5 top-performing global funds (and 13 stocks powering them)

While everyone loves to hear stories of successful stock picks, professional investors often remind us that avoiding underperforming stocks is just as important. But for the purposes of this wire, the ownership of a subset of companies – those most exposed to the AI revolution – was a crucial performance contributor.

In the following wire, I’ve used Livewire’s funds database to unearth the top five global funds over five years. I’ve also sought, where possible, to discuss some of the companies that have been large drivers of their performance over this period. In the case of the Janus Henderson Global Research Growth Fund, portfolio manager and research analyst Joshua Cummings names a couple of companies he believes will be outstanding performance contributors in the next five years.

The investment return dominance of AI

“They probably won’t shock you,” said Cummings, when asked which three companies have been the biggest contributors to the Janus Henderson Global Research Growth Fund’s five-year performance.

Measured in terms of total basis points of portfolio contribution over five years, his fund's top contributors were:

Nvidia (NASDAQ: NVDA)

On Nvidia, Cummings noted it has been a holding for several years. “Sometimes we get lucky, sometimes we’re wrong. But this is an example where the analyst understood what was going on in the market and made the call on Nvidia and it's been his number one pick for quite some time.”

He emphasised that his team’s thesis on the stock is driven primarily by earnings, despite valuation (the stock price is up a staggering 3,000% since mid-2019) dominating much of the commentary on Nvidia.

Microsoft Corporation (NASDAQ: MSFT)

Owned in Janus Henderson portfolios for more than 15 years, the thesis on Microsoft has morphed. This has shifted from a “turnaround” story surrounding Microsoft’s flagship Office suite of products to, more recently, the cloud.

“It's been about Azure and their performance there has surprised even us, and we've been bullish on Microsoft,” Cummings said.

Apple Inc (NASDAQ: AAPL)

On Apple, the story is “trickier” because Janus Henderson is currently underweight in its allocation to the stock.

“That's actually been a big positive contributor to the fund over a shorter period of time because we've been underweight and it's just a big position,” Cummings said.

A core distinction of Apple from other tech companies is that it is fundamentally a hardware business that uses hardware to drive customers into an ecosystem. “Hardware, for them, is the moat and that is the beautiful thing that they do better than anyone else,” Cummings said.

“But we've struggled a little bit with what drives the story from here because if you go back five years…the forward PE on Apple was 22 times, it's now 32 times,” he said.

“It isn't that we don't like Apple, it's just that it's an opportunity cost issue. And with these mega caps, the capital gets very scarce and so we have to make trade-offs.”

5 top-performing global funds over 5 years

| Fund name | 5-year performance | 3-year performance | 1-year performance |

| GQG Partners Global Equity Fund | 16.66% | 19.44%% | 37.91% |

| Janus Henderson Global Research Growth Fund | 15.22% | 12.73% | 21.23% |

| Arrowstreet Global Equity Fund | 12.73% | 13.52% | 24.78% |

| Aoris International Fund B | 14.47% | 15.65% | 21.23% |

| Hyperion Global Growth Companies Fund | 14.17% | 5.88% | 42.91% |

Source: Livewire Markets, Morningstar

To compile this list, I used the following steps on Livewire's "Find Funds" page, first filtering via "Managed Fund" and then "Shares - Global". I then selected "Performance View" and selected "Performance - 5 years" as the default.

Note: The following list of funds and companies should be considered general information only. Always seek professional financial advice before making investment decisions.

