A macro outlook you can hang your hat on

Economists and market forecasters often joke, “Prediction is very difficult, especially about the future.” While this quote is attributed to a wide range of people from Mark Twain to Niels Bohr, it certainly sounds like something Yogi Berra would have said. After all, the future ain’t what it used to be – it’s bound to be more chaotic, arbitrary, turbulent…shocking!

As the year-end prognostications flow in with respect to macroeconomics and financial market performance, one of the trusty tropes reinforced is around the unpredictable nature of things.

- “Expect the unexpected.”

- “It’s a messy world at the moment.”

- “Markets won’t move in a straight line.”

- “Interest rates will fluctuate.”

- “Volatility will pick up.” (Volatility, by the way, is a euphemism for markets going down…you never hear someone complaining about a spike in market volatility when stocks are ripping higher day after day.)

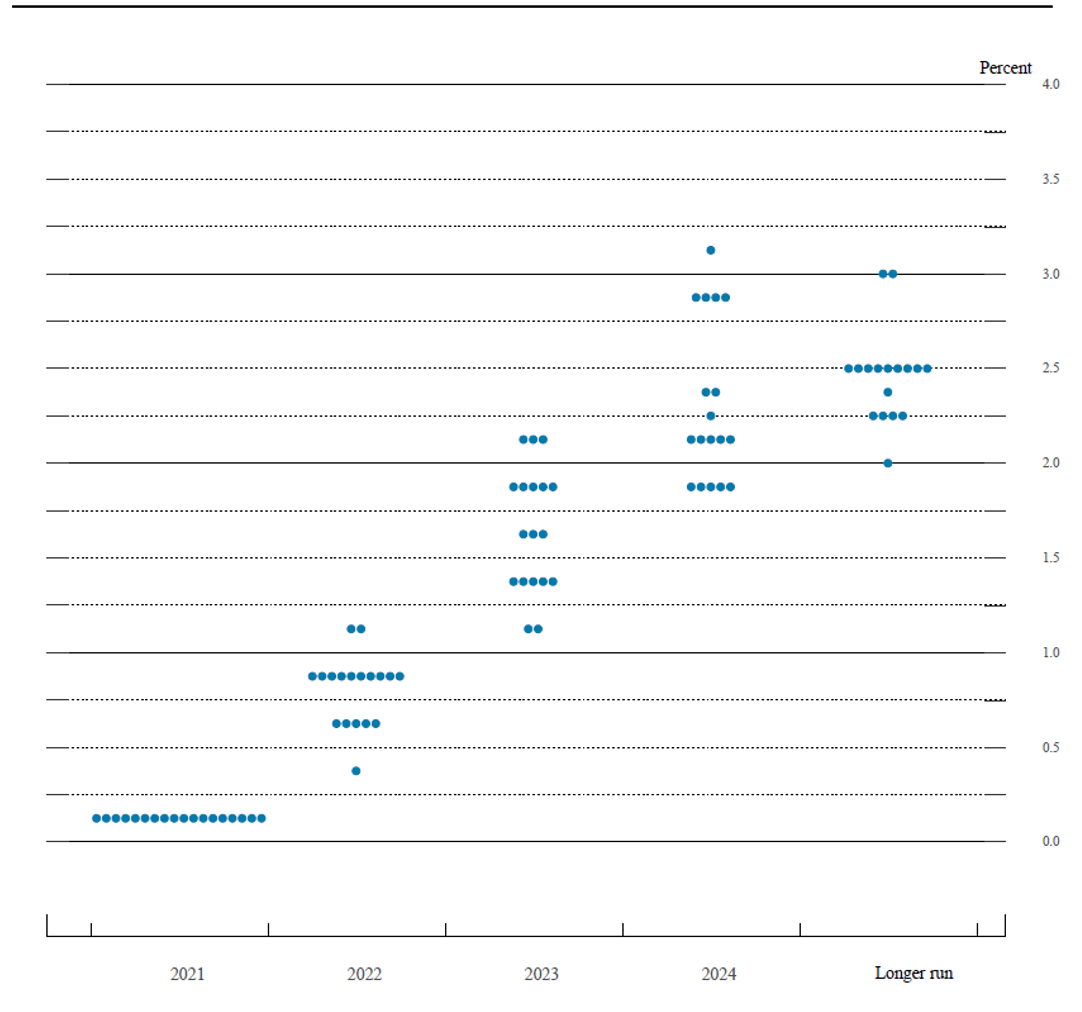

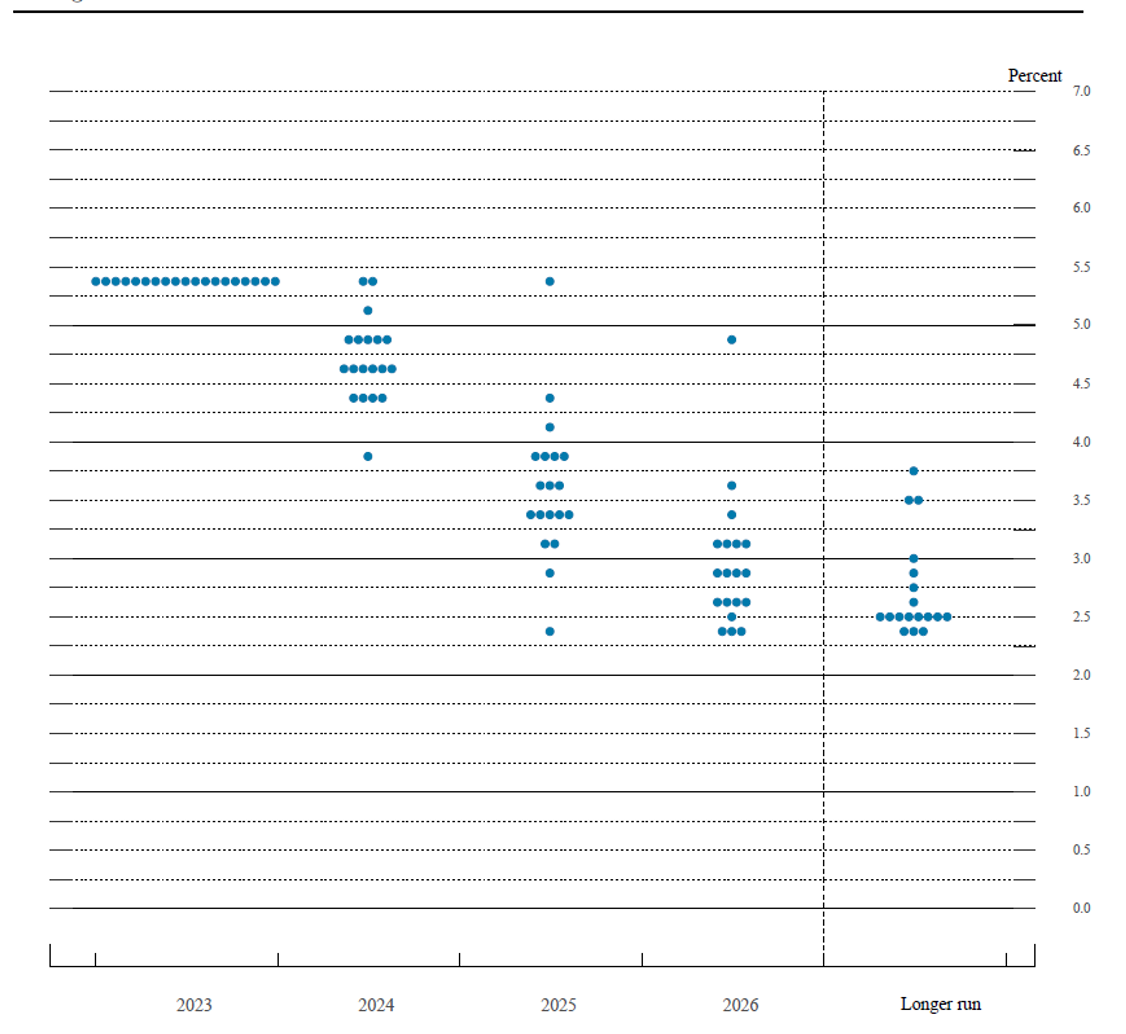

And recent track records of predicting economic and market performance have been quite ordinary (to put it politely). At the end of 2021, the US Federal Reserve (via the infamous FOMC Dot Plot) expectations of where the Fed Funds rate would be at the end of 2022 AND 2023 were 0.9% and 1.6%, respectively (the actual effective Fed Funds rate was 4.10% at end of 2022 and currently 5.33%). See below for Dot Plots from Dec 2021, along with the latest from Dec 2023.

