A focus on endowment-style investing

LGT Crestone

In theory, the goals of all investors are founded on the same underlying principle—to maximise returns for the risk that they are willing to bear, or to maximise risk-adjusted returns. And so, whilst return objectives and risk tolerance vary from investor to investor, the principles of how portfolios are built are the same. Of course, there are additional considerations to traditional risk and return analysis. For example, liquidity or regular income requirements or other practical constraints, such as access to opportunities and minimum investment amounts.

In recent years, there have been considerable changes in how portfolios are constructed, with many investors implementing larger allocations to alternative assets, a strategy that was pioneered by endowment-type investors. In this article, we outline our approach to endowment-style investing, we look at available research, which examines the performance of endowment-funds, and analyse the portfolios of ultra-high-networth (UHNW) investors and endowments, which do not have the kind of constraints typically applied to most portfolios.

Moving beyond typical stock and bond portfolios

Over time, we have seen considerable changes in the make-up of portfolios as

investors have moved beyond typical stock and bond portfolios and introduced

alternative assets, such as hedge funds, private markets, direct property and

infrastructure. It is this allocation to alternatives, however, that still differs

materially between investor types, with the allocation typically increasing as the

investment pool increases. This is true as we move from retail to high-net-worth

(HNW) investors and then to UHNW and large endowment pools of capital.

The driving force behind the often low allocation towards alternatives appears to

be a lack of familiarity, particularly among retail investors, and liquidity

constraints—while there are often questions of scale and access to investment

opportunities. Endowment funds, however, now have a long track record of

investing with high allocations to alternative assets. We have also identified a

reduced home country bias within the equity allocation of endowment-type asset

allocations, as investors are able to focus on maximising returns, rather than

matching liabilities in their domestic currency.

Maximising return for a given level of risk

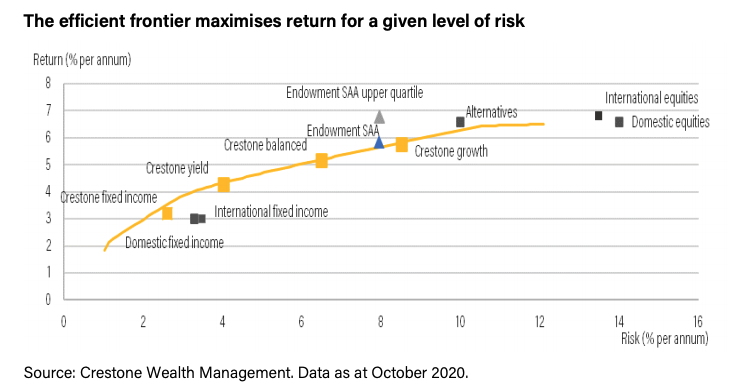

Crestone’s asset allocation process begins with the formulation of five-year forward-looking expectations of return and risk for each asset class, as well as the expected correlations between those asset classes. Quantitative analysis then helps drive the efficient frontier, which is the subset of all possible portfolios, which maximise return for a given level of risk.

It is at this stage that we traditionally impose constraints on the types of portfolios

that we want to look at. For example, we impose a minimum cash holding to

provide some operational liquidity; a minimum domestic equity holding to account

for the fact that most investors have liabilities denominated in Australian dollars;

and a maximum weight to alternatives to avoid building overly illiquid portfolios.

Asset allocations can then be developed according to the investor’s risk tolerance.

What happens as we ease constraints

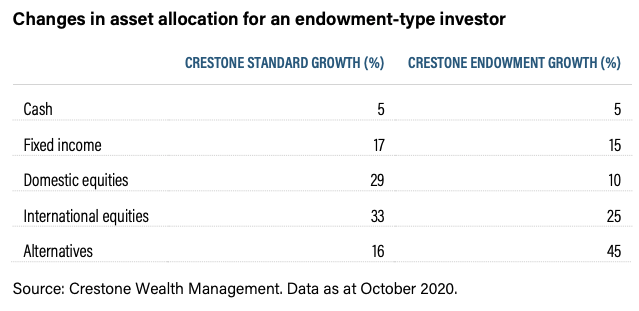

As we ease those constraints, the key change that we see the model push for is an increased weight in alternative assets at the expense of other asset classes, and a reduced weight in domestic equities via an increased weight in international markets.

Increasing exposure to alternatives

In the case of a growth investor, where the typical cap on alternatives is 20%, the portfolio’s allocation to alternatives might move towards 40-50%. This is an uncomfortable level for most investors in what is a comparatively illiquid asset class. However, some investors, typically those who are unconstrained and have a large pool of capital to deploy, are both willing and able to bear that additional illiquidity and are, therefore, able to construct more efficient portfolios. An increased allocation to alternative assets has a number of advantages at the portfolio level. The imperfect correlation with traditional assets helps to reduce portfolio volatility and the higher expected return helps increase overall portfolio return, thereby improving the expected risk-adjusted returns of the portfolio.