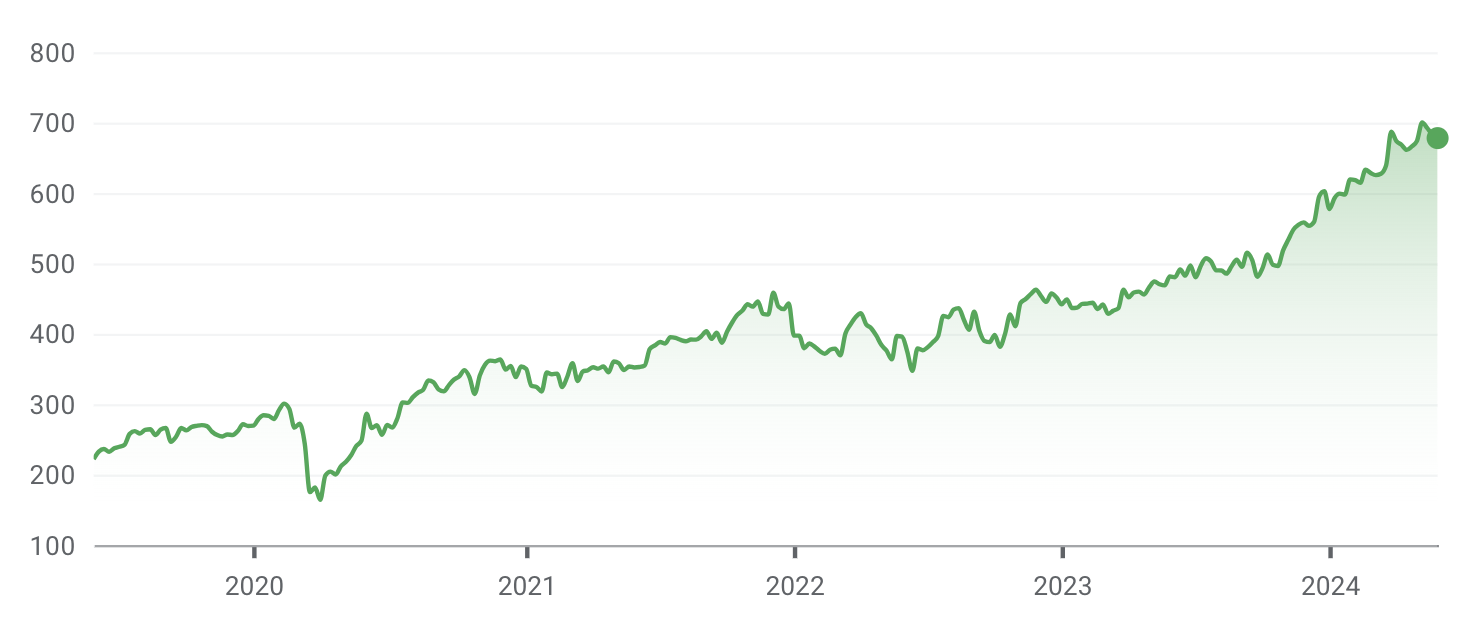

GQG Partners Global Equity

- Five-year return: 16.66%

- Inception: June 2017

A diversified financial services company, GQG Partners has been named as one to watch by multiple contributors to Livewire in the last 12 months. For example, 1851 Capital’s Chris Stott is a strong backer, as is Medallion Financial’s Michael Wayne.

The top performer from Livewire’s database over five years, the GQG Partners fund also topped the ranking over three years and came in #3 over 12 months (as of Monday 27 May).

Benchmarked against the MSCI All Country World Index ex-Tobacco, the portfolio holds 47 companies as of 30 April 2024. Of these, the 10 largest allocations comprise more than 46% of the total portfolio weight.

The five largest holdings as of 30 April were:

- Novo Nordisk

- Eli Lilly (NYSE: LLY)

- Amazon (NASDAQ: AMZN)

- Microsoft Corp (NASDAQ: MSFT)

- Meta Platforms (NASDAQ: META)

Large-cap US tech firms have featured in the fund’s top holdings for much of the last few years. For example, Nvidia, Alphabet, Microsoft and Amazon were all top 10 holdings in December 2020.

Big pharma names have also held large weightings in the portfolio for a while, including Astra Zeneca, Novo Nordisk, and Eli Lilly & Co.

AstraZeneca (LSE: AZN)

NovoNordisk (OMX: NOVO)

Eli Lilly & Co (NYSE: LLY)

Janus Henderson Global Research Growth Fund

- Five-year return: 15.22%

- Inception: December 2009

A fund focused primarily on high growth companies, the investment team seeks out businesses with brand power, enduring business models and strong competitive positioning.

Key sector contributors to returns last month were communication services and healthcare, with Alphabet and Teck Resources called out in the latest fund update.

As explained at the top, over five years, Nvidia, Microsoft and Apple are the biggest absolute return contributors. But what are some of the companies the team believes will underpin its performance in the half-decade ahead?

Progressive Corporation (NYSE: PGR)

An insurance underwriter, Janus Henderson’s Cummings conceded this space isn’t widely regarded as a great business model. “But if you do it well and you do it consistently over time, it can be a really good business, like GEICO at Berkshire Hathaway, for example,” he said.

Noting his team’s earnings estimates have consistently been up to 15% ahead of consensus for years, Cummings said the market underappreciates how quickly Progressive gains market share.

“Compounding at high rates of return, they're not doing anything weird. They're not getting into new lines of business. They're just keeping that moat really strong and compounding.”

ASML Holdings

A specialist in extreme ultra-violet lithography, the Dutch company is one of only a few companies worldwide that is intrinsically linked to the same theme that is driving the growth of Nvidia and other microchip manufacturers.

“Longer term, if you really believe that we are in the early innings of the next wave of computing, which is driven by AI and machine learning, the machines that ASML makes are even more impossible to replicate,” Cummings said.

“This is one that we're just, we're going to own forever. I like to tell my team, if you find one of these, just own it and move on. Try to find the next one. Don't overthink it.”

Arrowstreet Global Equity Fund

- Five-year return: 12.73%

- Inception: December 2006

Targeting long-term returns that exceed the MSCI All Country World ex-Australia index, the Macquarie managed fund also featured in our top five performers over three years.

