4 reasons why income investors should look to stocks and bonds (not cash)

Many investors have been attracted by the high rates available on cash in recent years. 5% rates in the US and UK and 4% in Europe have been a dramatic change from the near-zero on offer for most of the previous decade. Cash now not only provides investors with a store of nominal value and liquidity but has recently been providing a positive real return.

While the appeal of cash has grown, it is not as “low-risk” as it first seems.

In this wire, we look at popular assets that are often invested in for income and assess the attributes and risks that each entails. When it comes to generating income, there are four major risks which influence outcomes:

- Reinvestment risk

- Inflation risk

- Fundamentals risk

- Volatility risk

Yields of dreams?

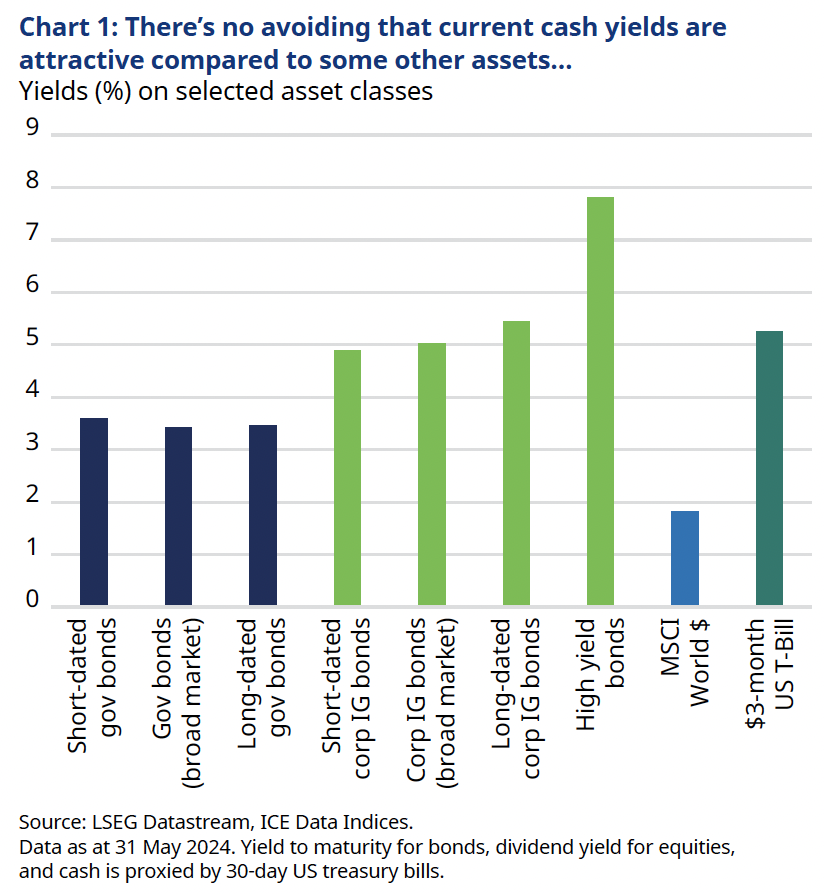

There’s no avoiding that current cash yields are attractive compared to some other assets. Cash (as proxied by 3-month US Treasury Bills) is yielding higher than many government bonds and similar levels to many corporate bonds. However, while cash can play an important role in portfolios for many investors, it is not the low-risk asset that investors might think.

