A beaten-up cyclical due for a rebound

Despite its strong run, the Allan Gray Australia Equity portfolio remains heavily tilted towards beaten-up cyclical companies, as their decade-long underperformance has resulted in the current attractive prices.

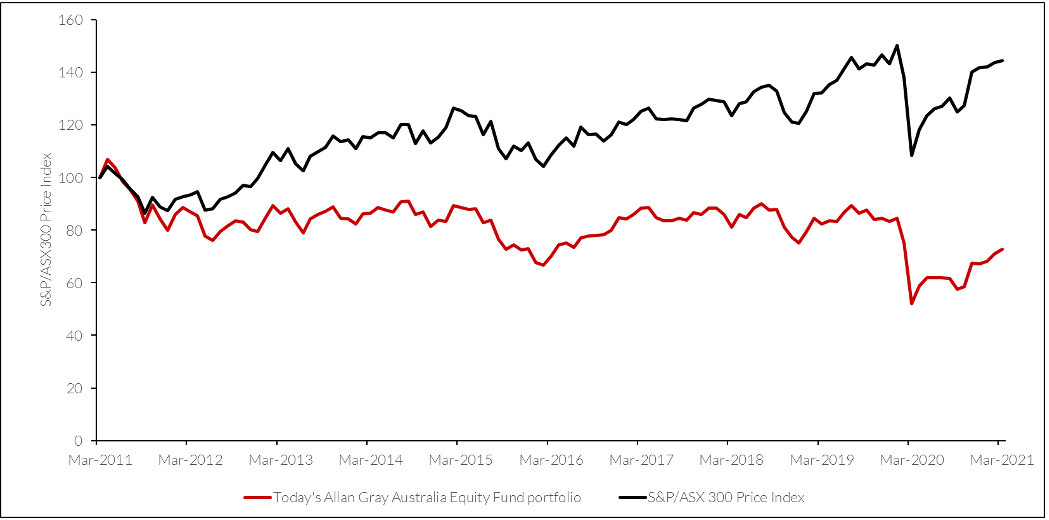

The extremes of mid-2020 have passed and markets appear more rational (on average) today, perhaps even a little optimistic, but there are still wide price discrepancies. Graph 1 shows the performance of the Equity portfolio of shares and the performance of the broader share market if initiated around 10 years ago (note: this assumes that we initiated the current portfolio 10 years ago, something we thankfully did not do!). We discussed this in detail in our September 2020 Quarterly Commentary but suffice it to say, the Equity portfolio’s holdings remain very depressed in price terms and have effectively underperformed the sharemarket by 50% over the past 10 years.

Graph 1: Price performance of the Allan Gray Australia Equity Fund portfolio if initiated around 10 years ago

Despite many of the companies held today being different to their 10-year-ago selves, we believe their cyclically-depressed earnings can be purchased very cheaply today. This is an exciting backdrop for potential outsize investment returns for the portfolio and we are confident that much of the dislocation which has arisen over the past 10 years should narrow in time.

Newcrest Mining Limited ('Newcrest') (ASX: NCM) is one such example that we discuss below. It has underperformed the sharemarket by 30% over the past 10 years and we believe it is cheap relative to our expectations of future earnings.

About Newcrest

Newcrest is a gold miner with operations in Australia, Papua New Guinea (PNG) and Canada. Its current production of two million ounces of gold per annum makes it the world’s seventh largest gold miner. Newcrest’s current production is concentrated, with two mines – Cadia (New South Wales, Australia) and Lihir (PNG) – contributing around 75% of its production.

