbouring China and remain democratic, as it is likely the best way to maintain a unified India due to the massive diversity across languages, religions, and caste distinctions," Tuckwell says.

- Top five holdings: HDFC Bank, Reliance Industries, ICICI Bank, Infosys, Larsen & Toubro

- Inception date: 19 June 2019

- NDIA was the first ETF to provide Australian investors passive access to the Indian market and it remains the only fund tracking the Nifty 50.

- Management fee: 0.69%

- AUM: More than $80 million (as at 15 December 2023)

2 topics

11 stocks mentioned

5 funds mentioned

1 contributor mentioned