9 small caps to buy and hold for the next 5 years

Australian small-cap companies are an interesting space for investors. After all, this is the realm where tomorrow’s CSL (ASX: CSL) or WiseTech Global (ASX: WTC) could be growing and building its customer base. Of course, it could also be the home of tomorrow’s ABC Learning or Volt Bank. It pays to be careful in your selection.

Small-caps are also notoriously volatile, with good reason.

Their smaller size (and often smaller customer base) can make them much more susceptible to market events. They can also carry credit risk and, for those in more of a start-up phase, be highly leveraged. Such companies are obviously going to find rising interest rates challenging.

Or as Donny Buchanan, Co-founder, CIO and Portfolio Manager for Lakehouse Capital puts it:

“The economic environment remains uncertain, and capital funding is both tighter and considerably more expensive than the preceding 5 years.

Given small caps are typically much earlier in their lifecycle, and have thinner balance sheets, they can be more exposed if the economic tide goes out.”

If you’ve got the stomach for volatility and the time to do your research, there’s no reason small caps can’t be a valuable part of your portfolio.

I spoke to three experts about the outlook for the small-caps market, the attributes they think are important in selection, and their top picks to buy and hold for the next five years. You might also be surprised by the companies they are avoiding.

.png)

A closer look at what is happening across Australian small caps

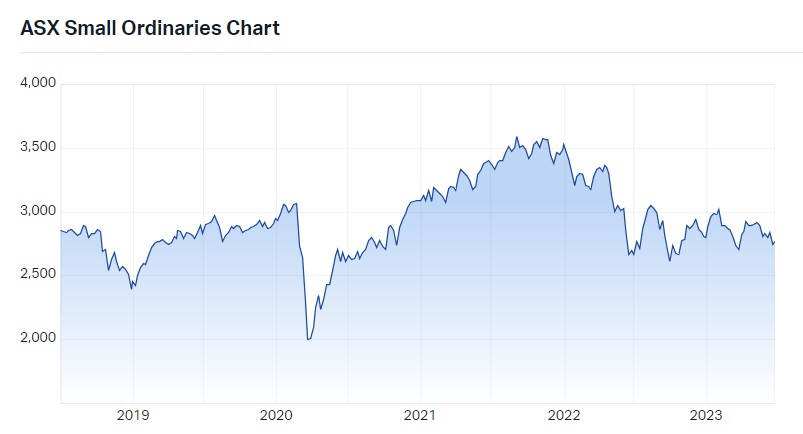

The last few years have been difficult for markets and small caps have had it particularly tough.

S&P/ASX Small Ordinaries performance over the last five years. Source: Market Index, 28 June 2023

“Weak investor sentiment and a dearth of liquidity has the small cap market more inefficiently priced than usual, providing a hunting ground for opportunistic buyers.

We’ve seen a number of businesses, particularly in the IT sector, acquired at significant premiums to their languishing market price,” he says.

Buchanan adds that such premiums are uncommon and provides the following examples:

Nick Guidera, Portfolio Manager for Eley Griffiths Group, warns that volatility in the market will continue due to hawkish central bank tilts and lagged effects of tightening monetary policy – but remains constructive on the outlook for small caps.

“If history is any guide, small and emerging companies could lead the next cycle. The timing of which, will likely be determined before FY24 is out.

Markets typically bottom well before earnings, and so with valuations reset we will be looking for evidence of a low in the coming months,” he says.

James Dougherty, Principal and Portfolio Manager for Lennox Capital Partners, also views history as a reason to be positive on the future, while the current market is opening opportunities for those on the hunt.

“The negative share price reaction to recent earnings downgrades has created some compelling long term investment opportunities. The conundrum facing small cap investors is how do they balance the risk of further earnings downgrades and share price falls with the compelling valuations.

While we do expect further earnings downgrades, we are conscious that equity markets are forward looking and this next set of downgrades may signal we have finally reached trough earnings for this cycle,” he says.

How to identify treasure in the mix

Factoring common concerns about volatility and leveraging in small caps, how can investors sift the diamonds from the cubic zirconia, so to speak?