Inflation risk

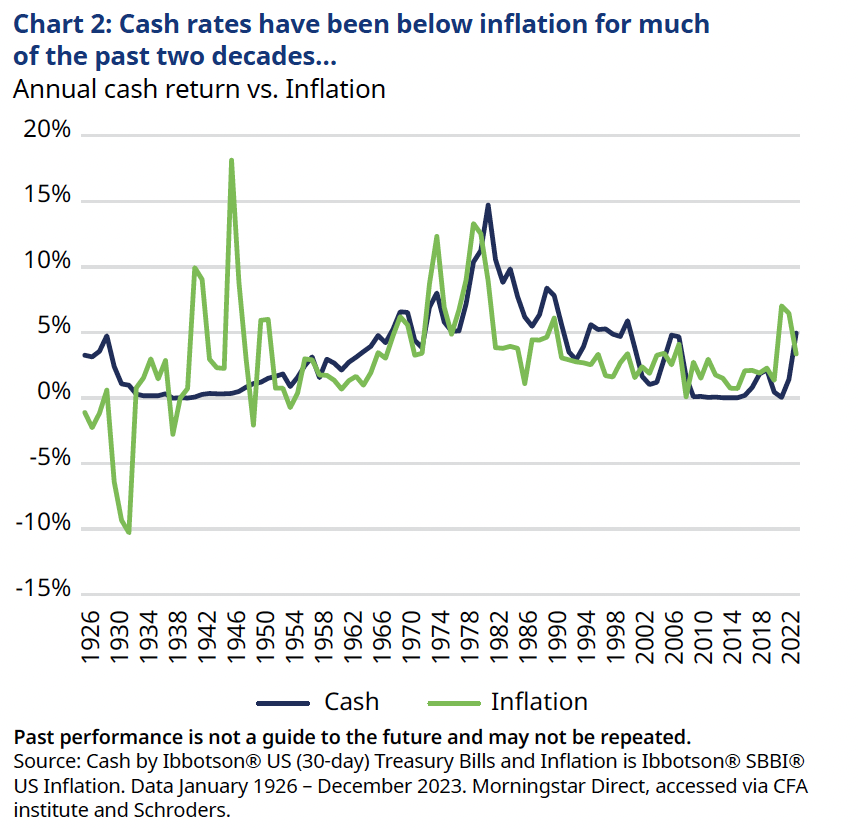

A 5% cash rate may look appealing, but if inflation runs higher, then the real value of that cash holding falls.

Cash rates have been below inflation for much of the past two decades. Source: Schroders

In the past, cash rates often exceeded inflation but that hasn’t been the case for a long time (see above). On a 10-year horizon, cash has beaten inflation 55% of the time since 1926. But most of this is driven by data further back in history, the last 10-year period in which cash beat inflation was from 2000 to 2010.

When it comes to beating inflation, equities have outperformed both bonds and cash. In the long run, both in terms of inflation-beating returns and the odds of outperforming inflation, equities have beaten bonds, which in turn, have beaten cash.

Equities have generated a return above inflation for various look-back periods, whether that be in the last 5 years (around 12%) or 50 years (around 7%). Over longer look-back periods such as 20 or 50 years, bonds have also delivered a greater than inflation return. Within bonds, corporate bonds have tended to beat inflation by more than government bonds.

Reinvestment risk

Reinvestment risk is where the investment horizon is longer than the period the income is locked in for. The longer the maturity of the investment, the lower the reinvestment risk.

For long-term investors, cash doesn’t provide a stable or predictable income stream. Interest rates on cash are not constant over time.

In contrast, bonds lock in yields for longer. For example, investment-grade corporate bonds are currently yielding around 5-6% with an average maturity of 9 years. And given extremely low default losses, for long-term investors who are less concerned about short-term price movements, these may be an attractive option.

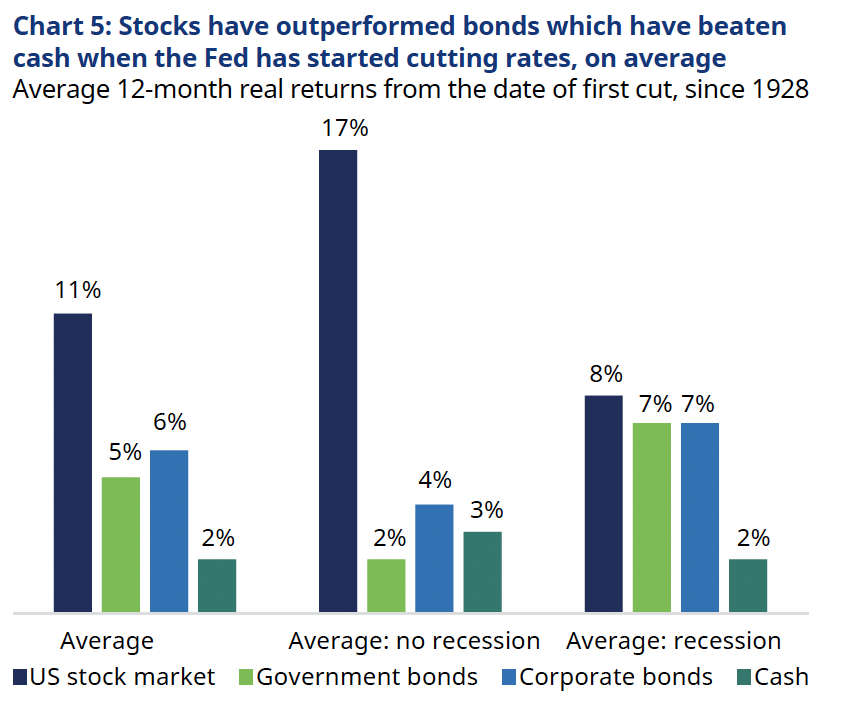

And when central bank policy rates start to fall, stocks have outperformed bonds which have beaten cash. In the 12 months after the Fed commenced cutting interest rates, the average return from US stocks has been 11% ahead of inflation. Stocks have also outperformed government bonds by 6% and corporate bonds by 5%, on average. Stocks have on average beaten cash by 9% in the 12 months after rates start to be cut.