The Arrowstreet fund uses a quantitative, benchmark-aware approach to adopt overweight and underweight positions in countries, sectors, and individual stocks.

The most recent contributors to performance were in Financials and Energy, driven by the fund’s overweight to companies in China and France, respectively.

Its five largest allocations as of 30 April were:

- Microsoft Corporation

- Apple Inc (NASDAQ: AAPL)

- Nvidia (NASDAQ: NVDA)

- Meta Platforms, and

- Wells Fargo (NYSE: WFC-Y)

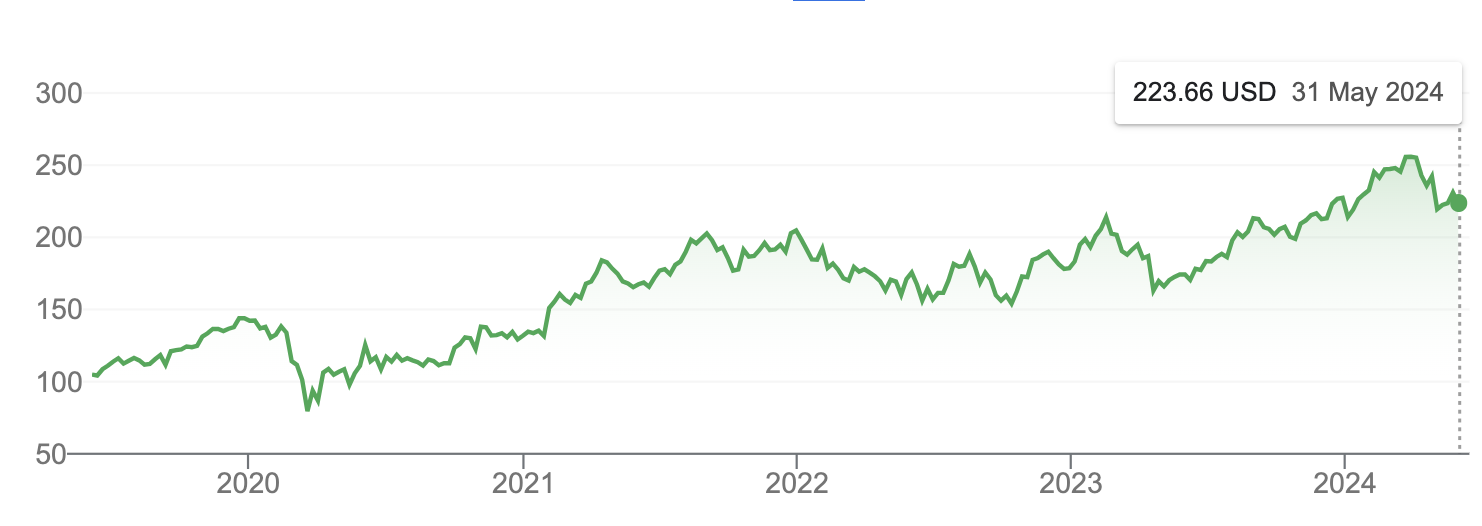

Aoris International Fund B

- Five-year return: 14.47%

- Inception: March 2018

Running a concentrated portfolio of no more than 15 companies, the fund targets a return of 8-12% per annum over a five to seven-year market cycle.

Some of the biggest contributors to its recent performance are Amphenol, Copart and Atlas Copco, which returned 21.5%, 15%, and 12.9% in the quarter ended April 2024.

Amphenol (NYSE: APH) – An American producer of electronic and fibre optic connectors and cables.

Copart (NASDAQ: CPRT) – A global provider of online auction services for new, used and repairable automotive vehicles.

Atlas Copco – A Swedish multinational industrial company dating back more than 150 years, Atlas Copco manufactures industrial tools and equipment.

The first of these has also been one of the fund’s top performing positions over the last five years, returning more than 175% since it was first added.

Two of the other largest contributors to performance are:

Cintas (NASDAQ: CTAS) - America’s largest uniform rental company, Cintas serves businesses across the Hospitality, Health Care, Education, Manufacturing and Construction industries.

The Aoris investment team emphasise that the firm’s large size are crucial, both on a national and local level. “National scale helps Cintas service large accounts, such as hotel chains that have multiple locations across the country. It also creates better purchasing power with vendors, which became particularly important during the pandemic,” Aoris says.

Locally, its high density of customers per mile – or “route density” creates scale efficiencies that are reflected in lower cost per uniform laundered. “This makes Cintas hard to beat on price. It also means Cintas earns superior returns on capital compared to smaller competitors,” Aoris says.

CDW Corporation (NASDAQ: CDW) – A reseller of technology hardware and software, CDW helps firms including Microsoft, Cisco, HP and Oracle serve their small to mid-sized corporate and government customers. In a highly fragmented market, CDW’s 5% market share is equal to that of its four closest competitors combined, says Aoris.