Increasing exposure to international equities at the expense of domestic

For Australian investors, the second major shift we see as we move towards an

unconstrained allocation is a greater holding in international equity markets

relative to the domestic market. This is a function of a reduced need for liability

matching within the portfolio, facilitating a larger weight to a greater variety of

exposures (and therefore return drivers) that are available offshore but not in

Australia. It also allows for a greater allocation to emerging markets, which are

expected to be a key return driver in today’s low growth environment. It should be

noted, however, that the correlation of domestic equities with international

equities, particularly on an unhedged basis, means that domestic equities will

generally hold a greater weight in a portfolio than a simple market cap weight

would suggest. For example, the Future Fund showed a holding of 7% domestic

equities in its most recent quarterly report. This is below the 27% allocated to

international equities, but materially higher than Australia’s approximate 2%

weight in the MSCI World index.

The case for alternatives

Various studies have found that increased allocations to alternatives, as pioneered by some of the large US endowment funds, have delivered superior risk-adjusted returns. Indeed, a review of available research shows that, not only do these larger pools of capital continue to invest more heavily in alternatives, but they have also outperformed traditional asset allocated portfolios.

Our review of large endowment-type investors found that typical alternatives allocations range from 44-72%, while Frontier research shows that US endowment funds greater than USD 1 billion in size have outperformed traditional portfolios by 1-2% per annum on average across various time periods.

The reason behind this outperformance is multi-faceted. The most obvious improvement in the risk-return outcome stems from the low correlation between alternatives and other assets in the portfolio, which reduces overall portfolio volatility (traditionally used as a measure of risk). There is also a return benefit to be gained from holding less liquid investments, the so called illiquidity premium, which is essentially the return amount in addition to that provided by a liquid equivalent. For example, part of the outperformance of private over listed equities would be attributed to the fact that private equity is less liquid than the listed equivalent. From a practical standpoint it is also true that alternative markets tend to be less efficient than traditional markets, meaning that there are more opportunities, and greater reward, available to savvy investors.

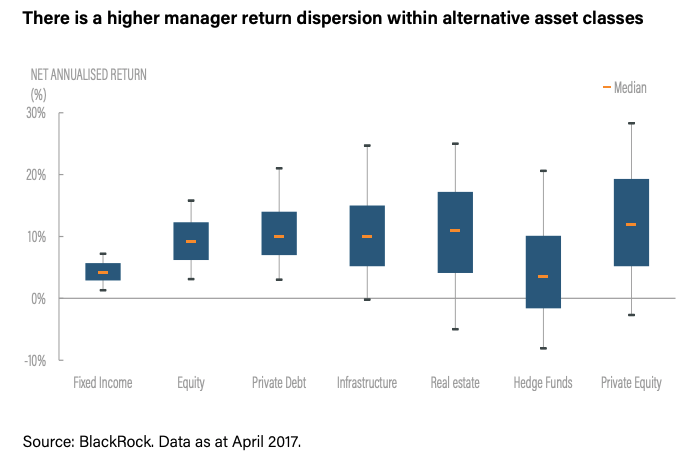

This leads to a final point, the potential for outperformance in alternatives is far

greater than in traditional asset classes, making it much more important (and

rewarding) to be able to identify and access the best managers. BlackRock

research shows that manager return dispersion within alternative asset classes is

three to five times higher than for traditional asset classes, making the rewards for

being able to identify (and access) the top-performing alternatives managers

much greater than for traditional asset classes.

Is an endowment style right for me?

For investors who have the scale, long-term investment horizon and lack of liquidity requirements, it makes sense to implement an asset allocation that can take advantage of a lack of constraints.

As noted earlier, however, the ability to identify high quality managers and strategies within the alternatives space is of key importance. Therefore, while adjusting public equity exposures may be relatively straightforward, when implementing an increased weight to alternatives, a more patient approach is required. This experience appears to mirror that of some of the largest investors, with the Future Fund a good local example. Here, the alternatives allocation currently sits at around 45%—but this has progressively been built out over the last 12 years, with just a 10% allocation back in 2008.

Although asset allocation methodologies are generally consistent across investor types, as investors seek to maximise risk-adjusted returns, the optimum asset allocation will vary according to the investor’s specific requirements. For investors with larger pools of capital, they are able to access investments which may not be available to those with smaller portfolios. These unconstrained portfolios typically have higher holdings in alternative assets and a reduced home country bias.

By observing how some of the largest investors in the world build their portfolios

and by studying the performance outcomes, we find both evidence of these asset

allocation skews and that the resulting portfolios have delivered superior

performance outcomes when compared to more traditional asset allocations. This

suggests that those investors who are able to adopt an endowment-style of

investing would benefit from doing so.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

1 topic

1 contributor mentioned

Rob is an Asset Allocation Specialist with experience across a wide range of asset classes (Equities, Fixed Income, FX) and investment functions (portfolio management, implementation, analytics and asset allocation).

Rob is an Asset Allocation Specialist with experience across a wide range of asset classes (Equities, Fixed Income, FX) and investment functions (portfolio management, implementation, analytics and asset allocation).