Dougherty describes it as “businesses with strong competitive advantages enabling defendable margins and predictable earnings.” He also likes to be financially aligned with management and the board.

Buchanan points to the value of pricing power as a result of competitive advantage.

“Pricing power is the financial distillation of a business’ competitive position, and it should come as little wonder that many of the world’s most successful businesses are price setters while the laggards are often price takers,” he says.

He also prefers conservative balance sheets in the current market environment because “a well-capitalised business will almost always live to see another day, and even better, they can play offence while others play defense”.

Guidera cautions investors to be mindful of specific fundamental attributes, such as management track record, industry structure and the addressable market, a strategic plan with merit, an above-average return on equity, and a time-weighted EPS growth profile ahead of peers. Valuation is also important.

He also added that a good small-cap investment is not one-dimensional. It will require more than a capable CEO, or a good PowerPoint presentation. Stocks can appear cheap, but sometimes the ‘E’ (earnings) are overstated.

We feel a comprehensive qualitative and quantitative assessment is required to identify good small-cap stocks,” he says.

The small-cap companies the experts would buy and hold for the next five years

In an environment where liquidity is constrained and investors are veering towards larger caps, I challenged the experts to share which 3 companies they’d each buy now and hold for the next five years. There’s finance, travel, technology, energy and healthcare across the mix.

Nick Guidera, Eley Griffiths Group

1. PSC Insurance Group (ASX: PSI)

“It’s hard to find a small business owner globally that isn’t seeing their cost of insurance increase significantly. The frequency of natural disasters in recent years, and subsequent damage to properties has seen an already extended insurance rate cycle, continue to be extended as insurers and reinsurers look to cover their losses. Insurance broking businesses like PSC Insurance with their high-quality management team, that is aligned with shareholders (at an equity ownership level), is well placed to take advantage of this trend.”

2. Macquarie Technology Group (ASX: MAQ)

"The world is consuming more data, and that data needs to be housed on servers, in a controlled environment. In recent weeks, the market has begun to understand how the data requirements will change as Generative AI takes hold, and the compute power required. Macquarie Technology is well positioned to manage the continued transition of Government & Enterprise clients to the cloud given its history as well as building Data Centre capacity in desirable locations to manage the demand of hyperscalers as they provide new cloud infrastructure.

3. Meridian Energy Ltd (ASX: MEZ / NZX: MEL)

"The shift to green energy is not just a thematic, it is a regulatory requirement for many administrations around the world. NZ is blessed with an amazing climate, and a variety of green energy sources – geothermal, mountains, and lakes. With an established industry, significant sunk capital and clean power generation mandate, NZ is also well advanced in the clean energy transition. Meridian Energy is the largest “gentailer”, with a quality group of enviable hydro assets and for many global small-cap investors, the size of Meridian Energy (~$13bil) is very much in their sweet-spot.

You can find out more about the Eley Griffiths Group approach to small caps investing here:

James Dougherty, Lennox Capital

Corporate Travel Management offers cost-effective all-in-one place business travel management services.

2. Kelsian Group (ASX: KLS)

"Kelsian Group operates a portfolio of tourism and public transport assets across Australia and various global markets. We are attracted to the defensive growth characteristics of the business which is a product of both the contracted nature of the public transport division as well as management’s ability to drive growth through winning and retaining contracts. Looking forward, we believe the outsourcing of Government contracts to the private sector presents an attractive structural growth story and the recent acquisition in North America provides an exciting opportunity to accelerate expansion into a large, underpenetrated market."

3. HUB24 (ASX: HUB)

"HUB24 is Australia’s second-largest independent platform provider with $62bn in Funds Under Administration (FUA) in a ~$1tn industry. The Company’s industry-leading (~15%) net inflows are driven by market-leading technology functionality which present a significant runway to materially increase its FUA, expand its economic footprint and generate material EPS growth over the next 5 years."