Source for return data: CFA Institute Stocks, Bonds, Bills, and Inflation (SBBI®) database, and Schroders. Source for Fed Funds data: Post-1954 is direct from FRED. Earlier data is based on the Federal Funds rate published in the New York Tribune and Wall Street Journal, also sourced from FRED. An approach consistent with that outlined in A New Daily Federal Funds Rate Series and History of the Federal Funds Market, 1928-54, St Louis Fed, has been followed. For that earlier data, a 7-day average has been taken to remove daily volatility i.e. the month-end figure is the average in the 7 days leading up to month-end.

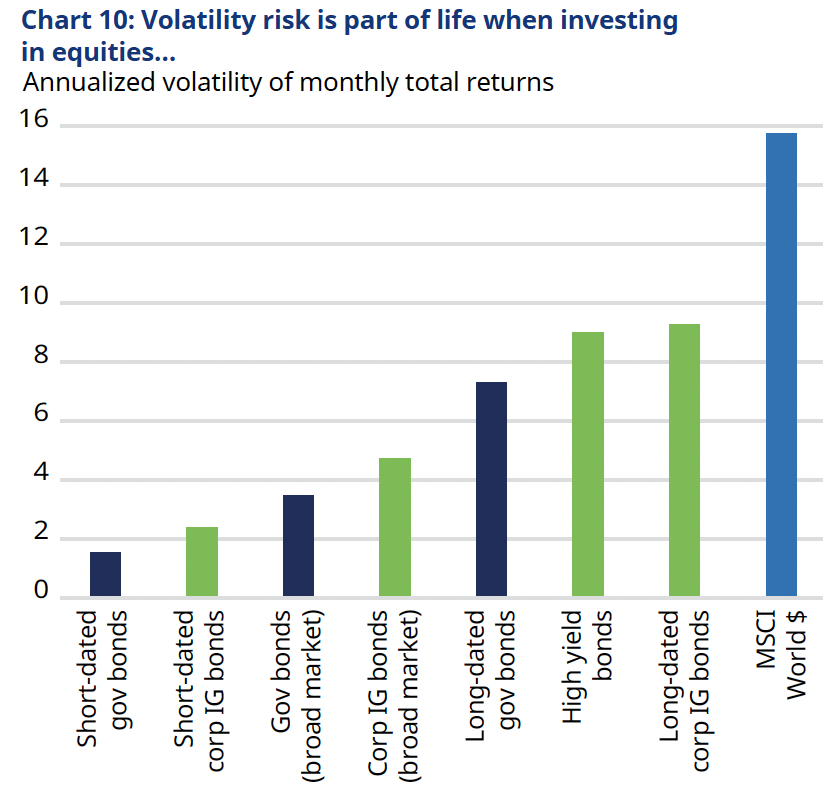

Volatility risk and fundamentals risk

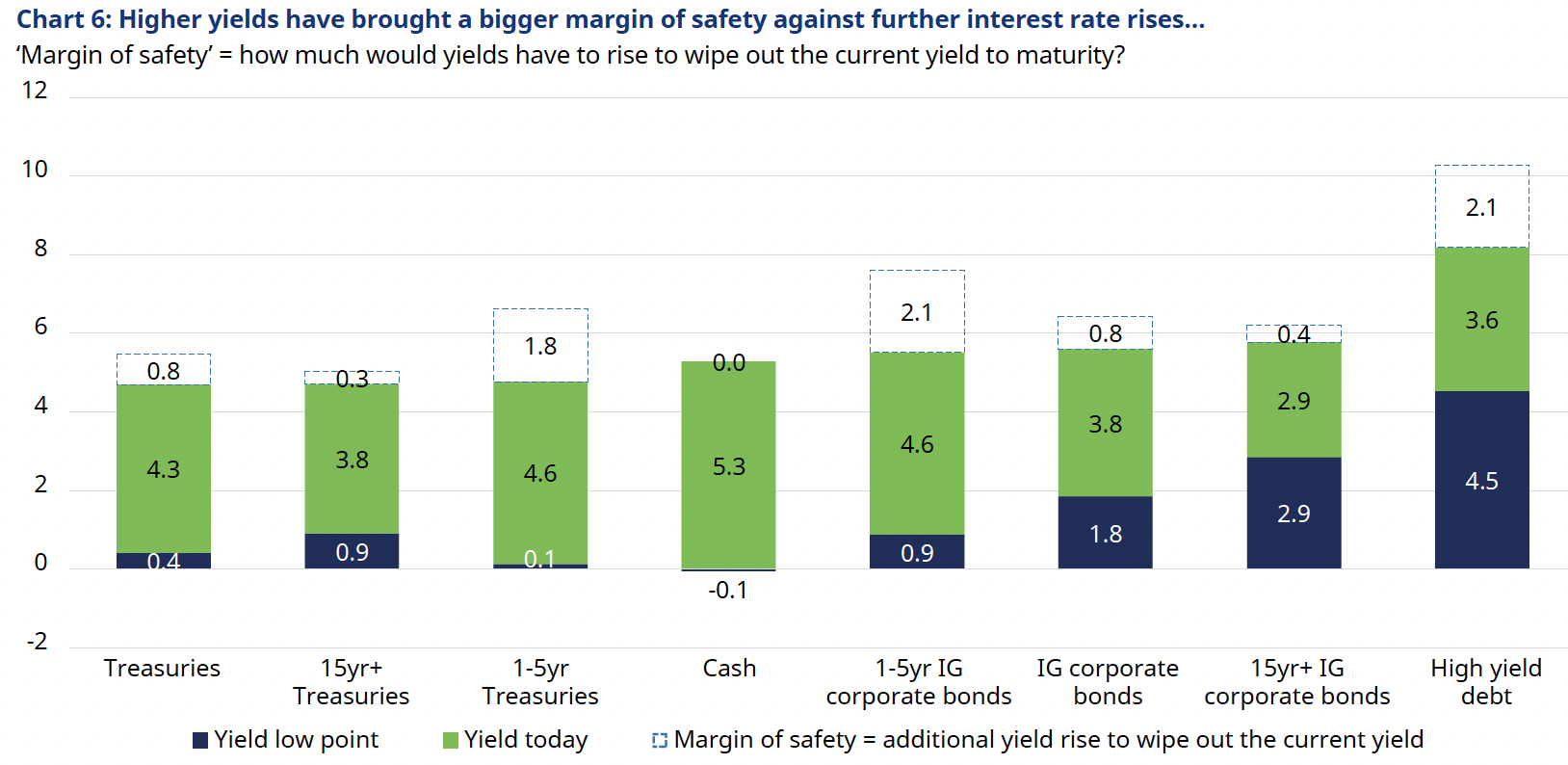

Locking in current yields requires taking risks, but maybe less than initially thought. For those investors with a longer-term perspective, reinvestment risk can be reduced by investing in bonds that lock in higher yields for longer. But many investors also care about volatility risk and relatedly the risk that price falls lead to losses.

For bonds, there’s more cause for optimism than has been the case for many years. With bond yields now at levels much higher than for most of the post-GFC period, the amount by which yields would have to further increase before investors would wipe out a year’s worth of yield is larger.