This time last year there was near uniform consensus on The Street that we’d enter a global recession and risk assets would struggle while bonds would do well. The Economist ran a piece a year ago titled, “Why a global recession is inevitable in 2023.” They pointed to bubbling geopolitical risks, spiking energy prices, and the impact of aggressive central bank policy to quell inflation. A lot of very smart people were completely wrong – not even directionally right.

15 December 2021 – FOMC participants' assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate

13 December 2023 – FOMC participants' assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate

But “stay invested” is the common recommendation…after all, many of us are in the business of managing money for a fee. Cynicism aside, this is sound advice. Most mistakes in investing involve either overtrading or the cardinal sin of selling at the bottom (or its sister: buying at the top). Despite the unpredictable nature of the world and financial markets, staying the course is usually the right strategy.

Just because the year ahead will inevitably play out differently than anticipated doesn’t mean we should just throw up our hands and give up making any investment decisions. Even while sticking to an investment strategy, there’s plenty of room to adjust course along the way.

Valuations change, new risks emerge, opportunities present themselves, life happens – and getting the broad macro narrative right can help. On that front, as one of my colleagues often says, “We’d rather be approximately right than precisely wrong.”

Given that, let’s quickly revisit the two key macroeconomic variables of growth and inflation.

From taming inflation to gauging growth

The big focus for the global economy and market over the past several years has been inflation, and rightfully so. The US and the actions of the Fed continue to be front and centre.

We’ve argued for some time that this is not a normal cycle – it hasn’t really been a cycle at all but rather a continued normalisation from a natural disaster (that is, COVID) which was further distorted by enormous fiscal and monetary stimulus.

This normalisation argument has meant that inflation will ultimately subside back to (or possibly below) target, allowing the Fed to take its foot off the brake.

