A compelling investment opportunity in a growing sector

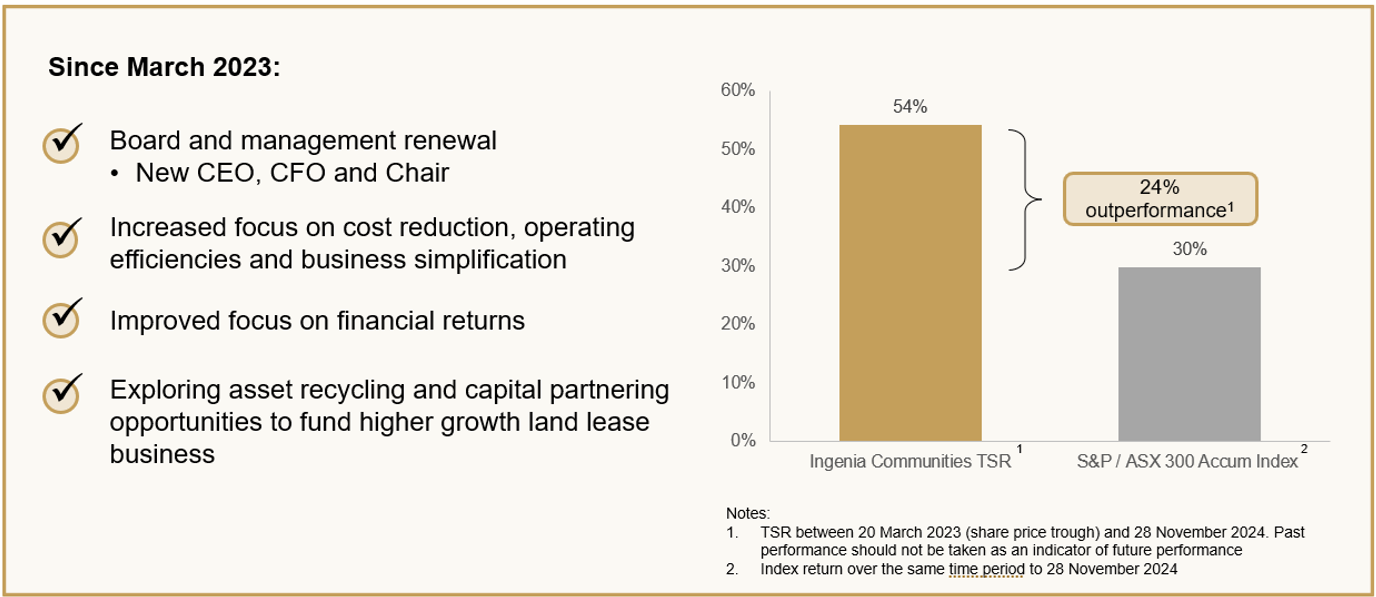

Ingenia Communities (ASX: INA), a leading operator, owner, and developer of land lease communities and holiday accommodations, is strategically positioned to capitalize on the growing seniors' market in Australia. After facing challenges in early 2023 due to construction delays, a softening residential market, and rising interest rates, the company is undertaking a reset under a refreshed Board and management team, with the support of major shareholder HMC Capital Partners Fund 1. From its share price low in March 2023, Ingenia's stock has significantly outperformed the broader market, delivering a Total Shareholder Return of ~54%, and the future looks even brighter.

Here’s why the land lease model is attractive for both customers and investors:

1. Affordable Housing for an Ageing Population

Australia's population is ageing rapidly, with Baby Boomers (those born between 1946 and 1964) now reaching retirement age and looking to downsize their homes. This trend is creating significant demand for affordable retirement living options that offer both affordability and lifestyle benefits. Ingenia Communities is strategically positioned to meet this demand through its Ingenia Lifestyle offering, which caters specifically to the over-55 market. These resort-style communities are in attractive coastal and outer urban locations, providing an ideal solution for retirees looking to unlock equity from their existing homes while enjoying a vibrant, community-oriented lifestyle.

Benefits for Residents:

- Affordable Housing: Land lease homes are typically around 30% cheaper than freehold properties in the same location, allowing retirees to unlock equity to fund their retirement.

- No Stamp Duty: Purchasers of land lease homes do not pay stamp duty, reducing the upfront cost of moving.

- Full Capital Gain: Homeowners capture any capital gain at exit, with no Deferred Management Fees (DMF) charged by Ingenia.

- Low-Maintenance Lifestyle: These modern designed homes offer low-maintenance living with resort-style facilities and a connected community, enhancing the quality of life for residents.

- Rental Assistance: Residents may be eligible for government rental assistance, further reducing living costs.

2. Attractive Investment Fundamentals

For investors, land lease communities offer a compelling investment opportunity due to their lower development costs and construction risks compared to traditional Build-to-Rent models. In addition to generating development returns, Ingenia's business model provides annuity-style income from inflation-linked rental payments from residents, ensuring a steady and predictable revenue stream.

Benefits for Investors:

- Lower Development Costs: Land lease communities have lower development costs and construction risks than Build-to-Rent projects.

- Steady Income: Investors benefit from annuity-style income through inflation-linked rental payments from residents.

- Efficient Capital Recycling: Typically, 100% of development capital is recouped at the time of sale of a home, allowing for efficient recycling of capital.

- Strong Demand: There is strong underlying demand for land lease communities, backed by a growing cohort of retirees and downsizers.

3. Operational Efficiency and Growth Potential

Since March 2023, when HMC Capital Partners acquired its initial stake in Ingenia, the company has undergone significant changes at the senior management and Board levels, bringing in substantial institutional real estate expertise. The appointment of John Carfi as CEO on 1 April 2024 marked a new era of focus on operational efficiency, productivity, and shareholder returns. Development activity in Ingenia's residential communities is accelerating, positioning the company to capitalize on the embedded value in its asset base and development pipeline. While there is still work to be done in cost optimization and enhancing development returns, with an increasing allocation of capital to land lease communities Ingenia is well positioned to deliver earnings for shareholders.

4. Benefiting from the Approaching Interest Rate Pivot

Interest rate-sensitive stocks, such as Real Estate Investment Trusts (REITs), were heavily impacted by rising interest rates starting in May 2022. However, with the US Federal Reserve beginning its pivot and markets anticipating an easing from the Reserve Bank of Australia (RBA) in H1 2025, Ingenia stands to benefit significantly. As the rate cycle turns, REITs are expected to outperform equities and Ingenia should benefit from several factors:

- Increased Home Purchaser Confidence: Lower interest rates boost home purchaser confidence, supporting sales rates.

- Lower Cost of Debt: Reduced interest rates lower the cost of debt for Ingenia.

- Valuation Support: Potential cap rate compression provides valuation support for Ingenia's assets.

The Path Forward

Ingenia's management is focused on becoming an operationally efficient land lease developer and operator. The company is progressing a range of initiatives to enhance development returns over the medium term, with scale benefits expected as the portfolio grows. With greater financial discipline now embedded in the business, asset recycling and capital partnerships offer opportunities to release capital from lower-growth assets and fund the exciting land lease development pipeline ahead.

In conclusion, Ingenia Communities is well-positioned to capitalise on demographic trends, operational improvements, and favourable market conditions. With a refreshed leadership team and a clear strategic focus, Ingenia offers a compelling investment opportunity for those looking to benefit from the growing seniors' housing market in Australia.

Find out more

HMC Capital Partners Fund I (Fund), is an Australian-domiciled open-ended Fund, comprising of HMC Capital’s (ASX: HMC) highest conviction ideas. Find out more here

2 stocks mentioned

.jpg)

.jpg)