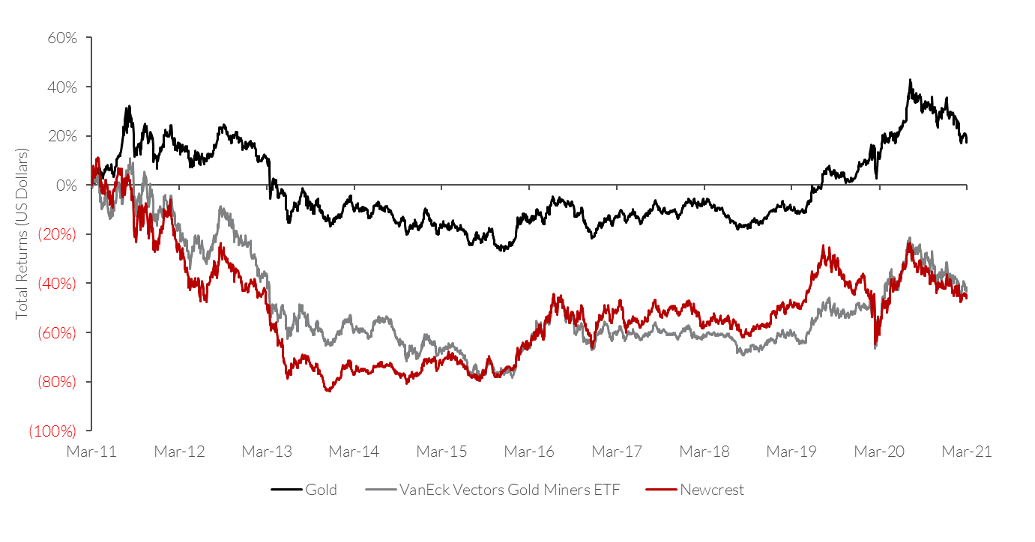

Newcrest’s share price has performed poorly in recent years, having underperformed the broader sharemarket and its gold-mining peers, as shown in Graph 2.

Graph 2: Newcrest and its peers have lagged the gold price over the last decade

Three broad factors have contributed to Newcrest’s weakness:

-

Lower production. Like all mines, Cadia, Newcrest’s lowest cost and most profitable mine, faces declines in the quality, or “grade”, of its gold ore. Whilst this has been well known to market participants for some years, it appears to have weighed heavily on sentiment as it has become more imminent. We do not dispute that Cadia’s grade is falling, but recent capital investments will result in increased ore throughput that will help partially offset the impact on production of the gold grade decline. The mine also produces copper, which lowers the cost of producing gold, as we explain later. Since copper grades remain relatively constant, copper production should also benefit from future increased throughput.

Elsewhere, Lihir has suffered from a number of unplanned operational challenges. These have contributed to reduced production and elevated costs, but the outcome of a recent optimisation study suggests that the operational challenges at the mine are temporary.

-

Political risk. PNG has experienced an elevated level of political upheaval in recent years, with the new government taking a more adversarial approach to mining licences and fiscal regime changes. Most recently, developments have been more encouraging. The signing of a Fiscal Stability Agreement governing a proposed liquefied natural gas development suggests it is possible to achieve acceptable fiscal outcomes in Papua New Guinea, boding well for Newcrest’s undeveloped gold deposits in the country.

- Weakness in the gold price during the past year. Large outflows from gold ETFs in recent months have created significant indigestion and an overhang for gold prices – and for gold miners’ share prices. A combination of concerns about the potential for higher real (above inflation) interest rates and more glamorous alternatives (like Bitcoin) appear to be the major driving forces behind these outflows. In our view, ETF flows may turn from being headwinds into tailwinds in future. Central bank balance sheets continue to expand, fiscal deficits remain large and financial markets are fragile. Central banks cannot print gold and some central banks, including China, may continue to accumulate gold reserves. However difficult to measure, gold exposure has some insurance value and this is cheaper today than in the recent past.

Why do we like Newcrest?

On closer inspection, we believe the factors contributing to Newcrest’s recent weakness have had little, if any, impact on Newcrest’s long-term intrinsic value, although we recognise it may take considerable time for others to share our view. At the same time, its assets retain the characteristics that first attracted us to the company: low-cost operations, a long reserve life with significant growth potential, and a strong balance sheet.