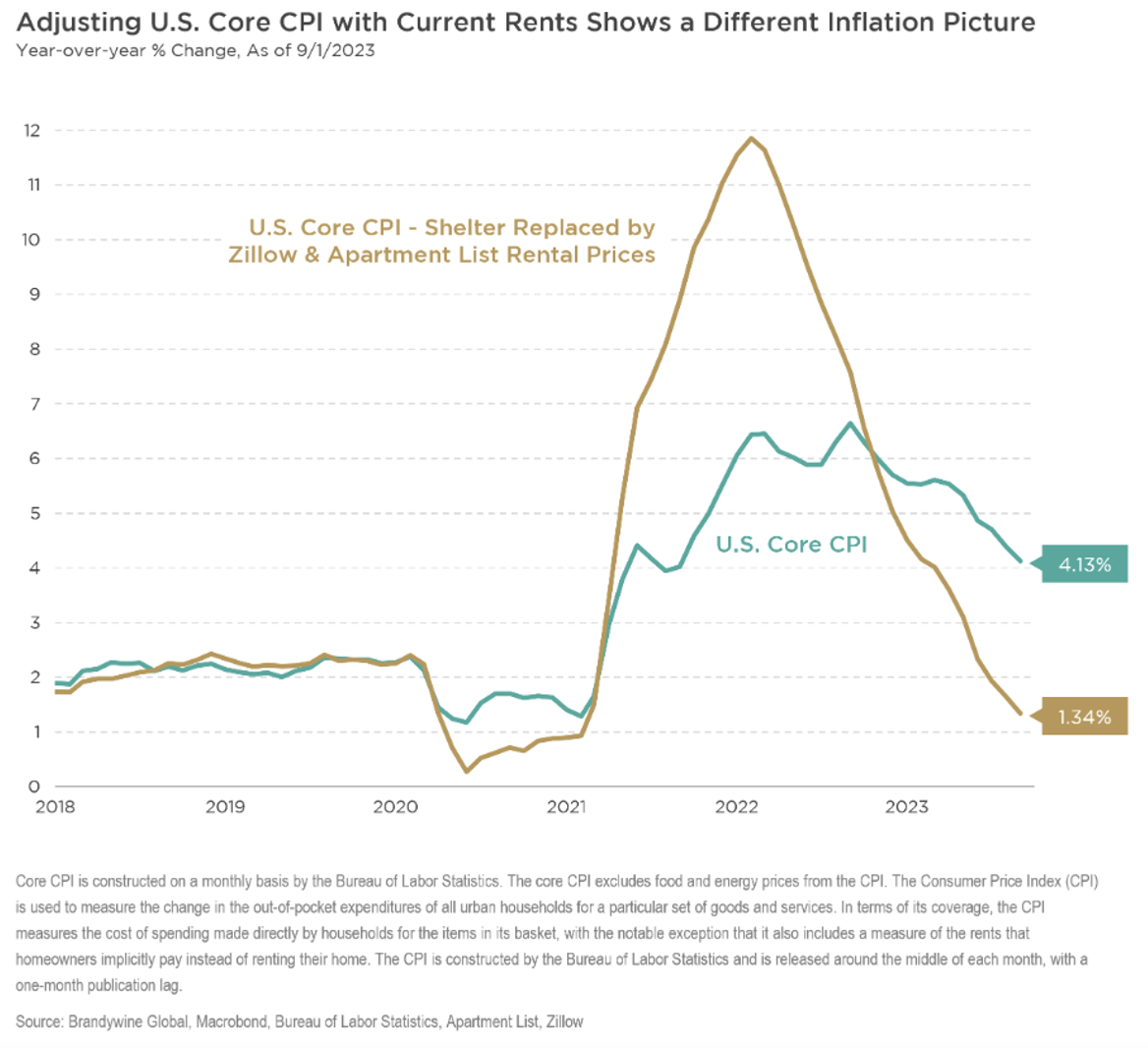

So, can we declare victory on inflation? In the US, it seems so. By making one key adjustment to core CPI in the US (using market rents instead of the official ‘owner’s equivalent rent’), core inflation sits at 1.34%, comfortably below the Fed’s 2% target (see below).

Moving onto growth, and again we’ll focus on the US – the big macro surprise globally in 2023 was growth outperformance predominantly driven from the US.

Europe and the UK have been teetering on recession, while China continues to experience a relatively anaemic recovery following the pandemic (don’t forget, China only abandoned their COVID-zero policy less than a year ago), and authorities are reluctant to reinflate the property market among other things.