Source: ICE Data Indices, LSEG Datastream, JP Morgan, and Schroders. Data as at 31 May 2024. The yield low point is the minimum from 2020 onwards. All bonds are USD-denominated bonds. Based on ICE BAML bond indices for Treasuries, Corporate bonds, and High-yield bonds. Cash is a USD 3-month treasury bill. Bond prices move inversely with yields so a rise in yields leads to a fall in price. The ‘margin of safety’ is how much of a rise in yields they can absorb over the next 12 months before investors lose money. This assumes a one-year holding period.

This margin of safety doesn’t eliminate risk but it does add a larger buffer than at any point for years. This elevated margin of safety should provide some reassurance to long-term investors worried about the risk of further price declines.

Equities are more volatile than bonds which in turn are more volatile than cash. But long-term investors should beware of making knee-jerk reactions to increasing equity volatility. Historically, staying invested has proved a better strategy.

Past performance is not a guide to the future and may not be repeated. Source: LSEG Datastream, ICE indices, Schroders calculations. Data as at 31 May 2024. Annualised volatility of monthly total returns since Jan 1998.

For long-term income investors who rely on dividend income, they may be less concerned with temporary falls in equity prices. Companies tend to be very reluctant to cut dividends so income investors may not directly feel the weak corporate performance so long as they receive the dividends. And if the firm manages to increase dividends per share over time, then the yield on the initial investment can grow substantially.

This is an abridged version of the full report from Schroders strategist Harry Goodacre. You can read the full report here.