8 of the best stocks to buy in a sell-off

They say there is nothing more expensive than something free, and the same could be said of the stimulus that we have enjoyed over the months and years living through the pandemic.

While markets around the world have skyrocketed from the lows of the COVID crash, so too has global debt - now at a staggering US$296 trillion according to The Institute of International Finance (or 353% of GDP), US$36 trillion higher than levels seen prior to the pandemic.

And with US banks already expecting the Federal Reserve to announce four interest rate hikes in a bid to stymie inflation in 2022, investors would be wise to brace for increased volatility over the months ahead.

So as part of our Outlook Series, we spoke to nine of Sydney's best fund managers for the stocks they would buy in the case of market weakness. These include some of Australia's highest-quality tech legends, as well as a handful of global stalwarts currently trading too high.

Our featured experts include:

- Matthew Kidman, Centennial Asset Management

-

Eleanor Swanson, Firetrail Investments

- Simon Shields, Monash Investors

- Steve Johnson, Forager Funds

- Anthony Aboud, Perpetual Asset Management

- David Moberley, Paradice Investment Management

- Hamish Carlisle, Merlon Capital

- Chris Demasi, Montaka Global Investments

- Bob Desmond, Claremont Global

Note: This vision was shot on the 6th and 7th of December 2021.

Edited Transcript

Ally Selby: Everyone's talking about valuations and markets trading at crazy prices. So today, we'll be talking to our fund managers about the business they would own if the market crashed, or if the stock traded at a cheaper price.

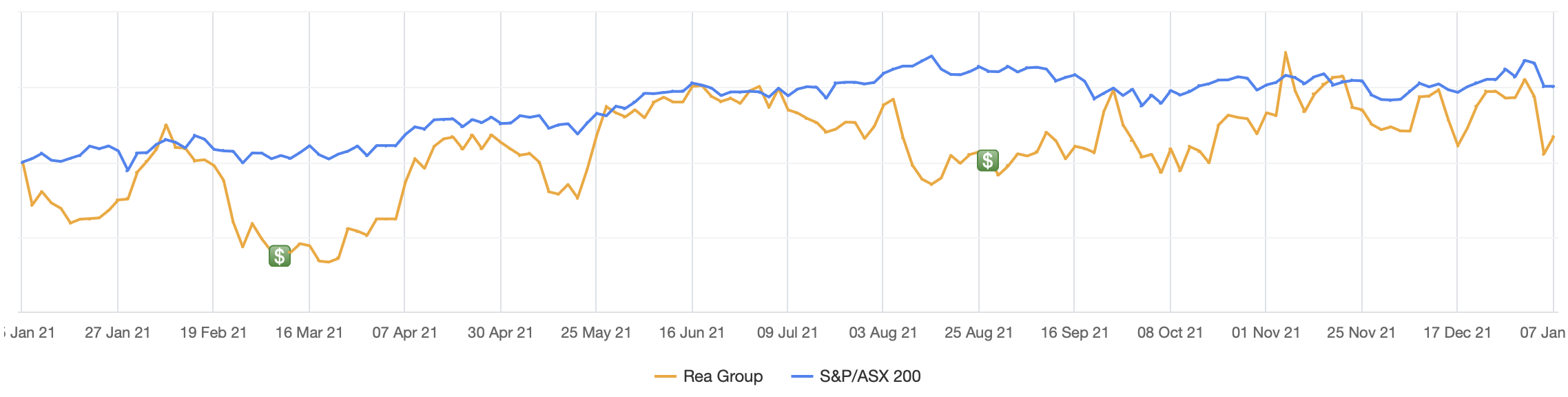

REA Group (ASX: REA)

Matthew Kidman, Centennial Asset Management

I think I'll go with the stock that I picked last year again. It's comfortably the best stock on the Australian market, and what I really like about it now is it's got international optionality that probably wasn't there before. And that's REA. We owned it in the period when it got sold off in the COVID collapse in 2020. For once, this question came about where we actually got to buy something at a price a lot cheaper.