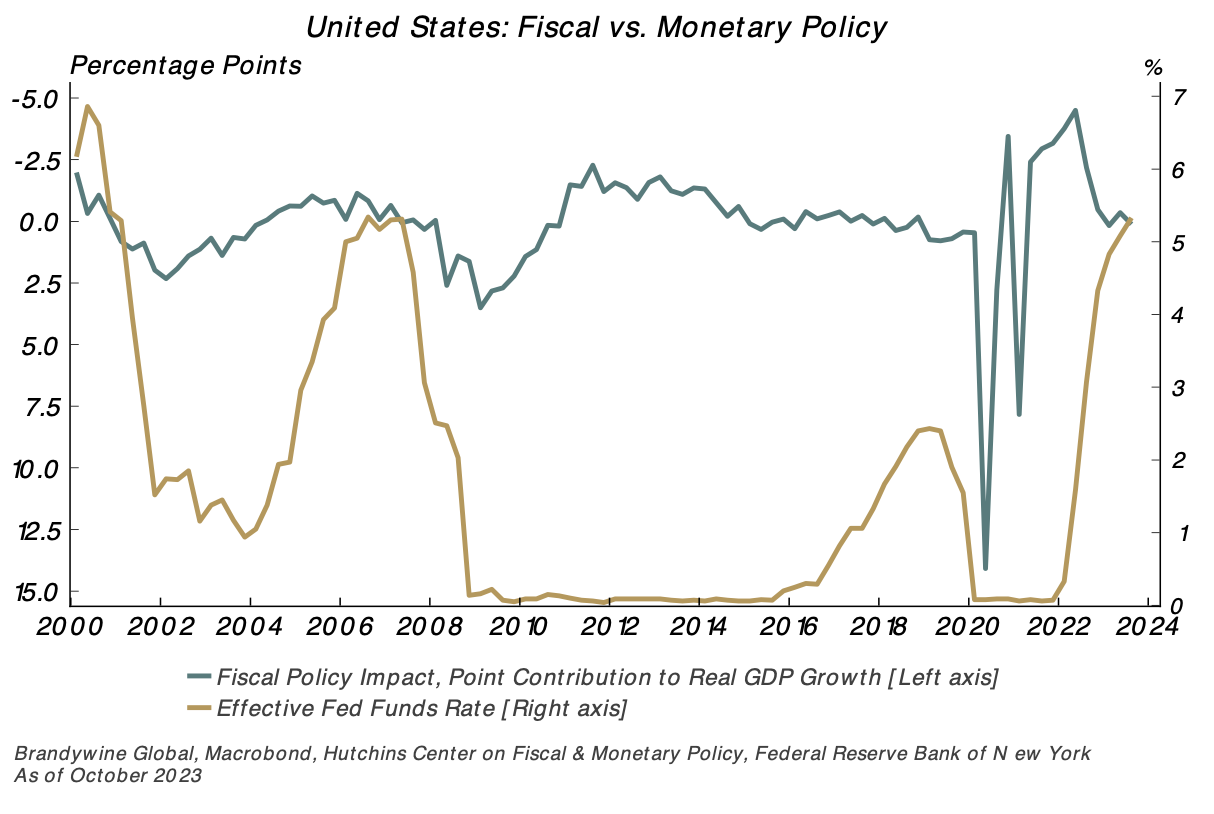

2023 saw few signs of the consumer cracking, as excess savings continued to be drawn down while government spending and increased fiscal deficits in the US have supported the economy as many programs initiated through the pandemic continued to have a long tail. This ongoing fiscal thrust was the biggest driver of the growth surprise in 2023. But that tailwind will likely become neutral at best, if not a headwind, in 2024.

So, ‘soft landing’, ‘hard landing’, or ‘no landing’?

Given inflation has been melting away while nominal growth is slowing, a ‘no landing’ scenario appears to be off the table (for now). The ‘soft landing’ or ‘muddle through’ case is one we have been biased towards even going into 2023, although largely hinged on falling inflation and less hawkish central banks combined with US-led economic resilience.

But the case for a ‘hard landing’ has been building – and the problem is that a hard landing usually starts by looking like a soft landing.

Examining traditional leading indicators points more towards a typical recession but again, this hasn’t been a normal cycle. And then there is the matter of the 500 basis points or so of hikes that are still working their way through the real economy. So, which one is it? Well, it’s…uncertain.

Clash of the Titans – US fiscal policy has been at odds with monetary policy

Why be roughly right?

But uncertainty is okay when investing because you can’t manage money on forecasting alone. No matter how good you are with your analysis, at some point, you are going to get it wrong. So, if you always position a portfolio based on specific point estimates or forecasts, then inevitably you are setting up for failure – eventually.

Instead, the focus should be on valuation anomalies and catalysts for those anomalies to normalise. Although getting the macro right over time is critical, successful investing involves assessing probabilities in terms of outcomes and often taking precise timing out of the equation by having a longer time horizon.

You can be early and/or wrong in the short term and still have a portfolio that has multiple ways to win in the medium to long term.

For example, in global fixed-income markets, we like high-quality duration – especially in markets like the US and UK, while not ignoring the income opportunity in select Emerging Markets, especially in Latin America. Credit has some attractive opportunities, especially in shorter-dated corporate paper or US agency mortgage-backed securities.

Finally, the yield curve being inverted remains a major anomaly that will ultimately normalise so looking for further steepening in 2024.

Assuming nothing ‘breaks’ along the way, ultimately the macro-outlook for next year boils down to this:

- how committed is the Fed with respect to the disinflation story, allowing the yield curve to normalise as they look to ease policy next year? and

- how much residual boost (or drag) will the ongoing fiscal policy have on growth going into an election year in the US?

Strap in for what will certainly be a bumpy and unpredictable ride in 2024!

Learn more

Acting with conviction and discipline, we look beyond short-term, conventional thinking to rigorously pursue long-term value across differentiated fixed income, equity, and alternative solutions. For further insights, please visit our website

3 topics

2 funds mentioned