An overlooked commodity with huge catalysts

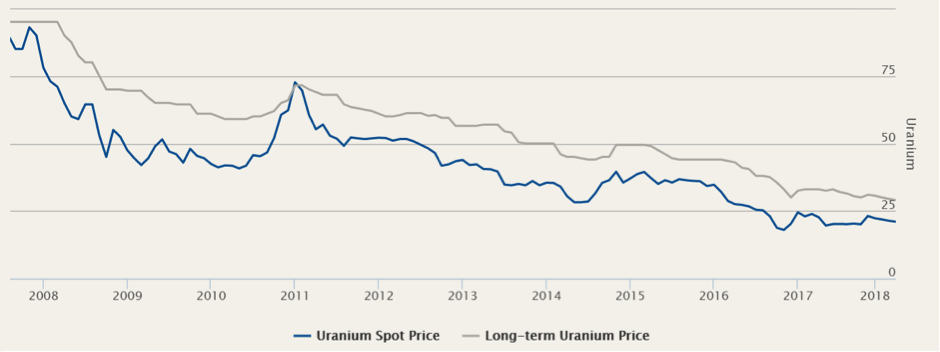

A few months ago we wrote on Livewire that the spot price of Uranium was far too low based on the fundamentals of the industry, and that it was like buying oil at $20/barrel. While prices have not moved higher yet, it is rare to see a commodity with so many fundamental factors working in its favour.

In that piece, we pointed to an international average cost of production of $50 vs a spot price of $20 and noted that all the industry reactions that you’d expect to see when prices were too low were being enacted.

We saw some of the lowest cost mines shutting down, we saw a concerted effort by the worlds major producers to cut production (by 20%), and we saw governments lighten the regulatory load on the industry allowing for a more efficient spot market.

Nevertheless, prices have remained persistently low...

Uranium Price - 10 Years

Source: Cameco

Source: Cameco

Industry insiders have been somewhat perplexed by the stubbornness of prices and have blamed it on a disbelief that the announced production cuts will be maintained, and a recognition that uranium markets are driven by contracting – and contracting only occurs every five years or so.

With cuts so far maintained (and new cuts being announced each week – see ASX:PDN this morning), and recontracting for US utilities just around the corner, it appears that a perfect storm is brewing for investors in the industry.

Making a Political Mess

Adding fuel to the fundamental fire, recent political friction over the war in Syria has seen the USA announce the implementation of sanctions on a number of governments seen to be friendly with the ruling Assad regime. Primary among those sanctioned nations are Russia.

Not being shy of conflict, Russia immediately announced retaliatory sanctions of their own. Chief among them being a restriction on cooperation with the USA (and its supporters in Syria) on all matters nuclear and aircraft related. These sanctions if enacted could generate a significant headache for the nuclear industry in the USA.

The USA currently imports the vast majority of their uranium needs, with almost half coming from Russia directly or countries within the sphere of Russian influence.

To add insult to injury the USA does not currently have any enriching facilities of their own. Instead, the US has relied primarily on Russia and URENCO (a joint venture between the British, Dutch, and Germans) to enrich their uranium for them. There too Russia controls almost 50% of the enriching facilities worldwide.

All these factors leave US nuclear utilities in a very precarious position.

The US energy market is the world’s largest consumer of nuclear energy, representing 30% of global usage. One in every 5 households in the US are powered by nuclear energy, more than half of which are fuelled by uranium mined or processed overseas.

Without access to half the world’s raw material or processing capacity, the US is left with limited options.

The two most obvious solutions would see the US increase domestic mining and reopen processing plants. However, the most efficient solution may be to do nothing!

As the proportional cost of uranium inputs into nuclear energy production are less than 3% of the total operational costs, utilities can simply enter the spot market and pay materially higher prices for their yellowcake (processed uranium), without impacting the overall cost of electricity to the end user.

In short, I’ve never seen a commodity with so many fundamental factors working in its favour.

Not only does the fundamental mismatch in cost and price suggest a change is imminent, but the underlying buyers of yellowcake are insensitive to price. Once we throw in a political conflict, there is every reason to believe that investors in the right uranium businesses will benefit greatly in the coming twelve months or so.

4 stocks mentioned