Everyone knows the platform in Australia. Everyone knows that it produces stunning returns, and it dominates that market (along) with Domain - a terrific market structure. But what it's got is a shareholding with News Corp, which is its own biggest shareholder, in a group called Move in the US. Everyone knows Zillow, but Move is a platform for residential real estate transactions, just like REA has here with realestate.com, and it's in the US. And it's probably 10 years behind what we have here. So I think there is great optionality that people don't realise. And in time, they'll probably buy that off News and own it outright.

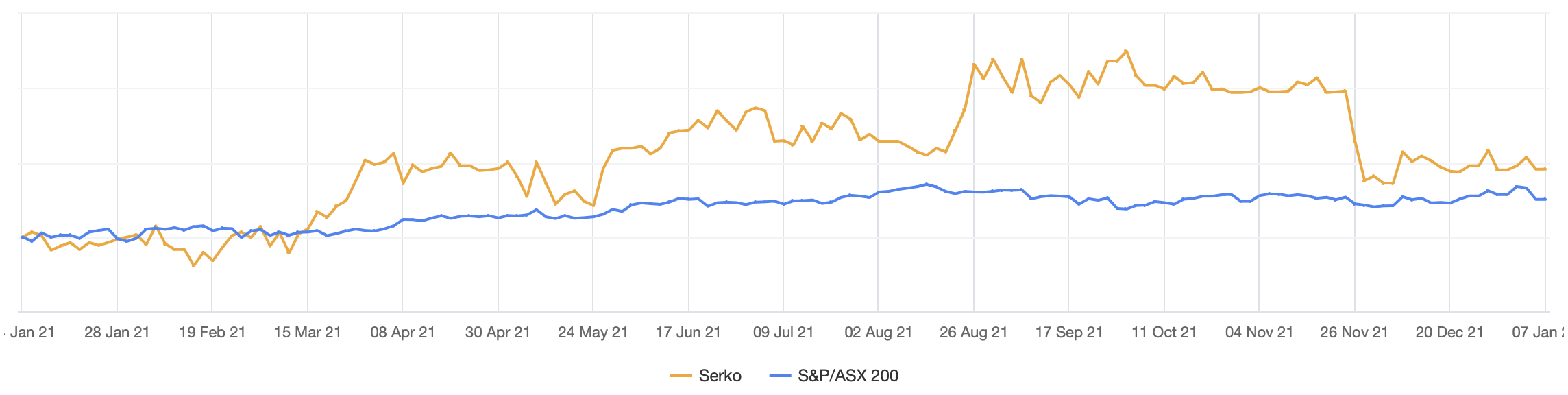

Serko (ASX: SKO)

Eleanor Swanson, Firetrail Investments

A stock that we absolutely love, and if we had an opportunity to buy it at a lower price, we'd definitely be piling in, and that company is Serko. I don't know if you've come across Serko. It's basically a corporate travel technology company and they're a market leader in Australia and New Zealand. They've got really big deals with Flight Centre and other big corporate travel management players, which is why their brand isn't kind of front-facing with consumers.

But Serko's just done the most incredible deal with Booking.com. Booking.com scoured the globe, looking for the best corporate travel tech platform. They landed on Serko. So that was a big tick. But the really outstanding thing about this deal is Booking.com has agreed to share 50% of their revenue from building a corporate travel business in Europe with Serko. And Booking.com is one of the best-known brands globally. They've already built quite a sizeable SME travel business in Europe. So, it's a huge opportunity for Serko and we're really expecting the company to execute on that over the next 12 to 18 months. But if it was to trade down further, we'd pile in again.

REA Group (ASX: REA)

Simon Shields, Monash Investors

Well, it's got to be realestate.com. It's the old "rivers of gold". You think about the newspapers from years ago - they talked about the classifieds being "rivers of gold". The whole dynamic of the way people advertise for real estate has now changed. And it's a quasi-monopoly. If you're selling your house, you have to advertise on realestate.com. They've got incredible pricing power. Historically, we've seen the earnings of these sorts of businesses only go one way over time. So if you get a chance to buy it cheaply, because the markets had a meltdown, it's a great stock to buy.