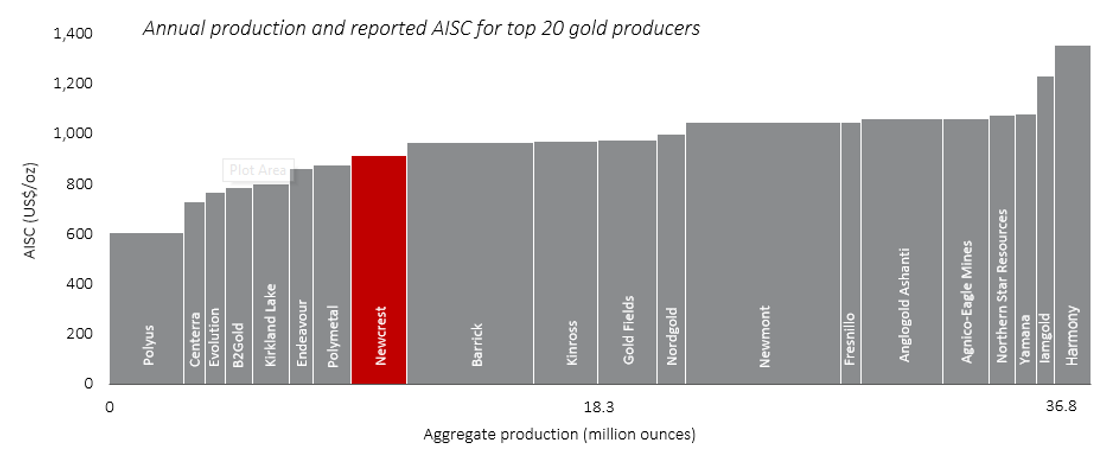

Like any company, a gold miner’s profits are the difference between its sales and its costs. One of Newcrest’s main attractions is its cost advantage over its peers. Newcrest’s all-in-sustaining-cost (AISC, an industry norm for reporting costs) of around US$915/oz is well below the median of world production. Graph 3 shows the AISC of the world’s top 20 producers.

There are reasons to expect costs to fall from here too. Revenues from selling copper that Cadia generates “for free” as a by-product help to lower its AISC and copper prices have strengthened recently. Also, the (hopefully) temporary operational challenges that have plagued Lihir this year (as discussed earlier) have contributed to its AISC exceeding US$1,300/oz. These should fall significantly as the results of its optimisation study are implemented. We could be wrong as all miners face the inherent risk that unforeseen geological challenges will cause their costs to increase, but we assign a low probability to this outcome.

Graph 3: Newcrest’s costs are lower than average

Newcrest also has a very large in-ground endowment of gold. Its flagship mines, Cadia and Lihir, have reserve lives in excess of 20 years with significant scope to extend their lives beyond this via resource conversion. Similarly, a high grade discovery called Havieron is likely to extend the currently-short life of its Telfer mine in Western Australia by a decade or more. Newcrest has also invested in high-potential projects in Ecuador, PNG and Canada. With approximately US$500m of net cash, Newcrest is unlevered and generates strong free cash flows from its current mining operations that, after paying a dividend, can reasonably be expected to fund its growth potential.

At the prevailing gold price of US$1,700/oz, our analysis suggests that Newcrest should generate around US$800 million of post-tax free cash flow. We conservatively estimate its currently unproductive investments to be worth US$3-5bn. Put in that context, the company’s market capitalisation of US$15bn appears undemanding. Of course, gold prices could fall materially. But a permanent decline would render uneconomic swathes of required production, especially as replacement capacity is likely to be much more expensive than current production. Importantly, Newcrest’s low costs and strong balance sheet mean it is well prepared to navigate any periods of gold price weakness. If anything, we think the gold price is more likely to rise than fall over our investment horizon.

How does Newcrest’s share price compare to other gold miners?

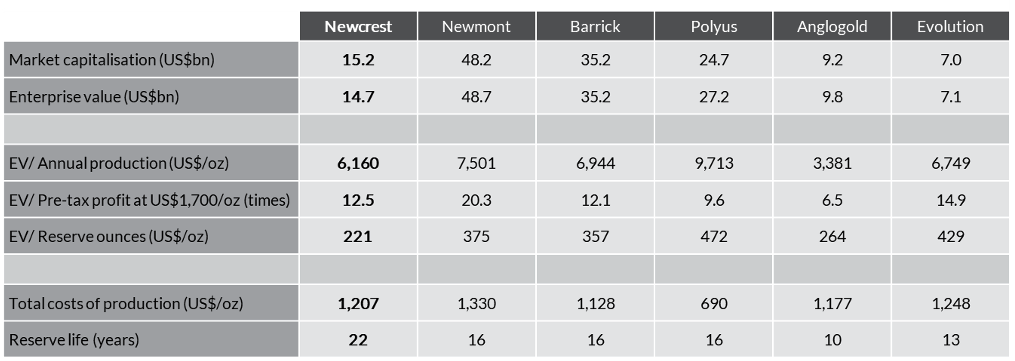

Newcrest also looks cheap relative to other gold companies. As shown in Table 1, Newcrest looks attractive relative to its peers on most valuation metrics. It has the longest reserve life, the lowest enterprise value relative to its reserves and an undemanding profit multiple, despite the operational challenges at Lihir inflating its costs.

Table 1: Newcrest looks attractive relative to its peers

Not only does Newcrest appear reasonably priced at today’s gold prices and elevated cost base, it appears cheap relative to other gold miners. We believe substantial upside potential exists as its growth pipeline is delivered, from lower costs as its operational challenges are addressed and from potentially higher gold prices sometime during the next 20-plus years of its reserve life.

Want to learn more?

Contrarian investing is not for everyone, however there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profile to find out more.

4 topics

1 stock mentioned

1 fund mentioned