A Closer Look at Boral's High Priced Acquisition of Headwaters Incorporated

A High Price Paid

The company cited a transaction multiple of 10.6x “pro-forma FY16 adjusted EBITDA (earnings before interest, tax, depreciation and amortisation)”. Our philosophy is built around the notion that the only way to value a business is on the basis of the sustainable free-cash-flow and franking credits it generates for its owners. We think EBITDA is a poor measure of free-cash-flow. This is because the measure either ignores capital expenditures or assumes that businesses will not make any.

Nowhere in its 78 page presentation outlining the acquisition did Boral reference Headwaters’ statutory earnings or its free-cash-flow. By our reckoning, Boral will pay 38x free-cash-flow for Headwaters. If it wasn’t high enough already, the multiple paid is all the more alarming considering there are no franking credits available from these US based earnings. Our analysis incorporates the A$175m of transaction fees including the ~A$30m poison pill to the Headwaters CEO.

Poor Capital Allocation Decision

Governance, attitudes towards capital allocation and management quality are important considerations in our process and provide context for our financial projections. In this respect, we had taken comfort in our numerous meetings with Boral management and the Board that acquisitions would be well considered and in line with strategy. We were also comforted by the fact that Boral’s senior management would forfeit their long term incentive compensation in the event that the company’s return on invested capital (“ROIC”) fell below threshold levels. To this point, Boral had a track record of disciplined capital allocation decisions in reshaping the portfolio by executing a series of valued adding joint ventures in both Bricks and Plasterboard.

Remarkably, this transaction will result in the forfeiture of senior managements’ long term incentive compensation. We will lobby strongly against any resetting of long term incentive vesting criteria to adjust for this acquisition but fear our efforts may be in vain.

A Good Strategic Fit

Despite the high multiple paid, there are some things to like in Headwaters. The main prize is the high returning Fly Ash business, which represents approximately half the company’s free cash flow. Fly Ash is a by-product of the coal combustion process in coal-fired power stations and used as a cheaper substitute for cement in the production of concrete. Headwaters has approximately 50% share of the US Fly Ash market to complement Boral’s existing 15% share. Despite this high share, the business is a series of local monopolies so we do not expect significant divestments to be required for approval.

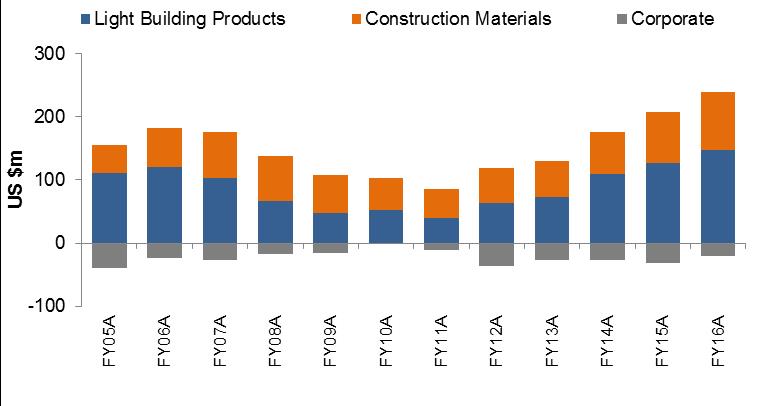

The Fly Ash business is an excellent fit for our investment style given it is very capital light, with capex of only ~2% of sales. Combined with low working capital requirements, this means most of the EBITDA converts to free cash flow. While the EBITDA margin appears high, EBITDA has been very resilient through the downturn in the US housing cycle as shown in Figure 1. This is due to the business’s low operating leverage and high exposure to Infrastructure spending (50% of revenue) which has not been as cyclical as housing.

Figure 1: Headwaters segment EBITDA

Source: Company Reports, Merlon

Headwaters Light Building Products segment is a diverse range of niche businesses that have been acquired over the last 15 years. These businesses span Manufactured Stone, Roof Tiles, Concrete Block, Vinyl Siding and Trim and Vinyl Windows. Each business has a strong market share either nationally or in the regional market that they operate in. This portfolio will significantly bolster Boral’s existing Light Building Products suite and increase access to distribution channels. However, this segment demonstrated far more earnings variability than Fly Ash through the housing downturn as also shown in Figure 1. We are also concerned about the underlying organic growth of the business given the number of acquisitions completed over this period.

The Light Building Products segment also has higher capital intensity (~5-6% of sales) and working capital requirements than Fly Ash, making it the less appealing segment in Headwaters.

Management has outlined a target of US$100m in synergies as it merges its existing US business with Headwaters. We have only factored in the 75% that relates to operating efficiencies from removing duplicate functions as revenue synergies from distributing a wider range of products are typically hard to achieve and measure.

Being a cyclical business, we also factor in a continued recovery in US housing starts, from 1.15m currently to 1.5m on a long run sustainable basis in line with the long term average. However, a difficult aspect of Headwaters earnings is that both its segments are earning margins at or above those of a decade ago which corresponded with a more normal level of starts.

Additional Downside Risks to Consider

One question mark about taking the above approach to modelling the transaction is that the combination of:

- operating leverage from rising US housing starts;

- the improved market structure in Fly Ash; and,

- the “advertised” deal synergies,

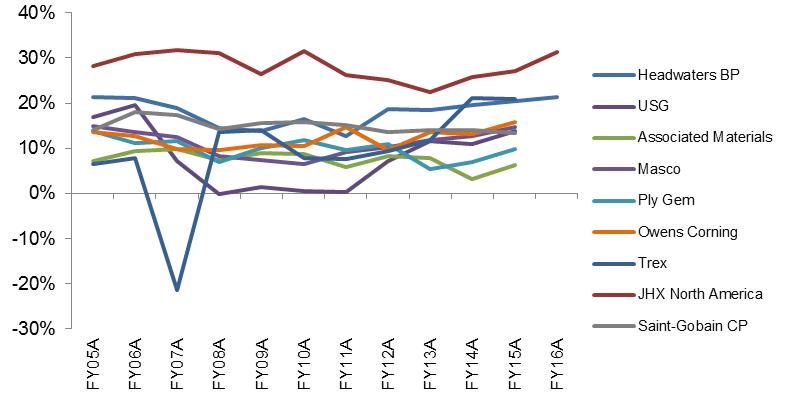

means that projected profit margins will increase to well above long-term averages and well above most US based Building Products peers (Figure 2). So there is a downside risk scenario that sees a significantly less profitably business that needs to be seriously considered in building an investment case.

Downside risk scenarios are a critical consideration in developing a “Conviction Score” that combines with our free-cash-flow based valuations to determine portfolio weights.

Figure 2: Headwaters Light Building Product peers EBITDA margins

Source: Company reports, Merlon

Summary

In summary, we can see the strategic merit in the transaction and are attracted to the capital light components of Headwaters various businesses. That said, we believe that:

- Boral overpaid for the transaction by between 10% and 40% under a range of free-cash-flow based valuation scenarios; and,

- there is some risk that transaction benefits and the earnings outlook have been overplayed, resulting in a lower degree of conviction that there is a misperception in the market.

Unfortunately, the market appeared to form a similar view to ourselves with the stock falling 12% (adjusting for the rights issue) following the announcement of the transaction. As a result of this share price fall, the company still ranks as one of our better investment ideas and remains a key holding in the portfolio.

However, the combination of the lower valuation and the downside risk scenario referenced to above means that the threshold to exit the position is lower than it was prior to the deal.

Read the full Merlon Wholesale Australian Share Income Fund Quarterly Report here: (VIEW LINK)

3 topics