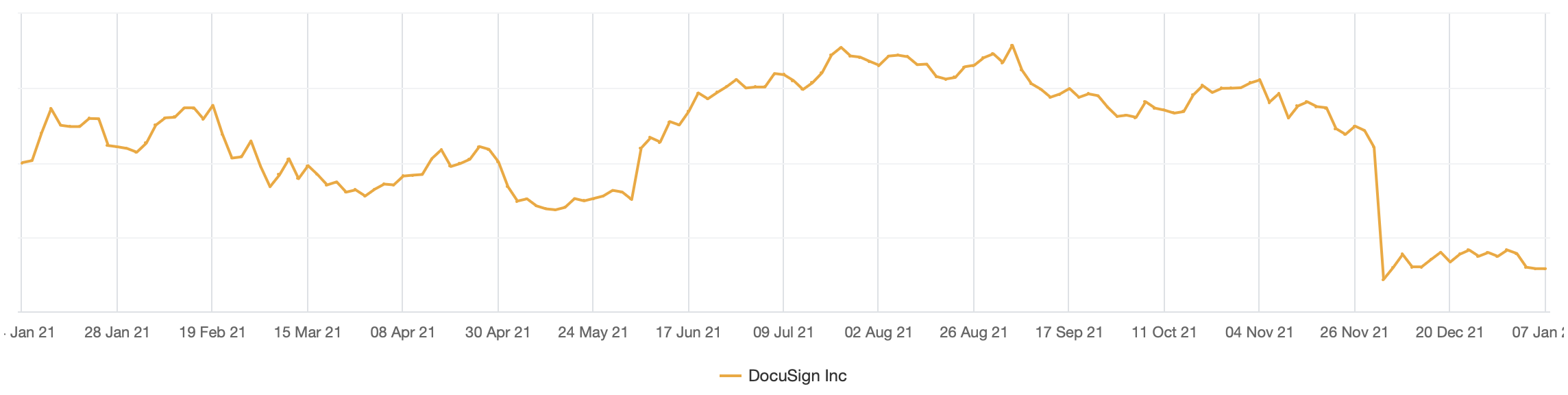

DocuSign (NASDAQ: DOCU)

Steve Johnson, Forager Funds

I'll give you one that's already fallen a long way, so it's getting closer, and that's DocuSign. It might be a name familiar to anyone who's working in the corporate world because it's being embedded in more and more companies. I love the business. I think it's got perfect network effects in terms of the more people that are using it, the more valuable the product becomes. They've been a huge COVID beneficiary, signed up hundreds and thousands of clients. That is slowing because COVID is ending and the share price was down 40% last Thursday. Another 40% would be nice, but it's a business that I would really like to own.

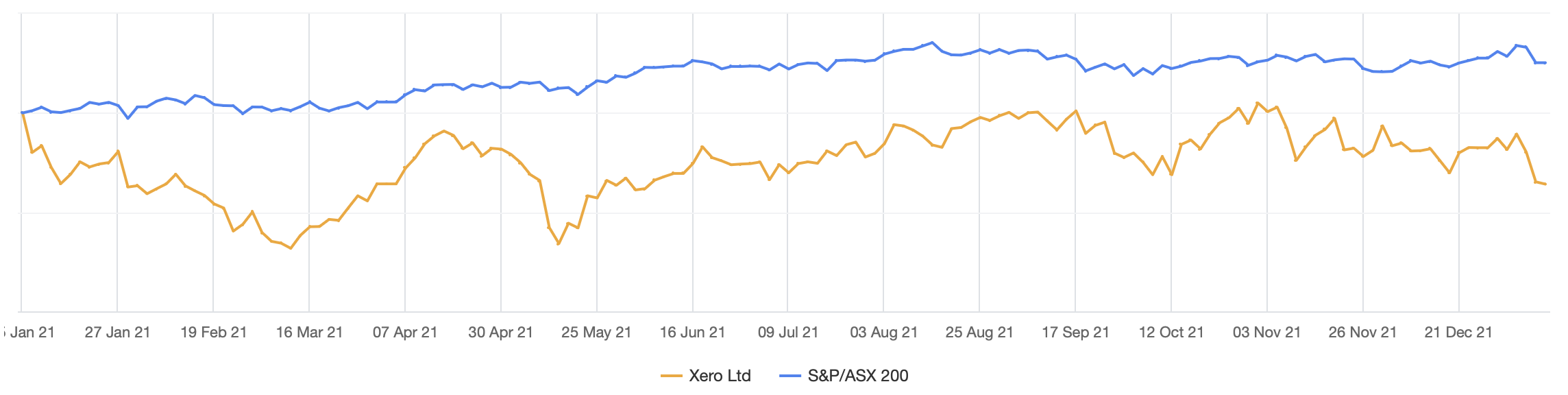

Xero (ASX: XRO)