You can find out more about the Lennox Capital approach to small caps investing here:

Donny Buchanan, Lakehouse

Nanosonics is an infection prevention company known for its unique automated disinfection technology, the Trophon device for ultrasound probe disinfection.

"Nanosonics, which is benefiting from improved profit margins following the transition to a direct sales model in its largest market, and the replacement cycle for the second generation of Trophon. The company is sitting on a large cash balance, an expanding annuity-like revenue base with a long growth runway, and is edging closer to launching a new growth platform following years of R&D. The new platform, Coris, is steadily tracking toward a launch in Europe or Australia later this calendar year. It should have a smoother path to market than Trophon as all markets already reprocess endoscopes and the platform significantly exceeds existing guidelines, with the potential to set new, higher, industry standards."

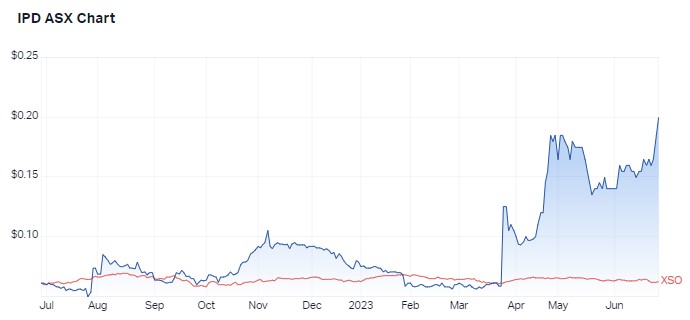

2. Impedimed (ASX: IPD)

"Impedimed has been receiving more attention from investors and customers alike since the National Comprehensive Cancer Network (NCCN) released updated guidelines in March. The guidelines accelerate Impedimed’s path to insurance reimbursement for its core product, Sozo, which helps identify and monitor lymphedema in breast cancer survivors. The response from insurance payors has been rapid. The company expects ‘nearly 50%’ of private payors to publish coverage by the end of 2023, and ‘nearly all’ by 30 June 2024. While reimbursement adoption will rapidly accelerate revenue growth, the company is still burning cash at around $3 million per quarter, and recently completed a $20 million capital raising to drive growth. Both prices and volumes should accelerate materially as payors adopt the updated guidelines and add Sozo to their reimbursement list, with added potential for Sozo to expand its addressable market into other areas of oncology."

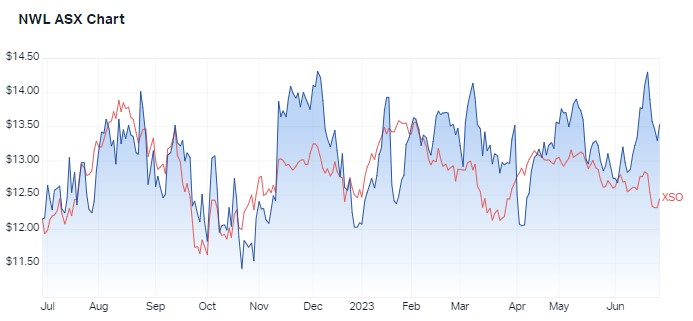

3. Netwealth (ASX: NWL)

"Netwealth is emerging from a period of heavy investment and we see a path to expanding margins in the months and years ahead. The industry has suffered from slower-than-expected growth over the past year, though we expect that will turn at some point. Netwealth remains well placed as it is capturing mid-40% of incremental flows against a sub-7% market share, has added new tools and features (including its noncustodial product and mobile platform) that should help both attract and retain customers. The company remains debt free and continues to benefit from rising interest rates."

You can find out more about the Lakehouse approach to small caps investing here:

And the companies the experts are avoiding

“Steer clear of highly cyclical, heavily indebted capital intensive, price-taking businesses,” says Buchanan.

Guidera suggests that investors be cautious of new IPOs given market conditions and be wary of crowded stocks with potentially stretched valuations like Dominos Pizza (ASX: DMP) and Johns Lyng Group (ASX: JLG).

“It feels like Iress is being priced for success very early in the turnaround,” he says.

18 stocks mentioned

3 funds mentioned

3 contributors mentioned