“This size and scale advantage over peers has been a powerful competitive advantage on both the customer and supplier side of the business,” Aoris says.

On the customer side, this has allowed CDW to structure its salesforce into industry specialties across health care, higher education, banking, and federal government. On the supply side, CDW is usually the largest or second-largest reseller for every vendor.

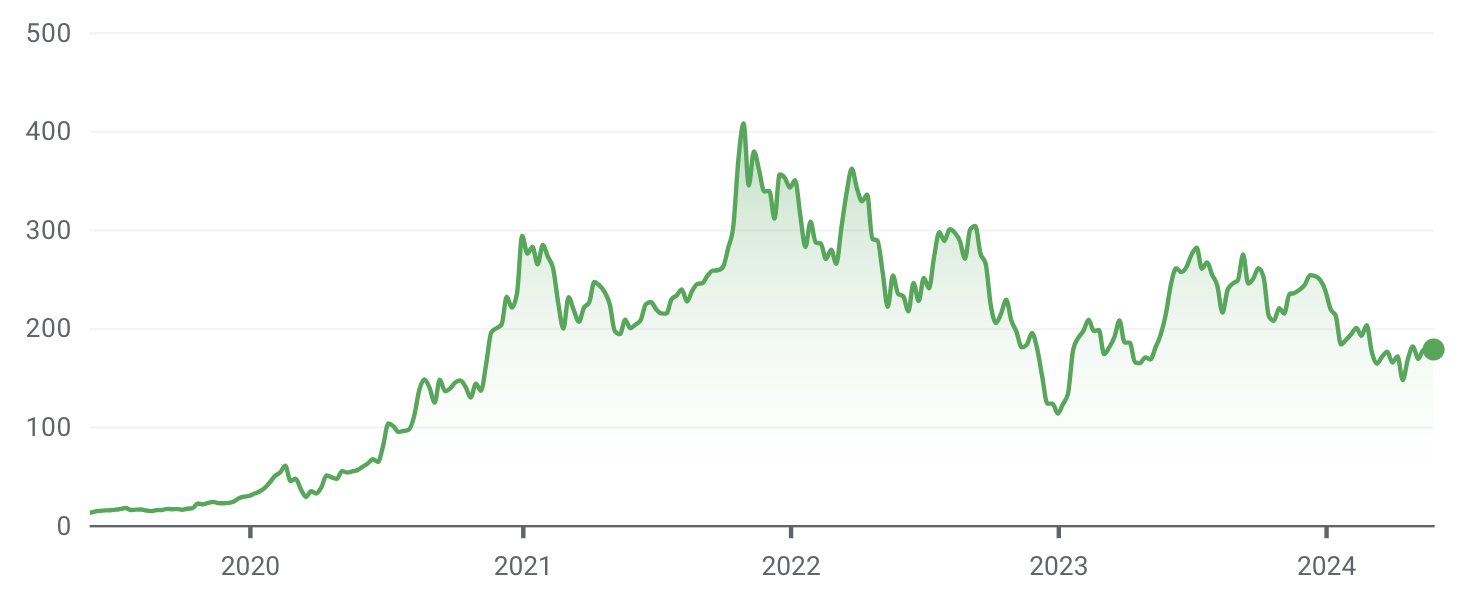

Hyperion Global Growth Companies Fund

- Five-year return: 14.17%

- Inception: June 2014

The Hyperion investment team, led by Mark Arnold and Jason Orthman, CIO and co-portfolio managers respectively, runs a concentrated fund of between 15 and 30 companies, with 22 companies as of 30 April. They focus on owning companies with:

- High quality franchises,

- Above-average long-term growth potential,

- Low levels of debt, and

- Sustainable earnings that can grow over the long term.

More recently, the fund has benefited from its high allocation to tech names that have ridden the AI theme, with Microsoft and Amazon in #2 and #3 positions in the portfolio weightings as of 30 April. These have featured within the top five holdings across much of the last 12 months.

Hyperion’s largest holding for some time has been Tesla (NASDAQ: TSLA), which comprises 12.5% of the portfolio as of the latest fund update.

"We believe Tesla is currently transforming from a hardware-based auto business to a predominantly software robotics and energy business,” Orthman told investors in a webinar earlier this month.

“Over the next few years, this transformation is likely to create significant value. We believe Tesla is rapidly approaching an iPhone moment when its cars will become smart enough to drive themselves without human supervision.”

What do you think?

If you own any of these names in your portfolio - or there are others you'd like to highlight, please let us know in the comments below.

Don't forget to give the article a "like" and follow me to stay up to date with all my wires as they're published.

1 topic

14 stocks mentioned

5 funds mentioned

3 contributors mentioned