Anthony Aboud, Perpetual Asset Management

I've got a caveat here because every crash is different. In March 2020, retail and cyclicals just fell through the floor, and we loaded up on things like AP Eagers (ASX: APE), Premier Investments (ASX: PMV), Event Hospitality (ASX: EVT). We loaded up on those. And they were great opportunities. The thing I like doing in these sorts of environments is finding where the stress is most acute and finding the best company in that space. But in the essence of answering your question, if everything was to fall the same, a company like Xero, which is something which is too expensive for me now, but I think it's a wonderful business, well-managed.

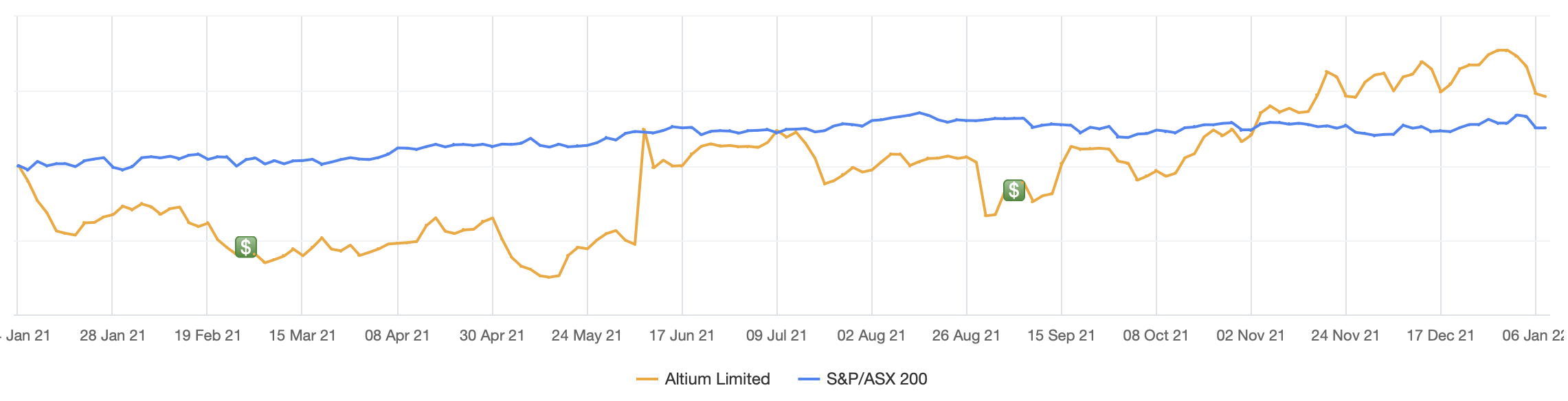

Altium (ASX: ALU)

David Moberley, Paradice Investment Management

So I've been doing a lot of work on Altium more recently. The business was impacted quite heavily over COVID-19. A lot of their customers are small, medium-sized businesses and they were not in a position to be buying that software over the COVID-impacted period. It's just starting to recover right now. And I think the market's numbers are actually a little bit undercooked in terms of the upside there, but unfortunately at the moment, it's the top end of its valuation range. And we are looking for a cheaper entry pricing into that name.

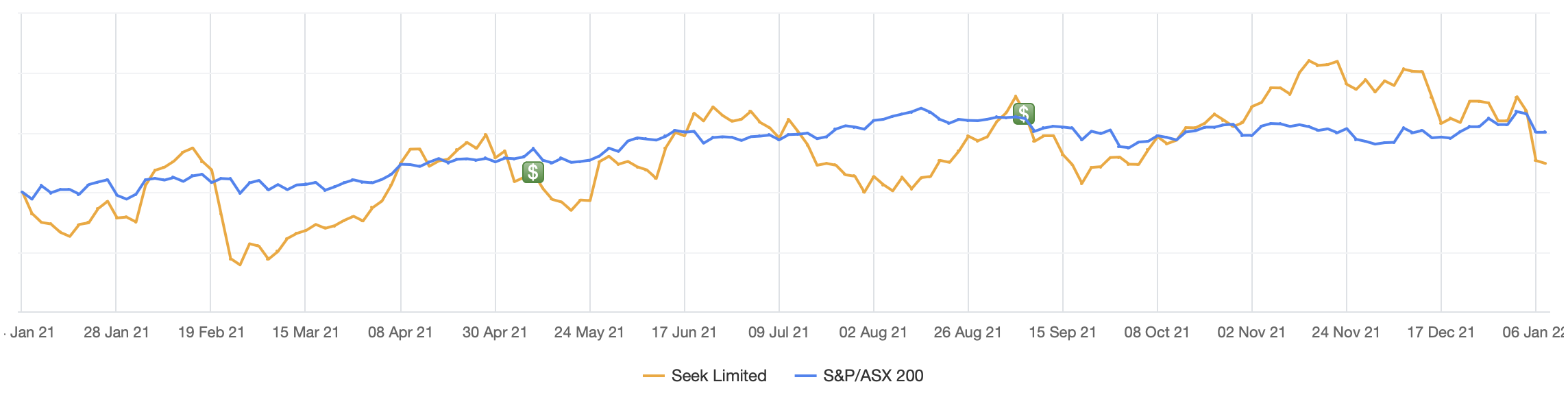

REA Group (ASX: REA) and Seek (ASX: SEK)

Hamish Carlisle, Merlon Capital

Local tech names are great companies. I mean, realestate.com and Seek are some of the best quality stocks in the Australian market in terms of long-term prospects. And particularly for REA. It has a low-risk profile. It's certainly not on our radar from a valuation perspective now, but if it pulled back by two-thirds or so, we'd certainly love to own it.

Airbnb (NASDAQ: ABNB)

Chris Demasi, Montaka Global Investments

I think we'd own every single stock in our portfolio in a bigger size if you'd sell it to me more cheaply right now.

Selby: Okay. But if you had to name one stock ...

Demasi: One stock. And it's a new stock, one that's not in the portfolio. I said it last year and I'll say the same one again. It's Airbnb. So, Airbnb is the largest platform in the world for alternative accommodation. So, connecting hosts that are renting out their place with guests. And as a result of doing that, they've got a massive network effect that can't be broken. And on top of that, the alternative accommodation space is a trillion-dollar market opportunity. It's less than 5% penetrated today. And we think that short-term stays are going to be supercharged, especially with the shift to remote working that we've seen come out of the back of the pandemic.

Airbnb IPO-ed at the end of 2020 and the stock very quickly doubled on the first day of trading. And it's been trading at about US$160, right around the same level for the last 12 months, which is a little bit too expensive for us. So we're waiting to see if it's going to pull back and give us an opportunity.

Sherwin-Williams (NYSE: SHW)

Bob Desmond, Claremont Global

We have a very small position in Sherwin-Williams, mainly on valuation, but that's something I'd like to own a lot more of. It's quite a boring industry - paints. Who thought paints could be exciting? It's based in Cleveland and has that amazing Midwest culture. They really focus on customers - they are obsessed with their customers and really look after their employees. They have a terrific culture. The CEO's been there 36 years; it's pretty much the only job he's ever had. The average management tenure is 24 years. Their staff turnover, store manager turnover is less than 10%, which is unheralded in retail. They've paid rising dividends for 45 years, and the company is over 160 years old. That's exactly the type of business I love to own. But at the moment, we've only got a very small position, because the valuation's quite full.

What stock would you pick up in a sell-off?

Is there a stock (or two) that you have been patiently watching, waiting for it to trade at a lower price? Let us know what that stock is and why in the comments section below.

Be sure to catch the rest of our 2022 Outlook Series

Hit the ‘follow’ button below for our fundies’ number one picks for the year ahead and other great content from our 2022 Outlook Series. Enjoy this wire? Hit the ‘like’ button to let us know or click the button below to view all the content on the dedicated landing page.

2 topics

8 stocks mentioned

8 contributors mentioned